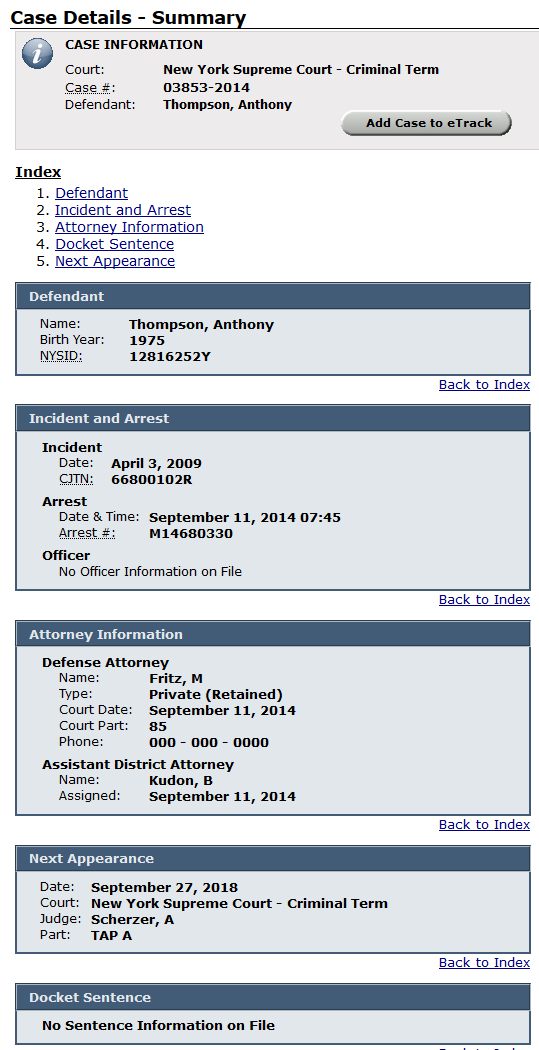

| Charge |

Detail |

Disposition/Sentence |

| PL 165.52 00 |

C Felony, 1 count, Arrest charge, Not an arraignment charge

Cpsp-2nd:value Of Prop >$50000

7

|

Dismissed |

| PL 165.54 00 |

B Felony, 2 counts, Arrest charge, Not an arraignment charge

Cpsp-1st:value Prop > $1000000

16

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

20

09/03/2014

|

Dismissed |

GB 0352C 05

**TOP CHARGE** |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >9 Perso

12

09/03/2014

|

Pled Guilty |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

23

|

Dismissed |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

27

|

Dismissed |

| PL 165.52 00 |

C Felony, 1 count, Arrest charge, Not an arraignment charge

Cpsp-2nd:value Of Prop >$50000

33

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

39

09/03/2014

|

Dismissed |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

52

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

66

09/03/2014

|

Dismissed |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

73

|

Dismissed |

| GB 0352C 05 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >9 Perso

77

09/03/2014

|

Dismissed |

| GB 0352C 05 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >9 Perso

1

09/03/2014

|

Dismissed |

| PL 190.65 1A |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Scheme Def 1st:10 Or> Persons

30

09/03/2014

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

53

09/03/2014

|

Covered By Gb 0352c 05 |

| PL 190.65 1A |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Scheme Def 1st:10 Or> Persons

61

09/03/2014

|

Dismissed |

| PL 190.65 1B |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Scheme Def 1st:property> $1000

62

09/03/2014

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

85

09/03/2014

|

Dismissed |

| PL 190.65 1A |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Scheme Def 1st:10 Or> Persons

2

09/03/2014

|

Covered By Gb 0352c 05 |

| PL 190.65 1B |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Scheme Def 1st:property> $1000

6

09/03/2014

|

Dismissed |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

19

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

9

09/03/2014

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

11

09/03/2014

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

26

09/03/2014

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

41

09/03/2014

|

Dismissed |

| PL 165.54 00 |

B Felony, 1 count, Arrest charge, Not an arraignment charge

Cpsp-1st:value Prop > $1000000

49

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

55

09/03/2014

|

Dismissed |

| GB 0352C 05 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >9 Perso

46

09/03/2014

|

Pled Guilty |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

57

09/03/2014

|

Covered By Gb 0352c 05 |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

68

09/03/2014

|

Dismissed |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

71

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

28

09/03/2014

|

Dismissed |

| PL 190.65 1B |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Scheme Def 1st:property> $1000

31

09/03/2014

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

45

09/03/2014

|

Dismissed |

| PL 190.65 1B |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Scheme Def 1st:property> $1000

48

09/03/2014

|

Dismissed |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

69

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

83

09/03/2014

|

Dismissed |

| PL 190.65 1B |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Scheme Def 1st:property> $1000

3

09/03/2014

|

Dismissed |

| PL 190.65 1A |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Scheme Def 1st:10 Or> Persons

5

09/03/2014

|

Dismissed |

| PL 165.54 00 |

B Felony, 2 counts, Arrest charge, Not an arraignment charge

Cpsp-1st:value Prop > $1000000

15

|

Dismissed |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

8

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

24

09/03/2014

|

Covered By Gb 0352c 05 |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

36

|

Dismissed |

| GB 0352C 05 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >9 Perso

29

09/03/2014

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

43

09/03/2014

|

Dismissed |

| PL 190.65 1A |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Scheme Def 1st:10 Or> Persons

47

09/03/2014

|

Dismissed |

| PL 155.40 01 |

C Felony, 1 count, Arrest charge, Not an arraignment charge

Gr Lar 2nd:property Val>$50000

65

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

70

09/03/2014

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

72

09/03/2014

|

Dismissed |

| GB 0352C 05 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >9 Perso

60

09/03/2014

|

Dismissed |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

80

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

81

09/03/2014

|

Dismissed |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

82

|

Dismissed |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

84

|

Dismissed |

| PL 155.30 01 |

E Felony, 1 count, Arrest charge, Not an arraignment charge

Gr Lar 4-vlue Prpty>$1000

10

|

Dismissed |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

25

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

37

09/03/2014

|

Dismissed |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

42

|

Dismissed |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

44

|

Dismissed |

| PL 165.52 00 |

C Felony, 1 count, Arrest charge, Not an arraignment charge

Cpsp-2nd:value Of Prop >$50000

50

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

59

09/03/2014

|

Dismissed |

| PL 165.54 00 |

B Felony, 2 counts, Arrest charge, Not an arraignment charge

Cpsp-1st:value Prop > $1000000

63

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

74

09/03/2014

|

Dismissed |

| PL 190.65 1A |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Scheme Def 1st:10 Or> Persons

78

09/03/2014

|

Dismissed |

| PL 190.65 1B |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Scheme Def 1st:property> $1000

79

09/03/2014

|

Dismissed |

| GB 0352C 05 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >9 Perso

4

09/03/2014

|

Dismissed |

| PL 190.65 1B |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Scheme Def 1st:property> $1000

14

09/03/2014

|

Dismissed |

| PL 165.54 00 |

B Felony, 1 count, Arrest charge, Not an arraignment charge

Cpsp-1st:value Prop > $1000000

32

|

Dismissed |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

40

|

Dismissed |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

54

|

Dismissed |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

56

|

Dismissed |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

58

|

Dismissed |

| PL 165.54 00 |

B Felony, 2 counts, Arrest charge, Not an arraignment charge

Cpsp-1st:value Prop > $1000000

64

|

Dismissed |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

21

|

Dismissed |

| PL 190.65 1A |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Scheme Def 1st:10 Or> Persons

13

09/03/2014

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

22

09/03/2014

|

Covered By Gb 0352c 05 |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

38

|

Dismissed |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

67

|

Dismissed |

| PL 155.35 01 |

D Felony, 1 count, Arrest charge, Not an arraignment charge

Grand Larceny 3rd Degree

75

|

Dismissed |

| GB 0352C 06 |

E Felony, 1 count, Not an arrest charge, Not an arraignment charge

Securities Fraud >$250

76

09/03/2014

|

Dismissed |