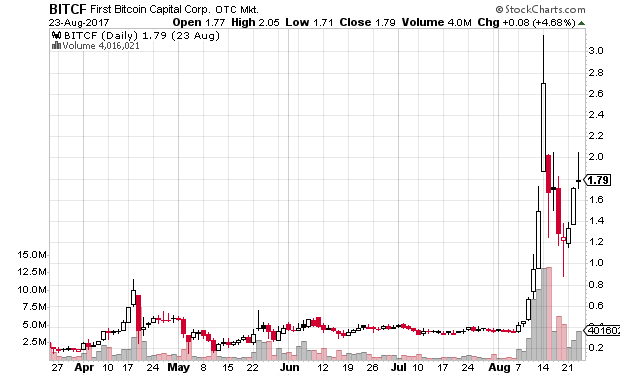

Just yesterday trading in First Bitcoin Capital Corp was suspended by the SEC. Today, the SEC suspended trading in American Security Resources Corp (ARSC).

SEC trading suspension release (PDF)

SEC trading suspension order (PDF)

The reason given for the trading suspension:

The Commission temporarily suspended trading in the securities of ARSC because of questions

that have arisen regarding publicly available information about the company in press releases on

OTCMarkets.com, dated August 1, and August 8, 2017, concerning, among other things, the

company’s business transition to the cryptocurrency markets and early adoption of blockchain

technology.

Following are links to and excerpts from the above-mentioned press releases:

American Security Resources Corp. (OTC PINK: ARSC) Officially Changes Name to Bitcoin Crypto Currency Exchange Corporation (August 1st, 2017)

HOUSTON, TX / ACCESSWIRE / August 1, 2017 / American Security Resources Corporation (OTC PINK: ARSC) is pleased to announce that the Company has officially changed its name to Bitcoin Crypto Currency Exchange Corporation in Nevada, the State of incorporation, as it prepares to enter the booming Crypto currency markets.

“We have decided to make this change to better reflect the new activities of our company. We have already taken steps to bring the company into compliance with OTC Markets and expect to have more announcements soon,” said CEO Frank Neukomm.

He further added, “The Company, today, has appointed Jay Jordon, Michel Beaulieu, and Duncan Brown to its Advisory Board as they have more than 50 years of combined experience in emerging digital technologies. We believe the Company is now positioned to aggressively pursue crypto-currencies and Bitcoin opportunities, and have changed our name to accurately reflect our new direction.”

HOUSTON, TX / ACCESSWIRE / August 8, 2017 / Bitcoin Crypto Currency Exchange Corporation (OTC PINK: ARSC), formerly known as American Security Resources Corporation, announces today that it has acquired 100% of Kachingpay.com Incorporated (“KaChing”), in a cash and stock transaction. KaChing will be merged in to ARSC as a wholly owned subsidiary.

About Kachingpay.com:

KaChing is a smartphone-based payment and money transfer system created by Prometheus Software. KaChing is fast, free, and failsafe. KaChing recognizes that current user fees and charges with existing payment and money transfer systems are excessive. Today’s payment transactions and systems are burdened by their complexity and cost.

KaChing will drive down user fees and charges so that purchase payment processing will become a low cost, commodity utility. Using the free KaChing mobile app, consumers purchase tokens for their digital wallet. KaChing gift card tokens are then used for purchases with merchants. Consumers do not need credit cards, debit cards or specialized hardware. Merchants use existing hardware as well: computers, smartphones or tablets. KaChing uses Apple iOS and Android mobile devices for payment.

Management considers this acquisition significant as it provides a mobile front end on iOS and Android to the BitcoinMWallet mobile exchange platform for crypto currencies, which will be created by the Company.

ARSC will resume trading on the grey market (no market makers) at the open on September 11th.

Disclaimer. No position in any stocks mentioned and I have no relationship with anyone mentioned in this post. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.