On Monday November 4th, 2019, two websites associated with the ‘tier 1’ or ‘Panamanian’ stock promoter as that promoter is referred to as by OTC Market Research started promoting Rivex Technology Corp (OTC: RIVX). This promoter has connections to the now-defunct promoter AwesomePennyStocks. I have previously written about this promoter and how OTC Markets’ Caveat Emptor Designation has not stopped them from promoting and making the price of the stocks they promote go up.

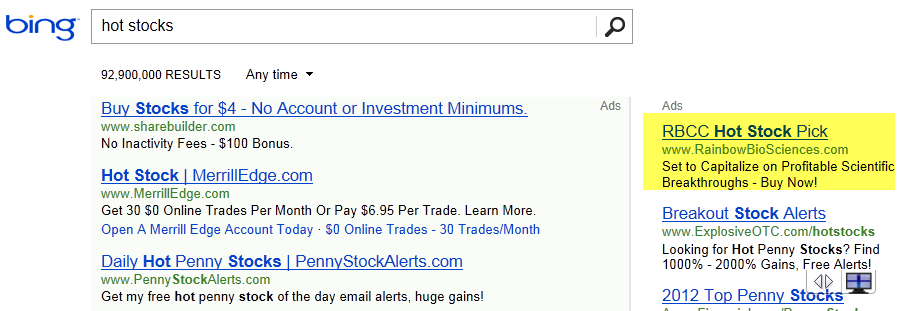

The two websites promoting RIVX are BlueChipPennyStockAlerts.com and PennyStockMarketNews.com. Both websites have been heavily advertising on Google over the last month. Also, both websites have apparently fake address information in their promotional emails. Per the FTC, marketing emails require a correct physical address.

At the bottom of its emails, PennyStockMarketNews.com lists the address 205 Dexter Ave Derry, NH 03038. According to Google Maps there is no Dexter Avenue (there is a Dexter Street). There is no 205 Dexter Street. BlueChipPennyStockAlerts.com lists its address as 1701 Walker Town Rd Castroville, CA 95012. According to Google Maps there is no Walker Town Road in Castroville, though there is a Walker Valley Road. There is no 1701 Walker Valley Road. I also believe the names of the analyst or editor of both sites are also fake (“Michael Griffins” for PennyStockMarketNews.com and “Louis Dalton” of BlueChipPennyStockAlerts.com). I have no evidence for these names being fake but there is also no evidence that they are real.

According to WHOIS data, BlueChipPennyStockAlerts.com was registered 10 June 2019 via NameCheap with contact information protected by WhoisGuard. PennyStockMarketNews.com was registered on 8 May 2019 via NameCheap with contact info protected by WhoisGuard.

Full PennyStockMarketNews.com disclaimer:

PennyStockMarketNews.com reports/releases/profiles are commercial advertisements and is intended for general information purposes only. We are engaged in the business of marketing and advertising companies for monetary compensation unless otherwise stated.

PLEASE NOTE WELL: PennyStockMarketNews.com and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever and we are not qualified to give financial advice. PENNYSTOCKMARKETNEWS.COM WILL NEVER ACCEPT FREE OR RESTRICTED TRADING SHARES IN ANY COMPANIES MENTIONED at PENNYSTOCKMARKETNEWS.COM OR OUR EMAIL ADVERTISING PLATFORMS.

Our website and newsletter are for Entertainment purposes only. This newsletter is NOT a source of unbiased information. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our site, or joining our email list.

We encourage all to read the SEC’s INVESTOR ALERT at https://www.sec.gov/oiea/investor-alerts-bulletins/ia_newsletters.html before reading this Newsletter.

Release of Liability: Through use of this email and/or website advertisement viewing or using you agree to hold PennyStockMarketNews.com, its operators owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. PennyStockMarketNews.com sponsored advertisements do not purport to provide an analysis of any company’s financial position, operations or prospects and this is not to be construed as a recommendation by PennyStockMarketNews.com or an offer or solicitation to buy or sell any security.

COMPENSATION: PennyStockMarketNews.com was compensated $4,000 in cash via bank wire by Upforce Digital Advertising LLC for advertising Rivex Technology Corp. (RIVX). PennyStockMarketNews.com does not own any shares of profiled companies. PennyStockMarketNews.com does not investigate the background of any third party. Any compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding profiled companies. The information contained in our newsletters are based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. PennyStockMarketNews.com encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled through their website, news releases, and corporate filings, or is available from public sources and PennyStockMarketNews.com makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. Further, PennyStockMarketNews.com has no advance knowledge of any future events of the profiled companies which includes, but is not limited to, news & press releases, changes in corporate structure, or changes in share structure.

None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead PennyStockMarketNews.com strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. PennyStockMarketNews.com is compliant with the Can Spam Act of 2003.PennyStockMarketNews.com does not offer such advice or analysis, and PennyStockMarketNews.com further urges you to consult your own independent tax, business, financial and investment advisers. Investing in micro-cap and growth securities is highly speculative and carries and extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions “may”, “could”, or “might” occur. Understand there is no guarantee past performance will be indicative of future results. Past Performance is based on the security’s previous day closing price and the high of day price during our promotional coverage.

In preparing this publication, PennyStockMarketNews.com has relied upon information supplied by various public sources and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this email and website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this email and website are believed to be reliable; however, PennyStockMarketNews.com and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. PennyStockMarketNews.com is not responsible for any claims made by the companies advertised herein, nor is PennyStockMarketNews.com responsible for any other promotional firm, its program or its structure.

Full disclosure from BlueChipPennyStockAlerts.com:

Bluechippennystockalerts.com

Bluechippennystockalerts.com reports/releases/profiles are commercial advertisements and is intended for general information purposes only. We are engaged in the business of marketing and advertising companies for monetary compensation unless otherwise stated.

PLEASE NOTE WELL: Bluechippennystockalerts.com and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever and we are not qualified to give financial advice. BLUECHIPPENNYSTOCKALERTS.COM WILL NEVER ACCEPT FREE OR RESTRICTED TRADING SHARES IN ANY COMPANIES MENTIONED at BLUECHIPPENNYSTOCKALERTS.COM OR OUR EMAIL ADVERTISING PLATFORMS.

Our website and newsletter are for Entertainment purposes only. This newsletter is NOT a source of unbiased information. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our site, or joining our email list.

We encourage all to read the SEC’s INVESTOR ALERT at https://www.sec.gov/oiea/investor-alerts-bulletins/ia_newsletters.html before reading this Newsletter.

Release of Liability: Through use of this email and/or website advertisement viewing or using you agree to hold Bluechippennystockalerts.com, its operators owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. Bluechippennystockalerts.com sponsored advertisements do not purport to provide an analysis of any company’s financial position, operations or prospects and this is not to be construed as a recommendation by Bluechippennystockalerts.com or an offer or solicitation to buy or sell any security.

COMPENSATION: Bluechippennystockalerts.com was compensated $8,000 in cash via bank wire by Upforce Digital Advertising LLC for advertising Rivex Technology Corp. (RIVX). Bluechippennystockalerts.com does not own any shares of profiled companies. Bluechippennystockalerts.com does not investigate the background of any third party. Any compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding profiled companies. The information contained in our newsletters are based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Bluechippennystockalerts.com encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled through their website, news releases, and corporate filings, or is available from public sources and Bluechippennystockalerts.com makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. Further, Bluechippennystockalerts.com has no advance knowledge of any future events of the profiled companies which includes, but is not limited to, news & press releases, changes in corporate structure, or changes in share structure.

None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead Bluechippennystockalerts.com strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. Bluechippennystockalerts.com is compliant with the Can Spam Act of 2003.Bluechippennystockalerts.com does not offer such advice or analysis, and Bluechippennystockalerts.com further urges you to consult your own independent tax, business, financial and investment advisers. Investing in micro-cap and growth securities is highly speculative and carries and extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions “may”, “could”, or “might” occur. Understand there is no guarantee past performance will be indicative of future results. Past Performance is based on the security’s previous day closing price and the high of day price during our promotional coverage.

In preparing this publication, Bluechippennystockalerts.com has relied upon information supplied by various public sources and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this email and website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this email and website are believed to be reliable; however, Bluechippennystockalerts.com and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. Bluechippennystockalerts.com is not responsible for any claims made by the companies advertised herein, nor is Bluechippennystockalerts.com responsible for any other promotional firm, its program or its structure.

Both disclaimers list the paying party as “Upforce Digital Advertising LLC” which likely does not exist in my opinion. It certainly has no web presence as a search for it on Google revealed no results whatsoever. I searched for business entities in all 50 States in the USA (clicking on the sites linked here) for “Upforce Digital Advertising” and found nothing close in any state.

RIVX was given Caveat Emptor designation by OTC Markets after the close on 4 November 2019 (the first day it was promoted). It dropped the next day but has since recovered.

The prior promotion by this promoter, using the older website ProPennyStockAdvisors.com, was at least somewhat successful despite the early Caveat Emptor designation of the stock by OTC Markets, as the price did not drop substantially until 25 October, the day after I received the last promotion emails. ProPennyStockAdvisors.com was registered in the same manner as the two websites that promoted RIVX, with a registration date of 2 April 2019.

Like with the newer promotion websites, the address given by ProPennyStockAdvisors.com does not appear to exist, at least according to Google Maps. That address is 516 Highway 159

Sekiu , WA 98326. Below is the disclaimer from the last PXPP promotion email I received.

One last thing to note: all the emails I have received in the last year from this promotion group have been sent by iContact. That is the same email service provider used by AwesomePennyStocks for most of that group’s existence.

Prior to publishing this post I sent an email requesting comment to all the emails from which I have received the stock promotion. I also sent an email to the iContact media email address requesting comment. Unsurprisingly, no one responded to my emails. If that changes I will update this post.

Disclaimer: No position in any company mentioned and no relationship with any person or entity mentioned. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.