Interactive Brokers has been one of my main brokers since 2007. Yet I didn’t realize until today that you can customize the smart routing of orders. I was trying to figure out how to set a hotkey to set a market/ECN destination (route) and stumbled across the smart routing configuration which is even better than what I was looking for. Read IB’s description of how it works.

The simple explanation is that you can set the smart router to prioritize execution (in various ways) or prioritize ECN rebates. This only affects orders where you are adding liquidity (when you are taking liquidity the smart routing always prioritizes execution). For someone who trades a lot of low-priced stocks, ECN fees and IB’s per share commissions add up fast. By setting my smart routing to always go to the highest rebate venue I will dramatically lower my trading fees on low-priced stocks. Simply put, I should have looked into this long ago and saved thousands of dollars in commissions.

For the record, for adding liquidity on Nasdaq stocks under $1, the best route is NSX, which offers a rebate of 0.25% of the trade value.

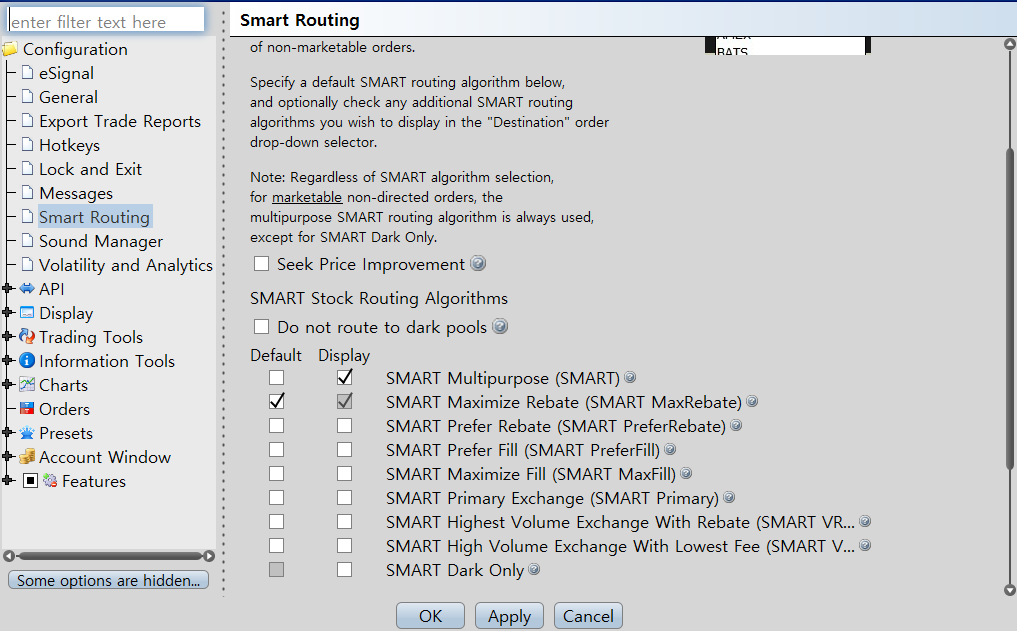

Here is a screenshot of how I have my smart routing configured now:

Disclaimer: No position in any stock stock mentioned above. I have no relationship with any parties mentioned above except that Interactive Brokers is one of my brokers. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

Thanks for posting this information! I’m also a long term ib user and trying to figure out how to maximize the ib trader can be difficult as their help is sometime difficult to understand.

You are not taking into account the extra adverse selection big rebate venues suffer. They usually are executed last and when the price action is adverse. There is a reason why big retail houses force their clients orders to places like EDGX(big rebate venue). Its because they collect the rebate and the client is the one who suffers the adverse selection

Whatever benefit one gets from the higher rebate is more than offset by the adverse price action.

I wrote about this issue and some solutions in an extra chapter of my book “Traders of the New Era Expanded Edition” in the “Trader ToolBox” chapter. I can send you a free copy if you would like

Fernando — Yes, I would be interested to read that.

Fernando — At least for stocks under $1.00 I don’t think the ECN matters for fill as long as you are adding liquidity, because you can set a price out to four decimal places. So it is very easy to jump in front of other bidders with an exchange/ECN that few use and then any sells that fill at the bid will fill against me. This is definitely an issue though with stocks over $1.00.

Fernando, what SMART setting would you recommend for most US stocks when adding liquidity?

Michael, is there a way to get rid of price capping at Interactive Brokers? Except of course calling them for each individual ticker.

I had a situation few times when I had short position on a stock (up already a ton) and the price went against me so I wanted to cover for a small loss, but I couldn’t because of price capping. Unless you have another account without price capping where I would buy that stock, I just couldn’t cover position that I already have. Not to mention buying ie promotion tickers on a day one (but that’s the price of having a wrong broker for buying promotions).

Thanks,

Igor

Igor — Unfortunately there is no way to turn it off on the user’s end. You just need to keep calling the trade desk when you want it removed. It is a horrible situation. All we can do is complain and hope they fix it.