Yesterday Havensight Capital LLC put out a press release announcing a tender offer for the shares of FreeSeas (FREEF), a distressed shipping company. For posterity the press release is quoted in full below. As of the writing of this post the PR has been removed from Yahoo Finance but is still on the OTCMarkets website.

Havensight Capital makes Tender Offer for Free Seas Inc. and Launches theSuperMallofWebsites.com

Jun 16, 2016

OTC Disclosure & News Service–

CHRISTIANSTED, United States Virgin Islands, June 16, 2016 (GLOBE NEWSWIRE) — Havensight Capital LLC makes tender offer for 85% of the outstanding common shares of Free Seas Inc. (FREEF) for U.S. $0.43 a share, commencing on July 25th, 2016, and ending November 25, 2016. Havensight Capital LLC will serve as the paying agent. Mr. Benjamin Woodhouse, Director, Havensight Capital LLC said, “Global transportation logistics are a critical component to the World economy, we are very excited about the potential to now capitalize on growth trends in this market.”

Havensight Capital LLC also announced the launch of the Super Mall of Websites.com. The Super Mall of Websites.com offers world class website design, hosting, and maintenance, all, for one low published rate. Customers can access the Super Mall of Websites.com team by going to www.thesupermallofwebsites.com and placing an order online. Mr. Benjamin Woodhouse, Director, Havensight Capital LLC said, “we have been pleased with the incredible global demand for our soccer brand, St. Thomas F.C., www.stthomasfc.com, and we are now capitalizing on such momentum, by adding a leading technology service provider to our portfolio.”

About Havensight Capital LLC

Havensight Capital LLC is a leading private equity firm, which is based in the U.S. Virgin Islands. The Firm specializes in investing in stellar consumer product companies that have, either, a technological advantage, or, have the potential to be exceptionally disruptive in their respective markets. The Firm seeks to actively maximize the potential of each, and every investment. Currently, Havensight Capital LLC owns, and operates, St. Thomas F.C. soccer brand, St. Thomas G.C. golf brand, Creditcard2cash.com, Coffee Ostrich consumer products, and the Super Mall of Websites.com.

Contact:Ben Woodhouse

Director

Havensight Capital LLC

5030 Anchor Way

Christiansted, VI. 00820

(805) 478 1958

Copyright © 2016 GlobeNewswire. All Rights Reserved

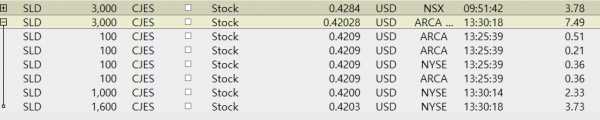

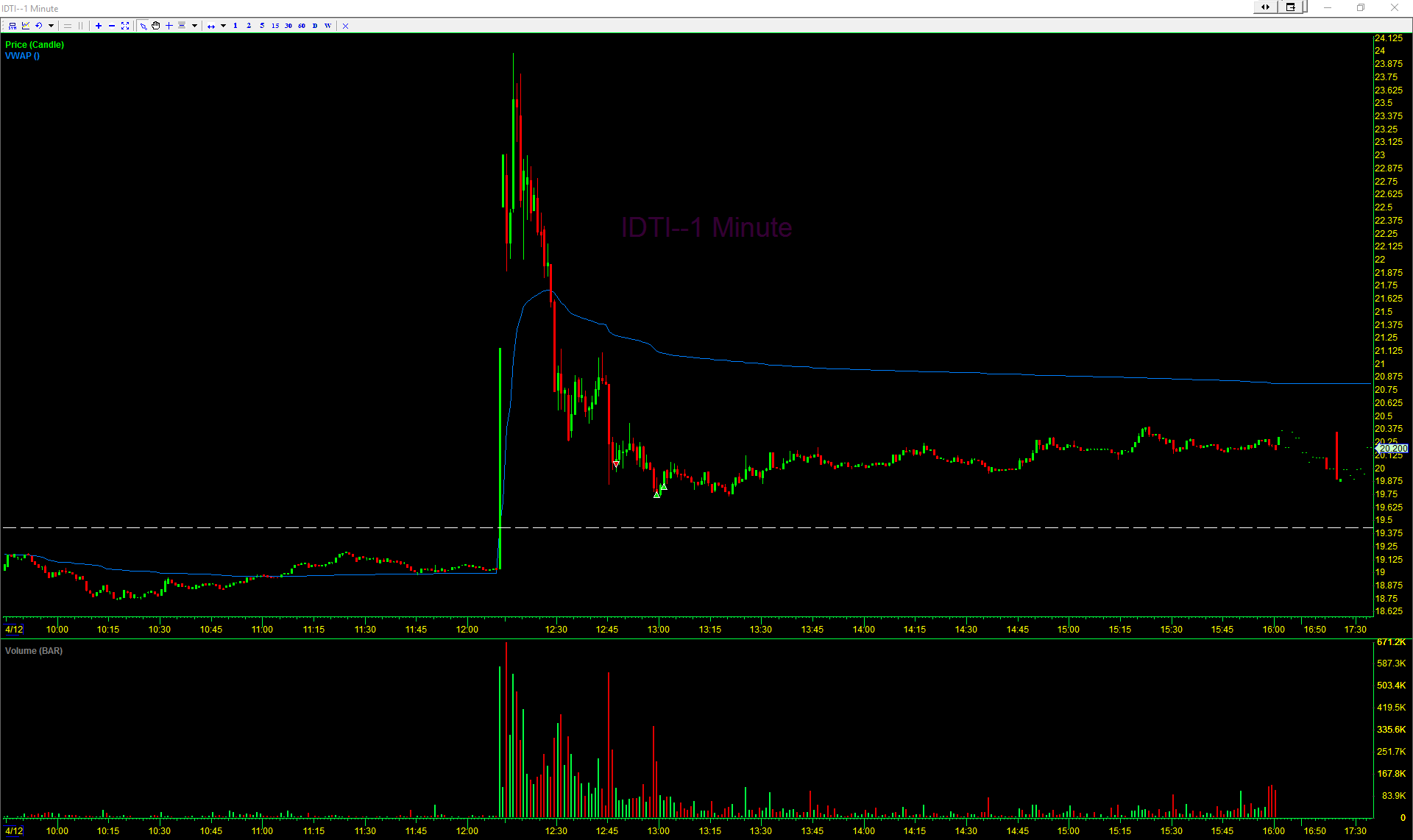

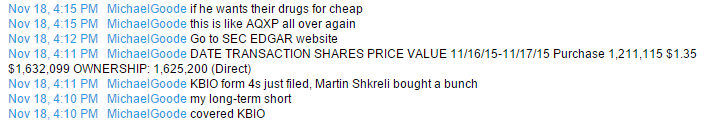

Unfortunately I was away from my computer for 20 minutes when the press release was put out otherwise I would have shorted into the stock’s spike. With the clarity of hindsight I can say now that I should have shorted even after it had already dropped because it was likely to completely erase the gains from that press release. Below is a one-minute chart of the stock.

There were a few things about the press release that struck me as odd and made me suspect that it was a fake. First, Havensight Capital is a no-name firm and their website lists their portfolio companies (also no-name companies) and includes Freeseas (when they have never filed a 13G or 13D or form 4 to indicate ownership of Freeseas stock). Also, the tender offer is way higher than the current stock price of FreeSeas and with the company’s troubles (all shippers have had a hard time the last few years) it would not make sense to me to buy the equity. Anyone interested in Freeseas could likely buy its debt at a steep discount and then take over after the company enters bankruptcy. For me though the biggest indicator that the press release was not serious was that half the press release was about Havensight Capital’s other companies; I have never seen anything like that before in a tender offer or buyout offer press release.

This morning FreeSeas put out a press release calling the Havensight Capital LLC tender offer “false and misleading.” The full press release is below:

FreeSeas Inc. Responds to Havensight Capital Misleading Press Release

Athens, June 17, 2016 (GLOBE NEWSWIRE) — FreeSeas Inc. (FREEF) (“FreeSeas” or the “Company”), a transporter of dry-bulk cargoes through the ownership and operation of a fleet of Handysize vessels and an owner of a controlling stake in a company commercially operating tankers, responded today to a press release published yesterday afternoon by Havensight Capital LLC (“Havensight”).

In its press release, Havensight indicated that it was making a purported tender offer to acquire 85% of the Company’s common stock at a price of $0.43 per share. FreeSeas was not aware of Havensight’s intention to issue such a press release and did not authorize Havensight to use the Company’s name and symbol so that the press release would appear in the FreeSeas’ news feed. Further, upon learning of the press release, the Company reached out to regulatory authorities to alert them to the actions of Havensight.

FreeSeas believes that the Havensight press release is false and misleading, in that it failed to disclose material facts. In particular, the Havensight press release fails to disclose that Havensight has not made the necessary filing with the U.S. Securities and Exchange Commission in order to commence a tender offer. Such tender offer filing would require Havensight to provide significant disclosures about itself, its financial position, the source of the funds in order to complete the tender offer, among other required disclosures.

Unless and until a valid tender offer is made, the Company will not comment further regarding the actions of Havensight. The Company believes Havensight may continue to disseminate false and misleading information. Public investors are urged to rely only on information authorized for dissemination by FreeSeas.

About FreeSeas Inc.

FreeSeas Inc. is a Marshall Islands corporation with principal offices in Athens, Greece. FreeSeas is engaged in the transportation of drybulk cargoes through the ownership and operation of drybulk carriers and also is an owner of a controlling stake in a company commercially operating tankers. Currently, it has a fleet of Handysize vessels. FreeSeas’ common stock trades on the OTCQB Market run by OTC Markets Inc. under the symbol FREEF. Risks and uncertainties are described in reports filed by FreeSeas Inc. with the SEC, which can be obtained free of charge on the SEC’s website at http://www.sec.gov . For more information about FreeSeas Inc., please visit the corporate website, www.freeseas.gr.

Forward-Looking Statements

This press release contains forward-looking statements (as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended) concerning future events and the Company’s growth strategy and measures to implement such strategy. Words such as ”expects,” ”intends,” ”plans,” ”believes,” ”anticipates,” ”hopes,” ”estimates,” and variations of such words and similar expressions are intended to identify forward-looking statements. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to be correct. These statements involve known and unknown risks and are based upon a number of assumptions and estimates, which are inherently subject to significant uncertainties and contingencies, many of which are beyond the control of the Company. Actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, changes in the demand for dry bulk vessels; competitive factors in the market in which the Company operates; risks associated with operations outside the United States; and other factors listed from time to time in the Company’s filings with the Securities and Exchange Commission. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based.

Contact Information:

At the Company

FreeSeas Inc.

Dimitris Papadopoulos, Chief Financial Officer

011-30-210-45-28-770

Fax: 011-30-210-429-10-10

dp@freeseas.gr

www.freeseas.gr

The one big question I am left with at this point is why Havensight Capital LLC would put out such an obviously misleading press release. I have seen fake tender offers and buyouts before but they are usually from fake companies. Havensight Capital is real (see for example their lawsuit against Google from a year ago). Either they put out a fake PR to manipulate the stock (in which case they will be quickly sued and sanctioned by the SEC) or they actually intend to buy those shares (there aren’t many outstanding), in which case they are complete morons because their ownership position will be highly diluted by convertible shares and warrants already outstanding:

As of May 10, 2016, we had 1,832,807 shares of common stock issued and outstanding, convertible notes outstanding that may be converted into an estimated 138,774,955 shares of common stock at current market prices and outstanding warrants to purchase 7.346 shares of our common stock that could result in our issuance of 131,262,660 shares of common stock based upon the exchange formula contained therein at current market prices. Although the investors may not convert their secured convertible note and/or exchange the Series C Preferred Shares if such conversion or exchange would cause them to own more than 4.99% of our outstanding common stock, this restriction does not prevent the investors from converting and/or exchanging some of their holdings and then converting the rest of their holdings. In this way, the investors could sell more than this limit while never holding more than this limit. There is no upper limit on the number of shares that may be issued which will have the effect of further diluting the proportionate equity interest and voting power of holders of our common stock. The conversion or exercise of our outstanding convertible securities could result in substantial dilution to our existing holders, and the sales of such material amounts of our common stock issued upon conversion or exercise could cause the market price for our common stock to decline.

The above is from Freeseas’ most recent 20-F (annual report) filing.

Disclaimer. I have no position in any stock mentioned above. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.