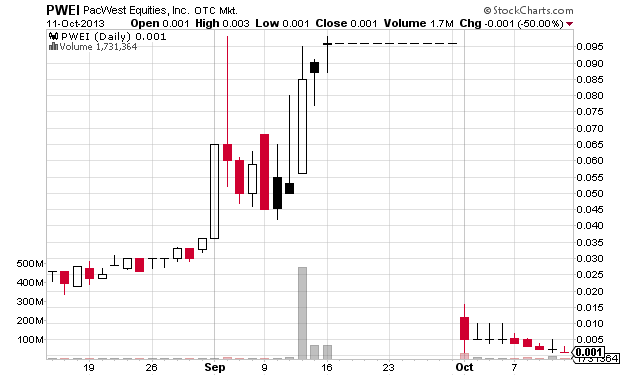

When I first wrote about PacWest Equities (PWEI) I thought it highly likely that the SEC would suspend trading in the stock. I was wrong. I then stopped following the company because it was no longer being promoted by high-profile stock promoters (Victory Mark Corp). Yet three days after a new promotion of the company by Awesomepennystocks.com and Victory Mark Corp, the SEC suspended trading in Pacwest Equities’ stock. The SEC suspension, likely in reaction to recent press releases, led me to look back at what I had written about the company and what the company has done since then. I was surprised by how contradictory a number of the company’s press releases were.

My main problems with PacWest Equities were with its press releases about deals with K. Hill Livestock and its press releases about its acquisition of PurGro Electronics LLC. First, I recap my research on K. Hill Livestock and then I show the blatant lies about PurGro Electronics.

K. Hill Livestock, about which PacWest Equities put out multiple press releases last year with regards to a purchase order and distribution agreement, does not appear to exist. I looked through phone listings, business registration listings, and did numerous web searches. No similarly named company exists with “Livestock” in its name. The only similar name that I could find was Kevin Hill Horseshoeing run (obviously) by Kevin Hill (I attached the Hawaii business record of that enterprise). There is only one Kevin Hill on the big island of Hawaii and a quick search of his name turned up a court filing made this summer indicating that he has almost no assets and no job and thus couldn’t have a meaningful business relationship with PacWest Equities’ subsidiary World Eco Source.

While K. Hill Livestock may exist, I doubt it, and no press releases or filings by Pac West Equities since last November have provided further evidence of a business relationship with K. Hill Livestock. There have been no revenues for the company over the last year from any source.

PacWest Equities, Inc. to Team With K. Hill Livestock for Distribution Rights for Hawaii in a Deal Worth up to $12 Million US in Annual Sales Marketwired (Mon, Nov 12)

World Eco Source Foods Corp. Unit of PacWest Equities, Inc. Announces Initial Purchase Order for up to 5 MobileFeed(R) Trailers in a Deal Worth Almost $1 Million USD Marketwired (Fri, Oct 19)

PacWest Equities, Inc. Announces Its Entry Into the $50 Billion a Year Organic Food Production Market Through Its Wholly Owned Subsidiary, World Eco Source Corp. Marketwired (Thu, Oct 11)

Even more damning than the likely lack of existence of a major customer/partner is the company’s contradictory filings and press releases about its acquisition of PurGro Electronics LLC of Georgia in October 2012. PacWest Equities put out three press releases about PurGro Electronics:

PacWest Equities, Inc. Announces 430% Increase in 3rd Quarter Sales Over 2011 Results for Wholly Owned Subsidiary, PurGro Electronics Marketwired (Mon, Nov 5)

PacWest Equities, Inc. Completes Acquisition of PurGro Electronics, LLC Including Approximately US$15 Million in Annual Sales and 11 Potential Revolutionary US Patents Marketwired (Mon, Oct 15)

PacWest Equities, Inc. Announces Letter of Intent to Acquire PurGro Electronics, LLC for Cash and Stock Valued at US$15M Marketwired (Wed, Oct 10)

Many statements in the press releases are false. The first press release describes a “Letter of Intent to purchase PurGro Electronics, LLC in exchange for cash and stock, in a deal valued at US$15M.” As of June 30, 2012 (per the company’s quarterly report filed with OTCMarkets.com) the company showed $0 in current assets so the acquisition could not have included a cash component.

More importantly, in its October 15, 2012 press release PacWest Equities stated, “through its wholly owned subsidiary, World EcoSource Corp., it has completed the acquisition of PurGro Electronics, LLC in exchange for cash and stock.” And in the November 5th press release PacWest Equities described PurGro Electronics as its “wholly owned subsidiary”. Yet no sales from PurGro ever showed up on PacWest Equities’ income statement and no shares were ever issued to pay for the acquisition; in fact, PurGro was never mentioned in any filings with OTCMarkets.com and was never mentioned in a press release after November 5th. At the time of those press releases I contacted the member/manager of PurGro Electronics, Greg Richter, using the email address listed in the LLC’s registration documents and sought comment on the acquisition. He neither confirmed nor denied the acquisition.

Recent Press Releases

It is possible that the SEC took a look at PacWest Equities’ older press releases after the stock promotion began in earnest again on September 12, but I think it more likely that the suspension was due to the company’s two recent press releases prior to the suspension (a third press release came just after trading in the stock was suspended):

PacWest Equities, Inc. Announces Partnership With Two of Brazil’s Energy Companies, Itambe Energy and 3CO Energy Marketwired (Fri, Sep 13)

LAS VEGAS, NV–(Marketwired – Sep 13, 2013) – PacWest Equities, Inc. (PINKSHEETS: PWEI) today announced details of the recent partnership agreements with two of Brazil’s energy companies, Itambe Energy and 3CO Energy, both located in the Capital of Parana, Curitiba, Brazil. The partnerships would give PacWest Equities an immediate foothold in the region to quickly deploy its Solar Manufacturing Line and help accelerate its plans to capture a large share of the estimated $US89 Billion Solar Market in South America by 2017.

The Solar Manufacturing Line, which costs over $100 Million to develop, with $67 Million going to Research and Development, $12 Million to build the prototype line, and $27 Million going to the actual production line now in physical possession of PacWest Equities, Inc., addresses the construction market’s need to replace typical tinted window panes in high-rise buildings with Solar Glass Panels that generate electricity at the same time as functioning as a window, a skylight, or any other type of building cover. This technology is designed to integrate with other technologies in the building market, but at the same time opening up huge surface areas for Solar Generation that previously were tinted, coated, and usually curtained to attempt to stop the transfer of heat and energy drain.

The above press release can be seen as misleading in that it describes the amount of money spent by Daystar (DSTI) to develop the (money-losing) product line that PacWest Equities bought, which is rather irrelevant, but I do not think it is blatant enough to warrant a trading suspension.

PacWest Equities, Inc. Secures 50 Million USD Financing Commitment From Euro Brazil Investments, SA in Exchange for a Minority Interest in PacWest Equities, Inc. Marketwired (Thu, Sep 12)

LAS VEGAS, NV–(Marketwired – Sep 12, 2013) – PacWest Equities, Inc. (PINKSHEETS: PWEI) announced today that it had secured a commitment for 50 Million USD in financing from Euro Brazil Investments, SA of Luxembourg City, Luxembourg. Euro Brazil Investments, registered through the Brazilian Central Bank, will receive a minority interest in exchange for its investment in PacWest Equities, Inc., which plans to bring its recently acquired Solar Line of CIGS Manufacturing Technology and its proprietary Intellectual Property to Brazil.

The technology, which cost over $100 Million to develop, with $67 Million going to Research and Development, $12 Million to build the prototype line, and $27 Million going to the actual production line now in physical possession of PacWest Equities, Inc., addresses the construction market’s need to replace typical tinted window panes in high-rise buildings with Solar Glass Panels that generate electricity at the same time as functioning as a window, a skylight, or any other type of building cover. This technology is designed to integrate with other technologies in the building market, but at the same time opening up huge surface areas for Solar Generation that previously were tinted, coated, and usually curtained in an attempt to stop the transfer of heat and energy drain.

The above press release is likely the reason for the trading suspension. A $50 million financing commitment for a pinksheet stock with less than $13,000 in tangible assets as of June 30th is ludicrous. I did check the Luxembourg corporate registry and EuroBrazil Investments does exist. Eurobrazil Investments was founded in January 2012, but the corporate records don’t give any other useful details. See its public filings. It is possible that this financing commitment is in the form of discounted shares that can be immediately sold; if that is the case, not stating it would be misleading enough to warrant a trading suspension. Of course it is also possible that the financing commitment is a complete lie.

[Edit 2013-11-11]: Lucio Lopez, purporting to be the President of Euro Brazil Investments SA, contacted me to state that his company had never even been contacted by PacWest Equities and had no relationship whatsoever with them. I encouraged him to file a complaint with the SEC and assured him that I would update this blog post.

My articles on PacWest Equities on OTCMicrocapResearch.com:

Coverage initiated on PacWest Equities: Strong sell

Is PacWest Equities a bona fide company or is it being run for the purpose of selling shares?

More contempt for the investing public from PacWest Equities

Another K Hill press release from PacWest Equities

Other articles on PacWest Equities:

PacWest Equities’ connections to VLNX (PromotionStockSecrets.com)

PacWest Equities: the $330 million pink sheet with no cash and 155 illegally issued shares (SeekingAlpha)

Disclaimer: I have no position in any stock mentioned. I have no relationship with any parties mentioned above. Some of the information in this post was submitted to the SEC Enforcement Division. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.