Needless to say, my previous post on KaloBios Pharmaceuticals was dead wrong. Martin Shkreli and friends bought up the majority of the company over the past couple days (at under $2 per share on average) and their SEC Form 4s after the close yesterday caused a massive short squeeze that sent the stock up to $24 in premarket today. The one thing I did not account for was the possibility that someone would see value in the company’s drugs and rescue the company. That is essentially what Shkreli is doing, as he explained to Fierce Biotech. In the future I will avoid any such overnight shorts on companies with substantial intellectual property even if I think it has little value, particularly if the market cap of the stock is low. Even a small risk of a catastrophic loss on a trade is too much.

I apologize for completely failing in my analysis. Luckily I had set up an alert for SEC filings on KBIO so I was able to cover my short for a small loss (around $4,000 net) at $2.0833. Hopefully my readers also avoided catastrophic losses. If you look at my trades on Profit.ly you will see a large loss at IB but a slightly smaller large gain at CenterPoint Securities. It is quicker for me to trade at CenterPoint so I just bought there at first to get flat.

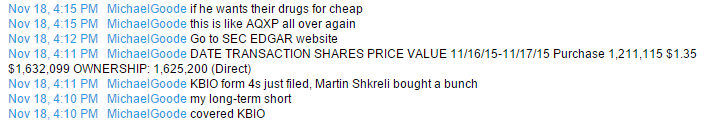

Below is a screenshot of my posts in TimAlerts chat mentioning my cover and the news:

See all my posts here.

Disclaimer: I have no position in KBIO but I will likely trade it after posting this article. I have a close business relationship with Tim Sykes (see Terms of Use for details). I have no relationship with any other parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

So then one sees a loss of $39920 he shouldn’t believe his eyes.

ok then.

You’ll soon see a $36,000 gain in my other account on the same day (once I get it imported). Believe what you will.

If you simultaneously go short and long the same stock

how does it relates to trading is beyod me.

there is no economic motive at all.

Hi Michael, how do you setup the alert on SEC filing?

how does it relate to…

sorry for grammar.

The point of the trade was to cover my short as quickly as possible. I trade much quicker at CenterPoint. So I bought there rather than cover at IB just because it was faster. Later in the evening I slowly got out of both positions.

Here’s the long position on KBIO: http://profit.ly/1MrUTt

How much faster could trading at Centerpoint be than IB. You can trade at IB in about 2 seconds.

I just use IB’s level 1 and don’t have hotkeys with it. Trading at CP easily saved me 10 seconds or more (and probably over 30 cents per share).

What other long term shorts do you have , I have seen a lot of different strategys from different gurus and none of them really do long term shorts , I am the most interested in long term shorting as I see all these stocks run then I look at them a few months later and 90% of the time there down a lot. Also do you have any videos on what you look for , for a potential long term short?

Mostly the only things I long-term short are pure pump and dumps. EURI will be my next one but there is a decent chance it makes new pump highs first.