One thing that surprised me at first about the SEC lawsuit against Jerry S. Williams (aka “Monk”) is that they did not charge him with market manipulation for his float lock-down schemes. It seemed to be an obvious case of market manipulation — attempting to buy every share in the float so that the traders in the group could squeeze market makers who ended up short. After some consideration, I now think Williams’ alleged lies and scalping of his followers prevented the float lockdown from ever having a chance at success, and if his intent was to scalp his followers then it would be hard to win a market manipulation case against him. At the very least, scalping is clearly illegal and easy to prove, making a market manipulation charge superfluous.

Despite this, I am certain that the SEC views float lock downs as market manipulation. This is shown by the suit the SEC filed a month ago against Philip Falcone and his hedge fund Harbinger Capital Partners LLC (and related entities). See the litigation release about that case. Below is an excerpt from that litigation release (emphasis mine):

Market Manipulation / Illegal Short Squeeze

In a separate civil action, the SEC alleges that from 2006 through early 2008 Falcone and two Harbinger investment management entities manipulated the market in a series of distressed high-yield bonds issued by MAAX Holdings Inc. In this fraudulent scheme, Falcone and the Harbinger entities allegedly orchestrated an illegal “short squeeze” – a market manipulation scheme in which an investor constricts the supply of a security, through large purchases or other means, with the intent of forcing settlement from short sellers at arbitrary and inflated prices.

The SEC’s complaint alleges that at Falcone’s direction, Harbinger purchased a large position in the MAAX bonds during April and June of 2006. After hearing rumors that a Wall Street financial services firm was shorting the MAAX bonds and also encouraging its customers to do the same, Falcone decided to seek revenge. In September 2006, Falcone directed the Harbinger-managed funds to buy every available bond in the market, often purchasing the bonds from short sellers. Ultimately, Falcone raised the funds’ stake to approximately 13 percent more than the available supply of the MAAX bonds.

At one point, Harbinger had purchased 22 million more bonds than MAAX had ever issued. Contemporaneously with these purchases, Falcone locked up the MAAX bonds the Harbinger funds had purchased in a custodial account at a bank in Georgia to prevent his brokers from lending out the bonds to sellers seeking to deliver the bonds to purchasers after short sales.

Having seized control of the supply of the MAAX bonds, Falcone then demanded that the Wall Street firm and its customers settle their outstanding MAAX short sales, not disclosing that it would be virtually impossible to find bonds available for delivery. The Wall Street firm bid daily for the bonds, which quickly doubled in price. Then, Falcone engaged in a series of transactions with certain short sellers at arbitrary, inflated prices, while at the same time valuing the funds’ holdings on his books at a small fraction of the prices he charged the covering short sellers.

The full complaint on the market manipulation charge against Harbinger and Falcone is here (pdf). While there are more details to the story than stated above it seems clear to me that the SEC has taken the position that buying up more than all the shares (or in this case, bonds) outstanding to then create a short squeeze and force shorts to cover at artificially high prices is illegal. Below are a few more details from the complaint:

19. By engaging in the conduct described herein, Defendants Falcone, HCP Offshore

Manager, and HCP Special Situations GP illegally manipulated the market for MAAX zips and

thereby violated Section 17(a) ofthe Securities Act of 1933 (“Securities Act”) [15 U.S.C. §5i ;. i77q(a)] and Section IO(b) ofthe Securities Exchange Act of 1934 (“Exchange Act”) [15 US.C. §

78j(b)] and Rules lOb-5 thereunder [17 C.F.R. § 240.10b-5].…

102. As described above, Defendants Falcone, HCP Offshore Manager, and HCP

Special Situations GP, acting knowingly, illegally manipulated the market for the MAAX zips

bonds by taking a series of steps intended to disrupt the normal functioning of the market. The

Defendants acquired more than 100 percent of the outstanding issue of such bonds at a time

when they knew or were reckless in not knowing that market participants held significant short

positions in the bonds. The Defendants at various times withheld from the market the

information about their holdings of the bonds. The Defendants prevented their holdings in the

bonds from being used to cover the short positions, and Defendants demanded that holders of

the short positions cover those positions at highly inflated prices demanded by Defendants,

knowing that the market participants had no other source from which to obtain the bonds. The

Defendants took these actions for the purpose of, and which had the effect of, disrupting or

manipulating the market.

Much thanks to Thomas Gorman of the SEC Actions blog (a must-read for anyone who follows stock fraud) for pointing out the relationship between the Falcone case and the float lockdown scheme. Unlike me, Mr. Gorman is a securities lawyer.

Disclaimer: No relationship with any parties named above (except that I trade pump and dumps) and no positions in any stocks or funds mentioned. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

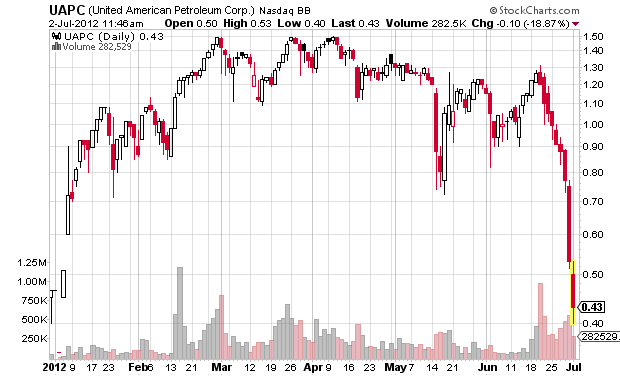

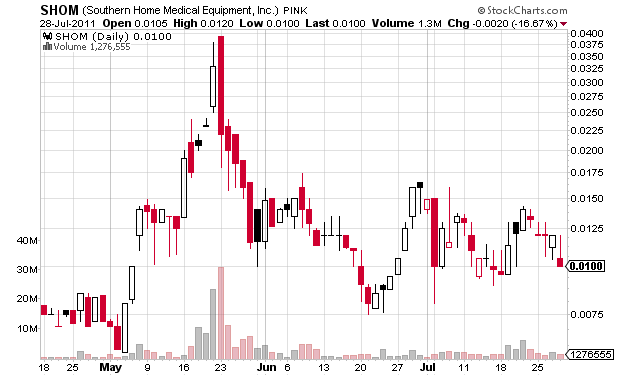

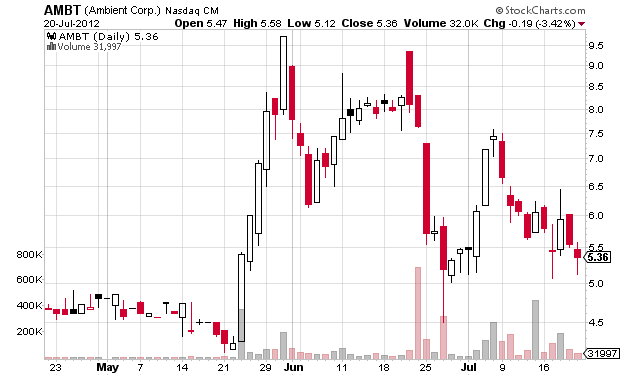

(click to embiggen)

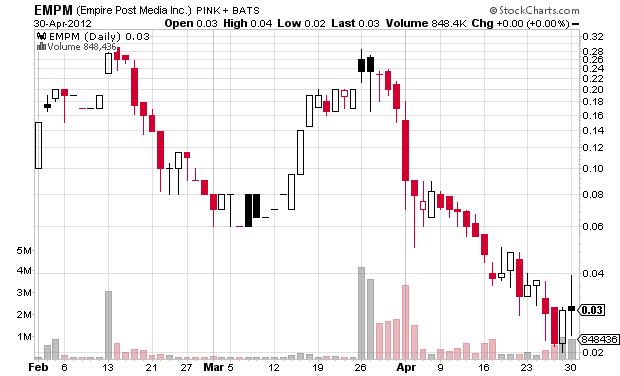

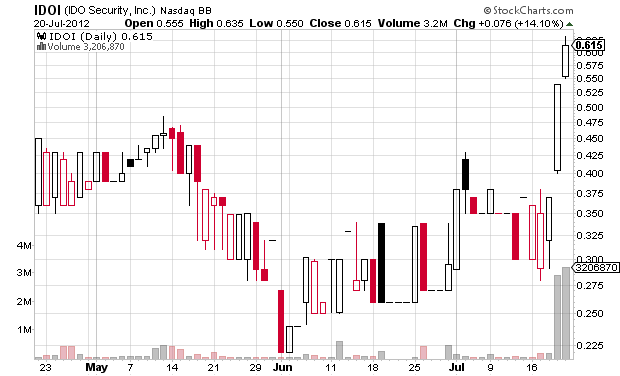

(click to embiggen)