Disclosure: I’m short ElitePennyStock’s current promotion, AREN. See details at bottom.

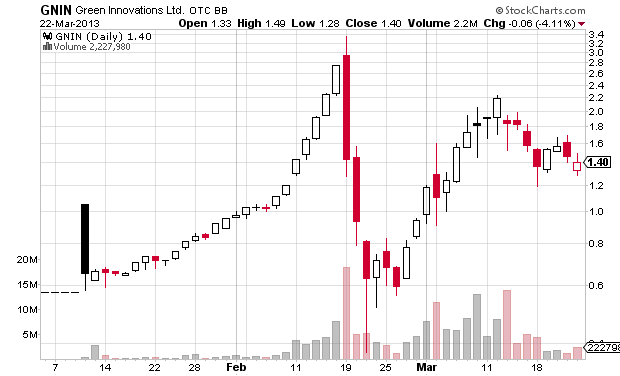

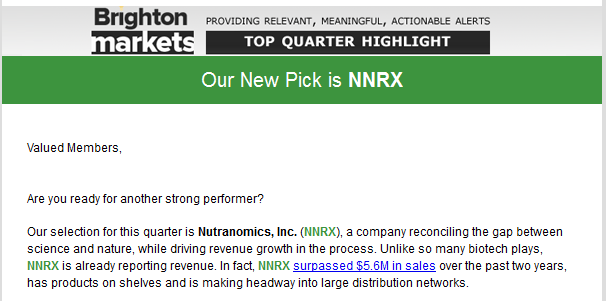

In a world in which ever more promoters and manipulators have not just been sued by the SEC but sent to prison by US Department of Justice it is a dangerous thing to be known as the best stock promoter. But with Stocktips.com having spectacularly failed in their most recent pump (of Coastal Integrated Services, COLV), ElitePennyStock is now in my opinion the best promoter out there. As detailed in a blog post by Tim Grittani (use code NEXT100 to save on his DVD), ElitePennyStock (and I use this name to refer to the people that run all the related websites) has ties to AwesomePennyStocks. See also the Promotion Stock Secrets research report on ElitePennyStock.

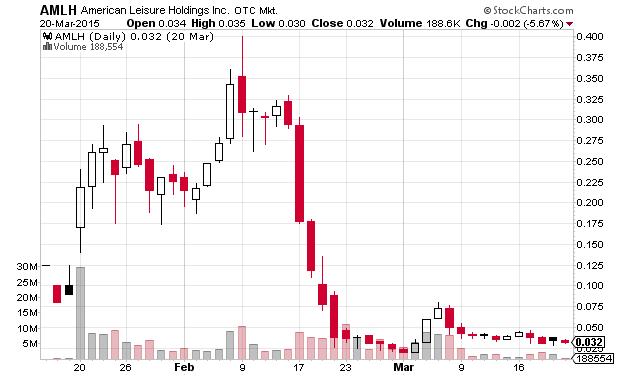

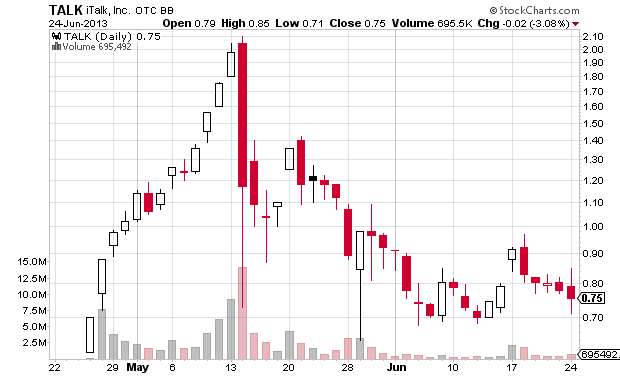

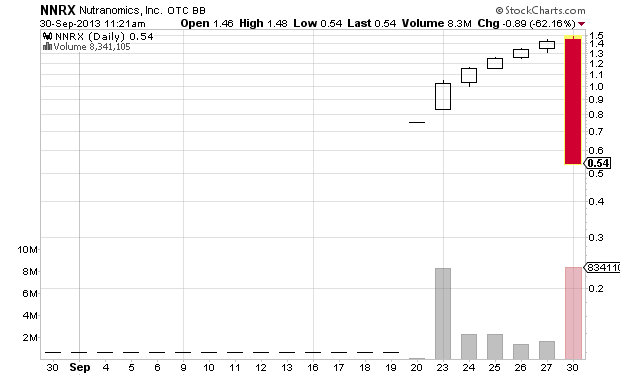

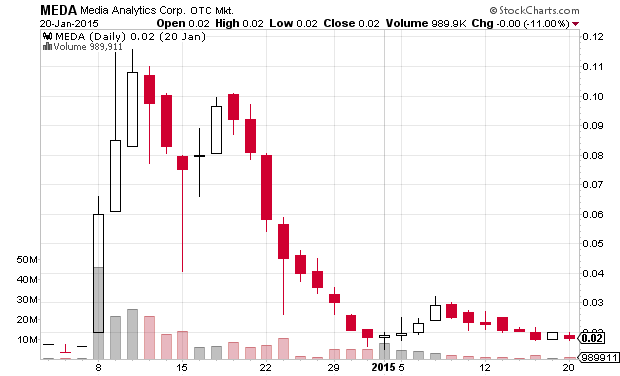

The two most recent ElitePennyStock pumps were American Leisure Holdings (AMLH) in January and February, and Media Analytics (MEDA) in December 2014 and January 2015. The AMLH pump lasted for 19 days prior to the big drop in price (note that the promotion continued through February 17. The MEDA pump lasted for 10 days prior to the precipitous drop (the last pump emails I received for MEDA came on December 19th).

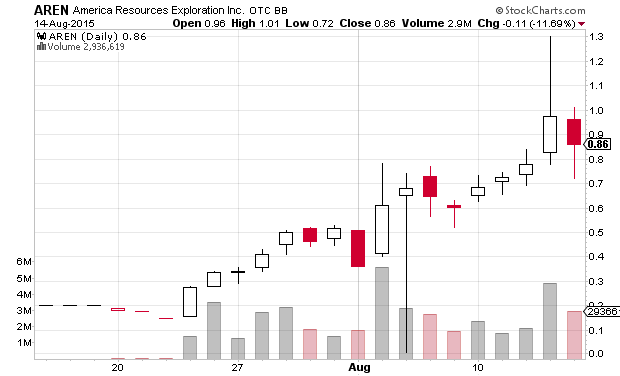

So far the AREN (America Resources Exploration Inc) promotion is on day 17. I believe it very likely that the end of this pump is quite near. See the Promotion Stock Secrets report on AREN if you care to learn the details on the insiders in the company and how it was set up to be a promotion.

Interestingly, AREN filed a form 12b-25 with the SEC just before the market close today, indicating that they will not be able to file their quarterly report on time. I wonder if that may be another indication that the pump will soon be over.

Compensation: [different in emails from the different websites]

Promoter: ElitePennyStock

Paying party: Intraday Holdings Ltd

Shares outstanding: 129,400,000

Previous closing price: $0.861

Market capitalization: $111 million

A Few miscellaneous notes

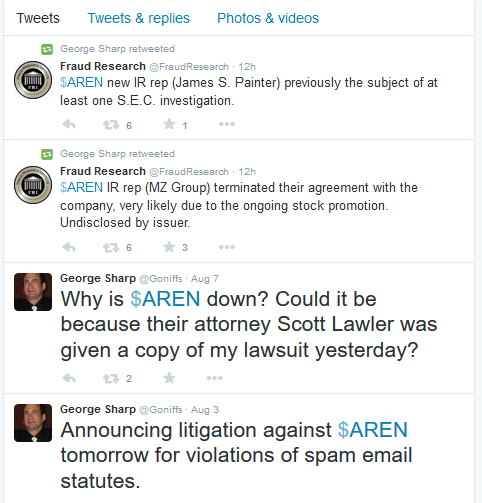

Penny stock gadfly and one-time stock promoter George Sharp threatened AREN with a lawsuit but never followed through.

I cannot vouch for their reporting skill / reliability, but The OTC Today reported that FINRA had asked clearing firms Alpine and ETC to voluntarily restrict the sales of large blocks of AREN stock.

One of the ElitePennyStock websites has a nice little video promoting AREN here. ElitePennyStock is following the lead of StockTips by inventing a fake person to be the promoter, in this case, Keith Richie.

Disclaimer: I am currently short 5200 shares of AREN. I may cover those shares or short more in the days following the publication of this post. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.