On September 28, 2018 the SEC filed an order resulting from an administrative proceeding against COR Clearing. COR offered a settlement that the SEC chose to accept.

COR Clearing SEC Press Release

COR Clearing Order (pdf)

The settlement is “for failing to report suspicious sales of penny stock shares totaling millions of dollars.” As a result of the settlement COR will pay $800,000 and substantially cease accepting deposit of penny stock shares.

From the press release (emphasis mine):

The Securities and Exchange Commission today announced settled charges against clearing firm COR Clearing LLC for failing to report suspicious sales of penny stock shares totaling millions of dollars. As part of the settlement, COR has agreed to exit a key penny stock clearing business by significantly limiting the sale of penny stocks deposited at COR.

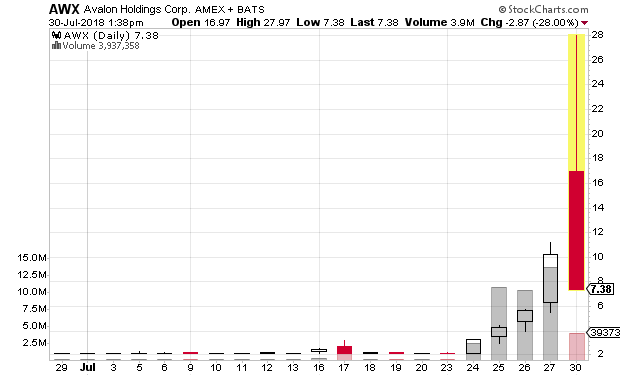

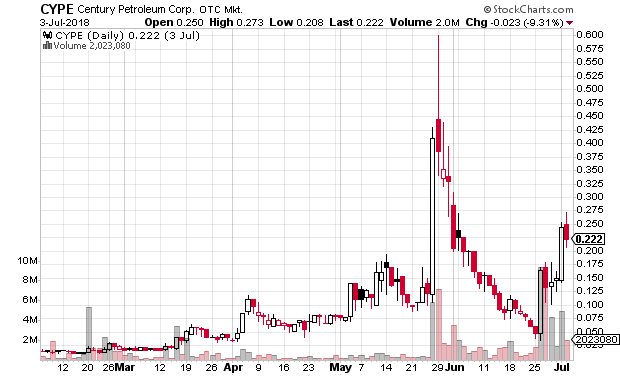

Broker-dealers are required to file Suspicious Activity Reports (SARs) for transactions suspected to involve fraud or with no apparent lawful purpose. According to an SEC alert dated March 29, 2016, microcap securities are more susceptible to manipulation and it is often easier for fraudsters to manipulate the price of microcap stocks because microcap stocks historically have been less liquid than the stock of larger companies. The SEC’s order finds that in 2016, COR ranked second among all broker-dealers in the total dollar value of sub-$1 penny stocks that it cleared, and from January 2015 to June 2016, COR cleared for sale a significant amount of penny stock on behalf of customers of its introducing broker-dealers. The SEC finds that approximately 193 customer accounts deposited large blocks of low-priced securities, quickly sold these securities into the market, and then withdrew the cash proceeds. The SEC further finds that in some instances the same customers engaged in this suspicious pattern with multiple securities. According to the order, COR failed to file SARs with respect to a subset of the foregoing transactions and, as a result, violated the securities laws.

“SAR filings by both introducing and clearing brokers, especially those who transact in the microcap space, are critically important to the regulatory and law enforcement communities,” said Marc P. Berger, Director of the SEC’s New York Regional Office. “The penalty imposed and the limitation placed on COR’s business reflect how seriously we take the failure to file SARs in the face of numerous red flags.”

Without admitting or denying the SEC’s findings, COR agreed to a settlement that requires it to not sell penny stocks deposited at COR with certain narrow exceptions and pay an $800,000 penalty. COR also consented to a censure and to cease and desist from similar violations in the future.

The SEC investigation was conducted by Jorge G. Tenreiro, Elizabeth Baier, Michael Fioribello, and Sandeep Satwalekar in the New York office with assistance from the Enforcement Division’s Bank Secrecy Act Review Group. The case was supervised by Lara Shalov Mehraban. The SEC’s examination that led to the enforcement action was conducted by Edward Janowsky, Stephen Bilezikjian, and Dennis Koval, and supervised by Steven Vitulano of the New York office.

According to the order:

RESPONDENT

COR is a registered broker-dealer headquartered in Omaha, Nebraska. COR was previously known as Legent Clearing, LLC (“Legent”), which changed its name to COR Clearing LLC following its acquisition by COR Securities Holdings, Inc. (“CORSHI”) in January of 2012. Originally as Legent, COR has been registered with FINRA since June 4, 2002. COR derives the majority of its revenues from clearing and settlement of fixed income and equity securities for approximately 79 introducing broker-dealers (“IBDs”).

FACTS

Background

1. COR’s practice of accepting low-priced securities for deposit and subsequent sale on behalf of the customers of its introducing broker-dealer clients predates CORSHI’s acquisition of Legent in 2012. COR continued clearing sales of low-priced security deposits after the acquisition. In 2016, for example, COR ranked second among all broker-dealers in terms of the dollar value of shares deposited with a price of $1 per share or less at The Depository Trust & Clearing Corporation.

Relevant Regulatory History

2. In 2013, COR settled a FINRA action that resolved findings from multiple FINRA exams of Legent (the “FINRA Action”) from prior years. The FINRA Action focused on operational issues preceding the acquisition, but identified certain shortcomings in Legent’s AML program as well, including a failure to devote adequate attention to AML surveillance and the failure to identify or report suspicious activity in 2009 and in early 2012.

3. Beginning in early 2012, COR’s new management began to take a number of steps to remediate the AML issues identified in the FINRA examinations that ultimately gave rise to the FINRA Action. These steps included expanding its AML-compliance staff, and implementing an automated suspicious activity software system provided by a third party vendor. As part of the settlement with FINRA, COR also hired a consulting firm to review the state of its AML compliance program and make recommendations. Subsequently, COR hired a second consulting firm (the “Consulting Firm”) to address and implement the recommendations arising from the first firm’s review.

4. Starting in early 2015 and through the issuance of a final report in January of 2016 (the “Consulting Report”), the Consulting Firm identified, among other things, a number of areas for COR to review and improve regarding the operation of the third party automated suspicious activity software licensed by COR and COR’s understanding of how this software worked.

5. For example, the third party automated suspicious activity detection software licensed by COR used 24 separate models to identify potentially suspicious activity for SAR-filing consideration (the “AML Software”). The Consulting Report identified potential problems with the AML Software, including the potential for data being loaded incorrectly or not loaded at all into the AML Software, and advised COR of the need to clearly understand the parameters that the AML Software used to identify suspicious activity.

6. Despite its efforts to implement the Consulting Firm’s recommendations between 2015 and 2016, COR experienced persistent difficulties with the operation of its AML Software relative to flagging deposit, sale, and withdrawal (“DSW”) transactions for review.

The order later goes into detail on COR’s failures to file SARs:

COR’s Failure to File SARs

12. COR cleared for sale a significant amount of penny stock that was originally deposited by its IBD’s customers. For example, between January 2015 and June 2016, approximately 193 accounts from COR’s IBDs deposited and sold blocks of low-priced securities and withdrew cash proceeds from the sale. Each DSW transaction occurred within 30 days and in amounts over $100,000, and involved multiple penny stock sales and outgoing money transfers. Nonetheless, unless another one of the modules of the AML Software flagged the transaction activity, the Software failed to alert COR’s AML staff to review a number of DSW transactions

due to the software issues described above in paragraphs 9 through 11.

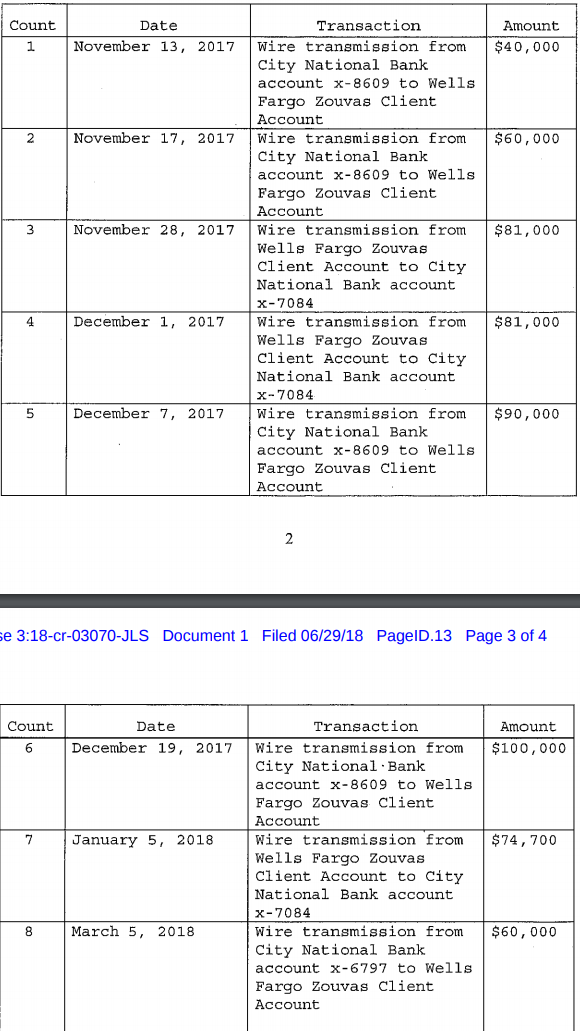

13. Below are examples of customers of COR’s IBDs who engaged in multiple DSW transactions in the same account lacking any apparent business or lawful purpose.

14. COR did not file SARs identifying the patterns and transactions described below in paragraphs 15 through 17.

15. Customer Account A

a. Between January 2015 and April 2016, an account opened at a COR IBD (“Customer Account A”) engaged in a repeated DSW pattern in at least three different low-priced securities.

b. Between January 2015 and April 2016, Customer Account A received approximately 24 physical deposits of large blocks of a certain low-priced security issuer (“Security A1”), and engaged in over 150 sales of Security A1 in the days immediately following the deposits, for a total of over 306 million shares of Security A1 deposited and over 273 million shares of Security A1 sold within this time period.

c. Between January and November 2015, Customer Account A received approximately 28 physical deposits of large blocks of a second low-priced security issuer (“Security A2”), and engaged in over 80 sales of Security A2 in the days immediately following the deposits, for a total of over 1.2 billion shares of Security A2 deposited and over 1 billion shares of Security A2 sold within this time period.

d. Between April and December 2015, Customer Account A received three physical deposits of large blocks of a third low-priced security issuer (“Security A3”), and engaged in over 25 sales of Security A3 in the days

immediately following the deposits, for a total of over 2.1 million shares of Security A3 deposited and over 2 million shares of Security A3 sold within this time period

e. In 2015 alone, Customer Account A withdrew more than $11 million from the proceeds of this activity within a short period of time after the sales of blocks of these securities.

Perhaps the most important part of the order is the Undertakings section, which goes over the steps COR will take to prevent future violations (footnote omitted from quote):

UNDERTAKINGS

22. COR undertakes to not approve for open market sale any equity security that does not trade on a national securities exchange and trades at a price of less than $5 per share at the time it is submitted to COR for sale approval; provided, however, that COR may approve for sale on the open market any such security if:

a. COR obtains and retains a trade confirmation evidencing that the securities were purchased on the open market, as opposed to having been deposited at COR or another broker-dealer;

b. The securities are exempt from the Securities Act of 1933’s (“Securities Act”) registration requirements under Section 3(a)(2) or Section 3(a)(5) of the Securities Act, or the securities are defined as “government securities” under Section 3(a)(42) of the Exchange Act;

c. The security is an unsponsored American Depositary Receipt (“ADR”); or

d. The aggregate value of the sale of the securities of any particular issue is less than $10,000 and the customer has not availed itself of this exception within the last three months in any account in the name of the customer, in which the customer has a beneficial interest as defined in 31 CFR Section 1010.230, or over which the customer has trade or signatory authority

Basically, this means that COR cannot accept new shares of OTC stocks for deposit and sale unless the securities are exempt, government securities, unsponsored ADRs, or the value of the security is under $10,000 and the customer has not deposited any other OTC shares in the prior 3 months. This does not prevent clients of COR from buying and selling OTC stocks on the open market, just from depositing new shares that have not previously been traded.

Brokers’ failures to file SARs (particularly in relation to penny stocks) have been a big issue with the SEC and FINRA lately. For example, the SEC and FINRA fined Aegis Capital in March; the SEC fined Chardan Capital in July; the SEC and FINRA fined ICBCFS in July; and the SEC fined Schwab in July (though Schwab’s failure to file SARs did not relate to penny stocks).

My apologies for being slow to blog about this! It is no longer news but is an important development in penny stock land so I wrote it up even though it is untimely.

Disclaimer: I have no position in any stock mentioned. I used to be a client of COR Clearing (through Speedtrader). I have no relationship with any other parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.