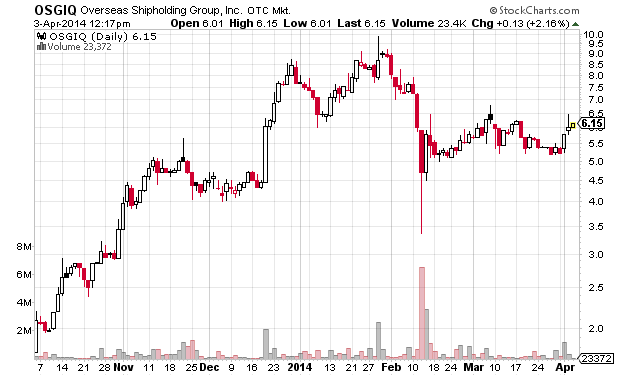

I follow LongShortGreek on Twitter and have found his information and thoughts about bankrupt stocks to be good and actionable. When he tweeted that the bankruptcy plan would give current OSGIQ shareholders $2/share worth of new equity I was intrigued by the seemingly obvious short.

See the most recent OSGIQ 10-K for the total share count:

As of March 3, 2014, 30,677,595 shares of Common Stock were outstanding.

See the most recent bankruptcy plan (dated March 7th, 2014).

From page 27 in the bankruptcy plan (emphasis mine):

(k) Class E1: Subordinated Claims and Old Equity Interests in OSG.

(i) Classification. Class E1 consists of all Subordinated Claims and

Old Equity Interests in OSG.

(ii) Treatment. Effective as of the Effective Date, on, or as soon as

reasonably practicable after the Initial Distribution Date, each Holder of an Allowed Class E1

Claim or Allowed Class E1 Old Equity Interest shall receive, in full satisfaction, settlement,

discharge and release of, its Allowed Class E1 Claim or Allowed Class E1 Old Equity Interest,

as the case may be, a pro rata share of Reorganized OSG Equity equal to $61.4 million, subject

to dilution on account of the Management and Director Incentive Program, the Rights Offering,

and the Commitment Premium Shares and Warrants. The Reorganized OSG Equity to be

distributed to each (x) Domestic Holder of an Allowed Class E1 Claim or Allowed Class E1 Old

Equity Interest shall be in the form of Reorganized OSG Stock, and (y) Foreign Holder of an

Allowed Class E1 Claim or Allowed Class E1 Old Equity Interest shall be in the form of a

combination of Reorganized OSG Stock and Reorganized OSG Jones Act Warrants, as necessary

for Reorganized OSG to comply with the Jones Act.

(iii) Voting. Class E1 Claims are Impaired and the Holders of Allowed

Class E1 Claims and Allowed Class E1 Old Equity Interest as of the Voting Record Date are

entitled to vote to Accept or reject the Plan.

So the shareholders of OSGIQ will receive shares in the new company equal to $61.4 million. Divide that by the number of shares and you get a value of $2.001 per share of OSGIQ.

For a contrary viewpoint see the shareholders’s response to the plan on February 26th (PDF).

Here are a couple recent filings by the debt & equity committee that bode well for the plan being approved:

http://www.kccllc.net/osg/document/1220000140328000000000011

http://www.kccllc.net/osg/document/1220000140319000000000010

So what is the catch? There are currently 170,000 shares of OSGIQ available to short at Interactive Brokers (FTP link to full short list) and the borrow rate is only 3.45% APR. That would indicate that there is something I am missing otherwise the borrow rate would be higher. For past obvious bankruptcy shorts like EKDKQ (Kodak) or EXMCQ (Excel Maritime) the borrow rates were way over 20% APR (closer to 60% if I recall correctly, and the effective borrow rate on each was well over 100% due to their low share price).

OSGIQ|USD|Overseas Shipholding Group Inc|10859|XXXXXXX81053|-3.37|3.45|1700000|

Equity holders have until April 4th to review and file objections to the plan. On that day the judge will review it (as I publish this I think that date has been delayed two weeks).

See this page for updates from the bankruptcy court.

For a contrary view of OSGIQ take a look at this random person’s tweets. I am thoroughly confused right now so I closed for a loss my original short position that I took two days ago.

Disclaimer: I have no position in OSGIQ and I may short or buy at any time. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.