First, because I cannot resist — just replace “OPP” with “OCC” when you sing along.

I’m not down with OPP. But I am down with The OCC (The Options Clearing Corporation). They are the ones who determine settlement and other important technical details of traded options. For most options traders, The OCC is unimportant — each option has a strike price and an expiry date and that is all that really matters. But when there are corporate events such as mergers, splits, bankruptcies, and the like, the OCC’s decisions become important.

Seadrill Inc (SDRL) just emerged today from its long trip through bankruptcy. From the company’s press release:

SDRL – Seadrill Announces Emergence from Chapter 11

Hamilton, Bermuda, July 2, 2018 – Seadrill Limited (“Seadrill” or the “Company“) announces today (the “Effective Date“) that it has emerged from chapter 11 after successfully completing its reorganization pursuant to its chapter 11 plan of reorganization (the “Plan“). All conditions precedent to the restructuring contemplated by the Plan have been satisfied or otherwise waived.

The Plan has equitized approximately $2.4 billion in unsecured bond obligations, more than $1 billion in contingent newbuild obligations, substantial unliquidated guaranty obligations, and c. $250 million in unsecured interest rate and currency swap claims, while extending near term debt maturities, providing the Company with over $1 billion in fresh capital and leaving employee, customer, and ordinary trade claims largely unimpaired.

The Plan has re-profiled the Company’s debt and provided substantial liquidity that puts the Company in a strong position to execute its business plan. The figures presented below highlight key financial metrics as of the Effective Date:

- total cash of c.$2.1 billion;

- secured bank debt of c.$5.7 billion with the first maturity in 2022;

- new Secured Notes of c.$880 million maturing in 2025;

- backlog of c.$2.3 billion for Seadrill Limited, excluding Seamex and Seadrill Partners; and

- common shares issued of 100 million as described further below.

Issuance, Listing and Trading of New Common Stock

The Company has received approval to list its new common shares with the new CUSIP number G7998G 106 (the “New Common Shares“) on the New York Stock Exchange (the “NYSE“) under the same NYSE ticker symbol “SDRL” as the Company’s existing common shares (with the CUSIP G7945E 105) (the “Existing Shares“). Subject to the relevant approvals, the Company also intends to have its equity listed on the Oslo Stock Exchange (ISIN BMG7998G1069).

On the Effective Date, the Company will have approximately 100 million New Common Shares outstanding. The New Common Shares will be allocated as set forth below, in accordance with provisions of the Plan and issued on the Effective Date:

- 14.25% of the New Common Shares issued to holders of unsecured claims against the Company and certain of its chapter 11 debtor affiliates;

- 23.75% of the New Common Shares issued to participants in the $200 million equity investment under the Plan;

- 54.625% of the New Common Shares issued to participants in the $880 million new secured notes investment under the Plan;

- 1.9% of the New Common Shares issued to holders of existing common equity interest in the Company as of the Effective Date, an effective exchange ratio of approximately 0.0037345 New Common Shares per each Existing Share, and

- 5.475% of the New Common Shares issued as a structuring fee to certain of the new money investors.

Trading in approximately 16 million New Common Shares issued to existing shareholders and holders of unsecured claims will commence on the NYSE one day after the Effective Date, on July 3, 2018, under the ticker symbol “SDRL”. Additional shares may commence trading in the coming weeks after a resale registration statement on Form F-1 with respect to additional shares issued on the Effective Date to certain investors is declared effective by the Securities and Exchange Commission. The Existing Shares will continue to trade on both the NYSE and Oslo Stock Exchanges under the same ticker symbol through the close of trading on the Effective Date but thereafter such trading will be suspended and the shares will be cancelled in due course.

Because the Company will continue to use the ticker symbol SDRL, holders of Existing Shares, brokers, dealers and agents effecting trades in the Existing Shares, and persons who expect to receive New Common Shares or effect trades in New Common Shares, should take note of the anticipated cancellation of the Existing Shares and issuance of New Common Shares, and the two different CUSIP numbers signifying the Existing Shares and the New Common Shares, in trading or taking any other actions in respect of shares of the Company that trade under the “SDRL” ticker.

Any questions regarding these distributions should be directed to the Company’s claims and noticing agent, Prime Clerk, on the numbers provided below.

Yesterday the OCC filed the preliminary notice (pdf) for how SDRL options would be treated. Below is the important part:

On April 17, 2018, United States Bankruptcy Court for the Southern District of Texas Victoria Division confirmed the Second Amended Joint Plan of Reorganization (“Plan”) for Seadrill Limited (SDRL). The Plan became effective on July 2, 2018, and SDRL shares were canceled. Under the Plan, SDRL shares will be converted into the right to receive approximately 0.0037345 (New) Seadrill Limited Common Share. Pursuant to the Plan, fractional shares will be rounded up or down to the nearest whole share with half shares being

rounded down.Because fractional share amounts less than 0.5 will be rounded down, it is anticipated that SDRL1 options will not be adjusted to call for delivery of (New) SDRL Common Shares (100 x approximately 0.0037345 = approximately 0.37345). OCC will delay settlement until the final rate has been confirmed.

What this means is that the options will now be for zero shares of new SDRL. So one $0.50 put will pay out $50.00. So even if someone had bought $0.50 puts at $0.45 yesterday they will still make a nice 11% return. Do note that this OCC memo is preliminary and the final memo and settlement have not yet occurred. I will update this blog post once final settlement on the options has occurred.

Comparison to Ocean Rig (ORIG) bankruptcy emergence options adjustment

In September 2017 Ocean Rig UDW (ORIG) emerged from bankruptcy with old shareholders getting a tiny fraction of new shares. In that instance, the old options were cash-settled. See the preliminary OCC notice (dated 9/21/2017) and the final OCC notice (dated 9/27/2017).

From the preliminary OCC notice:

Ocean Rig UDW Inc. (ORIG) has announced a 1-for-9200 reverse stock split/Scheme of Arrangement. As a result of the reverse stock split/Scheme of Arrangement, each ORIG Common Share will be converted into the right to receive approximately 0.0001087 (New) Ocean Rig UDW Inc. Common Shares. The reverse stock split will become effective before the market open on September 22, 2017. Cash will be paid in lieu of fractional ORIG shares

The cash in lieu amount was then determined ( and announced in the final OCC memo:

Adjusted Ocean Rig UDW Inc. options were adjusted on September 22, 2017 (See OCC Information Memo #41867). The new deliverable became cash in lieu of approximately 0.01087 fractional ORIG Shares. The settlement of the ORIG1 options exercise/assignment activity was subject to delayed settlement.

OCC has been informed that a price of $23.50 per whole ORIG share will be used to determine the cash in lieu amount at a rate of 0.01087.

Accordingly, the cash in lieu amount is:

0.01087 x $23.50 = $0.26 per ORIG1 Contract

Now that the exact cash in lieu amount has been determined, OCC will require Put exercisers and Call assignees, during the period of September 22, 2017 through September 27, 2017, to deliver the appropriate cash amount

I was told by an experienced trader that I trust that how the OCC determines settlement in these cases of corporate events is determined by the company — so when a similar situation happens in the future both the cash in lieu of settlement and the rounding of shares (up or down) are both possible.

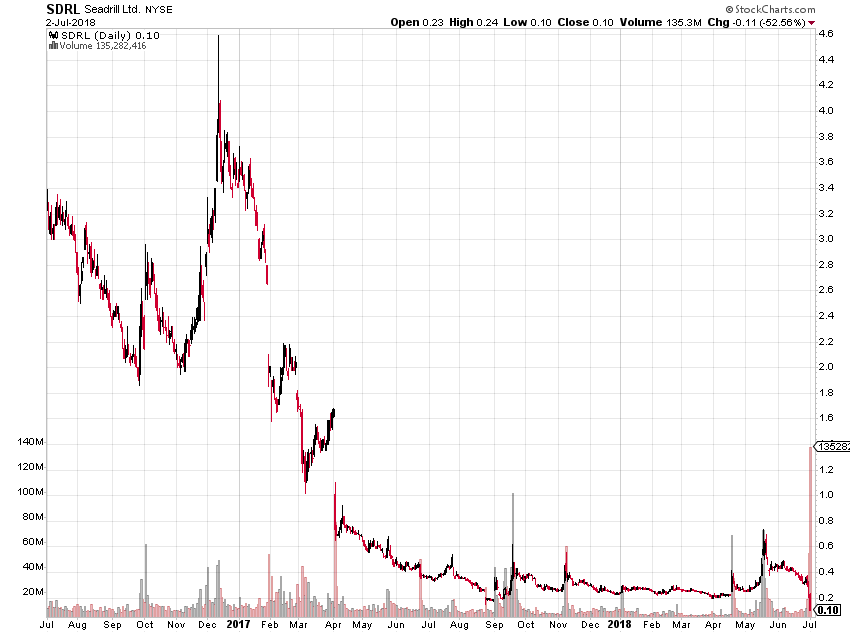

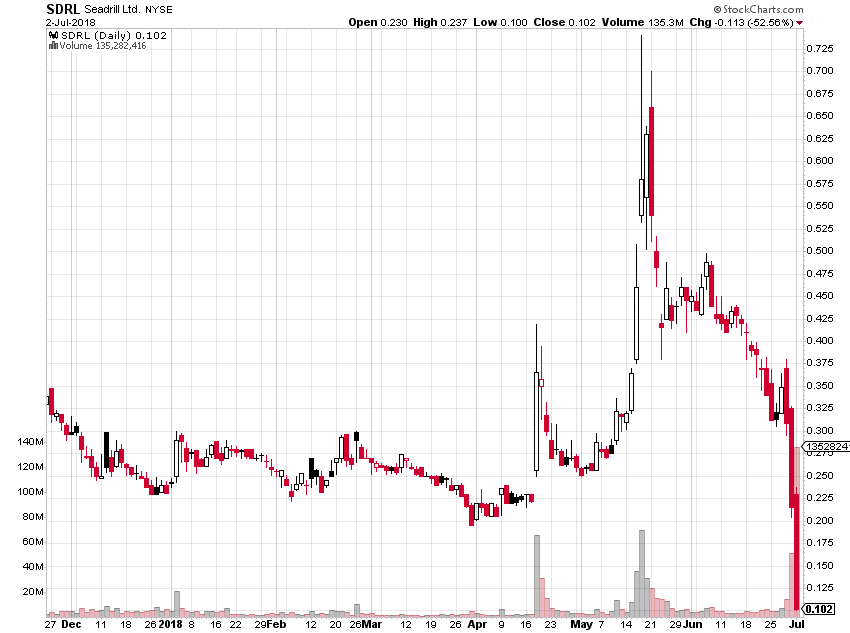

For the record: some final charts of Seadrill during the bankruptcy:

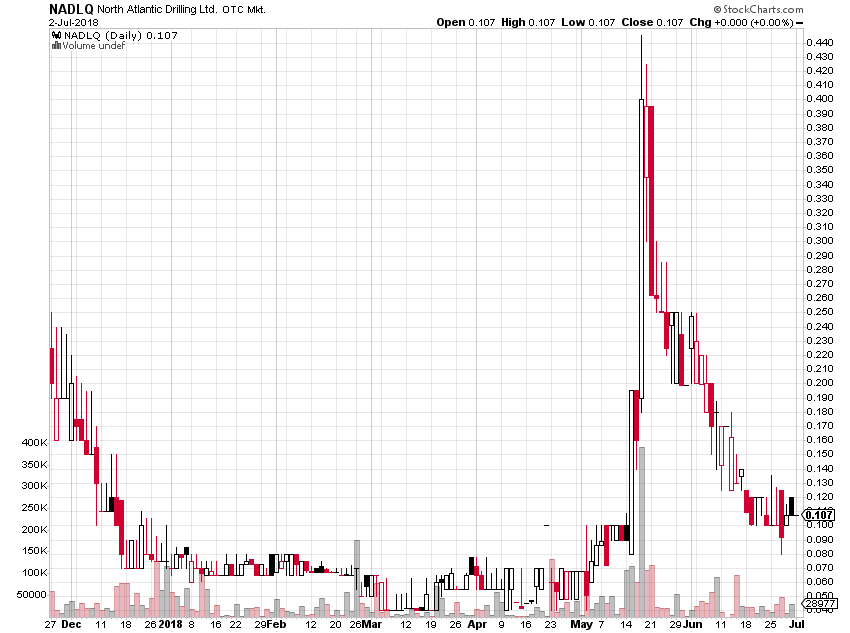

And here is a final chart of Seadrill affiliate North Atlantic Drilling (NADLQ), whose shareholders were completely wiped out in the bankruptcy:

I did not short NADLQ because of the high borrow rate and low price and uncertainty about when the stock would be deleted.

And here is the Ocean Rig UDW (ORIG) chart showing the time during which it emerged from bankruptcy — it appears that the two daily candlesticks in the $700 range are data errors — the stock closed at $0.075 on the last day of trading prior to emergence from bankruptcy and the 9200 for 1 reverse split. It opened around $40 the next day (it actually opened above $100 but those trades were busted)

Here are charts showing the actual prices (with no apparent data errors):

Disclaimer. I am short a tiny position of SDRL July 20th 2018 $0.50 calls. No position in any other stock mentioned and I have no relationship with anyone mentioned in this post. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.