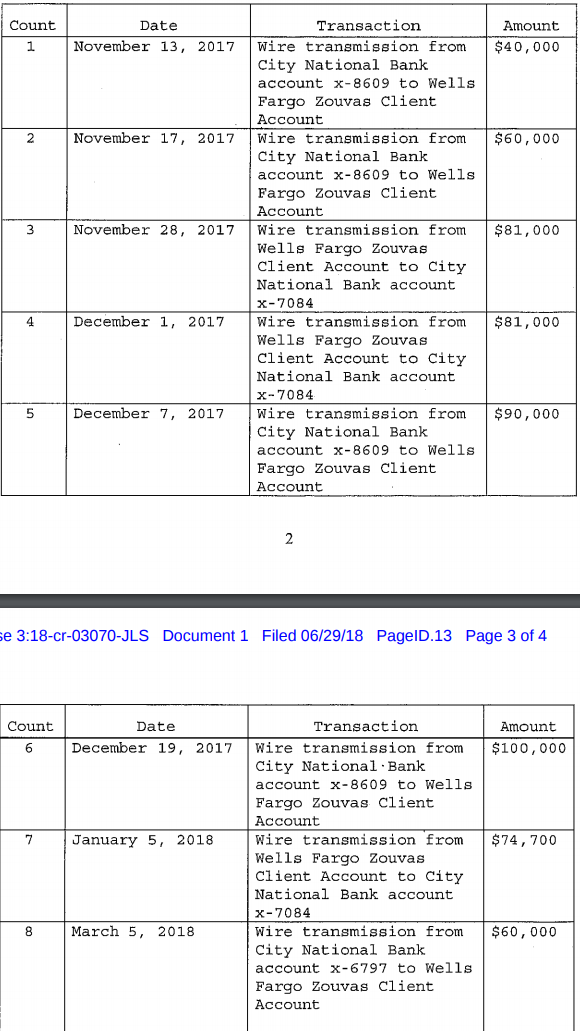

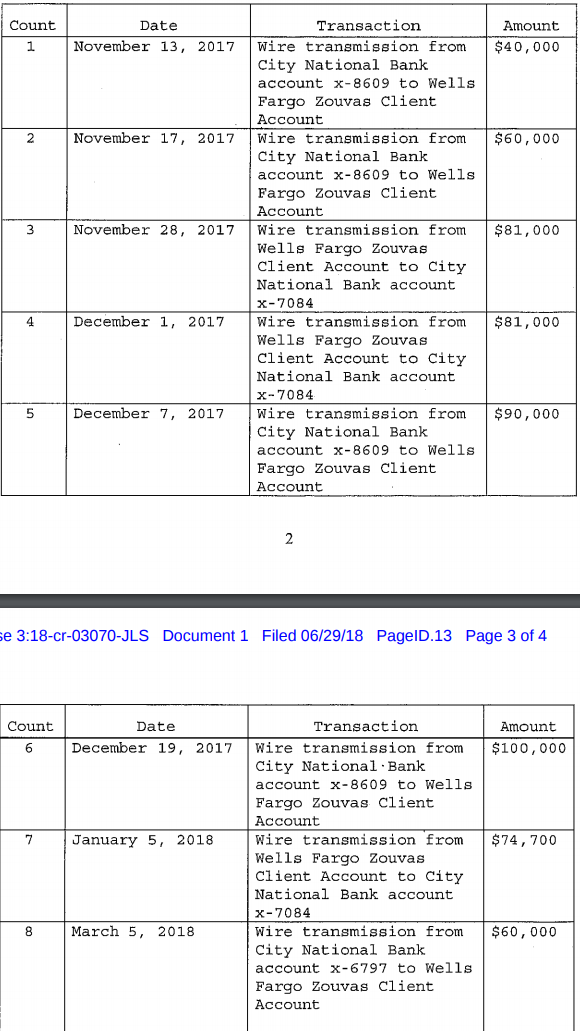

On Friday, July 13th the US Attorney’s Office for the Southern District of California announced a number of unrelated criminal indictments for stock-fraud related offences. I will write another blog post about the other indictments, but the first one I wanted to write about the indictment of attorney Luke Zouvas. The case against Zouvas is US v. Zouvas (3:18-cr-03070) in US District Court, Southern District of California. The indictment (pdf) is only four pages long. Zouvas was released on a $50,000 bond (pdf). The charges are 8 counts of money laundering (18 U.S.C. § 1956 (a) (3) (B)), each one relating to a separate wire transfer to or from Zouvas’ client escrow or trust accounts at Wells Fargo to or from three different accounts at City National Bank accounts between November 13, 2017 and March 5, 2018. Of the 8 wire transfers listed in the indictment, 5 (totaling $350,000) were to the Wells Fargo accounts and 3 (totaling $236,700) were to the City National Bank Accounts. Two of the City National accounts (ending in 8609 and 6797) only sent money to Zouvas’ Wells Fargo accounts, while one (ending in 7084) only received money from Zouvas’ Wells Fargo accounts. Below is a quote from the indictment:

3 2. On or about the dates indicated below, within the Southern

4 District of California and elsewhere, the defendant LUKE CHRISTOPHER ZOUVAS,

5 with the intent to conceal and disguise the nature, location,

6 source, ownership and control, of property believed to be the proceeds

7 of specified unlawful activity, did knowingly conduct the following

8 financial transactions affecting interstate commerce involving property

9 represented by a person at the direction of, and with the approval of,

10 a law enforcement officer, to be proceeds of specified unlawful activity,

11 to wit: fraud in the sale of securities:

The wire transfers at issue:

Zouvas has worked for a number of companies that have undergone pump and dumps and at least at one point he represented the people behind spam promoter “Stock Castle” and he received a subpoena in the case that George Sharp filed against the companies and promoter(s) involved in those promotions.

In 2016 Luke Zouvas was sued by the SEC for his role in a pump and dump. Read the complaint (pdf). Below are excerpts from the complaint:

2. As part of the scheme, Larson obtained controlling shares of Crown from Asher Z. Zwebner (“Zwebner”), an Israeli accountant who created and secretly controlled the company and its stock. Although Larson controlled Crown and acted as its de facto chief financial officer, his name did not appear in any of Crown’s filings with the Commission. With the assistance of Zouvas, an attorney

based in San Diego who served as Crown’s general counsel, Larson transferred free-trading Crown shares from Zwebner’s nominees – purported shareholders in Crown’s initial public offering – to Larson’s nominees, including Jorgenson and Schiprett. Larson then paid $400,000 for a “call center” to promote Crown and

placed manipulative trades in his own brokerage account to create the appearance of market interest in the stock. Robb prepared materially misleading press releases about the company’s business success. As Crown’s stock price became inflated as a result of Larson’s and Robb’s efforts to pump the stock, Larson’s nominees

Jorgenson and Schiprett sold Crown shares and wired most of the sale proceeds – at least $865,000 – to accounts controlled by Larson. Jorgenson and Schiprett retained some of the proceeds as compensation for their assistance in the scheme as nominees.

…

4. Zouvas, age 45, resides in San Diego, California. He is an attorney licensed to practice law in the State of California. During the relevant time period, he acted as escrow agent for Larson’s purchase of the Crown shell from Zwebner, and as general counsel for Crown. Zouvas declined to testify in the Commission’s

investigation based on his Fifth Amendment privilege against self-incrimination.

…

17. Ultimately, Larson purchased the Crown shell from Zwebner. On or about December 6, 2011, Larson wired $300,000 from a bank account titled to an entity he controlled – S&L Investments, LLC – to Zouvas’ trust account, which reflected that payment was for Crown. Two days later, Zouvas wired $25,000 to Zwebner. On or about December 14, 2011, Zouvas wired an additional $206,127 to Zwebner through a financial cash change house in Jerusalem. The next day, Larson wired an additional $25,000 from the same bank account he controlled to another of Zouvas’ trust accounts. Larson thus gained control of Crown’s 2.5 million freelytradable

shares that Zwebner had fraudulently placed in the names of the 40 Israeli subscribers and the shares held by the two nominee officers of the company.

…

21. On or about January 3, 2012, Zouvas directed Crown’s transfer agent to transfer the shares from the seven Israeli subscribers to Jorgenson and Schiprett. However, Zouvas instructed the transfer agent to send the certificates to Larson, rather than to Jorgenson and Schiprett, the supposed shareholders of record. The transfer agent did as Zouvas directed. As a result of a 3-for-1 forward stock split, Jorgenson and Schiprett became the record owners of 656,250 free-trading Crown shares each.

…

23. To enable Jorgenson and Schiprett to make the deposit, Zouvas prepared a false attestation for them to provide to the brokerage firm. The attestation was dated January 17, 2012. In it, Zouvas wrote that his law firm had acted as escrow agent for the transaction in which Jorgenson and Schiprett had purchased Crown shares for $25,850. He misrepresented that on December 14, 2011, he sent the funds to the selling shareholders. The attestation was false because Zouvas’s escrow account never received the funds from Jorgenson and Schiprett, and never remitted the funds to the seven purported subscribers. When

Zouvas provided the attestation, he knew, or was reckless in not knowing, that it was false.

…

35. On March 14, 2012, Crown filed a Form 10-K “Annual Report” (“10-K”) with the Commission. Zouvas approved a draft of the Form 10-K falsely reporting that Aninye owned the nine million shares of Crown, a statement which was repeated in the final Form 10-K. Zouvas became Crown’s general counsel in December 2011 and took responsibility for directing the transfer agent any time

shares of Crown needed to be cancelled or reissued. Zouvas therefore knew Aninye did not receive any shares from Rehavi and Zehavi because he had not directed the transfer agent to cancel the Rehavi and Zehavi share certificates or reissue them in Aninye’s name.

36. In a communication with FINRA three months later, Zouvas

reaffirmed the false 8-K by stating Aninye had purchased the nine million shares of Crown from Rehavi and Zehavi for $180,000: “On January 17, 2012, the Company executed a Stock Purchase Agreement, under which 9,000,000 (post-split) shares of

common stock of the Company were sold by Rehavi and Zehavi to Steve Aninye in exchange for $180,000.” Zouvas knew, or was reckless in not knowing, that his statement to FINRA was false because (i) he never had the shares placed in Aninye’s name, and (ii) he directed the transfer agent to cancel the shares and retire

them to Crown’s treasury.

…

H. Zouvas Receives Crown Shares and Provides False Certification to Transfer Agent

60. In or around June 2012, Zouvas received 87,500 shares of Crown stock for which he paid no consideration. According to a stock purchase agreement dated June 25, 2012, Zouvas purchased 87,500 shares of Crown stock from one of the original purported Israeli subscribers for $2,000. According to a second stock

purchase agreement dated June 19, 2012, a third-party entity purchased 100,000 shares of Crown stock from the same purported subscriber for $2,000. The purported subscriber was – like the other subscribers – Zwebner’s nominee. She did not purchase the shares or sell them to Zouvas or to the third party, nor was she even aware the stock certificate had been issued in her name. She never communicated with Zouvas and her signature was forged on the Stock Purchase Agreement.

61. On or about June 25, 2012, Zouvas directed the transfer agent to transfer the subscriber’s shares to himself and the third party. In his instruction letter to the transfer agent, Zouvas wrote, in part: “We certify that these shares have been validly purchased by the following parties,” including the third party and Zouvas himself. The certification was inaccurate because Zouvas did not purchase the Crown shares referred to in the letter, and the purported subscriber did not sell the shares either to Zouvas or the third party. When Zouvas made the certification, he knew, or was reckless in not knowing, that it was inaccurate.

62. Approximately one year later, in July 2013, Zouvas deposited the 87,500 Crown shares into his brokerage account. Between September 27 and October 7, 2013, Zouvas sold all of the 87,500 Crown shares he purportedly acquired for proceeds of approximately $10,300. Zouvas also received legal fees and other payments related to Crown in addition to his stock sale proceeds.

That case, SEC v. Zouvas et al, started in the US District Court, Southern District of California (3:16-cv-00998) but in 2017 was transferred to the US District Court for the District of Arizona (2:17-cv-00427). Read Zouvas’ answer to the complaint (pdf). Zouvas (at least as of the December 5, 2016 answer, is defending himself (‘in pro per’). The case is ongoing.

In 2013 Luke C. Zouvas and his wife filed for bankruptcy and that case was not terminated until December 28, 2017. That case is 13-06250 in the US Bankruptcy Court, Southern District of California. The bankruptcy case docket and a couple of the documents are available at the CourtListener website. The only interesting thing in the bankruptcy is the listing of unsecured non-priority claims which lists three claims resulting from San Diego Superior Court lawsuits. Those creditors/cases are as follows:

- Social Media Ventures, lnc. — NOTICE ONLY – 01/2012, prof. liability claim, San Diego Superior Court Case #37-2012-00097720, settled as of 06/14/13

- Joseph B. Larocco — NOTICE ONLY – 01/2012, prof. liability claim, San Diego Superior Court Case #37-2012-00097720, settled as of 06/14/13

- lronshore Indeminty, Inc. — 05/20/13, declaratory relief and reimbursement claim, San Diego Superior Court Case #37-2013-000502

At the time of the bankruptcy Zouvas listed net monthly take home pay as $19,085, which seems to me modest for an attorney in independent practice in San Diego County.

For years Zouvas worked with and for some time he was name partner with Luis Carrillo and Wade Huettel. In 2011 Vancouver journalist David Baines said that the firm has “facilitated many dubious bulletin board companies that have turned into horrendous promotions.”

In March 2013 the SEC sued Wade Huettel and Luis Carrillo and their firm (as well as others) for their involvement with multiple pump and dump scams and in May 2017 won a large default judgment against them. (Luke Zouvas was not named in that suit.) From the judgment:

IT IS FURTHER ORDERED, ADJUDGED, AND DECREED that Defendants are jointly and severally liable for disgorgement of $6, 703,484.15, representing the ill-gotten gains resulting from the conduct alleged in the Amended Complaint (reduced by the amounts procured by the Plaintiff from other defendants through settlement agreements), together with prejudgment interest thereon in the amount of $1,579,643.12 for a total of$8,283,127.27. In addition, each Defendant shall pay a civil penalty in the amount of $375,000 pursuant to Section

20(d) of the Securities Act [15 U.S.C. § 77t(d)] and Section 21(d)(3) of the Exchange Act [15 U.S.C. § 78u(d)(3).

Zouvas has also been named in other litigation, such as this in pro per lawsuit:

The docket for that case can be found on CourtListener.com. It is Willett v. Procopio (3:17-cv-02144-LAB-JMA) US District Court, S.D. California.

For more on Luke Zouvas including on his bankruptcy and other litigation, see George Sharp’s account of the Zouvas indictment.

Disclaimer: I have no position in any stock mentioned above. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.