It is always interesting to see who is behind various stock promotion websites. One interesting one is MJ Capital Management. It is not a very effective stock promoter (I like to short the stocks it promotes). Below is info on its stock promotion websites and how you can find that information. The inspiration for this post (and much of the research) comes from nodummy on the InvestorsHub DD Support Board and Fraud Research Team message board; he is one of the few non idiots on iHub and that message board is one of the few useful message boards on iHub).

I should point out that the research in this blog post was not hard at all — Jay Isip, the main person running MJ Capital LLC, does not appear to have tried to hide his identity and his companies are not difficult to understand. This is very different from some other stock promoters who use offshore companies and fake addresses or mail forwarding services to hide their identity.

The first part of my research on a stock promotion website starts with signing up to the email list. Then I look at the information disclosed in the disclaimer and below the disclaimer in the emails. The CANSPAM act requires all people sending commercial / promotional emails to disclose their name (business or personal) and a valid mailing address. StockBomb.com makes it easy by listing “MJ Capital, LLC | 110 Main Street | Newark, nj 07102”. This information then leads to a web search of the address and the legal entity. The search of the address gives us no useful information, but searching for MJ Capital LLC yields us the company’s website, www.mjcapitalmanagement.com/, and a Linked In profile page. The Linked In page doesn’t tell us much we don’t already know. The website is a great example of the kind of website that stock promoters have to sell their services to OTCBB/Pinksheets companies and shareholders in those companies.

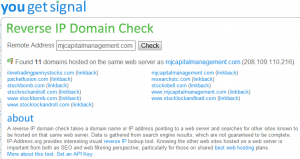

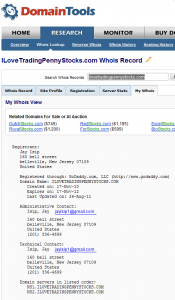

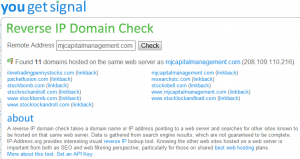

Next, we can take a look at the WHOIS data on the StockBomb.com and MJCapitalmanagement.com domain names — to find out who registered them. This is often a waste of time because of the availability of private registration (I use that for all my domain names). In this case, registration for both these websites is private and thus not useful. Next we can look at the server where the websites are hosted. Many websites are hosted on servers with thousands of other websites, but sometimes only a handful of websites are hosted on the same server, allowing us to draw connections between those sites. You can use this website to look this info up for free (another website that allows this kind of search is ReverseInternet.com).

This search hits the jackpot for us and yields only a handful of websites:

(click image to embiggen)

This gives us a nice list of potentially-related websites:

ilovetradingpennystocks.com

mjcapitalmanagement.com

packetfusion.com

researchotc.com

stockbomb.com

stockobell.com

stockrockandroll.com

www.mjcapitalmanagement.com

www.stockbomb.com

www.stocklockandload.com

www.stockrockandroll.com

I signed up for the emails on all the stock promotion websites and then I tried looking at the one non-pump website (packetfusion.com) to find any connections between it and the pump websites, which I could not find.

ilovetradingpennystocks.com shows the same content as pennystocklocks.com, so I signed up for that website as well.

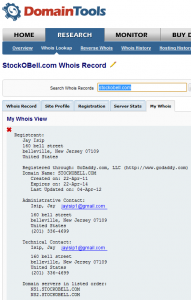

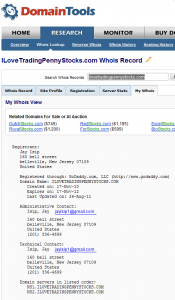

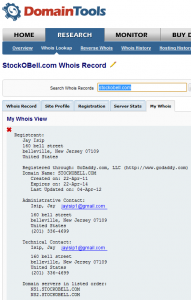

The contact email addresses for stockobell.com, researchotc.com, stocklockandload.com, stockrockandrollcom, and stockbomb.com are the same: MJCapitalManagement@gmail.com. StockLockandLoad.com and StockBomb,com both show Jay.StockRockandRoll@Gmail.com as the contact email address for ‘general inquiries’. That is pretty conclusive evidence that all of these stock promotion websites are linked to MJ Capital LLC. Now that we are nearly certain that all the websites are run by the same person or people, we can look at the WHOIS information on all the websites. All but three of the websites were registered privately so we cannot glean any information from those. However, ilovetradingpennystocks.com, pennystocklocks.com, and stockobell.com were not registered privately.

(click images to embiggen)

PennyStockLocks.com is registered to Robert McConnon of New Jersey. ILoveTradingPennyStocks.com and StockoBell.com are registered by Jay Isip of New Jersey. A google search of “Jay Isip” yields a Linkedin profile as one of the top few results. That Linkedin profile shows Jay Isip as the President/CEO of MJ Capital LLC and Stock Rock and Roll LLC and lists the following as company websites: http://www.stocklockandload.com/lp/ http://www.stockbomb.com/ http://www.researchotc.com/.

The next step is to look up MJ Capital LLC and StockRockandRoll LLC (as well as PennyStockLocks LLC that I found in the disclaimer of the pennystocklocks.com website). As a note for foreign readers, the LLC is a type of limited liability company in the USA that allows for less paperwork and potentially simpler taxes than a corporation. Like US-based corporations, LLCs are registered in a state (there is no national registry). Because the email from StockBomb.com listed a New Jersey address and the phone number on the MJ Capital LLC website lists a New Jersey phone number, the obvious next step is to search New Jersey’s business registry. A quick way to find that is search the web for “corporation search New Jersey”. The top four search results all get us to the place we want to go, the New Jersey business records service. Unfortunately the search engine isn’t particularly good, so slight variations result in no results. It took me a dozen searches before I put a space between M and J (M J Capital) and found the company.

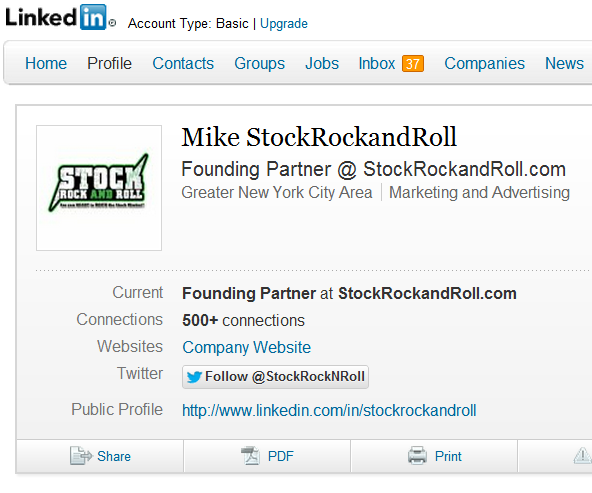

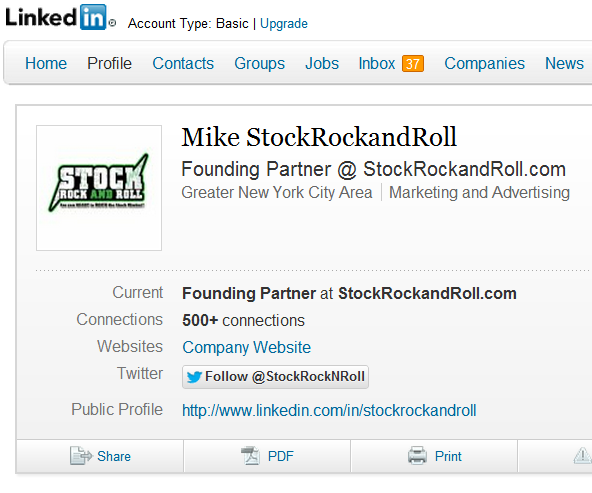

Unfortunately the State of New Jersey made me pay $0.10 to get the unofficial certificate of formation (pdf), but I paid and that gave me the valuable information that Jerome Isip formed the company on October 5, 2011. The unofficial certificate of formation (pdf) of StockRockandRoll LLC lists Jerome J. Isip as the person who formed the company (on April 17, 2008) — that leads me to conclude that his middle name is Jay and he is the same person as Jay Isip. Also listed as member/managers (owners/executives) of the LLC are Mike Killian and Nirav Amin. Google searches of those names yielded little info — I will return to them shortly, though. PennyStockLocks LLC (pdf) was formed on May 24th, 2011 as a single-member LLC by Robert McConnon. I tried searching the web for his name and found little other than a previous iHub post by nodummy on StockRockandRoll (I wish I had seen that earlier — it could have saved me some time). Reading that post led me to search for “Mike stockrockandroll” which led me to this Linkedin page of a purported co-founder of StockRockandRoll.com. StockRockandRoll LLC also has a Facebook page.

While I obviously can’t be certain, it would make sense that Mike Killian is the Mike who is a founding partner of StockRockandRoll LLC (and the “M” in MJ Captial — MJ likely stands for Mike & Jay). As to Nirav Amin, I have no clue where he went. Presumably he is no longer with the company.

So, what does this mean? StockRockandRoll LLC was the first company (from 2008); at some point, Nirav Amin likely left and in 2011 Isip started working with McConnon, who started his own website. Since PennyStockLocks.com has been set up and receiving payments for stock promotion, it has disclosed the exact same amount of compensation on every pump as has StockRockandRoll.com. In other ways (such as ilovetradingpennystocks.com, an Isip-registered domain name, showing the pennystocklocks.com content) the two LLCs appear to act as one. I believe that the M J Capital LLC was set up later in 2011 to give the group a more ‘professional’ look so they could more easily sell their services to the people who pay for pumps.

What conclusions can we make from all this information? First, stock promotion can be quite lucrative. The sum of compensation disclosed through 6/19/2012 in 2012 is $1,349,500 (this number could be off by a bit due to my counting error). Obviously there are significant expenses, the largest of which is new subscriber acquisition costs. Second, there is not that much benefit to finding out all this information for most stock promoters: I get pump emails from each of these pump websites at the same time (and I wouldn’t consider buying their pumps anyway because they tend to gap up and then drop). Third, stock promoters like to continually add new websites: ResearchOTC.com was created most recently, in September 2011, while StockRockandRoll.com has been around since 2008.

[Edit 29 August 2012 – It appears that MJ Capital LLC has added a new website, MomentumOTC.com, and that website is advertising with pay per click text ads on Bing. The website was first registered almost a year ago but I had not seen it advertised prior to today. The domain name is privately registered and it is on a server with thousands of other websites, but the CANSPAM-required name and address at the bottom of its emails gives pennystocklocks.com as the owner of the domain.]

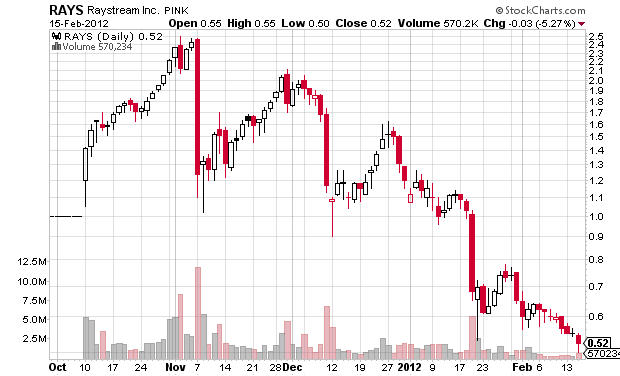

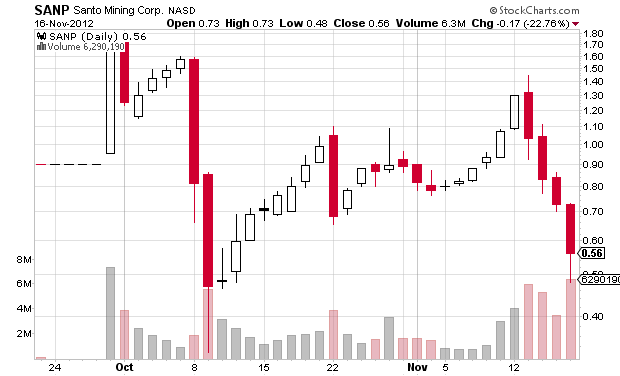

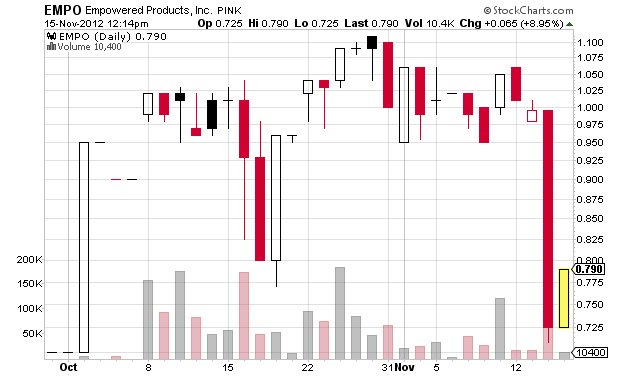

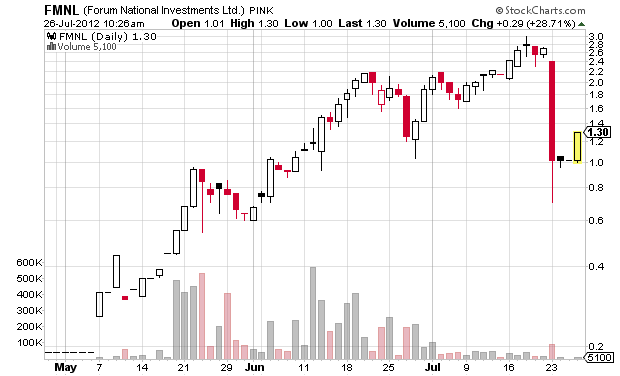

Below are charts of recent MJ Capital LLC paid promotions (they do uncompensated pumps from time to time that go up a lot, at least for the first few minutes):

LGBS – Promoted on 8/2/2012 – $25,000 paid for promotion

KALO – Promoted on 7/10/2012 – $20,000 paid for promotion by Equities Awareness Group, LLC

LBGO – Promoted on 6/26/2012 – $25,000 paid for promotion by Winning Media, LLC

Disclaimer: No relationship with any parties named above (except that I trade their pump and dumps) and no positions in any stocks or funds mentioned. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.