One of my favorite trades is shorting a stock when the stock spikes on news from a similarly-named company. This is a rare event, but it is quite enjoyable and I have written about it when it happened to Riviera Tool Corp and Jetcom / Jet.com. A couple similar situations were Nestor Therapeutics / Nest Inc and Tweeter / Twitter. However, this is usually something that happens to illiquid OTC stocks. It appears that something like this just happened with a Nasdaq-traded contingent value right (CVR) relating to Celgene.

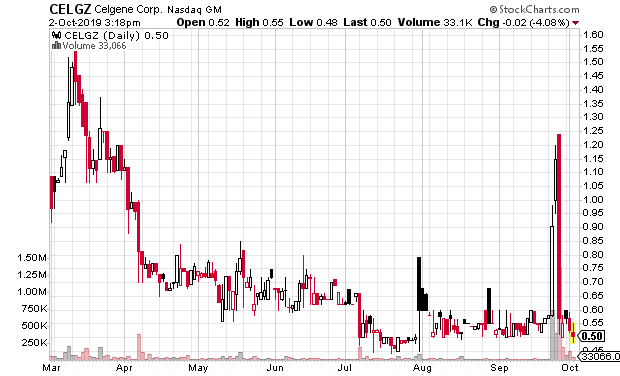

Basically, a CVR is a security issued by a company that is acquiring another company (usually a biotech) that will pay out if something good happens (usually drug approval). In this case, Charley Grant wrote a column for The Wall Street Journal that was bullish on a certain Celgene CVR that would pay out if three of its drugs in late-stage development got approved. That CVR was not yet assigned a ticker. Instead, a different CVR with the ticker CELGZ relating to Abraxane (from the merger of Abraxis and Celgene years ago) spiked 100% in two days starting the day the column was published and on the third day it lost all those gains.

The spike in CELGZ didn’t take it to an absurd value — it was higher back in March — but considering the timing and the volume it is almost certain that people bought the wrong CVR in response to Grant’s column. I checked Google News and I found no news for Abraxane around September 24th. Unfortunately, I did not trade CELGZ (even though it was available to short for about $0.006 per share at Centerpoint Securities on the day it dropped big). Oops.

Once again, thanks to Twitter and one of the smart traders I follow on Twitter for pointing all this out, as shown in the tweets below:

Charley Grant tweet:

Here was the response from a trader I respect and follow:

There are a lot of smart traders on Twitter and one of the best ways to find them is to look at who the smart people follow. Start by seeing who I follow:

https://twitter.com/goodetrades/following

Disclaimer: No position in any company mentioned. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.