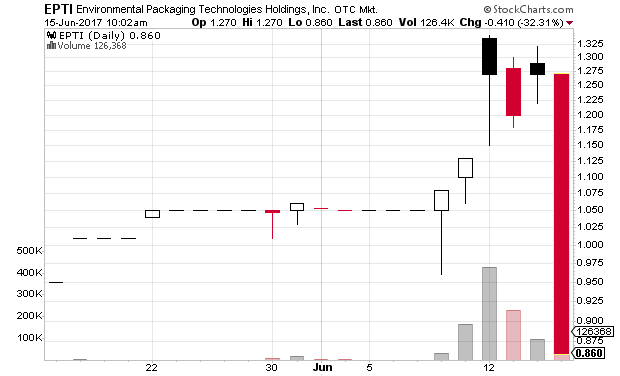

The newest landing page pump out there is Environmental Packaging Technologies Holdings (EPTI). It has only been pumped for a week and volume is not great and it already crashed today but is bouncing back. A short seller such as I can only hope that the pump recovers and gets more volume so that it will be worth selling short (I currently have no position). The landing page is at: http://profitplaystocks.com/epti/index.html. Today I received a 16-page glossy mailer that I have scanned (pdf).

As of the company’s most recent 10-Q, filed on June 8, 2017, the company reported total assets of $475 and no revenues for the most recent quarter.

Disclosed budget: $1,000,000

Promoter: Profit Play Stocks

Paying party: SVARNA LTD

Shares outstanding: 12,000,023

Previous closing price: $1.27

Market capitalization: $30 million

Disclaimer (emphasis added by me):

IMPORTANT NOTICE AND DISCLAIMER: DO NOT BASE ANY INVESTMENT DECISIONS UPON ANY MATERIAL FOUND IN THIS REPORT. This publication is distributed free of charge and does not purport to provide an analysis of a company’s financial position. The information contained herein has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company, including Environmental Packaging Technologies Holdings (EPTI). Environmental Packaging Technologies Holdings’ (EPTI) financial position and all other information regarding (EPTI) should be verified with the company. An individual should not invest in the securities of (EPTI) based solely on information contained in this advertisement. Information about many publicly traded companies, including (EPTI) and other investor resources can be found at the Securities and Exchange Commission’s website: www.sec.gov. Investing in securities is highly speculative and carries significant risk. It is recommended that any investment in any security should be made only after consulting with your investment advisor and only after reviewing all publicly available information, including the statements of the company. This mailing piece is not intended to be, nor should it be construed as, an offer to sell or a solicitation of an offer to buy securities, nor should it be construed as the provision of any investment related advice or services tailored to any particular individual’s financial situation or investment objective(s). Profit Play Stocks is a publisher of general and regular circulations offering impersonalized investment-related research to readers and/or prospective readers and is not an investment advisor or broker/dealer registered with either the U.S Securities and Exchange Commission (SEC) or with any state securities regulatory authorities. Profit Play Stocks is neither licensed nor qualified to provide financial advice. As such, it relies upon the “publisher’s exclusion” as provided under Section 202(a)(11) of the Investment Advisors Act of 1940 and corresponding state securities laws. Investing in companies like (EPTI) carries a high degree of risk. Do not invest in this company unless you can afford to possibly lose your entire investment. The “Company” featured herein appears as paid advertising, paid by a third party to provide public awareness for (EPTI). The publisher, Profit Play Stocks, understands that in an effort to enhance public awareness of (EPTI) and its securities through the distribution of this mail and online advertisement, SVARNA, LTD. paid all of the costs associated with creating, printing, postage, and distribution of this advertisement. The publisher was paid the sum of ten thousand dollars for its contributions. The marketing vendors will be managing a total budget of one million dollars, provided by SVARNA, LTD. for all mail and online advertising and marketing efforts and will retain any amounts over and above the cost of production, copywriting services, mailing and other distribution expenses, as a fee for its services. If successful, the advertisement will increase investor and market awareness, which may result in increased numbers of shareholders owning and trading the common stock of (EPTI), increased trading volumes, and possibly increased share price of the common stock of (EPTI). The publisher has not undertaken to determine if SVARNA, LTD. Is, or intends to be, directly or indirectly, a shareholder of (EPTI). This publication is based exclusively on information generally available to the public and does not contain any material, non-public information. The information on which it is based is believed to be reliable; nevertheless, the publisher cannot guarantee the accuracy or completeness of the information. The information contained herein contain forwardlooking information within the meaning of section 27a of the Securities Act and section 21e of the Securities Exchange Act including statements regarding expected growth of The Company. In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act, the publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the Company’s actual results of operations. Factors that could cause actual results to differ include, but are not limited to, the size and growth of the market for the company’s products and services, the company’s ability to fund its capital requirements in the near term and long term, pricing pressures and other risks detailed in the company’s filed reports with SEC. To the fullest extent of the law, we will not be liable to any person or entity for the quality, accuracy, completeness, reliability, or timeliness of the information provided herein, or for any direct, indirect, consequential, incidental special or punitive damages that may arise out of the use of information we provide to any person or entity (including, but not limited to; lost profits, loss of opportunities, trading losses, and damages that may result from any inaccuracy or incompleteness of this information.

*Projection: Profit projection based on Environmental Packaging Technologies (EPTI) potential to match their competitor’s (Kirby Corporation: KEX) price surge.

Copy of pump landing page (PDF)

Disclaimer. I have no position in any stock mentioned above. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

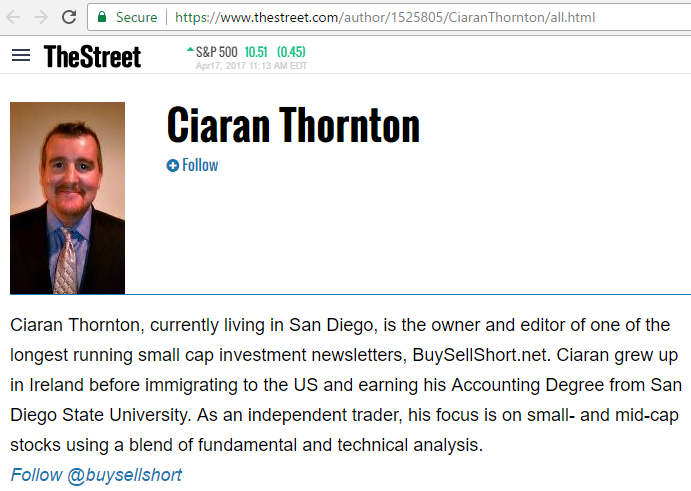

Evidently not content to make money running a stock trading newsletter, Ciaran Thornton was paid for positive articles that he wrote about some stocks, without disclosing that compensation. He was

Evidently not content to make money running a stock trading newsletter, Ciaran Thornton was paid for positive articles that he wrote about some stocks, without disclosing that compensation. He was