After the SEC reinstated a new version of the uptick rule following the 2008 financial crisis, there has been very little information available online. If you search for “uptick rule” most of the info you will find is on the old uptick rule. The current version isn’t really an uptick rule at all, but rather an upbid rule. This new version was first put into effect in November 2010.

Simply put, shares of a stock cannot be sold short at or below the best bid when the rule is in effect. The short seller must sell on the offer and wait for a buyer to fill his offer. The rule goes into effect when a stock’s price decreases by 10% or more from its previous day’s close. Once a stock has dropped 10% from its previous day’s close (even if just briefly dropping that far) the rule will then be in effect for the rest of the day and the next trading day. The rule can only be triggered during regular trading hours although if it is triggered it remains in force during after-hours and pre-market trading.

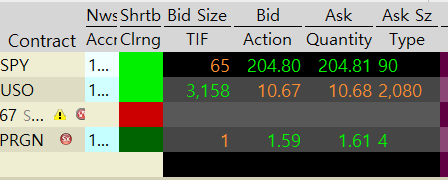

For those who use Interactive Brokers’ TWS platform, a little red circle will appear to the right of the stock description when the uptick rule is in effect. If you mouse over the red circle it will say “Short sale restriction is in effect from [date] to [date].”

In the screenshot below, IB TWS indicates that the uptick rule is in effect for PRGN with a little red circle to the right of the ticker.

There are some exemptions to the upbid rule but they do not apply to small traders. See this broker’s description of the exceptions.

The complete uptick rule can be found in this March 10th 2011 amendment to Regulation SHO (pdf).

I encourage reading the NYSE’s statement (pdf) about how it will enforce the uptick rule.

Disclaimer: No positions in any stock mentioned. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.