The GBGM pump has been one of the more interesting pump and dumps of late. It started on Friday June 8th around the open with pump emails from PHD-Trading.com (disclosing $200,000 in compensation). I thought the email was simply spam because I could not remember ever signing up to pump websites with that email (chatroom@reap..trades.com). I thought that email address had simply been scraped off of TimothySykes.com (where it used to be displayed on the chatroom rules page). Only much later that day did I get around to actually looking and I had only ever received one pump email to that email address, from ThePennyStockJerk.com, a website affiliated with BestDamnPennystocks.com. All the BDPS websites had already sent teaser emails talking about their new low-float pump that they would pump Monday at the open (for BestDamnPennyStocks.com and a few premium email lists) and at the open on Tuesday (all the other websites).

It was the strong price action of GBGM that made me look into it — plus Jarmall’s questions about GBGM that convinced me that the price action was not indicative of a pure spam pump. That led me to sign up to the free email list of PHD-Trading. The welcome email I received shortly thereafter was quite informative. At the bottom of the email, the name and address (as required by the CANSPAM law) was GS MEDIA | 2885 Sanford Ave SW #16525 | Grandville, MI 49418. I know from my pump research that GS Media is one of the legal entities tied to BestDamnPennystocks.com (BDPS), which of course was scheduled to have a new pump the very next trading day.

I thought this was a good opportunity to potentially front-run the BDPS pump, so I tried to find any other links between PHD-Trading.com (and GBGM) and BDPS. One link was that BDPS had sent teaser emails saying that their upcoming pump was a low-float stock. GBGM, while having tons of shares outstanding (461 million!), had its float listed as 1.2 million shares on OTCMarkets.com. Another connection was the fact that PHD-Trading.com had both a free email list and a paid product, sold through Clickbank — while there are other stock promoters who sell access to a ‘premium service’ through Clickbank, none has used it as extensively as BDPS. There were other links as well, but I won’t disclose them in a free blog post.

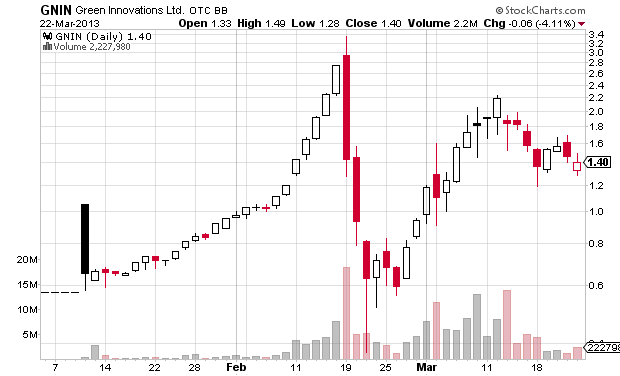

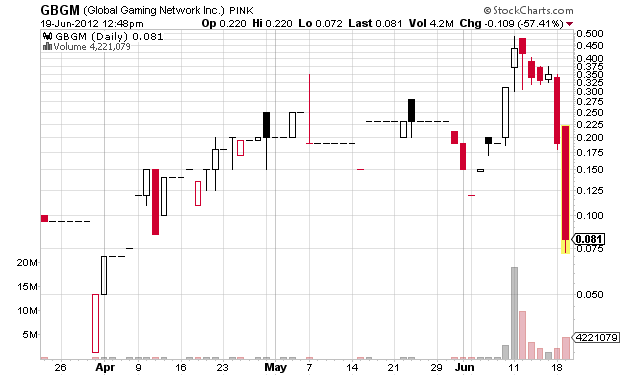

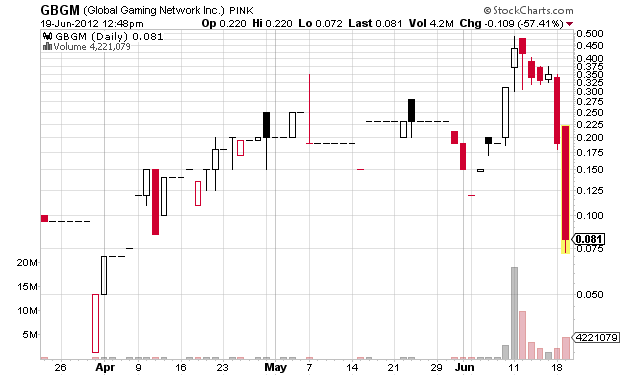

I have front-run BDPS pumps in the past, and it is a risky thing to do. It worked well once and another time they delayed the pump, likely because I had front-run it. I am fairly sure they have delayed other pumps when they were frontrun. However, when I first remember hearing about their HoleinOneStocks.net website back in autumn of 2010, the premium subscribers got one pump a full day before any other BDPS websites (since then they have never gotten a pump earlier than the main BDPS website, so don’t up for them!). If PHD-Trading.com was truly a new BDPS-related website then it would make sense that they woudn’t delay the pump. I bought 40,000 shares at .265, taking a substantial risk (if I was wrong and BDPS didn’t pump GBGM then I would likely lose 50%). I shorted 5,000 shares at Interactive Brokers at .29 to reduce my risk prior to the close and then held over the weekend, selling into the opening spike Monday.

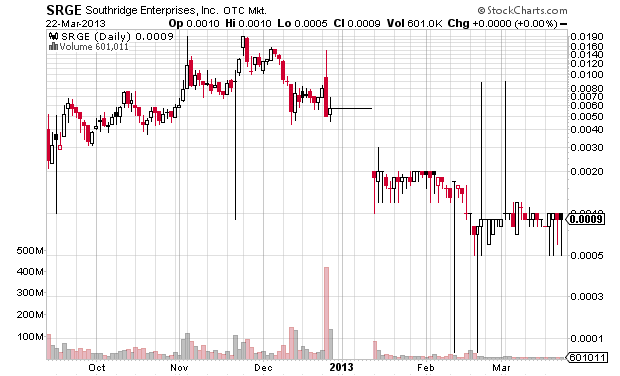

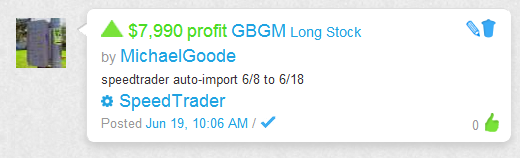

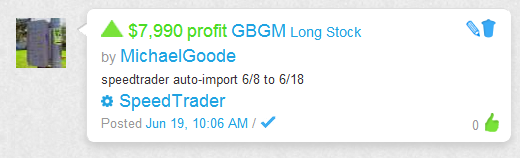

Here is my long trade:

Partly because of me shorting at .29 on Friday and partly because I made some stupid trades, I lost $766 on subsequent trades on GBGM. Click the links to see them: trade 2, trade 3, trade 4, trade 5, and trade 6.

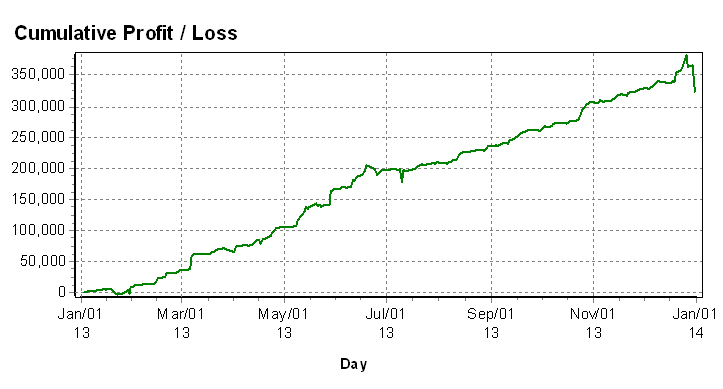

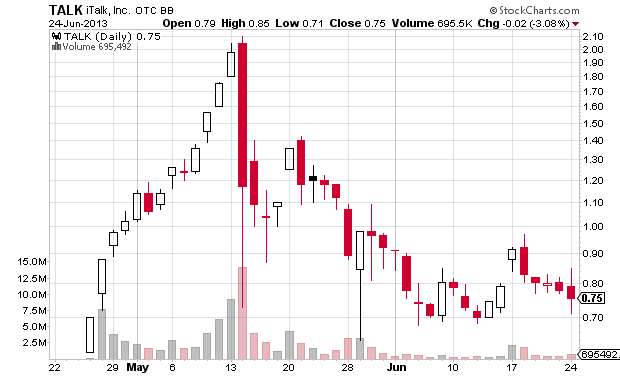

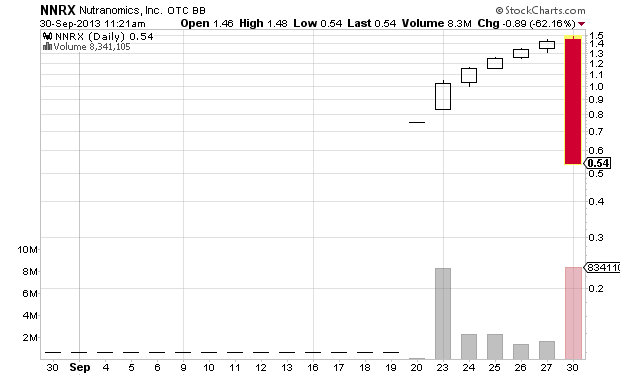

As with almost all BDPS pumps, GBGM has now dropped big from its highs just a week ago and is now well below its price at the beginning of the pump. As with all pump and dumps, it will go even lower in the long run. I do not recommend buying pumps or trying to front-run pumps — those are both very risky and most people who try it lose big. The easiest profits anywhere are from shorting pumps, particularly from the worst promoters. For example, after 41 trades this year shorting the pumps of crappy pumpers, I have made $8800 and my dollar-weighted average profit margin is 11.15% with no losses over $90. (I have had a bad year short selling and have actually lost $1900 on my pump shorts not including my crappy pump shorts or the $8400 I have made with longer-term pump shorts.)

Below is a listing of all the compensation listed from various promoters that I have seen on GBGM. The total compensation is certainly lower than the total disclosed below because some promoters have paid part of their compensation to other promoters.

First are the various legal entities / groups that comprise the BestDamnPennyStocks.com group of pump websites.

BestdamnPennystocks.com (BDPS) discloses, as usual, the most compensation:

BestDamnPennyStocks.com expects to be compensated $500,000 Cash by a non-controlling third party for a GBGM investor relations services.

There is JackpotPennyStocks.com, an affilaite of BDPS:

JackpotPennyStocks.com expects to be compensated $20,000 from a non-controlling third party for GBGM Investor Relations services.

Another group of BDPS-affiliated websites, exemplified by GetRichPennystocks.com, was paid $30k:

GetRichPennyStocks.com expects to be compensated $30,000 cash from a non-controlling third party for GBGM Investor Relation Services.

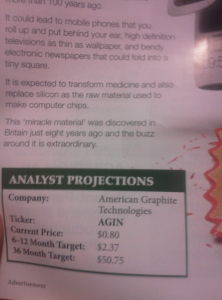

PHD-Trading.com started the pumping last Friday and prior to that no penny stock traders I know were aware of the website and it appears that got their email list from some other pumper. They have their disclaimer as an image, copied below the quote:

PHD-Trading.com expects to be compensated two hundred thousand dollars for GBGM advertising investor relations services.

(click image to embiggen)

StockMister.com is a 2nd-tier or 3rd-tier pumper that is run by the same company as StockExploder.com (which of course disclaimed the same compensation). Here is its disclaimer:

StockMister.com’s parent company Micro-Cap Consultants, LLC has been compensated up to Two-Hundred and Fifty Thousand Dollars Cash by a third party (Online Marketing Media LLC) for a 1 Week Marketing Program regarding GBGM, Micro-Cap Consultants, LLC has also been promised an additional compensation of up to Two-Hundred and Fifty Thousand Dollars Cash by the same third party (Online Marketing Media, LLC) for the same 1 Week Period of Marketing Efforts regarding GBGM.

Stockmister paid for IPR Agency LLC (see my prior blog post about Tim Sykes looking to sue them for libel) to promote GBGM as well:

We have been compensated up to eighty thousand dollars to conduct one day of investor relations marketing for GBGM by a third party, StockMister LLC.

StockLockandLoad.com is run by a pumper who also runs StockBomb.com and Pennystocklocks.com and Stockrockandroll.com.

StockLockandLoad.com has been compensated twenty-five thousand dollars for this one-day profile on GBGM by MJ Capital, LLC.

Another pumper is Pennystockcrew.com. They win the award for smallest font used for a text disclaimer:

Penny Stock Crew has received $20,000.00 in cash compensation from Hunter Marketing LLC for the one day profile of Global Gaming Networks […] Penny Stock Crew is owned by: ODD Marketing LLC , 433 Plaza Real Suite 275, [Boca Raton, FL] 33432

PennyStocksProfile.com is a small-time pumper most noted for riding the cottails of AwesomePennystocks.com pumps SNPK and GWBU this year. Unfortunately, they use an image rather than text for their disclaimer, which makes me retyped it. The image is copied below the quote.

PennyStocksProfile.com is owned and operated by PLVP LLC. The company has been compensated $10,000 by Online Marketing LLC for publication of this information.

(click image to embiggen)

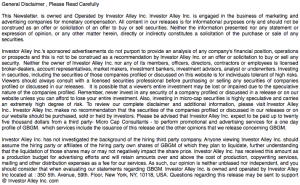

Another annoying pumper is Investors Alley Inc. (a Quebec corporation) group of at least six websites that used an image to show its disclaimer:

Please be advised that Investor Alley Inc. expect [sic] to be paid up to twenty five thousand dollars from a third party- Micro Cap Consultants – to perform promotional and advertising services for a one day profile of GBGM.

(click image to embiggen)

Stock Connection is a 5th tier stock promoter with a number of websites, including PennyStockPickAlerts.com:

PennyStockPickAlert has agreed to be compensated fifteen thousand dollars for a three day public awareness marketing campaign for GBGM from the third party InterVcap LLC.

Another pumper that promoted GBGM is GlobalInvestmentAlert.com, with which I was not familiar prior to this pumps:

GIA, Inc expects to be compensated up to $100,000 by CF, Inc for one weeks coverage of GBGM.

Disclaimer: I have no position in any stocks mentioned and I have no relationship with any people mentioned, except for Jarmall who is a member of Tim Sykes’ Trading Challenge (I work for Tim with that). I trade pump and dumps and OTCBB / Pinksheets stocks. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.