Recently I wrote about customizing IB’s smart routing. Particularly for larger orders though it is desirable to break orders into smaller chunks so as not to give the market too much information which can lead to other traders front-running large orders. Iceberg orders work fine but are so-so at best at limiting information leakage — any trader watching time and sales on a stock will quickly notice if a small bid/offer keeps filling many more shares than are displayed. One solution is simply to send multiple different small orders by hand. This can be slow and increases the probability of fat-finger errors (selling/buying too many or too few shares by accident).

IB has multiple different algorithmic order types but until now they have been relatively esoteric and not geared towards the smaller trader. But with the introduction of IB’s adaptive algorithm order real power is given to small traders. Just tell the algorithm your limit price and how aggressive you want it to be and it will take care of the rest for you, splitting your order up, attempting to offer price improvement and good fills.

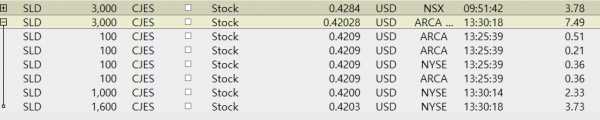

I tried the adaptive algo for the first time today with the patient setting on a short sell limit $0.42 for 3,000 shares of CJES. I had earlier sold 3,000 shares on the offer through NSX, getting an easy fill with low cost ($3.78 net commission).

Here is the chart of the stock as I was selling short:

Here are my fills:

One trade is not enough to draw any conclusions but the algo did a good job at splitting up my order and filling on the offer. I look forward to getting a chance to try the aggressive settings on this algo.

Disclaimer: I am short CJES. I have no relationship with any parties mentioned above (other than IB being one of my brokers). This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

how have you found using the adaptive algos since then? do you find much difference in the urgent setting vs the normal setting?

thanks!

I really haven’t used the adaptive algo much because for the most part my position sizes are not that large. When I have used it I have found that normal priority is too slow for my taste (but I am a day-trader).

Great! Thanks, this is finally the information I was looking for – how long IBALGO takes on normal settings to fill the order.