On July 19, 2019, FINRA Enforcement filed a complaint (pdf) against microcap broker Wilson-Davis & Co for market manipulation of promoted stock Nugene (NUGN), failures to supervise, and failing to establish and implement appropriate AML policies and procedures. Readers of this blog will recall that FINRA Enforcement alleged that another microcap broker, Glendale Securities, manipulated trading in NUGN; the OHO hearing panel on that count decided that Glendale and its broker did not manipulate NUGN. Glendale was fined for AML failures and failures to supervise relating to trading in NUGN as well as another promoted stock. FINRA Enforcement appealed that decision.

There have been three major regulatory actions against Wilson-Davis in the last few years:

- 26 April 2017: SEC settles with Wilson-Davis & Co for violations of Reg SHO (selling short stocks without having borrowed them and not engaging in bona-fide market making). Firm ordered to pay disgorgement of $208,645.71, interest of $27,068.79, and a civil penalty of $75,000.

- 27 February 2018: FINRA OHO (Office of Hearing Officers) extended hearing panel reaches decision against Wilson-Davis for improper short sales and failures to supervise and implement adequate AML (anti-money laundering) procedures. Firm fined $1,470,000 and ordered to disgorge $51,624. This decision is currently on appeal to the FINRA National Adjudicatory Council (NAC) and the fines and other penalties are not put into effect while the decision is being appealed. I expect the NAC to rule on this appeal within the next couple months.

- 15 May 2019: SEC settles with Wilson-Davis & Co for failures to file suspicious activity reports (SARs). The firm was fined $300,000. It also agreed to hire a consultant and follow the consultant’s recommendations to improve its compliance.

I should point out that at the present time the FINRA Enforcement complaint against Wilson-Davis contains allegations that have not been proven. At some point in the next few months to a year a FINRA OHO panel will be convened to hear the allegations and reach a decision on the facts of the matter and what penalties Wilson-Davis may face.

Along with Wilson-Davis & Co, its employees Craig Stanton Norton (CRD #349405), James C. Snow, Jr. (CCO & AMLCO), Lyle Wesley Davis (CEO; CRD #62352), and Byron Bert Barkley (VP and head of trading; CRD #12469) are named in the complaint.

Allegations

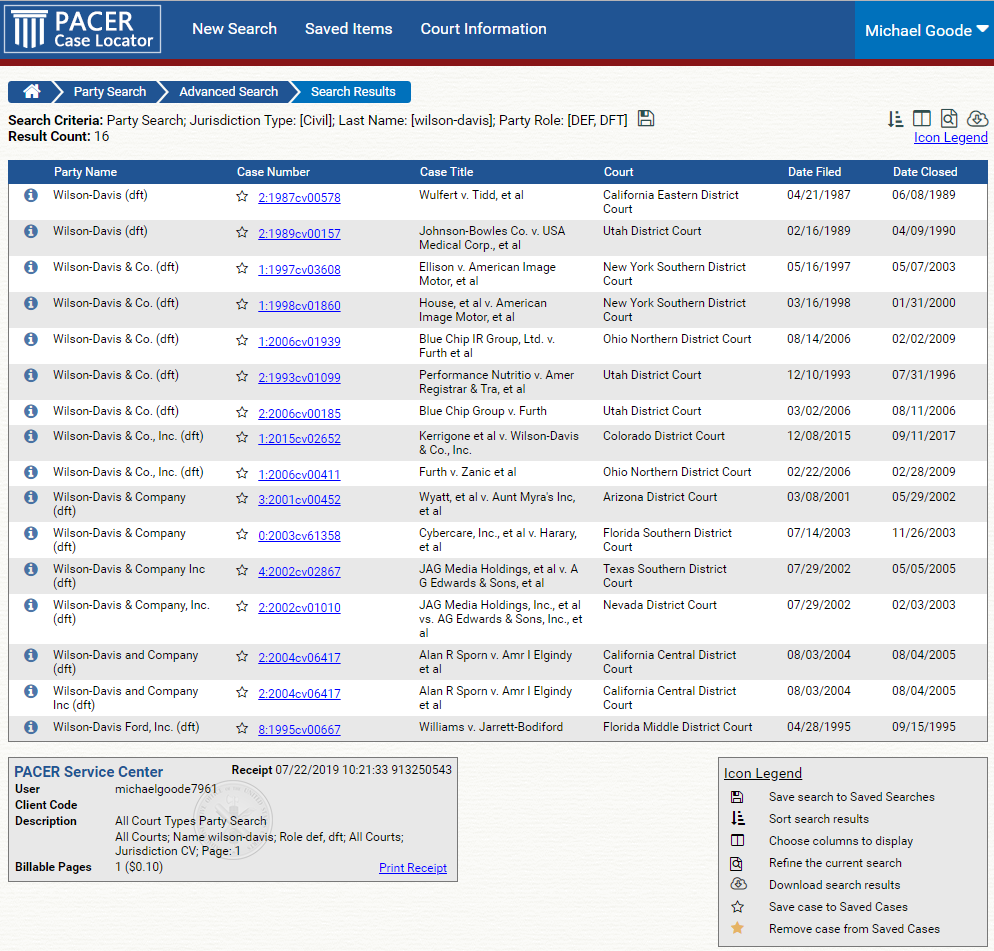

According to the complaint (pdf), over 20 clients of Wilson-Davis allegedly deposited over 4 million shares of Nugene (NUGN) that they had acquired privately and later sold. Prior to their trading in NUGN, FINRA had inquired with Wilson-Davis about some of those clients. Furthermore, some of those clients had been sued along with Wilson-Davis for involvement in an alleged pump and dump. I tried to find the lawsuit referred to in the allegations quoted below, but could not find it despite searching for Wilson-Davis in PACER’s case locator. Therefore I believe it must have been filed in Utah state court (where Wilson-Davis is based) as opposed to Federal court. Unfortunately, Utah does not have electronic access to case records. I also searched all Colorado state courts (Wilson-Davis has an office in Denver) and found no cases involving them in Colorado. Below are my PACER case locator search results:

Relevant excerpts from the complaint:

32. Around 2005, Norton attended an OTC investor conference in Las Vegas, where he met RW, AL, SH, and LB—all of whom opened accounts with Norton at Wilson-Davis and transacted in NUGN. Since meeting this group at the 2005 conference in Las Vegas, Norton has received several customer referrals through this group, including, in particular, RM (who controlled an entity named RC), JS (who controlled an entity named CC), JF (who controlled an entity named RH), and MT (who controlled an entity named CD). All of these individuals and entities were involved in the manipulative activity involving NUGN.

33. On December 18, 2014, just prior to the Bling-NuGene merger announcement, either Norton or his assistant, both of whom were located in Wilson-Davis’s office in Centennial, Colorado, telephoned numbers associated with Wilson-Davis customers RM, AL, SW, and JF.

34. A few days later, on or about December 20, 2014, RM (through his entity RC) acquired hundreds of thousands of shares of BLMK stock in a series of private transactions with existing BLMK shareholders, including several members of the same family. Later, in March 2015, RM privately sold some of this stock to other Wilson-Davis customers CC (controlled by JS), MS (controlled by AL), and PG and VH (entities connected to KC). CC, MS, PG, and VH deposited the NUGN shares bought from RM into accounts with Wilson-Davis.

35. In addition, at least 12 other Wilson-Davis customers who deposited NUGN stock with the firm apparently acquired their shares in similar private transactions, just prior to the merger, at or around the same time as Wilson-Davis customer RM.

36. Prior to December 2014, Wilson-Davis and Norton knew or should have known that RM, JF, and AL, as well as other Wilson-Davis customers who eventually transacted in NUGN, namely SH, MT, KC, JS, JC, and RW, had a history of engaging together in potentially suspicious activity involving other microcap securities. Specifically, during the period from June 2012 through November 2013, the firm had received several regulatory requests from FINRA staff concerning activity in other OTC microcap stocks traded by these customers. In addition, in November 2013, Wilson-Davis was named a defendant in a civil lawsuit alleging that the firm aided and abetted a network of its customers—including JF, RW, KC, JC, and MT—in orchestrating a “pump-and-dump” in another OTC microcap security.

Complaint, pages 9-10

A key part of the allegation of market manipulation is that by buying NUGN at $5.00 (for its proprietary trading account), Wilson-Davis allowed many of its clients to sell because they were no longer subject to the lock-up leak-out provision.

47. On February 24, 2015, when Norton accepted Broker-Dealer A’s offer and purchased 250 shares of NUGN at $5.00 per share, he did so without attempting to negotiate price. He did so even though, at the time of his $5.00 purchase, the highest offer to buy NUGN stock reflected in the market was $2.25 per share and Wilson-Davis’s own offer to buy the stock (publicly quoted by Norton, as a market maker) was $1.33 per share.

48. Norton’s $5.00 purchase of NUGN on February 24, 2015 represented 100% of the stock’s daily market volume that day and set the closing price for the stock at $5.00.

49. Over the next two trading days, Broker-Dealer A sold additional shares of NUGN stock in three transactions at $5.00 per share. These three transactions represented 100% of NUGN’s daily market volume on February 25 and 26, 2015, and resulted in setting the stock’s closing price at $5.00 per share for three consecutive days.

50. According to calculations in Wilson-Davis’s files, NUGN had approximately 41 million shares outstanding during the three-day period from February 24 through February 26, 2015. Based on those calculations, NUGN closing at $5.00 per share for three consecutive days would result in NuGene’s daily market capitalization exceeding $200 million. As a result of such market capitalization, pursuant to the terms of the Lock-Up/Leak-Out Agreement (see paragraph 23, above), Wilson-Davis customers with NUGN stock subject to the agreement were free to sell all their NUGN holdings regardless of the agreement’s restrictions.

51. Over the next few months, more than a dozen Wilson-Davis customers deposited over three million shares of NUGN stock with the firm that would have been subject to the trading restrictions set forth in the Lock-Up/Leak-Out Agreement absent the trading at $5.00 per share that occurred on February 24 through 26, 2015.

Complaint, pages 12-13

The entity that paid for the promotion is disclosed as “RC”, which is of course Result Corporation. It was disclosed in the mailer promotion and website as the party that paid for the promotion.

56. Shortly after AA’s deposit of NUGN, Norton’s customer RM (through his entity RC) paid $4.4 million dollars to create and disseminate a 28-page color brochure promoting NUGN and encouraging investors to buy NUGN stock. Among other things, the NUGN stock promotion brochure claimed that the price of NUGN shares “could fly from $1.27 to $25.08” and “could send NUGN shares soaring 1,875%.”

…

58. In addition, during the same time, RM was associated with the Wilson-Davis account for the entity BB, which deposited and sold NUGN stock through Norton, generating over $600,000 in sales proceeds.

Complaint, page 14

In my opinion the most damning part of the allegations of market manipulation is that Norton’s clients would use “not held” orders, which gave him discretion at which prices to buy or sell. These were not simple limit orders that were automatically executed as the price of NUGN hit those limits. The details:

67. Specifically, on March 2 and 3, 2015, Norton engaged in coordinating trading with one of his customers, FS, raising the reported price of NUGN stock. Specifically, toward the end of the trading day on March 2, 2015, Norton entered an order on FS’s behalf to buy 700 shares of NUGN at a maximum price of $1.60 per share. Seconds later, Norton filled FS’s order by short selling 700 shares of NUGN from his proprietary account at $1.50 per share, even 16 though the last reported trade for NUGN in the market was at $1.36 per share. Norton’s late-day trade with FS on March 2 set the closing price for the stock at $1.50 per share, $0.14 higher than the last reported trade in the market at the time, which was at $1.36 per share.

68. Then, on March 3, 2015, Norton placed an order on FS’s behalf to sell at $2.00 per share the NUGN stock she had just acquired from Norton the day before at $1.50 per share. As the market opened on March 3, 2015, Norton filled FS’s order by buying FS’s shares to cover his short position (which he had opened the day before to sell stock to FS) at an average price of $2.13 per share. Norton engaged in this trading with FS even though it caused him to cover Wilson-Davis’s short position at a loss. Norton’s morning trade with FS on March 3, 2015, was the first NUGN trade of the day and increased the reported market price of NUGN over the previous day’s close of $1.50—which he had set, as described above.

69. In addition, Norton made the last trade of the day in NUGN on March 3, 2015, when he sold 100 shares of NUGN out of Wilson-Davis’s proprietary trading account at $2.12 per share. This trade resulted in a price increase over the last reported trade from $2.00 to $2.12 and increased the closing price of NUGN stock by $0.62 over the prior day’s close.

70. In the early stages of the manipulation, Norton used his position as a NUGN market maker to coordinate trading in NUGN among his customers to further the appearance of an active and stable market for NUGN. Norton’s customers would often use “not held” buy or sell orders, which essentially gave Norton, as a market maker, discretion to buy or sell NUGN stock at various prices or amounts to coordinate trading between his customers. In other instances, Norton and his customers would cancel, replace or change existing orders in price or quantity to coordinate trading between Wilson-Davis customers.

Complaint, pages 16-17

The complaint alleges that over 50% of the trading from January 2015 to April 2015 involved Wilson-Davis clients or its proprietary trading account. Wilson-Davis clients being such a large proportion of the trading volume (both buying and selling) over such a long time period should have raised red flags about possible wash trading.

75. From March 2, 2015 through May 13, 2015, Norton and his customers’ NUGN trading activity dominated the market. During this time, Wilson-Davis accounted for 50% or more of NUGN’s daily market volume on 24 out of a possible 51 trading days. Specifically, Wilson-Davis’s trading in NUGN accounted for 50% or more ofNUGN’s total daily trading volume on the following days: March 11-12, March 25-26, March 30-April 2, April 6-9, April 13-16, April 22, April 24, April 28-29, May 6, and May 11-13. 19

76. Indeed, by early April 2015, Wilson-Davis was responsible for at least 50% of all NUGN’s trading volume since the stock began trading in January 2015. This trend continued throughout April 2015, when NUGN trading activity at Wilson-Davis accounted for at least 65% of the stock’s total trading volume for the month of April 2015.

Complaint, pages 19-20

The final results of the trading are quite impressive: 20 clients of Wilson-Davis allegedly deposited over 4 million shares of NUGN (acquired for pennies per share) that they then sold for almost $10 million. All the trading generated over $500,000 in commissions and fees for Wilson-Davis & Co.

82. In total, between February and October 2015, Wilson-Davis had over 20 customers deposit over 4 million shares of NUGN stock—most of which had been acquired from third parties for pennies a share just prior to the Bling-NuGene merger.

83. From March 2015 through October 2015, Wilson-Davis customers liquidated over 3.2 million of these shares, generating almost $10 million in net sales proceeds. In particular, customers who purchased NUGN stock privately from RM (through RC) generated over $2.5 million in NUGN sales proceeds coincident with the NUGN stock promotion.

84. In total, from February through October 2015, Wilson-Davis and Norton generated over $500,000 in commissions and fees from NUGN transactions. In particular, in just three months from March 3, 2015 to June 9, 2015, Norton generated approximately $415,000 in commissions from his customers’ NUGN trading.

Complaint, pages 21-22

The following section of the complaint details the alleged supervisory and AML system failures of Wilson-Davis. The section on the red flags associated with the trading of NUGN is in my opinion damning.

116. From December 2014 through October 2015, Wilson-Davis and the firm’s designated supervisors—Snow, Barkley, and Davis—failed to detect, escalate, or investigative numerous red flags of potentially suspicious activity associated with the firm’s customers’ liquidation and trading in NUGN, including:

a. In a short period, over 20 different customers deposited millions of shares of a thinly-traded, little known microcap security (NUGN) that they obtained in privately negotiated sales with third parties, including numerous members of the same family, just before this former shell company issuer (BLMK) announced a reverse merger, change in business line, and stock symbol change.

b. At least 12 Wilson-Davis customers obtained their NUGN stock at or around the same time (mid-December 2014) (see paragraph 35, above), and Wilson-Davis knew or had reason to know that several of these customers had garnered regulatory scrutiny for their microcap trading activity (see paragraph 36, above).

c. Several customers who deposited NUGN stock with the firm had questionable backgrounds, including SH (who was involved with prior stock promotions that garnered regulatory scrutiny), MT (who was fined $1.4 million by the State of Texas in 2005 for an illegal email stock promotion), and others who were named with Wilson-Davis in a lawsuit alleging that they engaged in a “pump and dump” scheme through the firm (including JF, RW, KC, JC, and MT).

d. Several of the original BLMK shareholders who sold their stock to Wilson-Davis customers were members of the same family (including NF, EF, MF, and SF), who were related to BLMK’s former CEO (DK), which was readily ascertainable from an Internet search for the former CEO’s name.

e. Stock deposit paperwork for several customers was incomplete and missing pages, including the reverse side of stock certificates and pages or sections of applicable stock purchase agreements. In addition, more than a dozen WilsonDavis customers who deposited NUGN stock with the firm used the same private attorney to provide opinion letters regarding their stock.

f. The total stock deposited by Wilson-Davis customers represented a significant percentage of NUGN’s public float (see paragraph 52, above)

g. At least eight Wilson-Davis customers—namely, AA, PE, MS, BB, AM, RG, KL, and CM—opened accounts with the firm only a few weeks prior to their NUGN deposit and liquidation activity. Seven of these customers (with the exception of MS) held no other securities in their accounts until they deposited their NUGN shares and two customers (AA and KL) began selling their NUGN holdings the day after depositing the stock; thereafter, they then began wiring the proceeds of these sales out of their Wilson-Davis accounts.

h. Wilson-Davis customer RM (through his entity RC) paid $4.4 million for the NUGN Stock Promotion (see paragraph 56, above), which the issuer addressed publicly in June 2015 (see paragraph 64, above), yet Wilson-Davis apparently failed to identify or address the stock promotion.

i. Shortly after depositing their stock and in the midst of a stock promotion paid for by one of Wilson-Davis’s customers (RM), Wilson-Davis customers liquidated millions of dollars’ worth of their newly-acquired, low-cost NUGN stock, while other Wilson-Davis customers with existing sizeable positions in the stock— namely AA, MS, and CD—engaged in significant buying activity in the stock (see paragraph 74, above).

J. Overall, Wilson-Davis’s and its customers’ trading in NUGN dominated the market from late February through early May 2015 (see paragraphs 48, and 75-76, above), including several trading days where NUGN trading through WilsonDavis alone accounted for 50% or more of the stock’s daily trading volume.

k. Wilson-Davis and its customers engaged in trading indicative of market manipulation, including coordinated trading between Wilson-Davis customers and the firm (see paragraphs 66-75, above).

Complaint, pages 28-29

The next section of the complaint alleges that when asked by FINRA to provide “[s]upervisory records evidencing review of all trading activity in NUGN” from May 5, 2014 through October 7, 2015, Lyle Davis created new records that he then provided to FINRA.

122. The firm did not have any documents responsive to FINRA’s March 4th Rule 8210 request for the time period covered by Davis’s retroactively created spreadsheet. Rather than inform FINRA that the firm did not have responsive documents reflecting Davis’s supervisory review of NUGN trading for the entire time period requested, Davis and Wilson-Davis created and produced the newly-created spreadsheet, which was not a contemporaneous supervision record responsive to FINRA’s request.

Complaint, page 30

The Charges and potential penalties

The charges are as follows:

FIRST CAUSE OF ACTION WILLFUL STOCK MARKET MANIPULATION Willful Violation of Section 10(b) of the Exchange Act and Rule 10b-5 thereunder and Violation of FINRA Rules 2020 and 2010 (Wilson-Davis and Norton)

…

SECOND CAUSE OF ACTION DEFICIENT SUPERVISORY SYSTEM AND FAILURE TO SUPERVISE Violation of FINRA Rules 3110(a), 3110(b) and 2010 (Wilson-Davis, Snow, Davis, and Barkley)

…

THIRD CAUSE OF ACTION UNREASONABLE AML SYSTEM Violation of FINRA Rules 3310(a) and 2010 (Wilson-Davis and Snow)

…

FOURTH CAUSE OF ACTION PROVIDING FALSE AND MISLEADING INFORMATION TO FINRA Violation of FINRA Rules 8210 and 2010, Both Independently and by Virtue of Violating Rule 8210 (Wilson-Davis and Davis)

Complaint, pages 30-36

Given the severity of the allegations and over $500,000 in commissions and fees earned by Wilson-Davis on NUGN, in my opinion it is likely that FINRA will seek over $1 million in combined fines and disgorgement. Considering that the 2018 FINRA Extended Hearing Panel decision (currently on appeal so penalties are not in force) included 1-year suspensions on Snow and Barkley, in my opinion FINRA may seek to bar them.

One random note: the FINRA Enforcement complaint lists four senior lawyers from the SEC from different offices: Denver, Boston, New Orleans, and Los Angeles. That seems unusual to me.

Corrections and changes:

2019-7-26 – Added a couple links to the complaint.

2019-10-30 – FINRA broke the link to the complaint. I updated the link.

Disclaimer. No position in any stock mentioned and I have no relationship with anyone mentioned in this post. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

Wilson-Davis & Co settles with FINRA:

https://www.finra.org/sites/default/files/fda_documents/2016048837401%20Wilson-Davis%20%26%20Co.%2C%20Inc.%20CRD%203777%2C%20et%20al%20Order%20DM.pdf