It has been awhile since my last trading strategy post so I thought I would write one about something that I have been paying attention to recently. If you don’t know my core beliefs on trading strategy, read these classic blog posts first:

So you want to be a trader, Part 1

So you want to be a trader, Part 2: Finding a trading system & dealing with emotion

A good chunk of the money I make comes from day-trading. The most important thing when considering a day-trade is that fundamentals almost don’t matter — what matters is supply and demand for the stock. If you can identify situations where demand will drop throughout the day or supply will increase, or both, you will be able to profit from short-selling. Conversely, if you can identify decreasing supply or increasing demand, you can profit from buying.

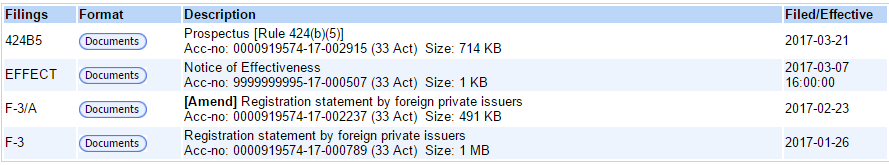

Perhaps one of the most predictable sources of increased supply of stock is the company issuing shares through an already-existing ‘at-the-market’ offering, commonly known as an ATM. Now it is one thing to identify a situation where a company has an outstanding ATM facility and the company needs cash (as can be known by looking at the balance sheet and cash flow statement). That is certainly useful and many traders do that. But wouldn’t it be even better to spend the time to follow such situations prospectively and then identify how often and how much those ATMs were actually used?

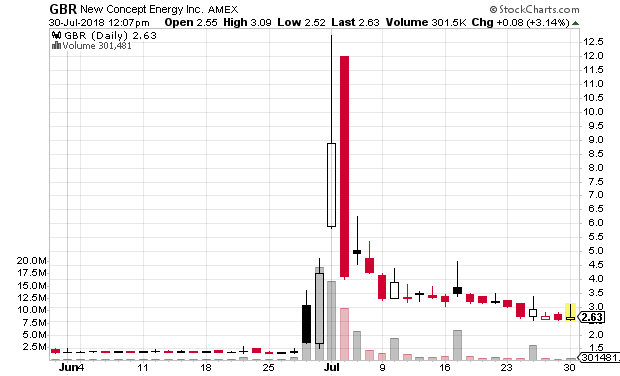

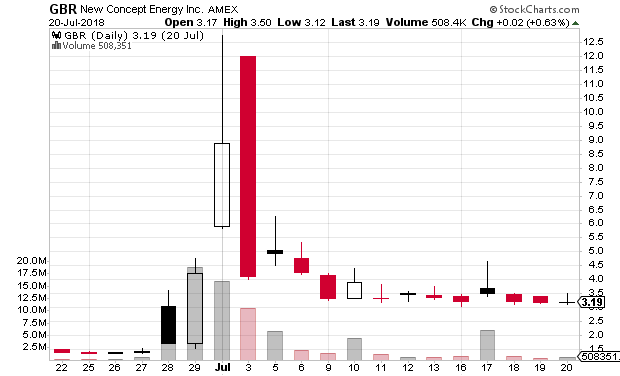

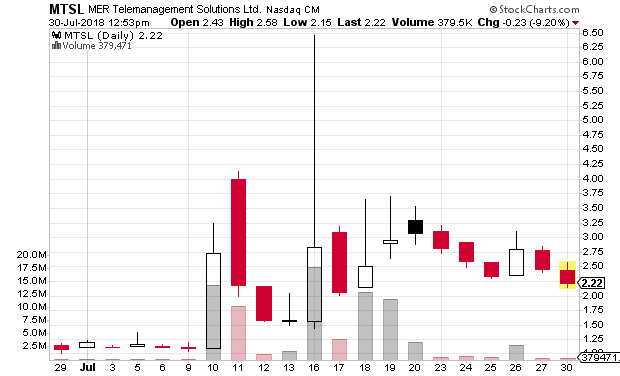

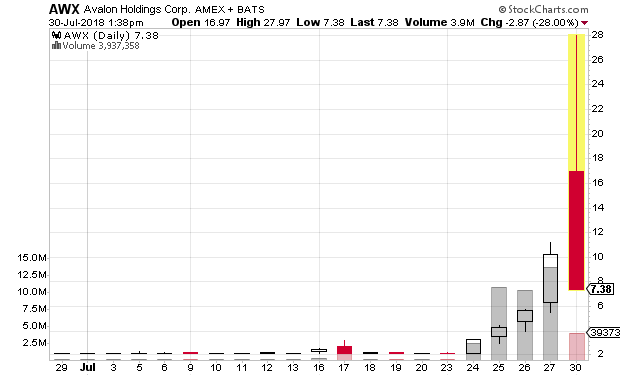

This is what I am spending time and effort on right now: whenever I see a stock gapping up on news that I might want to short because the news isn’t really that great, I look for outstanding ATMs. Regardless of whether I trade the stock or not, I make a note to look back at the SEC filings in the future to see if the company actually did sell shares through the ATM on that and following days. By doing this I will get a better sense of how reliably companies will use their ATMs in these situations and this will help me better evaluate the risks of shorting these stocks.

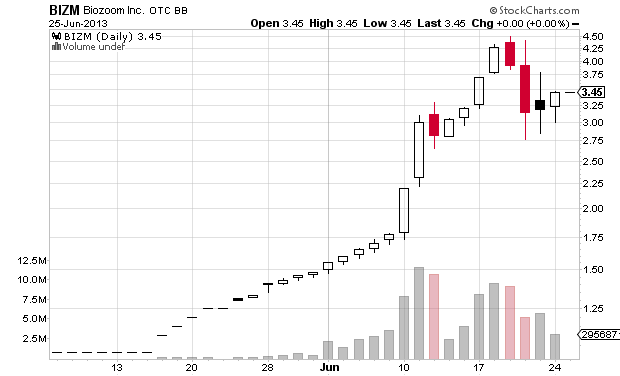

The first stock I made a note to look back at was Arca Biopharma (ABIO). This makes for a perfect example because the company put out a 10-K soon after having a big spike on February 20, 2019, and the stock had very low volume prior to that spike. So let’s take a look. Below is the daily candlestick chart of ABIO for the year up until today.

Having identified the stock as worthy of interest and having an ATM on February 20th, we can now look at the filings to see if it used that ATM. On February 27nd, the company filed its 10-K for the year ended December 31st. On the first page we find this: “As of February 22, 2019, the Registrant had 18,355,111 shares of common stock outstanding.” The balance sheet lists 13,924,058 shares outstanding as of December 31st, 2018. So from January 1st to February 22nd, 201 ABIO issued 4.43 million shares, increasing the share count by 31.8%. Next we go to the section entitled “(7) Equity Financings and Warrants” — I knew to go there because I searched the document for “at the market” (if that doesn’t work search “at-the-market”. Unfortunately, that just describes the ATM usage for 2017 and 2018 — I want more recent issuance so I go to the “subsequent event(s)” section.

In January 2019, the Company amended the Sales Agreement to increase the maximum aggregate value of shares which it may issue and sell from time to time under the Sales Agreement by approximately $2.5 million, from $10.2 million to $12.7 million. Subsequent to December 31, 2018, the Company sold an aggregate of 4,431,053 shares of its Common Stock pursuant to the terms of the Sales Agreement, as amended, for aggregate gross proceeds of approximately $2.5 million. Net proceeds received in the period were approximately $2.4 million, after deducting initial expenses for executing the “at the market offering” and commissions paid to the placement agent. As of February 22, 2019, the Company has sold all shares available under its current prospectus to the Company’s registration statement on Form S-3 (No. 333-217450).

So between January 1st and February 22nd of 2019 Arca Biopharma sold 4.431 million shares through its ATM (which is now exhausted — the company will have to file an amended S-3 registration statement if it wishes to sell more shares) for gross proceeds of $2.5 million. Divide $2.5m by 4.431m shares to get an average price of $0.5642 per share. Given that prior to February 20th, the stock traded an average of under 200,000 shares per day and never traded over $0.45, it is a good bet that Arca Biopharma sold no shares during that time period. (Also, as of the amended prospectus on January 25th, the company said it had sold a total of $10,083,445 worth of stock through its ATM, while as of Frebruary 22nd that was $12.6 million, meaning the company sold no shares or almost no shares from January 1st to January 22nd.)

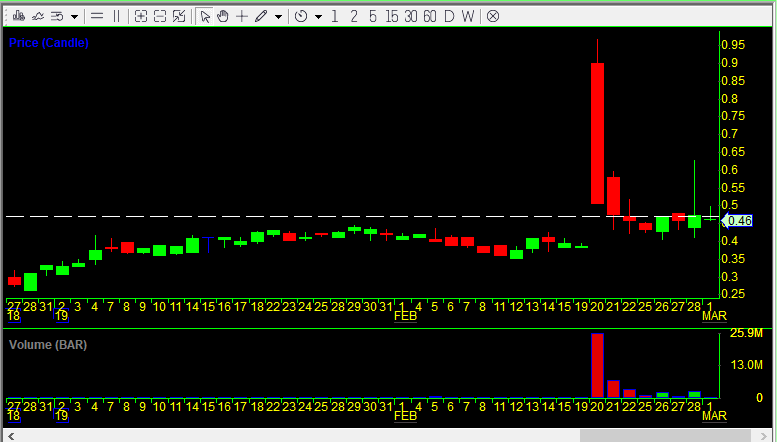

On February 20th, the stock opened at $0.90, hit a high of $0.97, and closed at the low of $0.508. Below is an intraday 5-minute candlestick chart of ABIO from that day. Note that the volume-weighted average price (VWAP) was $0.704 at the end of the day. The next day the VWAP was $0.487. So it is likely that the company sold a large number of shares over both days. The volume on February 20th was 25.94 million shares, and it was 7.14 million shares the next day. Over those two days the company likely sold 4.43 million shares, 13.4% of the total trading volume those days. It is important to look at the total trading volume like this and not just the increase in shares outstanding because if the number of shares sold by the company is small relative to the trading volume it is still possible for the stock to spike big. But here, with 13.4% of the volume being sales by the company through the ATM, that was not possible and it was all but inevitable that the stock would drop as it did.

For more on dilution, I recommend following AuspexResearch on Twitter. He is the one who got me to start looking at this stuff a couple years ago. Read a few of his Twitlonger posts.

Below is the full text of the February 20th press release that caused the stock to spike:

ARCA Biopharma Announces FDA Agreement for a Single Phase 3 Clinical Trial to Support Approval for the First Genetically-Targeted Cardiovascular Drug

GlobeNewswire•February 20, 2019

FDA Special Protocol Assessment agreement granted for PRECISION-AF clinical trial evaluating Gencaro as a potential treatment for atrial fibrillation in a heart failure population that has no FDA approved drug therapies 58% treatment benefit seen versus active comparator in Phase 2B for planned Phase 3 target population

Gencaro development program has FDA Fast Track designation

U.S. and European cardiovascular patents and regulations may provide commercial exclusivity for Gencaro for 10 years post approval

WESTMINSTER, Colo., Feb. 20, 2019 (GLOBE NEWSWIRE) — ARCA biopharma, Inc. (ABIO), a biopharmaceutical company applying a precision medicine approach to developing genetically-targeted therapies for cardiovascular diseases, today announced that it has reached agreement with the U.S. Food and Drug Administration (FDA) regarding a Special Protocol Assessment (SPA) on the design of a pivotal Phase 3 clinical trial, PRECISION-AF, to assess the safety and efficacy of GencaroTM (bucindolol hydrochloride) as a genetically-targeted treatment for atrial fibrillation (AF) in patients with a specific type of heart failure (HF). The target population for the planned Phase 3 clinical trial, partially identified by precision therapeutic phenotyping, currently has no FDA approved drug therapies. This SPA provides agreement that the Phase 3 protocol design, clinical endpoints, trial population and statistical analyses adequately address objectives that, if met, would support a regulatory submission seeking approval of Gencaro for the prevention of AF recurrence in a genotype-defined HF population.

If PRECISION-AF is successful and Gencaro gains regulatory approval, it has the potential to be unique in several aspects, including:

The first genetically-targeted cardiovascular therapy;

The only drug therapy indicated in HF patients with mid-range ejection fraction (HFmrEF); and,

The only drug therapy for AF approved against an active comparator.

The SPA process is designed to facilitate review and approval of drugs by allowing FDA to evaluate the proposed design and size of specific clinical trials that are intended to form the primary demonstration of a drug product’s efficacy and safety. FDA ultimately assesses whether the protocol design and planned analysis of the trial are acceptable to support regulatory approval of the product candidate for the indication studied. An SPA agreement can potentially reduce the regulatory risk of bringing a drug to market.

“Consistent with our mission to develop precision therapies on a pharmacogenetic platform, this SPA agreement with the FDA provides a clearly defined regulatory pathway for the Phase 3 development of Gencaro in a genotype-specific heart failure population that currently has no FDA approved drug therapy,” said Michael R. Bristow, MD, PhD, Chief Executive Officer of ARCA biopharma. “If the previous foundational therapeutic observations in the GENETIC-AF and BEST trials are confirmed in PRECISION-AF, we believe Gencaro could potentially provide a new standard of treatment for AF prevention for the estimated 2.5 million HFmrEF patients in the major markets in U.S., Europe and Japan.”

In accordance with the Company’s SPA agreement with FDA, PRECISION-AF is designed as a single, adequate and well-controlled Phase 3 clinical trial that may be sufficient to support an New Drug Application (NDA) submission for an AF indication if the objectives of the trial are achieved consistent with the requirements of the SPA. The trial is designed as a double-blind, active-controlled, multicenter, international study comparing Gencaro with Toprol-XL (metoprolol succinate) for the prevention of AF recurrence or all-cause mortality (ACM) in HFmrEF patients. HFmrEF is defined as HF with a left ventricular ejection fraction (LVEF) ≥ 40% and < 50%, which constituted approximately half of the enrolled population in the Phase 2 GENETIC-AF trial. PRECISION-AF is designed to enroll approximately 400 patients who have: HFmrEF, a recent AF event, and the genotype which responds most favorably to Gencaro. The primary endpoint of the trial will be time to first event of atrial fibrillation/atrial flutter (AF/AFL) or ACM during the 26-week Follow-up Period. In the recently completed GENETIC-AF trial, Gencaro showed a 58% treatment benefit compared to Toprol-XL in reducing AF recurrence in the HFmrEF population targeted for Phase 3 (hazard ratio = 0.42; 95% CI: 0.21, 0.86; p = 0.017). With 400 patients (200 per arm) the trial will have 90% power at a p-value of 0.01 to detect a 45% treatment benefit for Gencaro compared to Toprol-XL. Subject to securing additional financing, ARCA anticipates initiating PRECISION-AF in the fourth quarter of 2019.

About Special Protocol Assessment (SPA)

An SPA is an agreement with the FDA that the proposed trial protocol design, clinical endpoints and statistical analyses are acceptable to support regulatory approval. For further information regarding the SPA process, please visit the FDA website, www.fda.gov. A SPA agreement is not a guarantee of approval, and there are no assurances that the design of, or data collected from, the planned Gencaro clinical trial (PRECISION-AF) will be adequate to obtain the requisite regulatory approvals for the marketing of Gencaro.

About Atrial Fibrillation (AF)

AF, the most common sustained cardiac arrhythmia, is a serious disorder in which the normally regular and coordinated contraction pattern of the heart’s two small upper chambers, or the atria, becomes irregular, rapid and uncoordinated. AF can cause distressing symptoms that significantly impact quality of life and can also bring potentially serious medical consequences, including increasing the risk of stroke and serious cardiovascular complications. AF is considered an epidemic cardiovascular disease and a major public health burden. In 2015, there were approximately 5.2 million patients who had been diagnosed with AF in the United States. It is estimated that AF costs the U.S. economy about $6.0 billion annually.

About ARCA biopharma

ARCA biopharma is dedicated to developing genetically-targeted therapies for cardiovascular diseases through a precision medicine approach to drug development. ARCA’s lead product candidate, GencaroTM (bucindolol hydrochloride), is an investigational, pharmacologically unique beta-blocker and mild vasodilator being developed for the potential treatment of atrial fibrillation in heart failure patients with mid-range ejection fraction. ARCA has identified common genetic variations that it believes predict individual patient response to Gencaro, giving it the potential to be the first genetically-targeted AF prevention treatment. The Gencaro development program has been granted Fast Track designation by FDA. ARCA is also developing AB171, a thiol-substituted isosorbide mononitrate, as a potential genetically-targeted treatment for heart failure and peripheral arterial disease (PAD). For more information, please visit www.arcabio.com.

Safe Harbor Statement

This press release contains “forward-looking statements” for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, potential future development plans for Gencaro, ARCA’s ability to complete any Phase 3 clinical trial, the likelihood for PRECISION-AF results to satisfy the requirements of the SPA, ARCA’s ability to raise sufficient capital to fund the PRECSION-AF trial and its other operations, the expected features and characteristics of Gencaro, including the potential for genetic variations to predict individual patient response to Gencaro, Gencaro’s potential to treat AF and/or HFmrEF, future treatment options for patients with AF and/or HFmrEF, and the potential for Gencaro to be the first genetically-targeted AF prevention treatment. Such statements are based on management’s current expectations and involve risks and uncertainties. Actual results and performance could differ materially from those projected in the forward-looking statements as a result of many factors, including, without limitation, the risks and uncertainties associated with: ARCA’s financial resources and whether they will be sufficient to meet its business objectives and operational requirements; ARCA may not be able to raise sufficient capital on acceptable terms, or at all, to continue development of Gencaro or to otherwise continue operations in the future; an FDA SPA agreement does not guarantee approval of Gencaro or any other particular outcome from regulatory review; results of earlier clinical trials may not be confirmed in future trials; the protection and market exclusivity provided by ARCA’s intellectual property; risks related to the drug discovery and the regulatory approval process; and, the impact of competitive products and technological changes. These and other factors are identified and described in more detail in ARCA’s filings with the Securities and Exchange Commission, including without limitation ARCA’s annual report on Form 10-K for the year ended December 31, 2017, and subsequent filings. ARCA disclaims any intent or obligation to update these forward-looking statements.

Investor & Media Contact:

Derek Cole

720.940.2163

derek.cole@arcabio.com

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/af496e97-20da-420a-bf93-e51b3a3ed740

Disclaimer: I have no position in any stock mentioned above. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.