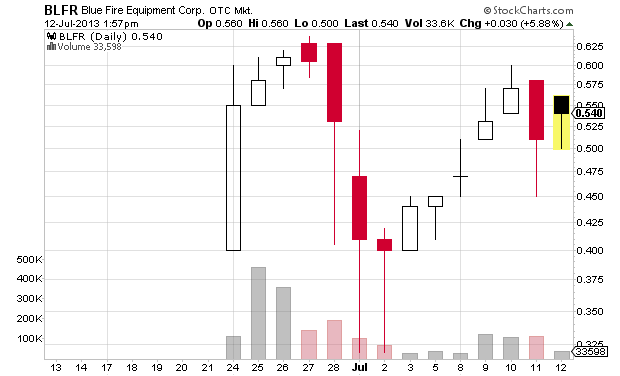

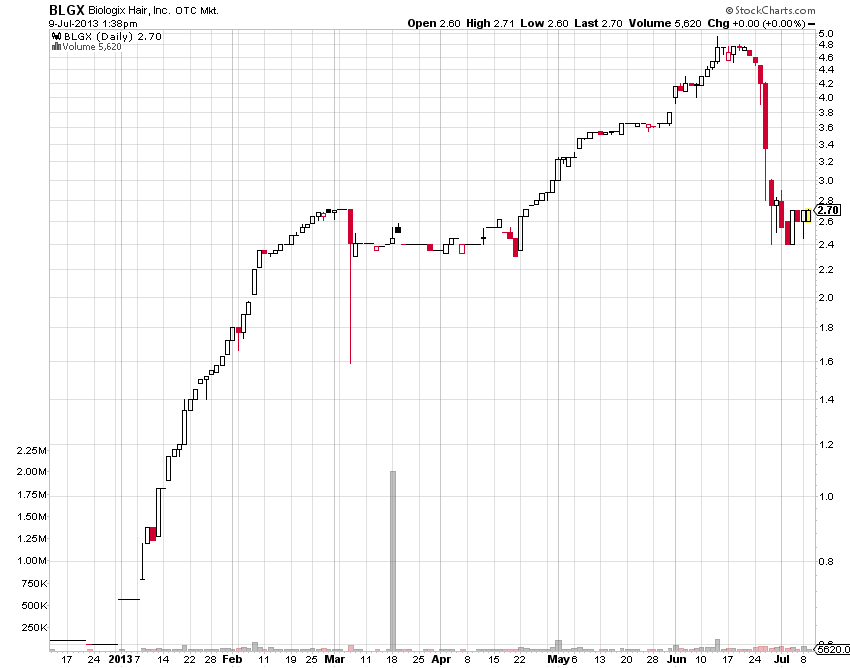

Bluefire Equipment (BLFR) is currently being promoted via ads on search engines. Clicking the ad takes you to the company’s investor relations page. The stock is too illiquid for me to be interested in trading it either long or short.

Shares outstanding: 33,947,368

Previous close: $0.61

Market cap: $20 million

PDF copy of company investor relations page.

[Edit 2013-7-12]: BLFR is also being promoted by the website at http://www.financialdigest.info/bfire.html. Thanks to Nodummy from Promotion Stock Secrets for pointing that out to me.

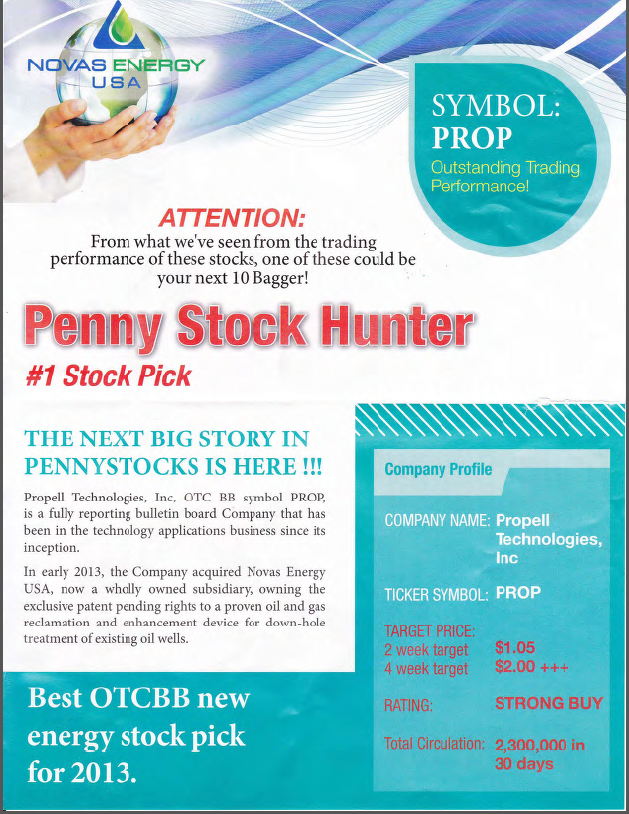

PDF copy of pump page.

Excerpt from disclaimer:

On June 25, 2013 FinancialDigest.info entered into a 90-day advertising agreement related to the dissemination of information about BlueFire Equipment Corp by a non-affiliated third party for compensation of up to fifty thousand dollars.

DIsclaimer:

Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our site, or joining our email list. The disclaimer is to be read and fully understood before using our site, or joining our email list.

FinancialDigest.info has a no tolerance spam policy; we will not sell or re distribute your email to any 3rd party. If applicable, please unsubscribe from the newsletter using the link at the bottom of any of our emails or from our homepage if you no longer wish to receive our emails. We only send our newsletters to opt-in members.

PLEASE NOTE WELL: The FinancialDigest.info employees are not registered as an Investment Adviser in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold Financial Digest.info, its operators, owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

FinancialDigest.info is written and published by FinancialDigest.info employees. Readers are advised that this analysis report is issued solely for informational purposes. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a representation by the publisher nor a solicitation of the purchase or sale of any securities. The information contained herein is based on sources that we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. The owner, publisher, editor and their associates are not responsible for errors and omissions. They may from time to time have a position in the securities mentioned herein and may increase or decrease such positions without notice. Any opinions expressed are subject to change without notice. FinancialDigest.info encourages readers and investors to supplement the information in these reports with independent research and other professional advice.

THERE IS NO GUARANTEE THAT YOU WILL EARN ANY MONEY USING THE TECHNIQUES AND IDEAS IN THESE MATERIALS. EXAMPLES IN THESE MATERIALS ARE NOT TO BE INTERPRETED AS A PROMISE OR GUARANTEE OF EARNINGS. EARNING POTENTIAL IS ENTIRELY DEPENDENT ON THE PERSON USING OUR PRODUCT/SERVICE, AS WELL AS THEIR IDEAS AND TECHNIQUES. WE DO NOT PURPORT THIS AS A “GET RICH SCHEME.” ANY CLAIMS MADE OF ACTUAL EARNINGS OR EXAMPLES OF ACTUAL RESULTS ARE NOT TYPICAL. YOUR LEVEL OF SUCCESS IN ATTAINING THE RESULTS CLAIMED IN OUR MATERIALS DEPENDS ON THE TIME YOU DEVOTE TO THE PROGRAM, IDEAS AND TECHNIQUES MENTIONED, YOUR FINANCES, KNOWLEDGE, AND VARIOUS SKILLS. SINCE THESE FACTORS DIFFER ACCORDING TO INDIVIDUALS, WE CANNOT GUARANTEE YOUR SUCCESS OR INCOME LEVEL, NOR ARE WE RESPONSIBLE FOR ANY OF YOUR ACTIONS. MATERIALS IN OUR PRODUCT/SERVICE AND OUR WEBSITE MAY CONTAIN INFORMATION THAT INCLUDES OR IS BASED UPON FORWARD-LOOKING STATEMENTS WITHIN THE MEANING OF THE SECURITIES LITIGATION REFORM ACT OF 1995. FORWARD-LOOKING STATEMENTS GIVE OUR EXPECTATIONS OR FORECASTS OF FUTURE EVENTS. YOU CAN IDENTIFY THESE STATEMENTS BY THE FACT THAT THEY DO NOT RELATE STRICTLY TO HISTORICAL OR CURRENT FACTS. THEY USE WORDS SUCH AS “ANTICIPATE,” “ESTIMATE,” “EXPECT,” “PROJECT,” “INTEND,” “PLAN,” “BELIEVE,” AND OTHER WORDS AND TERMS OF SIMILAR MEANING IN CONNECTION WITH A DESCRIPTION OF POTENTIAL EARNINGS OR FINANCIAL PERFORMANCE. ANY AND ALL FORWARD LOOKING STATEMENTS HERE OR ON ANY OF OUR SALES MATERIAL ARE INTENDED TO EXPRESS OUR OPINION OF EARNINGS POTENTIAL. MANY FACTORS WILL BE IMPORTANT IN DETERMINING YOUR ACTUAL RESULTS AND NO GUARANTEES ARE MADE THAT YOU WILL ACHIEVE RESULTS SIMILAR TO OURS OR ANYBODY ELSES, IN FACT NO GUARANTEES ARE MADE THAT YOU WILL ACHIEVE ANY RESULTS FROM OUR IDEAS AND TECHNIQUES IN OUR MATERIAL.

As with any business, your results may vary, and will be based on your background, dedication, desire and motivation. We make no guarantees regarding the level of success you may experience. You may also experience unknown or unforeseeable risks, which can reduce results. We are not responsible for your actions. All information on featured companies is provided by the companies profiled, or is available from public sources and FinancialDigest.info makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. FinancialDigest.info, nor any of its affiliates are registered investment advisers or a broker dealers.

FinancialDigest.info has been advised that the investments in companies profiled are considered to be high risk and use of the information provided is at the investor’s sole risk. FinancialDigest.info has also been advised that the purchase of such high-risk securities may result in the loss of some or all of the investment. Investors should not rely solely on the information presented. Rather, investors should use the information provided by the profiled companies as a starting point for doing additional independent research on the profiled companies in order to allow the investor to form his or her own opinion regarding investing in the profiled companies.

Factual statements made by the profiled companies are made as of the date stated and are subject to change without notice. Investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. FinancialDigest.info makes no recommendation that the securities of the companies profiled should be purchased, sold or held by individuals or entities that learn of the profiled companies through FinancialDigest.info. FinancialDigest.info owners, employees, and affiliates may or may not hold positions in the companies that are profiled. Investing in securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

Third Party Web Sites and Information

FinancialDigest.info and newsletters may provide hyperlinks to third party websites or access to third party content. FinancialDigest.info does not control, endorse, or guarantee content found in such sites. You agree that FinancialDigest.info is not responsible for any content, associated links, resources, or services associated with a third party site. You further agree that FinancialDigest.info shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only.

The information contained herein contains forward-looking information within the meaning of Section 27A of the Securities Act of 1993 and Section 21E of the Securities Exchange Act of 1934 including statements regarding expected continual growth of the company and the value of its securities. In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 it is hereby noted that statements contained herein that look forward in time, which include everything other than historical information, involve risk and uncertainties that may affect the company’s actual results of operation. Factors that could cause actual results to differ include the size and growth of the market for the company’s products, the company’s ability to fund its capital requirements in the near term and in the long term, pricing pressures, unforeseen and/or unexpected circumstances in happenings, pricing pressures, etc. Investing in securities is speculative and carries risk. Past performance does not guarantee future results. Investors are cautioned that they may lose all or a portion of their investment in any company profiled.

FinancialDigest.info may receive compensation and its employees and affiliates may own stock that they have purchased in the open market either prior, during, or after the release of the companies profile which is an inherent conflict of interest in FinancialDigest.info statements and opinions and such statements and opinions cannot be considered independent.

FinancialDigest.info and its management may benefit from any increase in the share price of the profiled companies and hold the right to sell the shares bought at any given time including shortly after the release of the companies profile. This should be viewed as a definite conflict of interest and as such, the reader should take this into consideration.

FinancialDigest.info DOES NOT accept free or restricted shares as a fee for advertising services.

On June 25, 2013 FinancialDigest.info entered into a 90-day advertising agreement related to the dissemination of information about BlueFire Equipment Corp by a non-affiliated third party for compensation of up to fifty thousand dollars.

Disclaimer: [Edit 2013-7-12: still no position] I have no position in any stock mentioned and no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.