I apologize for the very late posting! At this point it is only posted for the record. There is an online promotion page at http://www.beverageinvestor.com/kredreport/

See the previous Promotion Stock Secrets post on the KRED pump and their post on the KRED hard mailers that people have received.

Disclosed budget: $2,300,000

Promoter: MarketFirst Media

Paying party: MarketFirst Media or related entities

Shares outstanding: 71,366,067

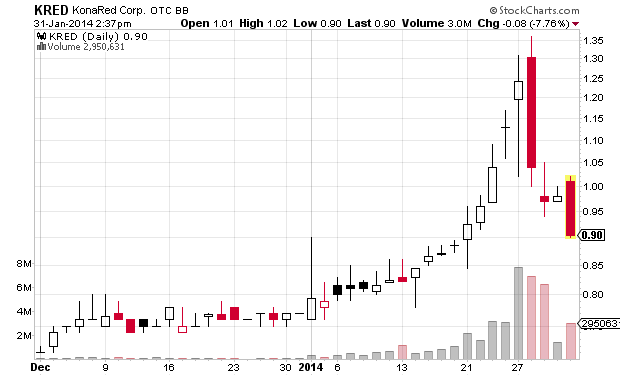

Previous closing price: $0.98

Market capitalization: $69 million

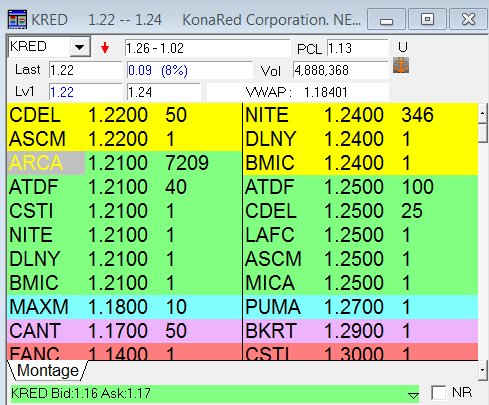

One interesting facet of the KRED pump is that it appears that some person or persons has been trying to manipulate the stock by providing manipulative bid support with very large bids. See the screenshot below. No reasonable trader would submit a 700,000 share bid for a stock that has traded less than ten times that volume. If a trader wants to be a large position they buy slowly over time in small chunks. The only reason to display such a large bid, particularly when it is not the best bid, is to artificially support the price. I would like to thank the manipulators for using Arca for KRED so I don’t have to worry about a corrupt market maker suing me for libel for accusing them of manipulating an otc stock (there has been a market maker apparently supporting KRED too, though).

Excerpt from disclaimer:

MarketFirst Media has managed up to a $2,300,000 USD advertising production budget as of December 1, 2013 in an effort to build industry and investor awareness. Any funds leftover after expenses for research, overhead, advertising and public relations related to KonaRed Corp (ticker symbol KRED) will be considered profit.

Full disclaimer:

THE BOWSER REPORT (TBR) SAFE HARBOR STATEMENT: Statements contained in this online report and/or video, including those pertaining to estimates and related plans, potential mergers and acquisitions, estimates, growth, establishing new markets, expansion into new markets and related plans other than statements of historical fact, are forward-looking statements subject to a number of uncertainties that could cause actual results to differ materially from statements made. TBR provides no assurance as to the subject company’s plans or ability to affect any planned and/or proposed actions. TBR has no first-hand knowledge of management and therefore cannot comment on its capabilities, intent, resources, nor experience and makes no attempt to do so. Statistical information, dollar amounts, and market size data was provided by the subject company or its agent and related sources believed by TBR to be reliable, but TBR provides no assurance, and none is given, as to the accuracy and completeness of this information.

DISCLAIMER: The information, opinions and analysis contained herein are based on sources believed to be reliable but no representation, expressed or implied, is made as to its accuracy, completeness or correctness. Past performance is no guarantee of future results. The Bowser Report is an independent paid members-only website. (www.thebowserreport.com) This online report and/or video is a solicitation for membership in The Bowser Report service. The Bowser Report did not receive any direct compensation with respect to the writing of this online report and document. This stock was chosen to be profiled after The Bowser Report completed due diligence on the stock. The Bowser Report expects to generate new membership revenue, the amount of which is unknown at this time, to its paid website through the distribution of this online report and/or video. This constitutes a conflict of interest as to TBR’s ability to remain objective in its communication regarding the subject company. Analysts, principals, associates and employees of TBR do not own or trade equities under coverage. For detailed disclosure as required by Rule 17b of the Securities Act of 1933/1934 contact The Bowser Report, P.O. Box 5156 Williamsburg, VA, 32188. TBR is not an investment advisor and this report is not investment advice. This information is neither a solicitation to buy nor an offer to sell securities but is a paid advertisement. Information contained herein contains forward-looking statements and is subject to significant risks and uncertainties, which will affect the results. The opinions contained herein reflect our current judgment and are subject to change without notice. We encourage our readers to invest carefully and read the investor information available at the web sites of the U.S. Securities and Exchange Commission (SEC) at http://www.sec.gov and the National Association of Securities Dealers (NASD) at http://www.nasd.com.

The NASD has published information on how to invest carefully. Readers can review all public filings by companies at the SEC’s EDGAR page.

Third Party Advertiser/Advertising Agency IMPORTANT NOTICE AND DISCLAIMER: MarketFirst Media has managed up to a $2,300,000 USD advertising production budget as of December 1, 2013 in an effort to build industry and investor awareness. Any funds leftover after expenses for research, overhead, advertising and public relations related to KonaRed Corp (ticker symbol KRED) will be considered profit. Entities related to MarketFirst Media hold a large amount of shares in KRED and intend to sell those shares. Their sales of KRED common stock will affect the value of your shares (negatively). This should be considered a direct conflict of interest. Please review all investment decisions with a licensed investment advisor. This report is a commercial advertisement and is for general information purposes only. MarketFirst Media are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on this site or emails unless you can afford to lose your entire investment.

PDF copy of pump page

Disclaimer: I have no position in KRED. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.