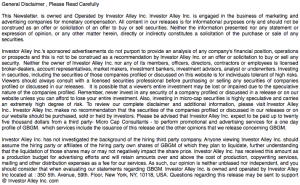

One thing that most investors and traders do not know about the crazy, slimy underworld of OTCBB and Pinksheets stocks is that a large proportion of the companies are created for the sole purpose of being used in pump and dump schemes. Below is a guide to how penny stock operators create listed companies for pump and dumps. Not all of these steps are used in every pump and many pumps do not involve many of these steps.

(Note: I am not an expert on this so it is quite possible that there are significant errors in this post. As always I welcome corrections.)

The Ten-Step Guide to Creating a Pump and Dump

Option 1: Start from scratch

1. Create a corporate shell.

2. Use a Regulation S placement to sell stock to a few close associates. These ‘seed’ shareholders often pay just a few thousand dollars for the stock.

3. Do a reverse merger with some company with a promotable product or technology (the best companies have cool new technology in the development stage so they can be hyped without worrying about actual sales or profits). You can buy some technology that doesn’t work but sounds like it should to laypersons for a couple hundred thousand dollars or a chunk of shares in the public company. If you have no good ideas and have no connections, start your own mining company, lease a mining claim for $10,000 and pay an engineer $5,000 to say it is worth digging.

4. Fund the company by selling convertible debt to insiders / friends. Bonus points are earned for using front companies based offshore to hide the identities of the beneficial owners of the debt.

5. Do a large forward split to get the share count into the tens or hundreds of millions. (These first five steps can take up to a year or more in order to ensure that all your shares are free-trading and not restricted shares.)

6. Contract a stock promoter to promote the stock at an arbitrary price ($1.00 per share or thereabouts is common for big promotions).

7. Sell some shares at a pre-arranged price in large blocks to the promoters or friends. Use these sales to create a bit of a price history at a high price.

8. Install a friend or compliant stooge as the company’s President/CEO and make sure that he follows your instructions.

9. Have the CEO/President start putting out press releases to coincide with the start of the promotional campaign. This way people unfamiliar with pump & dump campaigns will interpret the new volume in the stock as legitimate investor interest (and not the blatant stock promotion it is). It is much harder for the SEC to go after promoters who lie and exaggerate than it is for them to go after corporate officers who lie, so stick to verifiable facts and positive opinions in the press releases.

10. As soon as the promotion starts, start selling your shares on the offer and let the stock slowly uptick to keep traders interested. Because you controlled the company from the very beginning, all the shares being sold belong to you and your associates. Selling shares slowly while letting the stock go up slowly seems to be the most effective way to sell the largest number of shares. Careful manipulation of the price action by providing bid support is also important (it is also illegal but very hard to prove).

Option 2: Purchase control of a publicly-traded shell company

1. Purchase control of a traded shell company on the OTCBB or Pinksheets. Last I checked, such companies, depending on the details (OTCBB companies are more valuable than Pinksheets companies, operating companies with few operations are more valuable than shell companies), the publicly traded shell can cost from $100,000 to maybe $500,000.

2. This step is not necessary.

3. Same as step 3 above — do a reverse merger with a company (that you control) with a promotable technology or product. You can use the reverse merger to dilute the existing shareholders into irrelevance.

4. Same as step 4 above — fund the company by selling convertible debt to yourself and friends. Again, if there are lots of other shareholders, you can use unfavorable debt deals to dilute them into irrelevance.

5. Same as step 5 above — do a stock split to increase the number of shares outstanding. Unlike when starting from scratch, you have a number of shares of your company that are still in the hands of the public. You will thus want to support the stock price or manipulate it higher during and after the stock price. Real companies share prices drop in proportion to the increase in number of shares during a stock price. You are looking to increase the market cap of your company drastically so you will have to keep the price from dropping. The few public shareholders of your stock will benefit handsomely but they should have mostly been diluted into irrelevance by steps 3 and 4.

6. Same as step 6 above — contract with a stock promoter.

7. Similar to step 7 above, but there are already shares out there and a trading history, so it is best to use wash sales and matched trades between multiple accounts to build a trading history at the current (high) price that you wish to start the promotion at. (Caution: this is illegal.)

8. Same as step 8 above — install a friend or stooge as company CEO/President.

9. Same as step 9 above — have the CEO issue press releases to coincide with the promotion.

10. Same as step 10 above.

For an investment of some time and up to $5 million dollars for the most expensive of promotional campaigns, it is possible to realize over $100 million in profits. It is quite possible to put together a pump like this for under $1 million (and for just a few hundred thousand) and you can still expect to realize returns in excess of 1000%.

An example of the 10 steps to creating a pump & dump

Following are the steps allegedly taken by the insiders and promoters of RCYT (promoted in February 2010). All quotes below are from the SEC complaint (pdf). See also the SEC litigation release about the lawsuit. Note that many of the steps were completed in a different order than I have above. First, though, meet the defendants in the lawsuit:

A. Defendants

8. Recycle Tech is a Colorado company. From February 16, 2010 through June 2010 its principal place of business was Miami, Florida. Its common stock is quoted on the OTC Link (formerly, “Pink Sheets”) operated by OTC Markets Group Inc. under the symbol “RCYT.” From no later than February 2010 to June 2010, Recycle Tech purported to be a development and engineering firm specializing in “green building.”

9. Sepe, age 54, is a resident of Miami. At the time of the scheme, he was a longtime acquaintance of Halperin and is listed as the officer or director of several private Florida companies.

10. Halperin, age 63, is a resident of Aventura, Florida. He is an attorney licensed to practice law in Florida and is the sole member of the law firm Ronny J. Halperin, P.A. Halperin also served as CEO of HydroGenetics, Inc., a Florida corporation, from January 2009 until April 2009, and served as its director from 2009 until late 2011.

11. Gonzalez, age 33, is a resident of Miami and a friend of Sepe’s nephew. Since February 16, 2010, Gonzalez has been the CEO and President of Recycle Tech.

12. OTC Solutions is a Maryland limited liability company formed by Thompson in 2007 as a marketing and advertising company. From no later than January through March 2010, it was associated with “Explicit Picks” and “Ox of Wall Street,” both stock promotional newsletters.

13. Thompson, age 35, is a resident of Bethesda, Maryland. From no later than January through March 2010, he was the sole member of OTC Solutions.

14. Pudong is a Florida limited liability company with its principal place of business in Delray Beach, Florida. From no later than January through March 2010, it was a marketing and advertising company associated with “Penny Pic,” a stock promotional newsletter.

15. Fung, age 37, is a resident of Delray Beach, Florida. From at least January through March 2010, he was the sole member of Pudong.

16. Rees, age 44, is a resident of Salt Lake City, Utah. He is a corporate and securities attorney licensed to practice law in Utah. He is a partner at the Utah law firm Vincent & Rees, LLC.

1. “On February 16, 2010, Sepe and Halperin orchestrated the purchase of Recycle Tech from the professional shell provider. Sepe paid more than $200,000 to the professional shell provider for Green Building’s purchase of the majority of Recycle Tech’s [RCYT] shares. Halperin, in turn, provided a common stock purchase agreement to Gonzalez for his signature. Pursuant to this agreement, Green Building became the owner of the controlling majority of Recycle Tech’s shares. With the reverse merger completed, Gonzalez took his position as CEO and president of Recycle Tech.”

2. This step was not necessary.

3. Completed in step 1.

4. Rather than issue convertible debt, the people involved with RCYT allegedly purchased already outstanding convertible debt: “In late January 2010, Halperin retained Vincent & Rees to coordinate the purchase, assignment, and subsequent conversion of Recycle Tech’s debt into purportedly free-trading stock. Halperin also asked Rees to issue an opinion letter regarding the transactions, and he provided Rees with the necessary documents and signatures for the transaction.” The outstanding share count of RCYT was doubled by the conversion of the debts into shares: “In early February 2010, pursuant to the Opinion Letter and the corporate resolution, Recycle Tech’s transfer agent issued more than 25 million shares of stock to more than twenty Assignees, including OTC Solutions, Pudong, and Halperin”

5. This step was not taken.

6. “Four days after the February 18 press release, OTC Solutions and Pudong started touting Recycle Tech stock in their newsletters. Thompson and Fung, the respective owners of OTC Solutions and Pudong, had previously agreed to coordinate their touting with each other and with Sepe. Before they issued their newsletters, Sepe agreed to provide Thompson and Fung with 2.325 million shares each of Recycle Tech stock. Halperin provided the actual shares to Thompson and Fung.”

7. In the case of RCYT, the SEC has not alleged that the insiders/promoters engaged in manipulative trading.

8. “With the reverse merger completed, Gonzalez took his position as CEO and president of Recycle Tech.”

9. “From February 18 to 25, 2010, Recycle Tech issued seven false and misleading press releases. As CEO of Recycle Tech, Gonzalez had ultimate authority over the press releases. He drafted them, hired a public relations consultant, and provided the releases to the consultant. Gonzalez also instructed the consultant to issue the press releases pursuant to a time schedule Sepe set.”

10. “Taking advantage of Recycle Tech’s artificially raised stock price, a number of the Defendants sold their shares. From February 23, 2010 to March 2, 2010, Halperin sold 1,130,000 shares for $235,060. From February 22, 2010 to February 25, 2010, OTC Solutions sold 2,325,000 shares for $441,722. On February 23, 2010, Pudong sold 2,325,000 shares for $456,457. On February 23, 2010, Rees sold 25,000 shares for $5,982. Sepe, who did not directly receive shares of Recycle Tech stock pursuant to the conversion of debt, was compensated from others’ sales of Recycle Tech stock. Halperin wired Sepe’s company, Charter Consulting, $300,000 from his law firm account on April 12, 2010. At least $150,000 of that wire came from the illegal sale of Recycle Tech stock.”

Many thanks go to Janice Shell for summarizing the steps undertaken by shell companies destined for pump and dump schemes. I have added more detail and more steps and I of course take full responsibility for any errors I have introduced. David Baines often writes about the above steps taken by penny stock pump and dump operators.

Disclaimer: I have no positions in any stocks mentioned and no relationship with any people mentioned. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.