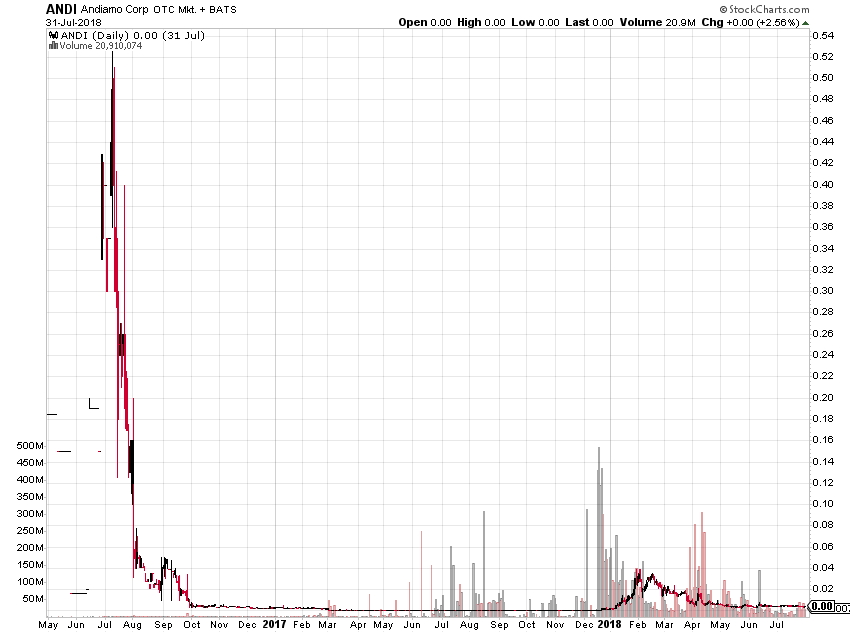

On August 22, 2019 the SEC filed suit against William White, former CEO of Andiamo Corp’s (OTC: ANDI) for allegedly arranging for a stock promoter to receive discounted shares in exchange for a kickback. On September 30, 2019 the SEC filed suit against Michael J. Starkweather and Andiamo Corporation or issuing an allegedly false press release and receiving a kickback from a stock promoter. The SEC put out a press release about the suits last week. For a good overview of the second case, read Mike Caswell’s article on Stockwatch (free registration required to view the whole article).

Both cases are in the Eastern District of New York. The case dockets are below:

Securities and Exchange Commission v. White (2:19-cv-04825)

Complaint (pdf)

Securities and Exchange Commission v. Starkweather (1:19-cv-05528)

Complaint (pdf)

The White complaint (pdf) alleges misdeeds that happened between June and November 2016, when William White was CEO of Andiamo Corp. From the SEC complaint:

1. From at least June through November 2016 (the “Relevant Period”), White—then

the chief executive officer of Andiamo Corporation (“Andiamo”), a penny stock issuer—arranged for a stock promoter (the “Promoter”) to obtain millions of shares of Andiamo stock at a large discount so that the Promoter could make lucrative, manipulative trades and kick back a substantial portion of the profits to White.2. Specifically, from June through October 2016, after the Promoter told White he planned to engage in pre-arranged matched trading with a buyer (the “Matched Buyer”) and agreed to give White half of the Promoter’s profits from those trades, White arranged for the Promoter to obtain at least 66 million shares of Andiamo common stock at a significant discount from the market price.

3. From July through November 2016, the Promoter engaged in eleven matched trades to sell over two million of these Andiamo shares to the Matched Buyer in pre-arranged transactions that created the false appearance of high-volume trading at inflated prices.

4. In exchange for White’s assistance, the Promoter paid White a significant portion of the Promoter’s profits from his matched trades.

Besides the Promoter and White, the complaint against White also mentions a “Matched Buyer” who worked with the Promoter to manipulate the stock using matched trades.

The more recent complaint (pdf) against Michael J. Starkweather and Andiamo Corporation alleges that they put out a false press release in April 2018. It was easy enough at the time to spot the problems with the press release and the company; see for example this insanely detailed research posted on the InvestorsHub message board on April 6, 2018 by pseudonymous researcher NoDummy. According to the SEC complaint:

The press release announced the “unveiling” of a smartphone Andiamo had purportedly developed, touted the phone’s technical features, and claimed that the phone was “available” for distribution. In reality, as Starkweather knew and later admitted, the purported smartphone did not exist: Andiamo had not actually had any such smartphone manufactured.

2. In the months leading up to this false press release, Starkweather and Andiamo issued four press releases touting the purported smartphone’s development in order to pique investor interest in Andiamo and its purportedly forthcoming smartphone. During this prior press release campaign, Starkweather sought and received “kickbacks,” as he called them, totaling over $15,000 from a stock promoter. These kickbacks supposedly represented a portion of the stock promoter’s profits from selling Andiamo shares during this press release campaign.

3. The false press release, which was the culmination of the preceding press release campaign, caused the volume of trading in Andiamo stock to triple and the stock price to increase.

The allegedly false press release gave many details about the phone:

The Utopya Odyssey is the first smartphone to be unveiled in the Company’s product lineup. This 4G smartphone features an incredible 4950 mAh battery, a beautiful 6″ FHD 18:9 display, dual SIM card functionality, up to 192 GB storage capacity, a 16 MP rear camera and 16 MP front camera, and 4 GB of RAM. The Androidbased Device also comes equipped with facial unlock technology and a fingerprint sensor for added user security.

Starkweather would later reveal to the subsequent CEO of Andiamo Corp, “There is no phone—there is no physical phones [sic] that I can sell right now .”

I believe there is a possibility that criminal complaints may yet be filed against the above-named defendants, considering that the SEC thanked the US Attorney’s Office from EDNY and the FBI in the press release about the lawsuits (“The SEC appreciates the assistance of the United States Attorney’s Office for the Eastern District of New York and the FBI.”). Of course it is also possible that the USAO and FBI investigated but decided that only civil charges were warranted. It is possible that the promoter mentioned in the complaints has been acting as a cooperating witness for the FBI in other cases and then gave the FBI information about Andiamo that was then forwarded to the SEC. This would also explain why the promoter was not charged in these cases. One last note — there is no information in the SEC press release or in the complaints that indicates whether the stock promoter in each case was the same or if they were different people.

Disclaimer: No position in any company mentioned. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

They swindled 13,000 + from me

Sorry to hear that.

They swindled about 500 from me, while not a whole helluvalot, I genuinely invested based on information they gave, which was not at all true.. Can we demand to be paid back?

You could do that but they wouldn’t give you the money back. If the SEC obtains a substantial amount of money then sometimes they return some to investors who owned the stock during the time of the fraud or whatever.

They got over 4000$ from me