It looks like Green Innovations Ltd. (GNIN) is the new Brighton Markets pump and dump (thanks to Tim for the confirmation).. Their last two pumps were PUNL and IDNG. Both offered some nice opportunities for speculators to make money on the long side, but both had truly epic dumps.

Some of the Brighton Markets websites:

WorldStreetFundamentals.com

BrightonMarkets.com

BollingerReport.com

GlobalEquityAlert.com

EquityLeader.com

MarketFoundations.com

BreakoutFinder.net

PennyStockplayerz.com

EquityMarketsinc.net

RisingSunReport.com

nationaltradersassociation.com

dividendseeker.net

investors-alliance.com

tradersinsight.net

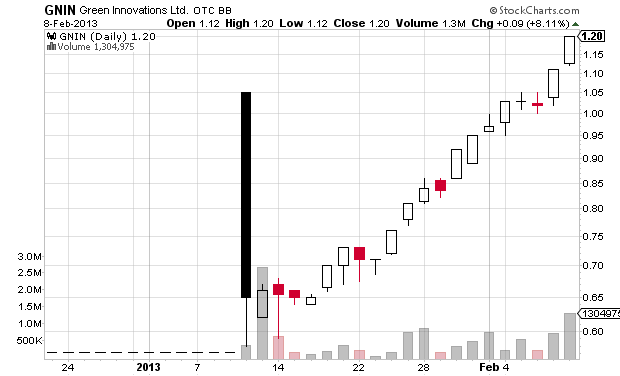

GNIN (Green Innovations Ltd)

Current market cap: $36 million

Free trading shares owned by seed shareholders: 20m

[Edit 2/10/2013] – This company loves mucking about with their share structure. As of October 1st, 2012, a 20 for 1 forward split became effective and the company’s shares outstanding increased from 5m to 100m. However, the company had already issued 49.5m shares (post split) and canceled 79.5m shares (post-split) in the reverse-merger dated September 26th, 2012. This reduced shares outstanding to 70m, Then 45m of the remaining 70m shares were canceled and replaced with 5m super-voting preferred shares, leaving the company with 25m common and 5m preferred shares outstanding.

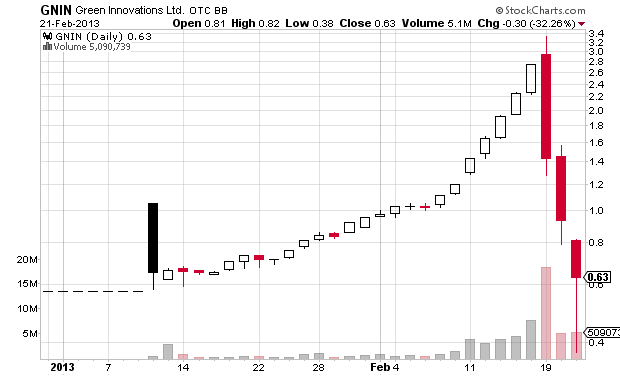

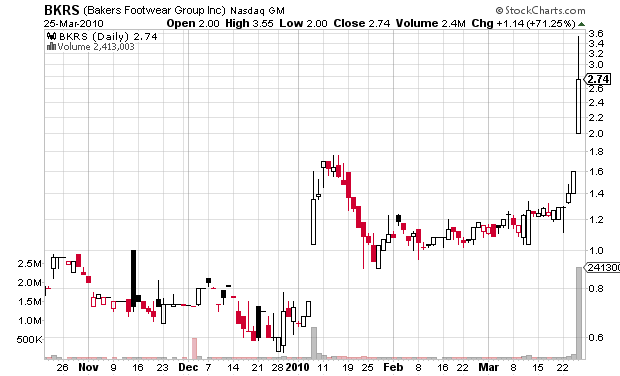

[Edit 2/21/2013] – Here is a chart of GNIN after the dump:

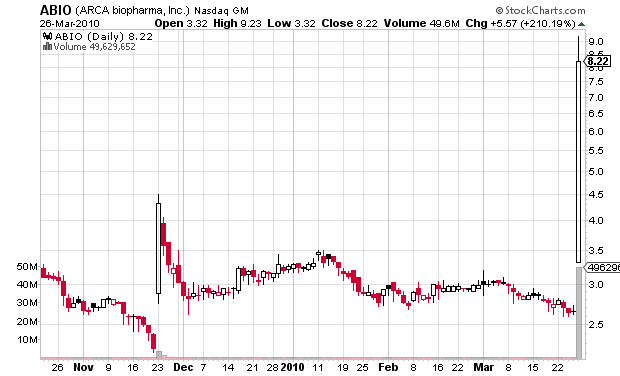

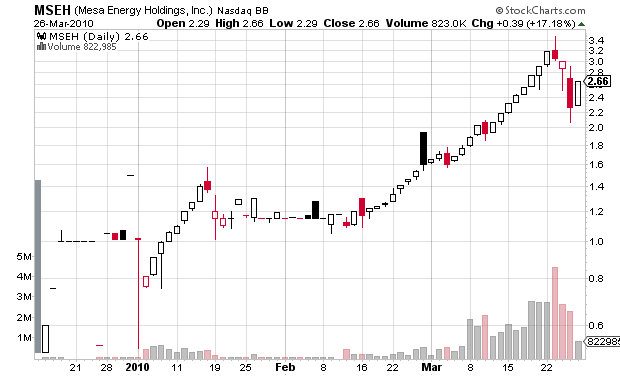

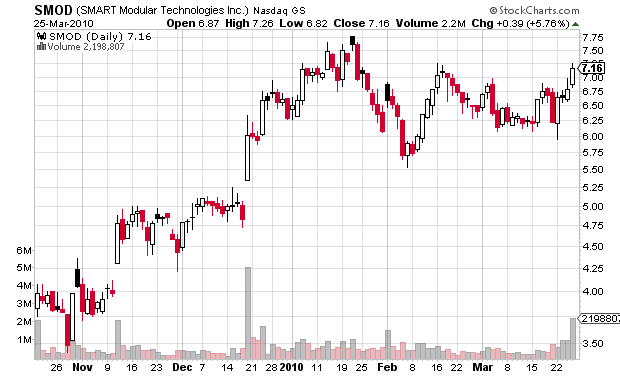

PUNL (Punchline Resources) – click to enlarge

Maximum market cap: $82 million

Free trading shares: 20m (at time of promotion)

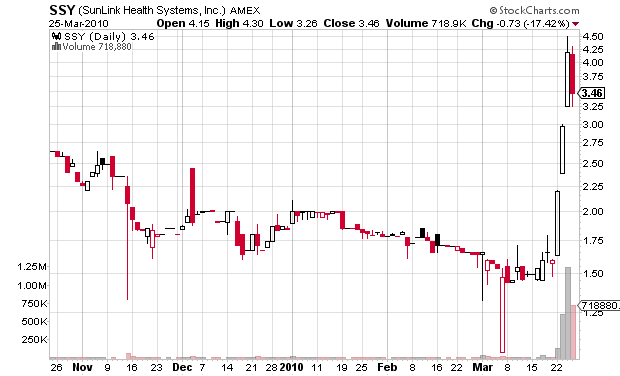

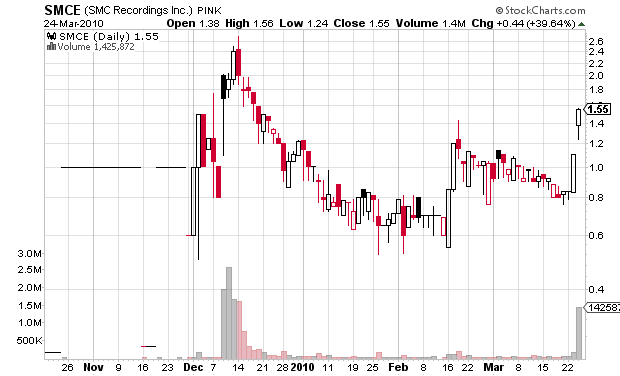

IDNG (Independence Energy Corp) — click to enlarge

Maximum market cap: $116 million

Free trading shares: ?? (at time of promotion)

Disclaimer: I have no position in any stock mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.