A decent outline of how value investing has evolved from Graham and Dodd to Buffett. Best of all, it is free!

PDF by Robert F. Bierig from Duke University ~April 2000

The Best Source for Penny Stock Insight

A decent outline of how value investing has evolved from Graham and Dodd to Buffett. Best of all, it is free!

PDF by Robert F. Bierig from Duke University ~April 2000

Nothing is perhaps the hardest thing to do. When faced with a difficult situation, it is far easier to do something, anything, than to sit and watch and wait.

Over-activity is deleterious in many situations: in gardening, in building, in thinking, and in investing. The best thing you can do to improve your investing performance is simply to do less trading. This (and the rest of this article) summarizes the work of Brad Barber and Terry Odean in the article “Trading is hazardous to your wealth: The common stock investment performance of individual investors,” published in 2000 in The Journal of Finance.

Barber and Odean analyzed the actual broker accounts of 66,000 households over a period of five years, from 1991-1996. Some of their results were quite encouraging: on average, the gross returns of those individual investors were about equal with the gross returns of the S&P 500, indicating that individual investors, by and large, do fine.

The problem was that the ‘investors’ traded way too much. Interestingly enough, it wasn’t the trading per se that hurt their performance: the most active traders had gross returns equal to the least active traders. However, their frenetic trading cost them in commissions, and those costs were huge, reducing annual returns from about 18% to about 12%. See the figure below (taken from the article; a larger version is available here). Notice how low the turnover of the quintile with the least trading is–they had maybe 5% annual turnover. Their net return is thus almost equal to their gross return.

There were some other interesting findings in the study: individual investors tend to favor small, high beta (high volatility) stocks. I would call this the ‘Peter Lynch Effect’, since Lynch recommended small companies with prospects for great growth. This is not really important, though, because it is necessitated by the size of institutional investors. Since institutional investors have so much money to invest, they shun small- and micro-caps. Therefore, individual investors have to own a disproportionate share of small-cap stocks.

Since small stocks tend to outperform the market, individuals should have done better the market as a whole. That they did not is telling. While average investors do not beat the market, good investors can do so. I certainly intend to do so.

Click on the thumbnail below for the full-sized graph of investment performance as it relates to frequency of trading.

I discuss how balance sheets may not accurately reflect values, with an eye particularly towards sub-prime mortgage exposure.

Stocks discussed include TECUA, TECUB, ACA, Enron, Quaker Fabrics, NFI, CFC, and New Century Financial

Disclosure: I own no companies mentioned in the report.

I have Google Analytics set up on this website, and that makes tracking my visitors (and how they find me) quite easy. A lot of my hits have come from people looking for information on Andrew Left of StockLemon. In fact, 3 of my top 10 articles were about him. A week or two ago I did a multi-part series investigating him. I am quite proud of the job I did profiling him, and it is a service to those who would invest in the companies he disparages that I have helped to dispel some of his critics’ lies about him (while confirming other of the criticisms leveled against him).

Crazy Searches

Evidently, if you search for ‘pretty panties’ or ‘pure panties’ you will find my blog article (syndicated on SeekingAlpha) about Movie Star Inc. [[msi]]. I would not recommend using those search terms because of the other things you might find! If you search for ‘worst investment blog’, my article on Remote MDX (RMDX.oB) comes up on the first page of Google. I have received numerous visitors searching for prosaic things like ‘value investing’, which is good. I have seen some traffic from people searching for the lyrics to “Catch a Falling Star”, due to my “Short a Falling Stock” parody. I have also received a visit from one poor soul who searched for “phd quant jobs hedge funds pay $1 million”. I have a feeling he is still not making millions at a hedge fund.

Disclosure: I own MSI and I am short RMDX.ob. I have no relationship with Andrew Left of StockLemon. My disclosure policy is a popular place to visit.

Not bad considering that music sales were down big. Rick Munarriz has a decent take on the earnings announcement over at The Motley Fool.

Hastings [[hast]], currently selling around $7 per share, is a scrappy little retailer that sells books, music, movies, video games, and rents movies and video games. The company is cheap when compared to its book value or earnings. I generally think management is competent, although the company should institute a dividend to better allocate capital.

Disclosure: I own Hastings stock. My disclosure policy always beats analyst estimates.

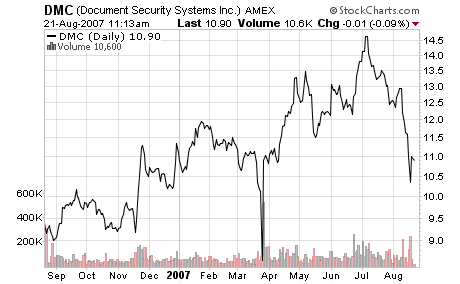

No, I’m not writing about the old school rap group. I’m writing about Document Security Systems, Inc. [[DMC]], which is currently trading at $10.90. Any investor in DMC should do one thing: run!

DMC is a company without a decent product, without any significant assets (tangible or intangible), without any hope of ever making any sales significant enough to justify its current market cap. While the company has doubled its revenues over the last year ($1.75 million in Q1 2007, vs. $0.86 million in Q1 2006), about half of that increase has come from acquisitions ($215k from 2006 acquisition of P3) and from growth in the acquired companies (approximately $200k in sales growth in P3, see p.17 of the 10Q for details). Also, for an intellectual property company, Document Security Systems spends very little on R&D: $109k in the most recent quarter (see the August 9, 2007 press release). Net loss was $2.9 million in the most recent quarter (Q2, ended June 30). As for sales, they were up 10% in Q2 2007 versus Q2 2006. Not bad. But again, the company did make some acquisitions in that time. Oh, and share count was up 6% in the same period of time.

DMC’s one supposed asset is a patent on a document security system that prevents documents from being digitally scanned or copied. The one problem is that the patent was ruled invalid in the United States in 2000 and was ruled invalid in Britain and WIPO just this spring (the company has filed appeals). The company is of course appealing the recent rulings in Europe, but the case against them seems to me to be pretty strong. Also, if the company loses its appeals in Europe, it will not only have its patents invalidated but it will be liable for the court costs of the European Central Bank (which is trying to have the patents ruled invalid). The company did win an identical case in Germany, but it is unclear what would happen if the company won cases in some countries but not others. For a brief synopsis, I suggest reading Asensio.com’s report (Asensio.com is an independent short-selling research outfit). I also suggest reading Asensio’s prior reports on DMC. You can see DMC’s European patent online. I have uploaded a pdf copy of the patent to my website here.

I came across an analyst that upgraded DMC to buy recently (see report). It turns out that the company that hired the analyst is being paid $30,000 per year to ‘to assist with strategies related to the increase of share liquidity and general market presence’. That sounds a lot like ‘pump up the stock’ to me. And while the analyst himself is independent, he would be a fool to bite the hand that feeds him, and he is no fool. CCM Opportunities, the research company that hired the analyst, has only 1 company with a rating of sell or avoid, and of the companies that it rates hold, only one is a microcap (others, like WMT and ADM are megacaps). So in other words, if you pay CCM to get coverage for your microcap company, you can be pretty darn sure that you will get at least a ‘speculative buy’ rating. Not bad for $30k.

DMC has a market cap of $148 million. It has net tangible assets of about $3 million. Because of its huge SG&A costs and resulting losses, the company’s fair value is $0. I suggest avoiding investing in DMC.

I am currently trying to get a copy of the German patent court decision and I am trying to get an opinion from an expert on European patent law. I will post an update when I know more information.

Disclosure: I am short DMC. Short selling is very risky and I do not recommend it. My disclosure policy has patents pending.

Successful executives can turn around even bad companies. Consider Jack Byrne, who has turned around numerous insurance companies such as Fireman’s Fund, Travelers, and GEICO; he recently served as chairman of White Mountains Insurance [[WTM]]. On the other hand, bad executives tend to be consistently bad. So it should not surprise us that our friends at Remote MDx Inc. (RMDX.ob), James Dalton and David Derrick, both had high level positions at former biotech flame-out Biomune. Biomune delisted from the Nasdaq in 2000. Biomune was sued by shareholders back in 1998, and while the lawsuit was dismissed because the statute of limitations had passed, the allegations of the plaintiffs make for interesting reading. As for myself, I won’t accuse our friends James and David of being anything more than inept. I anticipate Remote MDX will end up like Biomune: a forgotten, worthless shell of a company.

Relating to Remote MDX’s future, I found some more fun information in the company’s financial statements. See pages 5 & 26 in the company’s 2006 10k. The company’s main subsidiary, SecureAlert, has a bunch of convertible preferred stock outstanding. Some of that stock is controlled by insiders. The conversion privilege of those preferred stockholders means that Remote MDX beneficially owns only 80% of SecureAlert:

"As a group, all Series A Preferred Stock may be converted at the holder's option at any time into an aggregate of 20% ownership of the common shares of the SecureAlert, Inc. During the quarter ended December 31, 2005, the Company sold 600,000 of these shares for $600,000. As of December 31, 2005, there were 3,590,000 shares of SecureAlert Series A Preferred Stock."

Even better, the owners of that preferred stock get paid dividends at a rate of 10% and an extra $1.50 per day for each parolee that is using the company’s product (see page Q-11 of this filing with the SEC). That total dividend is divided among all preferred stock holders (it is not per share), but it is still outrageously high.

Disclosure: I am short RMDX.ob. I do not recommend short selling due to its high risk. See my disclosure policy.

Remote MDx Inc. (RMDX.ob), currently trading at $1.86, sells tracking systems to be used either on parolees or on the elderly. The systems allow for the location of the person wearing the device and instant communication with an operator in a call center run by the company; the call center operator can quickly call a parole officer or anyone else should a reason to do so arise. The system can also set off an alert based on many different situations (such as an elderly person falling down or a parolee leaving the state). The company also has another segment, but I will not discuss that because it has annual sales under $1 million, has little prospect of growth, and operates at a loss. The company has a market cap of $230 million, yet it has a book value available to common stockholders of negative $2 million and an accumulated deficit (total loss since the company’s founding) of $127 million. I do not foresee the company ever making significant profits. Therefore, I believe that Remote MDX is essentially worthless. Current (and potential future) shareholders beware.

Despite horrendous losses, the company continues to dole out huge stock option awards to its two main executives: chairman and CEO David G. Derrick and President James J. Dalton. In FY2005 the pair each received 2.5 million stock options (with an exercise price of $0.54), in addition to $540k cash each. Over the past year the pair have been dumping a lot of stock: they owned 9.1 and 8.9 million shares respectively as of June 6, 2006 (all data from the company’s 2006 proxy; see all their SEC filings). As of July 25, 2007, each owned 5.2 million shares. And this doesn’t even account for all the options they have exercised–just in their most recent forms 4 linked above, the pair acquired over 14 million shares. So the two top executives have sold well in excess of 22 million shares over the last year. That is not exactly a sign of confidence in the future.

Unlike some of the OTC stocks I come across, Remote MDX is a real company with a real product and real employees (112 full time at last count). The only problem is that the company is not likely to ever make a profit, because it competes against a number of much larger and more profitable companies (such as Philips [[PHG]], ProTech, and Sentinel Security. It should be instructive from a valuation standpoint that two of the companies that Remote MDX’s itself calls significant competitors (see p.26 in the recent form SB-2) also trade over the counter and have market caps of under $15 million each. These companies are Wherify (wfyw.ob) and iSecureTrac (isec.ob). iSecureTrac has greater revenue than Remote MDX, a decent gross profit margin, smaller losses than Remote MDX, and yet somehow investors think that Remote MDX is 15 times more valuable ($230 million market cap v. $15 million market cap). Something doesn’t seem right with that comparison, and that something is that Remote MDX is way overvalued.

A bull in the stock would argue that the company has just recently increased its revenues drastically, that these increasing revenues will soon lead it to profitability, and that the company is in a great growth niche. I won’t disagree with the first and third points. But I have some trouble believing the company will be profitable anytime soon. For example, in the most recent quarter the company reported sales of $3.1 million and selling, general, and administrative (SG&A) expenses of $5 million. In the past 9 months the company has had $5.8 million in revenue and $15.7 million in SG&A expenses. Most of the SG&A is from executive compensation. As long as the executives of Remote MDX overpay themselves, the company will not be profitable. Notice that this comparison doesn’t even include cost of goods sold or R&D expenses. Even though the company’s sales have increased drastically, it has not been able to narrow its losses significantly. It had a $5.3 million loss in the most recent quarter, essentially the same as the loss from the year ago quarter (after accounting for the greater stock option awards in 2006).

Perhaps the worst part of Remote MDX from an investment standpoint is the share situation. There are currently 123,008,784 shares outstanding. Exactly 13 months ago there were 71,878,237 outstanding. The number of shares has increased by a whopping 70% in just over one year! And the company has gotten essentially nothing from those shares because it has lost as much money over the last year as it received for selling its shares. Even worse, many of the company’s largest shareholders are about to sell 23 million of their shares (see the registration statement filed with the SEC). It is obvious what such massive selling will do to the stock’s price in the near term.

Remote MDX is a good example of why most people should avoid OTC stocks. It has a nice story, and even a product, but it will not generate profits anytime soon. If management were more interested in the company’s success than in their own paychecks, perhaps the future would be brighter for the company. Alas, that is not the case.

Disclosure: I am short RMDX.ob. I do not encourage short selling as it is very risky. My disclosure policy cannot be sold short.

I’ll pile in along with others linking to this wonderful ode to the over-leveraged hedge fund. I will discuss recent hedge fund troubles within the next couple days. Unfortunately, the same problems that have caused Goldman Sach’s Global Alpha fund to lose 40% this year have hurt my portfolios too (although much less).

You heard it here first, although if you have read the company’s SEC filings it would be obvious. First, I should state that I am not an impartial observer of the company and of the failings of its management. I have been a shareholder for a few months and I intend to remain a shareholder for some time. I bought into the company well aware of the management’s failings, but believing that the company would easily be worth 50% more than I paid should management suddenly get fired. That is not a strategy I recommend unless you are a hedge fund with the money to buy a large stake in a company. I have been burned once before with this strategy, with Career Education [[CECO]], which I bought during a shareholder’s proxy fight against management that he ultimately lost (and I lost money on that).

Regent Communications, trading around $3 currently, [[RGCI]] is a small radio company with radio stations in a number of ‘mid-market’ cities, such as Buffalo, New York. The company aims to have a number of stations in each of its markets so that it can spread out fixed costs over greater revenue. The company’s stations have eked out small increases in revenues over the last few years, despite the tough advertising market. The company increased its size last year by buying a number of stations from ABC radio. Regent Communications trades at a very modest P/CF (price to cash flow) ratio of 10.9 on a trailing twelve months basis.

So what is wrong with Regent management? For starters, they are paid too much for what they do: $670k and $500k last year for the two top executives (see the 2006 proxy for details). While that does not seem like much, that includes substantial bonuses in a year in which the company’s stock price nose-dived by 40% and operational improvements were minor. Also, keep in mind that radio is not a business where the top executives need to do much–all they really do is decide on a few broad initiatives and allocate capital. The station managers could easily do their jobs autonomously.

Oh, and with regards to allocating capital, Regent is horrible. The company bought back loads of stock at much higher prices in 2005 and 2006. Then it took on loads of debt to buy new stations last fall. Even as the stock price was falling the company stopped buying back more stock. The company generates strong and stable cash flows, and is in a mature industry, yet it pays no dividend.

I am not the only one disappointed with Regent’s management. One hedge fund, Riley Investment Management (which holds or controls 7.4% of RGCI), tried to call a special meeting to elect new directors. The company blocked the move. So earlier this week, Riley filed suit against Regent because Regent would not provide it with a list of shareholders or allow it to call a special shareholders meeting for the purpose of electing new directors. You can see Riley’s original letter to Regent dated July 19, 2007. The company’s charter allows for 20% of shareholders to call a special meeting of shareholders, and Riley asserts that it and several other shareholders easily

Just yesterday (August 15, 2007), Regent Communications filed a lawsuit against the hedge funds that are suing it–Riley Investment Partners Master Fund, L.P. and Riley Investment Management LLC, (collectively “Riley”) and SMH Capital Inc. (“SMH Capital”). While I have no clue as to the legal validity of Regent’s claim, it is obvious that this is an attempt to prevent Riley from calling a special shareholder’s meeting and getting a list of all shareholders.

I hope that the directors suddenly remember their fiduciary duty to shareholders and fire management and then began a liquidation of the company. An orderly liquidation of the company could easily bring $4.50 or more per share to shareholders. This was first proposed by Riley back in April (see their letter at the end of their 13d filing), but the company ignored them. If Riley has to win in court to get their director nominees elected and to get the company sold or liquidated, the legal costs could erode some of Regent’s value.

Disclosure: I hold RGCI stock. My disclosure policy makes for good reading.