SKTO is likely to be suspended by the SEC. See all the reasons why in this post on Promotion Stock Secrets. This presents a nice low-risk shorting opportunity. However, due to the low stock price it is not yet a large enough opportunity to entice me.

Interactive Brokers has 4 million shares of SKTO to lend with a 1.25% APR borrow rate. That gets charged on collateral ($1.00 per share) so it is the equivalent of a 25% APR on the value of any short position. With a stock price of $0.05, to short 40,0000 shares requires $100,000 in cash and gets you a $2,000 position. Assuming that SKTO gets an SEC suspension within a couple weeks and drops 75% you cover for $500 and pay $42 for the borrow for one month and you make $1.46% on your $100k of capital used in one month. Very nice low risk trade for anyone who has tons of spare cash. That doesn’t describe me so I’m hoping SKTO stocks goes up a lot more. At $0.10 and above the short starts looking really nice.

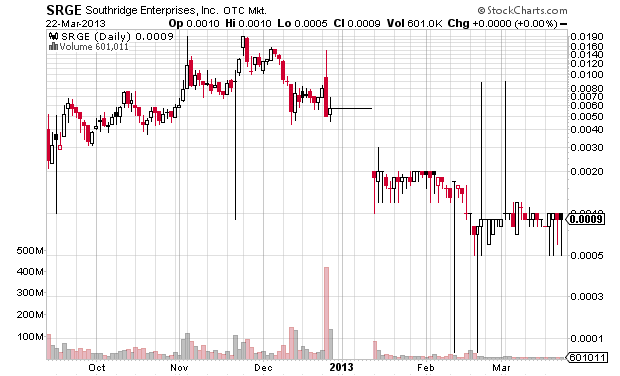

Here is the chart of another scam company that was suspended by the SEC not long ago, Southridge Enterprises (SRGE):

Disclaimer: I have no position in any stock mentioned above and no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

Well one problem with this trade idea now is that all the shares to short at IB quickly disappeared, making the possibility of a forced-buy-in a real risk. That is far more important than SKTO moving up more.

any info on NIA’s CCUR? The pump is working again. Would you short? When?

I’m not tempted to trade it — still range-bound and volume has really dropped off.

Hey Mike… there seems to be some weakness in SKTO last trading session.. and candlestick formed a bearish pattern… maybe is this a good time to short if you can find shares?

Well with the stock price so cheap it is still not worth it unless you have a ton of idle cash. But yes it is looking a bit weaker. I wouldn’t be surprised to still see it spike today though.

I don’t think u need so much idle cash if u r shorting with SureTrader … why dont u try them?

Akshay — Well, the reasons to not use Suretrader are many.

1) It is very hard to hold shorts for very long and Suretrader has forced buy-ins on shorts on the same day (even an hour later) on multiple occasions.

2) It is offshore so no SIPC protection and that would likely force me to file more forms with the IRS

Hey Mike… in one of ur conferences you said you got a short cover call where you had to close a $100,000 loss on a short position… was that with SureTrade?

PS: You have a pretencious captcha that assumes ur users have basic maths skills …

Hey Mike, love the blog you running, lots of useful info. I remember hearing from someone that you are from Grand Rapid, where do you currently live?

I am originally from the Chicago area and currently living in the Grand Rapids area.

Akshay — That was at Interactive Brokers: http://profit.ly/1MmgPw

Hey Mike… STKO doesn’t seem to be following the pattern of a dump in a pump and dump… though there is weakness do you think it will rise again before the actual dump?

It isn’t a normal pump and dump. The whole company is a scam and they keep it going longer than otherwise possible because they are willing to put out press releases that are very likely lies. That being said, it is weakening a bit relative to the past couple days.

It’s a more sophisticated P&D I figured… it may fade down rather than a crash down … what about MJNA … do you think that it is a legit company… they also don’t release SEC filings..

MJNA is certainly more legitimate than SKTO but I doubt they ever accomplish anything meaningful or generate meaningful profits.

good call Mike… seems SKTO crashed today …

Hey Mike,

I have been inspired by this page. When I opened this page for the first time it was Tuesday, March 26th because I was looking for information concerning OTC Research , a newsletter I am signed up with. I am feeling that now I will be using your page for a long time.

I am new to Penny Stocks but I want to start trading soon everyday. Since it is hard to know which stocks are “Pump and Dumps”- and since I have noticed that majority of the OTC Research companies actually have an Increase in share prices just as they “predict”– is it possible to “join their pump and dump” strategy– for example, Invest in – say VVIT ( Vista International Technologies– they have been promoting it this week and it has risen in shares price accordingly)– and so I wonder if it would be Ok to buy a position in the company for just one day- like early in the morning 9 am when they open– ( join the pump)– and then sell ALL the shares I purchased in the afternoon around 2 or 3 pm when the share price reaches its peak for the day. In this way, I would profit from the pump. Or is it required to hold onto the position for a longer period ( 1 month, 6 months, 1 year). I am willing to join pumps and dumps as long as I can sell all my shares the same day before the share price tanks. Please enlighten me on the restriction of the duration I can hold positions I purchase for. If this strategy can work, then I will be starting it very soon.

Thanks !

Chris

Chris — I have made a bunch of money buying pumps early and selling them for quick profits. I have made even more money shorting them, though. The purpose of a pump is to get buyers so insiders or large shareholders can dump their shares. Most pumps and most pumpers never get the stock price up much — the price might gap up but then drop right back down. For example, look at ITNS today. Stocks that have been pumped in the past almost always do poorly. So to make money buying pumps is hard — you need to have your timing right and you need to only buy pumps of the few promoters that get stock prices up.

Thanks Mike. I perfectly understand that the insiders want to dump their shares and the rising of the price is only temporary– may be a 1 day thing– since you have made money by selling early, this is what I was looking for as confirmation that it can be done– Basically, what I want is to join their trick, but use it to my advantage. For example VVIT share price went up about 150% this week. What I would do, would be purchasing shares around 4 pm the evening OTC research “predicts” a company will do well the following day– in morning I wake up– wait for the pump– then between 11 am and 2pm, sell all my shares I bought the previous evening– The difference is usually between 20 cents and 40 cents, but that is quite a lot of money if you have 10,000 shares, which would be between $2000 and $4,000 of profits.

I did not understand what you meant by “shorting them”– if you care to elaborate, I would appreciate it.

Thanks

Chris

Are you referring to this? http://www.otcgsw.com/ He is just a stock promoter and I wouldn’t recommend his service. By shorting, I mean selling short. See http://www.investopedia.com/terms/s/shortselling.asp

Hey Mike, that page is not the one for OTC research I was talking about, what I was talking about is the one you made an analysis for in a different article- the New Jersey guys– Jerome Jay Isip- the one who runs multiple pumps and dumps newsletters/Ads like Stockrockandroll, stock bomb, and OTC research. It occured to me to realize that each company they promote as going to do well the following day it grows by 150% or so on average, FITX for example grew by 200% the following day this week. What this means for example is that if you get the news on Monday before the Market closes and FITX is $0.0058 you can buy it and then Tuesday Morning because of the pump and rise of the stock, it is selling around $0.0189 on Tuesday morning around 11 am, you will be able to sell at a price almost triple your investment- with only $580 a buyer could get 100,000 shares on Monday 4:00 pm and sell all of them on Tuesday 11 am for $1700, that is a profit of $1100.

I looked at the page of short selling on investopedia, I still don’t get it, how can someone possibly make money when the price of a share goes down? I thought that only people profited if the price of share goes up and then lose money when the price of a share goes down.

Chris

Chris — The problem with your analysis is that no one but the promoters knows what they will promote before they promote it. I suggest searching “short selling” and seeing other explanations of how it works. There are plenty online that explain it better than I could.

Well it looks like I was wrong about SKTO getting a trading suspension. Oh well. I am quite surprised that it is still trading.

More on SKTO: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=86550208

Mike what are your thoughts on PHOT! Out of all the medical marijuana company’s I thought that this had the most potential. What are your thoughts?

I doubt any of these companies have any real chance of making money. I believe they exist solely to pay their executives and sell shares.