On October 5th, 2017 FINRA Enforcement filed a complaint (pdf) against Glendale Securities and its employees George Alberto Castillo (CRD No. 1936486), Paul Eric Flesche (CRD No. 3277904), Albert Raymond Laubenstein (CRD No. 303462), Jose Miguel Abadin (CRD No. 1273345), and Huanwei Huang (CRD No. 3268328). On April 5th, 2019 the FINRA Office of Hearing Officers released its Extended Hearing Panel Decision (pdf) regarding the allegations. The OHO decision is a 103-page beast that took me the better part of a day to read. See my highlighted and lightly-annotated copy (pdf). At the time I publish this there is no indication on FINRA’s website that the OHO decision has been appealed. I sent an email to Glendale Securities asking about that and they have not responded yet. I will update this article if they respond or if I learn that the decision is being appealed.

[Update 6/3/2019: Per my check of Glendale’s detailed BrokerCheck report today, FINRA Enforcement has appealed the OHO decision to the FINRA National Adjudicatory Council. Until the NAC has reached a decision the penalties against Glendale, Flesche, Laubenstein, and Huang will not go into effect.]

Currently, FINRA BrokerCheck shows that Castillo, Flesche, Abadin, and Huang remain registered with Glendale Securities. The BrokerCheck website indicates that Laubenstein left Glendale Securities after 12/31/2016 and has not worked at any registered broker since leaving Velox Securities on 2/10/2017.

Interestingly, this whole action “arose from a 2015 cycle examination of FINRA member firm Wilson-Davis & Co., Inc. (‘Wilson-Davis’), whose customers traded some of the same securities that Glendale’s customers traded and are the subject of this Complaint” (decision, page 2; all quotes in this article are from the hearing panel decision unless otherwise noted ). I have written previously about Wilson-Davis & Co., including an April 2017 SEC fine for Reg SHO violations and a February 2018 FINRA hearing panel decision (that has been appealed to the FINRA NAC). One important note: while Glendale Securities currently clears through Wilson-Davis, it did not do so during the period of time covered by the FINRA complaint and hearing panel decision.

Below is the overview of the complaint from the hearing panel decision:

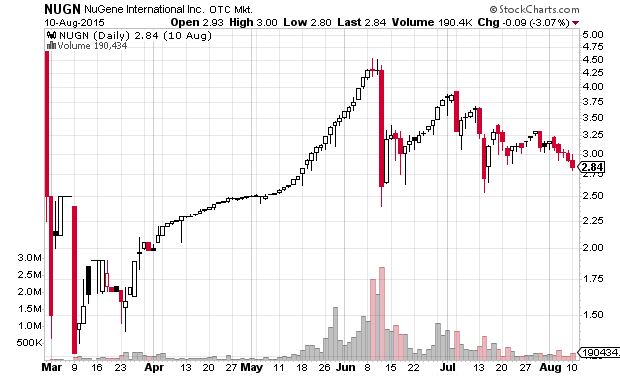

FINRA’s Department of Enforcement filed a six-cause Complaint against Respondents. Cause one charges Glendale Securities, Inc. (“Glendale” or the “Firm”), acting through its President and head trader George Alberto Castillo (“Castillo”), with manipulating the price of NuGene International, Inc. (“NUGN”), to benefit two Firm customers who owned the stock. For this, Glendale and Castillo are charged with violating Section 10(b) of the Securities Exchange Act of 1934 (“Exchange Act”), Exchange Act Rule 10b-5 thereunder, and FINRA Rules 2020 and 2010.

Cause two charges Glendale, Paul Eric Flesche (“Flesche”), the Firm’s Chief Compliance Officer (“CCO”), andJose Miguel Abadin (“Abadin”), a registered representative and trader, with reselling unregistered or non-exempt shares of NUGN on behalf of two customers, in violation of Section 5 of the Securities Act of 1933 (“Securities Act”), which is a violation of FINRA Rule 2010. The Complaint alleges that a portion of the NUGN shares the two customers sold were bought from affiliates of the issuer and accordingly could not be re-sold within six months of acquiring them pursuant to the Securities Act and SEC Rule 144.

Cause three charges each of the Respondents with committing anti-money laundering (“AML”) violations of FINRA Rules 3310 and 2010 relating to customer deposits and liquidations of shares of NUGN and two other securities in 2015 and 2016: Broke Out, Inc. (“BRKO”) and Vitaxel Group Limited (“VXEL”). It charges Respondents with failing to establish a reasonable AML system to detect and report suspicious activities associated with Firm customers’ sales of NUGN, BRKO, and VXEL. Cause three also charges the Firm, Flesche, Laubenstein, and Huang with failing to comply with their obligations under the customer identification program (“CIP”) in connection with customers who deposited VXEL shares. Cause three further charges the Firm and Albert Raymond Laubenstein (“Laubenstein”), the Firm’s AML Compliance Officer (“AMLCO”), with AML violations for failing to establish and maintain an adequate due diligence program for customer correspondent accounts introduced to the Firm from 2007 to approximately 2011 by a bank based in Belize (“Belize Bank”). Belize Bank did not disclose the identities of approximately 18 customers who opened accounts at Glendale through the bank.

Cause four charges the Firm, Castillo, Flesche, and Laubenstein with supervisory failures in two distinct areas. It charges that Glendale, Castillo, and Flesche failed to establish and maintain a supervisory system, including written supervisory procedures (“WSPs”), reasonably designed to ensure the Firm’s compliance with Section 5 of the Securities Act for sales of unregistered, non-exempt securities. Cause four further charges the Firm, Flesche, and Laubenstein with failing to reasonably supervise Respondent Huanwei Huang’s (“Huang”) activities, specifically with respect to his Asian customers who deposited and sold BRKO and VXEL shares.

Causes five and six contain allegations only against Huang. Cause five charges Huang with improperly providing nonpublic personal information to third parties about his customers who deposited VXEL in their accounts, in violation of Securities and Exchange Commission (“SEC”) Regulation S-P, which constitutes a violation of FINRA Rule 2010. Cause six charges Huang with communicating about VXEL with a customer and another person in Asia via a cell phone text messaging service not approved by Glendale, in violation of FINRA Rules 4511 and 2010. The Complaint charges that Huang’s use of the unapproved text messaging service prevented Glendale from being able to preserve securities-related communications among its books and records.

Respondents filed Answers denying the allegations and requesting a hearing. In their Answer, Glendale, Castillo, Flesche, Laubenstein, and Abadin stated that Glendale “occupies a unique niche” in the securities industry because “[f]ew introducing brokers or clearing firms are willing to service the needs of early round investors and founders of microcap companies because of the intense regulatory scrutiny and labor-intensive processes that are required.” Glendale “believes that its experience in this type of trading has gotten the firm to the point where it can conduct this business without rule violations.”

pages 1-2

Below is the hearing panel’s decision / order in full:

As set forth above, the Hearing Panel dismisses causes one and two of the Complaint because Enforcement failed to meet its burden of proof. Enforcement failed to prove by a preponderance of the evidence that Glendale and Castillo violated Section 10(b) of the Securities Exchange Act of 1934, Rule 10b-5 thereunder, and FINRA Rules 2020 and 2010 by manipulating the price of NUGN.

A majority of the Panel also finds that Enforcement failed to prove by a preponderance of the evidence that Glendale, Flesche, and Abadin participated in the unlawful resale by customers RC and JH of NUGN shares, in violation of Section 5 of the Securities Act, which constitutes a violation of FINRA Rule 2010. These charges are therefore also dismissed.

As for the remaining causes of action in the Complaint, Respondents are sanctioned as follows:

Glendale Securities Inc.:

● Censured and fined $125,000 for the AML-related violations of FINRA Rules 3310 and 2010 associated with its customers’ deposit and liquidation of NUGN, BRKO, and VXEL (Cause Three).

● Censured and fined $30,000 jointly and severally with Paul Eric Flesche for failing to reasonably supervise Huanwei Huang, in violation of FINRA Rules 3110 and 2010 (Cause Four).

● This Decision shall serve as a Letter of Caution for the failure to conduct proper due diligence on Belize Bank and its customer accounts, in violation of FINRA Rules 3310 and 2010 (Cause Three).

Respondent Paul Eric Flesche:

● Suspended from associating with any FINRA member firm in any capacity for 30 business days and fined $30,000, jointly and severally with Glendale Securities, Inc., for failing to supervise Huanwei Huang, in violation of FINRA Rules 3110 and 2010 (Cause Four).

Respondent Albert Raymond Laubenstein:

● Suspended from associating with any FINRA member firm in any capacity for 18 months and fined $20,000 for AML-related violations of FINRA Rules 3310 and 2010 associated with the liquidations of NUGN, BRKO, and VXEL (Cause Three).

● Suspended from associating with any FINRA member firm in any capacity for 15 business days and fined $5,000 for failing to supervise Huang, in violation of FINRA Rules 3110 and 2010 (Cause Four). This suspension will run concurrently with the 18-month suspension imposed for misconduct alleged in cause three.

● This Decision shall serve as a Letter of Caution for the failure to conduct proper due diligence on Belize Bank and its customer accounts, in violation of FINRA Rules 3310 and 2010 (Cause Three).

Respondent Huanwei Huang:

● For sharing customers’ nonpublic personal information with third parties in violation of Regulation S-P, which is a violation of FINRA Rule 2010, this Decision shall serve as a Letter of Caution (Cause Five).

● Suspended from associating with any FINRA member firm in any capacity for ten business days and fined $5,000 for books and records violations of FINRA Rules 4511 and 2010 associated with engaging in securities-related communications with a customer and a third party via text instead of Firm email (Cause Six).

Respondents Glendale, Flesche, Laubenstein, and Huang are ordered to pay the costs of the hearing in the amount of $22,289.23, which includes a $750 administrative fee and the cost of the hearing transcript, $21,539.38. Their responsibility to pay these costs is apportioned as follows: Glendale is ordered to pay $12,289.23; Laubenstein is ordered to pay $5,500; Flesche is ordered to pay $2,500; and Huang is ordered to pay $2,000.

If this decision becomes FINRA’s final disciplinary action, the suspensions shall become effective with the opening of business on Monday, June 3, 2019. Respondent Laubenstein’s suspension of 15 business days for the misconduct alleged in cause four is to run concurrently with the 18-month suspension for the misconduct alleged in cause three. Respondent Huang’s

(pages 97-99)

suspension of ten business days shall end at the close of business on Friday, June 14, 2019. Respondent Flesche’s suspension of 30 business days shall end at the close of business on Monday, July 15, 2019.

The names of two of the three companies mentioned in the complaint should be familiar to readers of this blog because I have written about them. I wrote about the mailer promotion of Nugene (NUGN) on May 27, 2015. I also wrote about Broke Out (BRKO) after the SEC suspended trading in it on March 17, 2016.

The Dissent

I have read every single FINRA Decision involving penny stocks that has been published over the last ten years (that I could find, searching the FINRA Disciplinary Actions database for “penny”). I have never seen a FINRA hearing officer dissent from findings of the extended hearing panel. This doesn’t mean that it hasn’t happened before but it is certainly noteworthy. Starting on page 100 of the decision, hearing officer Michael J. Dixon lays out a dissent from the panel’s decisions on causes two and four and furthermore describes increased fines that he wanted to levy. Bear in mind that each FINRA extended hearing panel consists of a hearing officer (who administers the proceeding) and “two industry panelists, drawn from a pool of current and former securities industry members of FINRA’s District and Regional Committees, current and former industry members of its Market Regulation Committee, former industry members of FINRA’s National Adjudicatory Council (NAC), and former FINRA Governors.” (That quote comes from FINRA’s OHO website.)

I encourage my readers to read the full dissent, but following are the excerpts I find most meaningful, first with regards to cause two from the complaint, which alleged, “Glendale, Flesche, and Abadin violated Section 5 of the Securities Act, which constitutes a

violation of FINRA Rule 2010″ (emphasis mine):

The circumstances surrounding RC’s purchases of NUGN contained numerous red flags that should have triggered a true “searching inquiry,” as the SEC has instructed.

…

Additional factors were suspicious. The stock had traded just once as BLMK (in January 2015) and only recently (a week earlier, February 4) had begun trading as NUGN. RC opened its

account solely for the purpose of liquidating its recently acquired NUGN shares. Also, relying on the transfer agent, as Respondents did, is insufficient to discharge a duty of reasonable inquiry.…

JH’s deposit of another large tranche of NUGN shares on February 27 (which also was the day that RC started liquidating its shares), followed by SEI’s deposit on March 2 and JH’s

page 100

second and much larger deposit on March 10, should also have raised red flags concerning RC’s deposit two weeks earlier. The three customers had purchased their BLMK shares nearly at the

same time, and paid little for them. RC was able to generate enormous revenues from its sales as a result of NUGN’s dramatic price increase. Even assuming Respondent’s inquiry into RC’s

deposit was reasonable at the time, JH’s and SEI’s deposits should have caused Respondents to reconsider whether RC’s deposit was part of a distribution of the issuer’s securities.

Next in the dissent is cause four from the complaint, which alleged that “Glendale, Castillo, and Flesche failed to establish and

maintain a reasonable supervisory system.” Below are the most relevant excerpts (emphasis mine):

As Glendale, Castillo, and Flesche noted in their Answer, the Firm’s customers predominantly traded in low-priced securities, and accordingly they expect “virtually every one” of their customers to trigger at least one red flag. The Firm’s procedures do not reflect this view.

…

As implemented in practice, the Firm employed a “check-the-box” process for completing required forms and obtaining documents that it used to review a customer’s stock deposits. This process failed to identify for Firm personnel examples of red

page 101

flags that could be indicative of an unlawful distribution of restricted securities.

My Take

I agree wholeheartedly with Hearing Officer Michael J. Dixon: in my opinion Glendale Securities’ procedures were inadequate and the numerous red flags particularly with the deposits and sales of NUGN should have called for a “searching inquiry”.

In my opinion the fine for Glendale is too small to provide a strong incentive for it to change its behavior and to motivate other brokers to do the same. Glendale was fined $125,000 individually, $30,000 jointly with Paul E. Flesche, and ordered to pay costs of $12,289.23. This is less than the firm earned from its commissions on one client’s (RC) sale of NUGN ($193,055; see decision page 27). I believe that at a minimum Glendale should have been forced to forfeit all the commissions it earned from the transactions discussed in the hearing (approximately $260,000; decision page 93).

Changing Clearing Firms

One interesting thing I learned in researching this article is that Glendale Securities has had a few different clearing firms over the past five years. According to the FINRA BrokerCheck detailed report, Glendale Securities currently clears through Wilson-Davis & Co. and it began that clearing relationship on January 29, 2018 (see page 11). By looking at the Archive.org archived version of Glendale Securities’ website, I found that on September 17, 2013 it cleared through Apex Clearing Corp. As of November 27, 2014 it cleared through Vision Financial Services. Vision Financial changed its policies in 2015 “to prohibit clearing deposits of physical certificates of penny stocks” and Glendale then switched clearing firms again (that quote is from Vision Financial Services recent settlement with the SEC for its failures to file SARs for penny stock share deposits and liquidations). As of August 14, 2015 Glendale cleared through Electronic Transaction Clearing (ETC).

The Nugene Pump & Dump

For the reader interested in how people running pump and dumps acquire and then liquidate their shares, FINRA hearing panel decisions are a gold mine of knowledge. The Glendale Securities account holder that made the most money selling Nugene (NUGN) shares is referred to as “RC” in the decision. However, RC is easily de-anonymized because of how RC is described: “RC was incorporated in Nevada on January 29, 2015” (page 22). Later, on page 36, the decision states, “Beginning in March 2015, RC sponsored a promotional campaign that touted NUGN’s cosmetic products and urged investors to buy shares of the company.” Looking back at my blog post about the pump as it was happening, and then zooming in on the disclaimer, reveals RC to be Result Corporation. As shown by the Nevada Secretary of State website, one man — Robert J. Martins — is shown to have been the sole officer of the company. The corporation’s registration was revoked in 2016.

As I wrote on my blog post about the NUGN promotion, the budget listed in the mailer was $2,287,000. The hearing panel decision states, “A disclaimer at the end of the brochure disclosed that RC had paid $4.4 million ‘to marketing vendors to cover all the costs of creating and distributing this Advertisement'” (page 37). The different budget disclosures are not contradictory: promoters will sometimes update their disclaimers during the promotion as they increase their spending.

As for the shares Results Corporation would end up selling, they were purchased on the cheap: “According to the decision, Result Corporation paid $6009 for all its shares of BLMK that then turned into NUGN” (page 23). Result Corporation “bought the shares more than a month before its incorporation in Nevada” (page 23). The decision describes Result Corporation’s sales of NUGN in an odd way, stating that it sold NUGN shares for total proceeds of over $7.3 million, but that includes sales of shares it had bought in May and June 2015 for over $2.5 million. So the net proceeds from selling the shares is better described by the amount Result Corporation wired out of its account, $4,990,595 (page 27). Subtract the $4.4 million for the promotion and the $6009 for the shares and you end up with net profits of $584,586.

However, I believe this vastly understates the total profits from the pump for multiple reasons. First, “According to Enforcement’s investigator, customers at Wilson-Davis purchased most of the NUGN shares that RC sold. Wilson-Davis customers had also deposited shares of NUGN in their accounts” (page 27). Result Corporation had started selling shares of NUGN on February 27, 2015. I did not see anyone post about receiving the NUGN mailer prior to May 15, 2015. While I am certain people received it before that date, I think it likely that the actual promotion didn’t start until at least mid-April. That would mean that whomever was buying the shares from Result Corporation could have been associated with it, in which case their trading profits would have to be counted as well. Later in the decision the accounts at Wilson-Davis are mentioned again: “Enforcement argues that many persons played a part in the manipulation of NUGN—in particular, BS, ND, RC (which paid for a promotion campaign), and persons connected to the issuer, and Wilson-Davis, which made a market in NUGN and represented the buy side of NUGN transactions on February 24, 2015” (page 62). Also, one of the other sellers of NUGN shares mentioned in the hearing panel decision, “BS”, “later transferred his remaining NUGN shares to an account at Wilson-Davis” (page 62). Plus, there are the two other sellers of NUGN that held accounts at Glendale Securities — “JH” (whose NUGN sales proceeds were $812,989) and “SEI” (whose NUGN sales proceeds were $459,467).

So after adding up the profits of the three sellers of NUGN with accounts at Glendale Securities, it looks like about $1.8 million in profits. That is not bad, but there were millions of other free-trading shares outstanding at the time of the promotion held in accounts at other brokers (including Wilson-Davis as mentioned above). A writer on SeekingAlpha estimated that there were approximately 11 million free-trading shares at the time of the Nugene stock promotion. SEI deposited 216,410 shares, JH deposited 1,360,790 shares, and Result Corporation deposited 2,899,878 shares at Glendale Securities. That leaves 6,522,922 shares in the float that could have been controlled by others acting in concert and deposited at other brokers. Assuming an average sale price of $2.50 per share those shares could have resulted in an extra $16.3 million in profits for the people who owned them. That would be an impressive return on a $4.4 million investment in stock promotion.

Random Observation: If you can’t sell it, stock is worthless

One of the craziest things I read in the extended hearing panel decision was the following tidbit about a shareholder of Broke Out Inc (BRKO) (emphasis mine):

On March 17, 2016, three days after ECM’s last sale, the SEC announced the suspension of trading in BRKO until March 31, 2016, due to “concerns regarding the accuracy and adequacy of information in the marketplace and potentially manipulative transactions in BRKO’s common stock.” Huang informed ECM about the trading suspension. At the time of the trading halt, ECM had sold 472,782 BRKO shares and therefore still held 837,218 shares of the 1,310,000 shares he had deposited in his Glendale account. On the day of the trading suspension announcement, ECM emailed Huang asking if he would be able to resume liquidating his BRKO shares once the suspension ended or whether he needed to find another broker-dealer to sell the shares.

Huang and ECM did not communicate with each other for two months. On May 23, 2016, Huang emailed ECM, stating that Glendale had determined that ECM needed to close his account and that he could transfer his assets to another broker-dealer. Huang and Glendale never heard from ECM again. ECM effectively abandoned the BRKO shares left in the account.

page 47

Disclaimer: I have no positions in any stocks mentioned in this blog post. I have a brokerage account at Centerpoint Securities that is held at Vision Financial Services; otherwise, I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

ABIO exploded