As I have talked about building my own computer before I thought I’d put together a sample of a nice trading computer I would buy right now if I weren’t so much into overkill. It continues to get cheaper to get great performance. Building your own computer used to be fairly difficult but gets easier every year — just make sure you discharge static before touching components and then it is mostly just plug and play. Even a complete novice should be able to watch a few Youtube videos and then put together a computer in an afternoon (if everything goes right). Figure an extra day if you wind up with a bad component (like a bad stick of RAM). This has happened to me once before and for this reason I recommend buying such components from Newegg.com — they aren’t always the cheapest but they have great service and a good return policy. I almost always buy my RAM, motherboards, and CPUs from Newegg.

If you have not yet read it, take a look at my post from a year ago on my current trading computer. The most important things when building a trading computer (as opposed to a gaming computer) are that you want more CPU cores (clock speed doesn’t matter much) and you want plenty of RAM and a good video card with lots of video outputs (to support multiple monitors). There is no point in overclocking or liquid cooling — overclocking can be great for games but not trading or general use and liquid cooling is unnecessary without overclocking.

As for monitors, I have eight. However, I gradually added monitors over time. If I were starting from scratch I would likely get just a couple really big monitors.

Without further ado, here is my example build. You can find all the components on a public wishlist at Newegg.

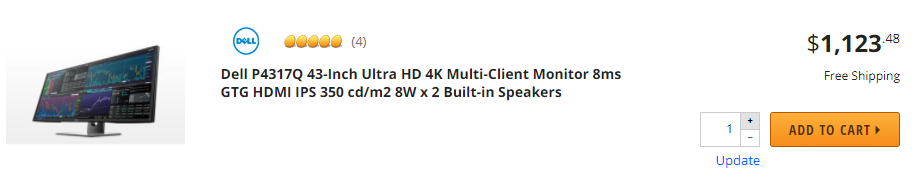

Monitor

The monitor is the Dell 43″ multi-client monitor that has 4 video inputs; each quarter of the monitor is treated like a separate monitor. This is what my friend Tim Bohen uses and recommends. It is expensive but the nice thing is you don’t have to deal with bezels of multiple monitors wasting space. If you want to save money, just buy a couple 22″ monitors for about $100 each. This Dell monitor can currently be found for sale at Amazon for $902.

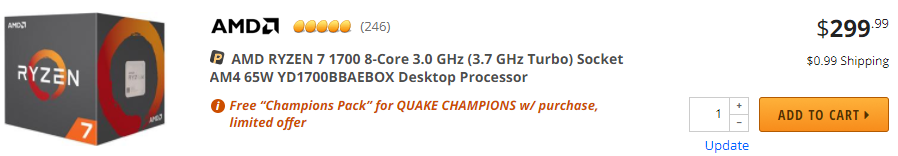

CPU

With the new line of Ryzen CPUs AMD is finally competitive with Intel again. While the Ryzen CPUs underperform compared to similar Intel CPUs at the same clock speed and number of cores, the Ryzen CPUs give you more cores for your money and for a trader that is what is important. The AMD Ryzen 7 1700 8-core CPU will outperform any quad-core Intel CPU that is not overclocked. Anything more than this would be overkill.

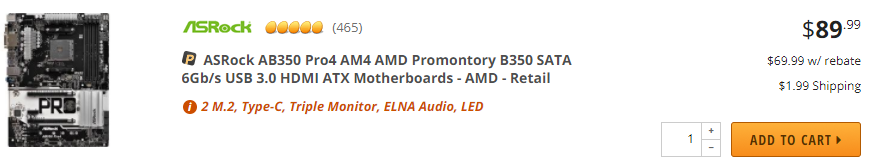

Motherboard

If you aren’t going to overclock or do anything fancy, the motherboard doesn’t matter that much. You just want a reliable motherboard that has a good feature set. There is no point to spending lots of money on a fancier one. Don’t worry about integrated graphics because you will need a separate graphics card.

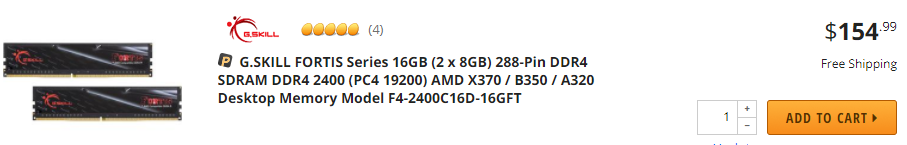

More memory is better but unless you are paranoid or believe in overkill or are running way more apps than any reasonable person, 16GB is enough. Make sure that your memory is on the list of qualified / tested memory for the motherboard you buy (that means you will get more and better support if there is a problem and there is less likely to be a problem). The above memory is on the supported/tested list for the above motherboard.

Hard Drive

I highly recommend buying a solid state hard drive (SSD) and they are now cheap enough that you don’t need to get a magnetic hard drive as well. In this case, $150 buys a 500GB SSD from the most respected brand. Although if you have a huge video/music collection, it is easy enough to find a quality 2 terabyte or larger hard drive for $100. The reason I recommend an SSD is because they are much faster and will make for a much faster boot up and faster program load times. If you really want fast performance, get an M.2 NVME SSD hard drive (like I have), which is even faster.

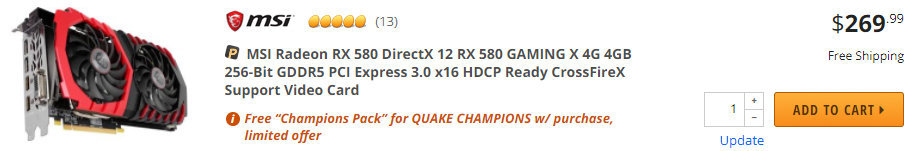

Graphics Card

The graphics card is not a place to skimp. You do not need a top of the line card but a medium high end card will give plenty of performance and have plenty of video outputs. This Radeon 580 card has four DisplayPort outputs and one DVI output and 4GB of RAM.

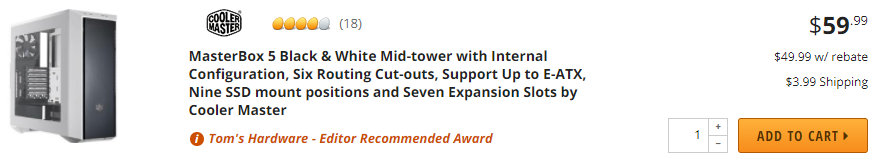

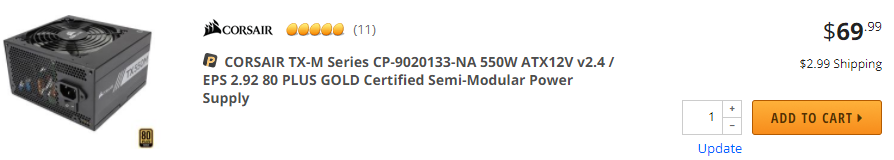

Case and Power Supply

The case is not that important although you will want to pay more attention and read reviews and maybe spend a little more if having a very quiet computer is important. A power supply is important but they are mostly commoditized. Just buy one from a major manufacturer and I recommend 80+ Gold — they are more energy efficient and will save you money in the long run. An 80+ Platinum power supply is likely not worth the extra cost for a tiny additional gain in efficiency. For this computer, a 550 watt power supply is overkill but that gives you the room to add a second graphics card without any problems if you want 8 monitors (or two of those monster Dell monitors).

DVD writer

These are commoditized. Pay $20 or less for one with good reviews.

These are commoditized. Pay $20 or less for one with good reviews.

Other things

You will also need to buy a copy of Windows 10, a mouse, and a keyboard. Of course most people will already have a mouse and keyboard in which case there is no need to buy new ones.

All told, the above computer costs $1115 without the monitor or $2020 with the monitor (if you purchase it from Amazon). Not bad at all and a good deal cheaper than most “trading computers”.

Disclaimer. No position in any stocks mentioned and I have no relationship with anyone mentioned in this post (except that I shop at Amazon and Newegg). This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.