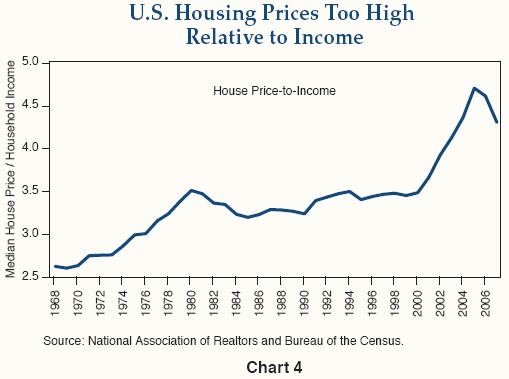

Many people have argued that the current high house price to income ratio is not reason for house prices to decline, considering that interest rates are very low now. These people argue that what is important is not the actual price of the house, but the mortgage payment required to carry the house (for an example see user jcrash’s comments on my previous aritcles on the coming mortgage crisis at SeekingAlpha).

To some extent, these arguments are correct. Most home buyers use mortgages, and the difference in monthly payments between a 5.5% and a 8% mortgage is staggering. However, there are two important reasons why low interest rates do not mean that houses are affordable now: household debt is at an all-time high and mortgage rates will certainly go higher.

Total Debt Matters

Housing affordability is not independent of the affordability of other consumer goods. What matters for the affordability of housing and all consumer goods is the money available to pay for those goods (ie, money not spent on necessities). Total household debt is at an all-time high. The savings rate is close to zero. The most instructive number to look at is the household financial obligation ratio, or the ratio of income to household debt servicing and house or apartment-related expenses. To quote the Federal Reserve definition, “Debt payments consist of the estimated required payments on outstanding mortgage and consumer debt. The financial obligations ratio (FOR) adds automobile lease payments, rental payments on tenant-occupied property, homeowners’ insurance, and property tax payments to the debt service ratio.”

Keep in mind that these ratios do not include other non-discretionary expenses such as food and gasoline, the price of both of which has been increasing at staggering rates, which means that consumers have less ability to service their debt than even the following graph shows (click for a full-sized image). The data are available from the Federal Reserve. The key number to look at is the FOR Homeowner Total (light blue). Over the last decade this has increased from about 15% of income to about 19% of income.

These are the costs on debt and home-related expenses that current homeowners pay. Because these are broad averages (many homeowners do not have mortgages after paying them off, reducing these ratios), it is important to look at the change over time. The ratio is currently about 4 percentage points higher than anytime prior to 2000. While this may not seem like much, consider that house prices are set on the margin and that approximately 40% of homeowners do not have mortgages. The marginal home buyer has much larger debt payments of all kinds than ever before, reducing his ability to buy. This alone indicates that home prices need to fall. However, the picture gets even bleaker when we look at mortgage rates.

These are the costs on debt and home-related expenses that current homeowners pay. Because these are broad averages (many homeowners do not have mortgages after paying them off, reducing these ratios), it is important to look at the change over time. The ratio is currently about 4 percentage points higher than anytime prior to 2000. While this may not seem like much, consider that house prices are set on the margin and that approximately 40% of homeowners do not have mortgages. The marginal home buyer has much larger debt payments of all kinds than ever before, reducing his ability to buy. This alone indicates that home prices need to fall. However, the picture gets even bleaker when we look at mortgage rates.

Inflation Matters

Those that argue that house prices are affordable would agree that lower interest rates make houses more affordable, ceteris parabus. This is true not just for houses but for all capital assets. As interest rates increase, asset prices decrease. As interest rates fall, asset prices rise. If a buyer finances a high-priced asset with cheap financing and does not sell when financing becomes expensive, that buyer will do fine. However, a buyer who cannot hold indefinitely must pay attention to asset prices. Even when payments are equal, it is better to buy a cheap asset with expensive financing than to buy an expensive asset with cheap financing. The reason is simple: interest rates change. Interest rates are more likely to fall when they are high than when they are low. If they do fall, the seller who had bought when interest rates were high will have a capital gain as the price of the asset increases. However, the seller who buys when interest rates are low will take a capital loss if he sells after rates rise.

Inflation in the US is at a 4% annual rate as of March, and investors expect inflation to continue or get worse, as evidenced by the low yields on TIPS (Treasury Inflation Protected Securities). With 15- and 30-year fixed rate prime mortgages near their lowest rates since before the 1960s/1970s inflation epidemic, there is little place for mortgage rates to go but up. Even if housing were fairly affordable now (which the FOR ratios above show that it is not), higher interest rates will ensure that it becomes less affordable and that house prices need to continue to drop.

See Also

Option ARMageddon take on this issue

The Coming Mortgage Crisis: Part 1

The Coming Mortgage Crisis: Part 2

Disclosure: I have significant real estate holdings and I plan on selling short one or more regional banks.