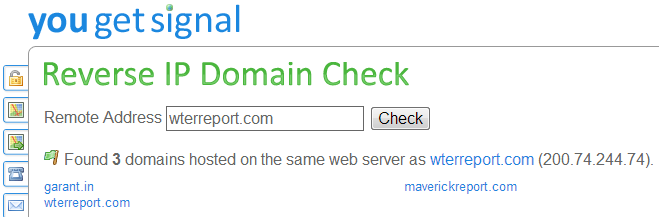

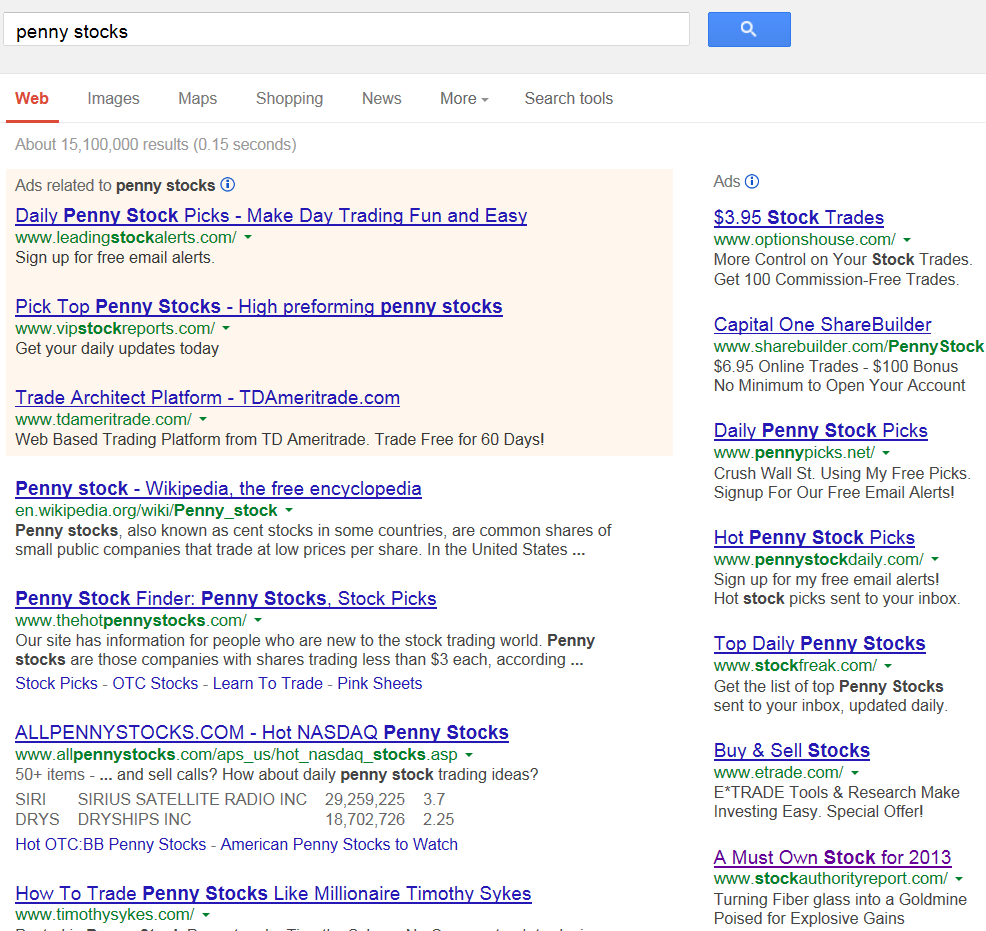

I was first alerted to the promotion for Virtual Sourcing Inc (PGCX) by Tim Lento. See his post where he found the pump website PGCXreport.com. The stock had almost no volume so I didn’t write a post about it. I should have then set a volume alert for the stock — when it first starting getting volume it was down a lot from when Tim posted about it and in the next few days ran from about $0.20 to over $1.00 (that being said, I probably would not have bought it). I then noticed search ads on Google for another promotion page: StockAuthorityReport.com. That reminded me of the stock and prompted this blog post. StockAuthorityReport.com is a new website, not linked to any past promotions. The promotion pages seem pretty sparse considering the purported pump budget.

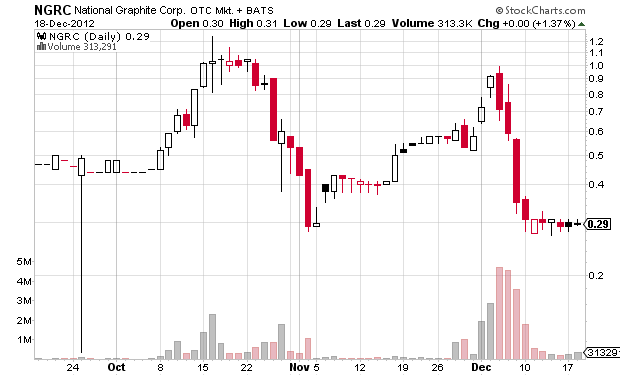

Disclosed budget: $750,000

Promoter: StockAuthorityReport.com

Paying party: NGS Ventures Ltd

Shares outstanding: 81,886,184

Previous closing price: $0.84 (I use the close just prior to my blog post here, not at the start of the pump)

Market capitalization: $68 million

Excerpt from StockAuthorityReport.com disclaimer:

NGS Ventures LTD has managed a total production budget of $750,000 for this advertising effort. StockAuthorityReport.com is being paid $200,000 and also expects to receive new subscriber revenue as a result of its participation in this advertising effort.

Excerpt from the PGCXreport.com disclaimer:

PGCXREPORT.COM is being paid $25,000 and also expects to receive new subscriber revenue as a result of its participation in this advertising effort.

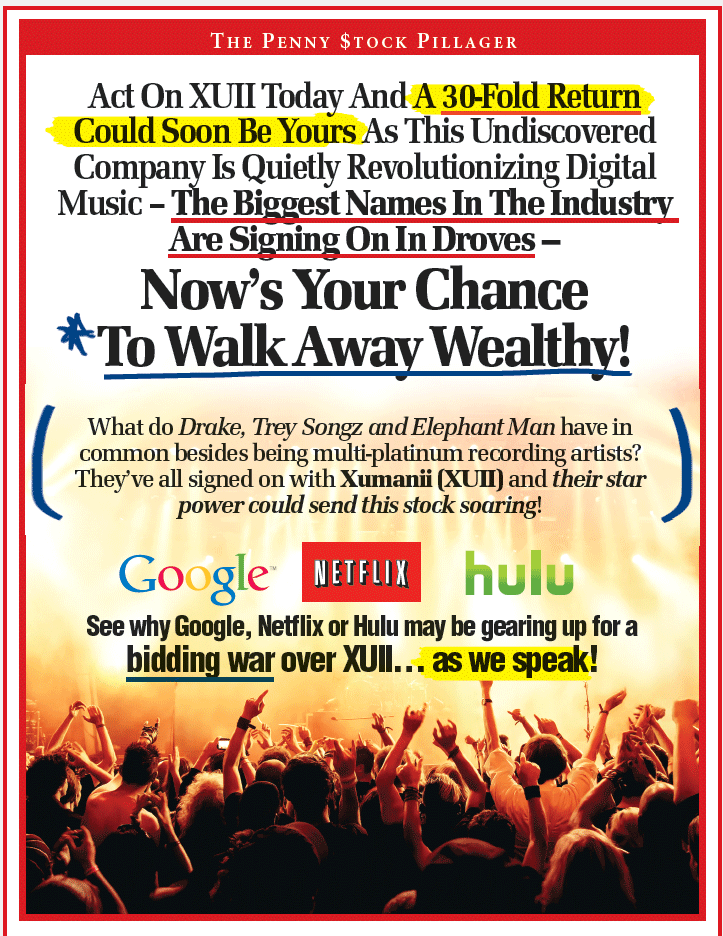

Below is a screenshot of the promotion page:

The screenshot below shows an ad for StockAuthorityReport.com (lower right-hand corner).

StockAuthorityReport.com Disclaimer:

Important Notice and Disclaimer – This paid advertising issue of StockAuthorityReport.com does not purport to provide an analysis of any company’s financial position, operations or prospects and is not to be construed as a recommendation by StockAuthorityReport.com or as an offer or solicitation or as an offer or solicitation to buy or sell any security. StockAuthorityReport.com does not perform any due diligence on the stocks and companies discussed herein. Virtual Sourcing Inc., the company featured in this issue, appears as paid advertising paid for by NGS Ventures LTD. to increase public awareness of the company and its prospects. All information appearing in this advertisement is taken from publicly available sources. Although StockAuthorityReport.com and its editor and publisher believe this information to be accurate and reliable, neither StockAuthorityReport.com nor its editor or publisher has independently verified any information contained in this advertisement. StockAuthorityReport.com or its editor or publisher does not makes any representation or warranty whatsoever with respect to the accuracy or completeness of any information contained herein. StockAuthorityReport.com and its editor and publisher expressly disclaim any liability resulting from how readers may choose to utilize the contents of this paid advertisement. Readers should perform their own due diligence and are strongly urged to independently verify all statements made in this or any other paid advertisement. Any investment should be made only after consulting with a qualified investment professional and after reviewing the publicly available financial statements of, and other information about, the company and verifying that the investment is appropriate and suitable for you. StockAuthorityReport.com nor any of their principals, officers, directors, partners, agents, or affiliates are not, nor do we represent ourselves to be, registered investment advisors, brokers, or dealers in securities. “Insert text here” is not offering securities for sale. An offer to buy or sell can be made only with accompanying disclosure documents and only in the states and provinces for which they are approved. StockAuthorityReport.com does not offer or sell securities. You can obtain more information about Virtual Sourcing Inc., from its website at http://www.virtualsourcinginc.com. Virtual Sourcing Inc., is a reporting company under the Securities Exchange Act of 1934, as amended, and trades on the OTC Bulletin Board under the symbol PGCX. Virtual Sourcing Inc., periodic and other reports filed under the Securities Exchange Act of 1934, as amended, are publicly available from the Securities and Exchange Commission at their website at http://www.sec.gov/edgar/searchedgar/webusers.htm. General investor information about publicly-traded companies like Virtual Sourcing Inc., advice to investors, and other investor resources are available from the Securities and Exchange Commission’s website at www.sec.gov or from the Financial Industry Regulatory Authority website at www.finra.com. Many states have established rules requiring the approval of a security by the state securities administrator. Check with www.nasaa.org or call your state security administrator to determine whether a particular security is licensed for sale in your state. Many companies have filed information with state securities regulators and many companies will supply prospective investors with additional information upon request. This advertisement is not intended for readers in any jurisdiction where not permissible under local regulations and investors in those jurisdictions should disregard it. NGS Ventures LTD has managed a total production budget of $750,000 for this advertising effort. StockAuthorityReport.com is being paid $200,000 and also expects to receive new subscriber revenue as a result of its participation in this advertising effort. Investing in securities is highly speculative and carries a great deal of risk, especially as to new companies with limited operations and no history of earnings. Past performance does not guarantee future results. This paid advertisement contains forward-looking statements regarding Virtual Sourcing Inc., its business and plans. Such forward-looking statements are within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to be covered by the safe harbor provisions created by these laws. Where Virtual Sourcing Inc., expresses or implies an expectation or belief as to future events or results, such expectation or belief is believed to have a reasonable basis. However, forward-looking statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by such forward-looking statements. Such risks include, but are not limited to, the size and growth of the market for Virtual Sourcing Inc., products and services, its ability to develop and distribute its products, the ability of the company to fund its capital requirements, competition, regulatory developments, the effects of short-selling and other market pressures, and other factors. , All other trademarks used in this publication are the property of their respective trademark holders. StockAuthorityReport.com is not affiliated, connected, or associated with, and are not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by StockAuthorityReport.com to any rights in any third-party trademarks. Read our Privacy Policy

PDF copy of promotion page.

PGCXreport.com disclaimer:

Important Notice and Disclaimer – This paid advertising issue of PGCXREPORT.COM does not purport to provide an analysis of any company’s financial position, operations or prospects and is not to be construed as a recommendation by PGCXREPORT.COM or as an offer or solicitation or as an offer or solicitation to buy or sell any security. PGCXREPORT.COM does not perform any due diligence on the stocks and companies discussed herein. Virtual Sourcing Inc., the company featured in this issue, appears as paid advertising paid for by Catalina Advertising Corp. to increase public awareness of the company and its prospects. All information appearing in this advertisement is taken from publicly available sources. Although PGCXREPORT.COM and its editor and publisher believe this information to be accurate and reliable, neither PGCXREPORT.COM nor its editor or publisher has independently verified any information contained in this advertisement. PGCXREPORT.COM or its editor or publisher does not makes any representation or warranty whatsoever with respect to the accuracy or completeness of any information contained herein. PGCXREPORT.COM and its editor and publisher expressly disclaim any liability resulting from how readers may choose to utilize the contents of this paid advertisement. Readers should perform their own due diligence and are strongly urged to independently verify all statements made in this or any other paid advertisement. Any investment should be made only after consulting with a qualified investment professional and after reviewing the publicly available financial statements of, and other information about, the company and verifying that the investment is appropriate and suitable for you. PGCXREPORT.COM nor any of their principals, officers, directors, partners, agents, or affiliates are not, nor do we represent ourselves to be, registered investment advisors, brokers, or dealers in securities. “Insert text here” is not offering securities for sale. An offer to buy or sell can be made only with accompanying disclosure documents and only in the states and provinces for which they are approved. PGCXREPORT.COM does not offer or sell securities. You can obtain more information about Virtual Sourcing Inc., from its website at http://www.virtualsourcinginc.com. Virtual Sourcing Inc., is a reporting company under the Securities Exchange Act of 1934, as amended, and trades on the OTC Bulletin Board under the symbol PGCX. Virtual Sourcing Inc., periodic and other reports filed under the Securities Exchange Act of 1934, as amended, are publicly available from the Securities and Exchange Commission at their website at http://www.sec.gov/edgar/searchedgar/webusers.htm. General investor information about publicly-traded companies like Virtual Sourcing Inc., advice to investors, and other investor resources are available from the Securities and Exchange Commission’s website at www.sec.gov or from the Financial Industry Regulatory Authority website at www.finra.com. Many states have established rules requiring the approval of a security by the state securities administrator. Check with www.nasaa.org or call your state security administrator to determine whether a particular security is licensed for sale in your state. Many companies have filed information with state securities regulators and many companies will supply prospective investors with additional information upon request. This advertisement is not intended for readers in any jurisdiction where not permissible under local regulations and investors in those jurisdictions should disregard it. Catalina Advertising Corp. has managed a total production budget of $750,000 for this advertising effort. PGCXREPORT.COM is being paid $25,000 and also expects to receive new subscriber revenue as a result of its participation in this advertising effort. Investing in securities is highly speculative and carries a great deal of risk, especially as to new companies with limited operations and no history of earnings. Past performance does not guarantee future results. This paid advertisement contains forward-looking statements regarding Virtual Sourcing Inc., its business and plans. Such forward-looking statements are within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to be covered by the safe harbor provisions created by these laws. Where Virtual Sourcing Inc., expresses or implies an expectation or belief as to future events or results, such expectation or belief is believed to have a reasonable basis. However, forward-looking statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by such forward-looking statements. Such risks include, but are not limited to, the size and growth of the market for Virtual Sourcing Inc., products and services, its ability to develop and distribute its products, the ability of the company to fund its capital requirements, competition, regulatory developments, the effects of short-selling and other market pressures, and other factors. PGCXREPORT.COM is a trademark of “Miski Inc., All other trademarks used in this publication are the property of their respective trademark holders. PGCXREPORT.COM is not affiliated, connected, or associated with, and are not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by PGCXREPORT.COM to any rights in any third-party trademarks.

PDF copy of promotion page.

Disclaimer: I have no position in any stock mentioned. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.