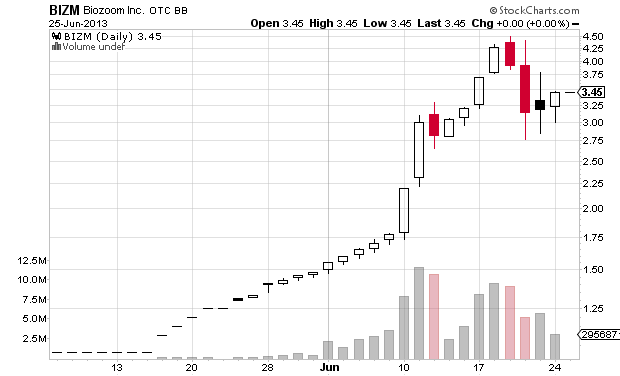

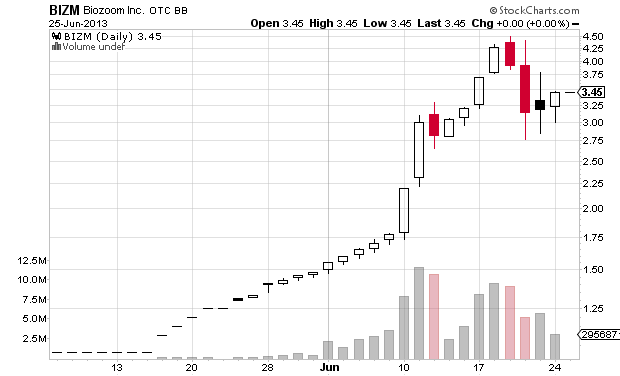

This year has already seen more suspensions by the SEC of actively traded pump and dumps than any year since I started trading them back in 2007. Today’s suspension of Biozoom takes it to the next level though: the stock had only been actively promoted for a month and it was averaging huge dollar volume (for an OTC stock) of over $10 million per day. This is much higher volume than any other promoted stock was doing at the time it was suspended. When the SEC has in past years suspended stocks that were the subject of stock promotions, it was usually long after the initial stock promotion. The reason for this suspension was also quite clear and was different from the normal reasons given by the SEC.

Before looking at the details of the suspension of Biozoom (BIZM), I recap other notable trading suspensions this year (links are to my blog posts on the suspensions):

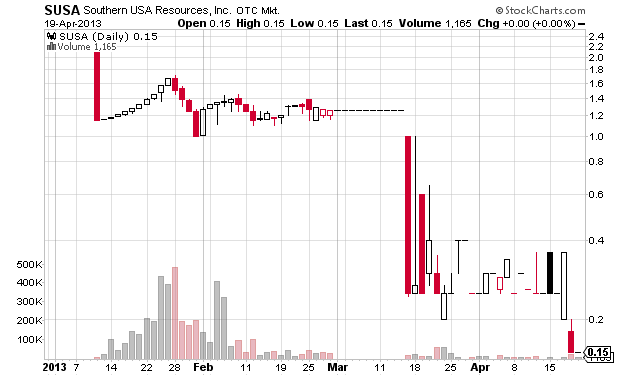

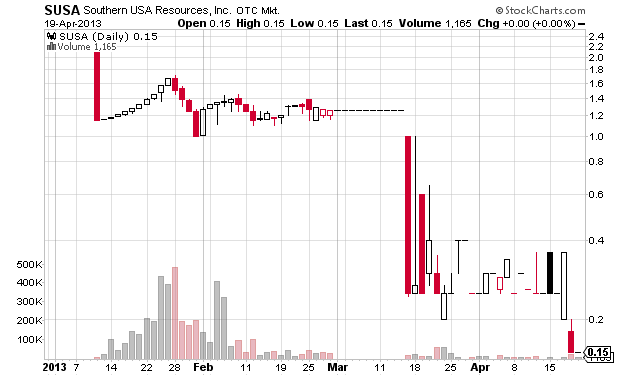

1 March 2013 – Southern USA Resources (SUSA): This was a mailer promotion that had not collapsed at the time it was suspended.

The Commission temporarily suspended trading in the securities of Southern USA Resources because of questions that have been raised about the accuracy of assertions by Southern USA Resources, and by others, in press releases and other public statements to investors, and in promotional mailers, concerning, among other things: (i) the company’s operations; and (ii) thecompany’s outstanding shares.

8 March 2013 – Endeavor Power Corp. (EDVP): This was an email promotion by various poor promoters the day before the suspension; it had previously been promoted in January by others.

It appears to the Securities and Exchange Commission that there is a lack of current and accurate information concerning the securities of Endeavor Power Corp. (“Endeavor Power”), quoted under the ticker symbol EDVP, because of questions regarding the accuracy of assertions in Endeavor Power’s public filings and press releases relating to, among other things, patents.

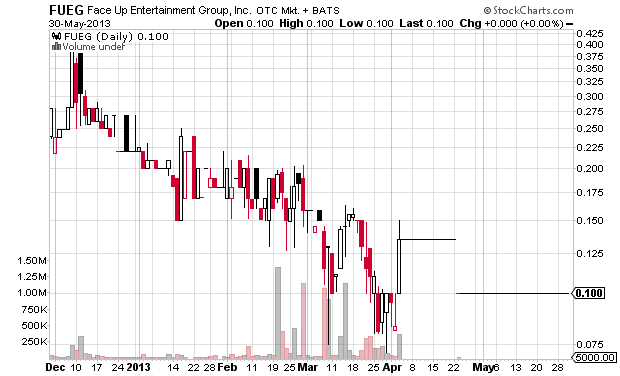

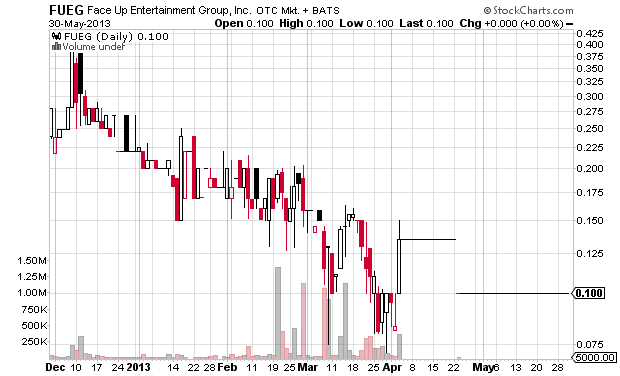

14 March 2013 – Face Up Entertainment (FUEG): This suspension was likely related to a Department of Justice criminal investigation into death threats made by some people involved in the promotion against one of the promoters.

The Commission temporarily suspended trading in the securities of Face Up because of questions concerning the adequacy and accuracy of publicly available information about Face Up, including, among other things, its financial condition, the control of the company, itsbusiness operations, and trading in its securities.

10 June 2013 – Polar Petroleum (POLR): This hard mailer and email pump lasted for a month and a half before being suspended and it averaged over $1 million in daily dollar volume over that period. The suspension was almost certainly related to the company’s press releases that said more about Exxon’s operations than about Polar Petroleum’s.

The Commission temporarily suspended trading in the securities of Polar because of questions

regarding the accuracy and adequacy of assertions by Polar, and by others, to investors in press

releases and promotional material concerning, among other things, the company’s assets,

operations, and financial condition.

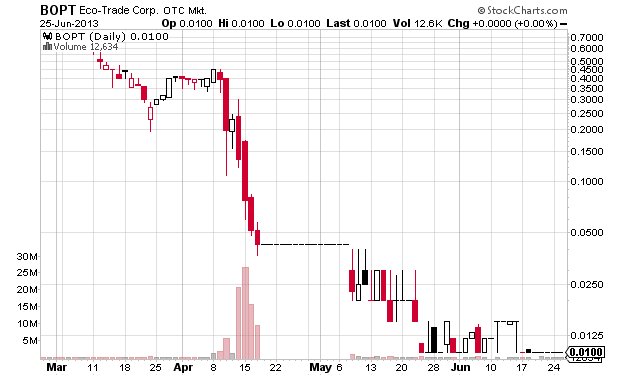

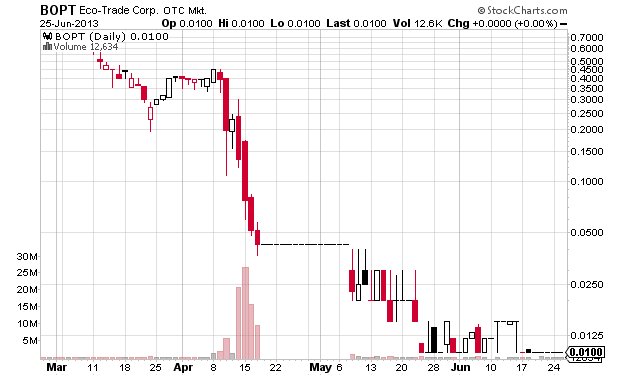

Besides the increased pace of SEC trading suspensions of active stock promotions this year, FINRA also joined the party, halting trading in Eco-Trade Corp (BOPT) for 14 trading days back in April, just a week after the beginning of a disastrous promotion by StockMarketAuthority / StockDectective that saw the stock drop in days from $0.24 to $.05. FINRA has for awhile had the ability to halt trading in OTCBB stocks but to my knowledge this is the first time they used that power. FINRA gave no notice whatsoever nor any explanation

The Biozoom Suspension

SEC press release

Suspension Order

Unlike the previous suspensions this year, the SEC was quite specific in why Biozoom’s stock was suspended:

The Commission is concerned that certain Biozoom affiliates and shareholders may have unjustifiably relied upon Rule 144 of the Securities Act of 1933 (“Securities Act”) and they, Biozoom, and others may be engaged in an unlawful distribution of securities through the OTCBB.

The SEC has a concise but vague description of Rule 144:

Rule 144 provides an exemption and permits the public resale of restricted or control securities if a number of conditions are met, including how long the securities are held, the way in which they are sold, and the amount that can be sold at any one time. But even if you’ve met the conditions of the rule, you can’t sell your restricted securities to the public until you’ve gotten a transfer agent to remove the legend.

The law firm Morrison Foerster at Mofo.com has much better description of Rule 144 and what it means (pdf). I am not a securities lawyer and am certainly not an expert on Rule 144, but the likely cause is that the insiders / control persons selling the shares had to wait 12 months after obtaining the shares before selling them (because Biozoom was listed as a shell company as recently as February 2013). Thanks to nodummy of Promotion Stock Secrets and Janice Shell for pointing this out. If Biozoom had not ever been a shell company then insiders would only have to wait 6 months before selling restricted shares under Rule 144.

I expect to see some litigation releases relating to the allegedly illegal share sales sometime in the coming months. See my previous report on Biozoom (and make sure to check out all the other articles about the company I link to). One interesting thing to note is that while I and others (like Ashraf Eassa writing at SeekingAlpha) have brought up the likelihood that the promotional campaign is being paid for by a shareholder (despite the promoters disclosing no compensation), which would make the promotion illegal, this was not mentioned in the SEC suspension order. I believe that the Rule 144 violation is simply easier and quicker to prove and that in time the SEC will sue the promoters for what I believe to be a false disclosure of no compensation.

A Note on Trading BIZM

I made more than a few thousand dollars buying BIZM and shorting it at various times over the last month. Especially after the POLR suspension I became very cautious especially considering the lack of disclosure of compensation in the BIZM promotional materials. I warned people repeatedly in TimAlerts chat that it was risky to hold BIZM overnight. But I tried to get cute and get out at the best possible price and ended up not fully filling my sell order. Trying to save a few cents per share will likely end up costing me over $3 per share: I bet BIZM opens under $0.50.

[Update 2013-6-27]: See Janice Shell’s article on what the recent rash of SEC trading suspensions means for pumps.

Disclaimer: I am net long 1700 shares of BIZM (long 11,700 shares in one account and short 10,000 shares in another account); I am short 3200 shares of POLR; I have no positions in any other stock mentioned and no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.