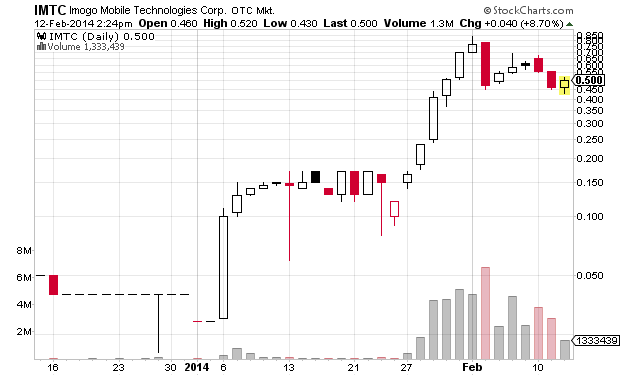

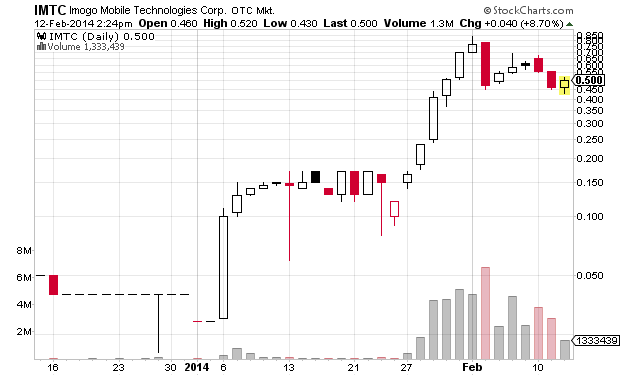

Again, my apologies for this delayed posting. Luckily others on the internet have posted about the IMTC pump:

Promotion Stock Secrets post about IMTC hard mailer

Direct link to IMTC full mailer (pdf) from Promotion Stock Secrets

Penny Stock Realist article on IMTC on SeekingAlpha

The SeekingAlpha article goes into the promotion of IMTC by StockCastle, a notorious spam promoter. The most recent stock promoted by StockCastle was NVGC and that was suspended by the SEC. NVGC was also promoted via a hard mailer. IMTC is definitely at risk of a trading suspension.

Disclosed budget: $3,000,000

Promoter: Wall Street Revelator / Andy Carpenter

Paying party: Fenvo Enterprises Limited

Shares outstanding: 73,500,000

Previous closing price: $0.46

Market capitalization: $34 million

Below is a screenshot of the top of the IMTCreport.com website.

Excerpt from disclaimer:

The Wall Street Revelator and/or its publisher, Andrew Carpenter has received a total amount of ten thousand dollars in cash compensation to assist in the writing of this Advertisement, as well as potential future subscription and advertising revenues, the amount of which is not known at this time with respect to the publication of this Advertisement and future publications. Fenvo Enterprises Limited paid three million dollars to marketing vendors to pay for all the costs of creating and distributing this Advertisement, including printing and postage, in an effort to build investor and market awareness.

Full disclaimer:

IMPORTANT NOTICE AND DISCLAIMER: DO NOT BASE ANY INVESTMENT DECISION UPON ANY MATERIALS FOUND IN THIS REPORT. This publication is distributed free of charge and does not provide an analysis of a company’s financial position. The information contained herein has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company, including Imogo Mobile Technologies (IMTC). Imogo Mobile Technologies’ financial position and all other information regarding Imogo Mobile Technologies should be verified with the company. An individual should never invest in the securities of any company, including IMTC based solely on information contained in this advertisement. Information about many publicly traded companies, including Imogo Mobile Technologies, and other investor resources can be found at the Securities and Exchange Commission’s website at www.sec.gov. Investing in securities is speculative and carries risk. It is recommended that any investment in any security should be made only after consulting with your investment advisor and only after reviewing all publicly available information, including the financial statements of the company. This mailing piece is not intended to be, nor should it be construed as, an offer to sell or a solicitation of an offer to buy securities, nor should it be construed as the provision of any investment-related advice or services tailored to any particular individual’s financial situation or investment objective(s). The Wall Street Revelator is a bona fide publication of general and regular circulation offering impersonalized investment-related research to readers and/or prospective readers and is not an investment adviser either with the U.S. Securities and Exchange Commission (SEC) or with any state securities regulatory authority. The Wall Street Revelator is neither licensed nor qualified to provide financial advice. As such, it relies upon the “publisher’s exclusion” as provided under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. Staff members of The Wall Street Revelator and its afiliates do not hold positions in investments mentioned herein. Investing in companies like Imogo Mobile Technologies carries a high degree of risk. Do not invest in this company unless you can afford to possibly lose your entire investment. Individuals should assume that all information contained herein about IMTC and other companies is not trustworthy unless verified by their own independent research. The Wall Street Revelator and/or its publisher, Andrew Carpenter has received a total amount of ten thousand dollars in cash compensation to assist in the writing of this Advertisement, as well as potential future subscription and advertising revenues, the amount of which is not known at this time with respect to the publication of this Advertisement and future publications. Fenvo Enterprises Limited paid three million dollars to marketing vendors to pay for all the costs of creating and distributing this Advertisement, including printing and postage, in an effort to build investor and market awareness. If successful, the Advertisement will increase investor and market awareness, which may result in increased numbers of shareholders owning and trading the common stock of Imogo Mobile Technologies increased trading volumes, and possibly increased share price of the common stock of Imogo Mobile Technologies. It is believed that all outside research, materials and information used to compile this Advertisement, is accurate and reliable. However, each person should perform their own due diligence and consult with advisors of their choice in making any investment decision. Past performance does not guarantee future results. Additionally, it includes forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including statements regarding expected growth of the featured company. Any statements that express or involve discussions with respect to predictions, expectation, beliefs, plans, projections, objectives, goods, assumptions or future events or performance may be forward-looking statements. The forward-looking statements contained herein (which include all statements other than historical information) are based on expectations, estimates and projections at the time the statements are made that involve a significant number of risks and uncertainties that could cause actual results or events to dier materially from those presently anticipated. To the fullest extent of the law, we will not be liable to any person or entity for the quality, accuracy, completeness, reliability, or timeliness of the information provided herein, or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information we provide to any person or entity (including, but not limited to, lost profits, loss of opportunities, trading losses, and damages that may result from any inaccuracy or incompleteness of this information)

PDF copy of pump page

Disclaimer: I have no position in IMTC. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

Disclaimer: I have no position in any stocks mentioned and no relationship with any parties mentioned above. This blog has a

Disclaimer: I have no position in any stocks mentioned and no relationship with any parties mentioned above. This blog has a