Marijuana stock Frelii (OTC: FRLI) has had a landing page promotion off and on for some months at TheNextBigThing.com (that landing page is currently promoting OTC stock Blue Eagle Lithium (BEAG): https://thenextbigthing.com/2018/11/20/artificial-intelligence-for-your-health-y/). (Check out this page to see all current landing page stock promotions.) On May 13th I became aware of another landing page with a purported big budget promoting the stock, when Tim Lento posted it on his blog. I then searched online for the language on that landing page (https://thehealthinvestor.com/) and found a second landing page at https://dnainvestoralerts.com/.

Below is a screenshot of the top of the first landing page:

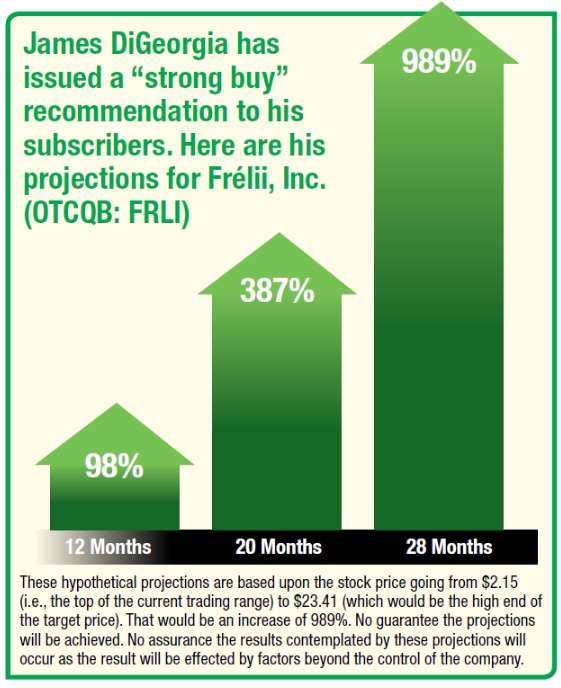

The image below, taken from the same landing page promoting FRLI, is beyond absurd:

At least one person posted on a message board that they have received a physical mailer promotion on FRLI.

Due to how poorly pumps have done over the last couple years I started a short position in FRLI on May 7th. I planned to short more as I found more shares to short at Interactive Brokers but by the time I had found more shares to short on May 14th Interactive Brokers marked the stock as “No opening trades: Ineligible PINK stock”. IB has for over a year restricted trading of OTC stocks that are marked ‘Caveat Emptor‘ by OTCMarkets.com but this is the first time I have seen IB restrict a non-grey market OTC stock that isn’t marked Caveat Emptor. I contacted IB support to ask for an explanation and the following was the unhelpful reply:

After talking with several other traders I learned that IB had marked scores of other OTC stocks with that same trade restriction at the same time. They did not have one thing in common but it is likely that IB is looking at multiple risk flags that OTCMarkets.com is putting out (such as potential shell risk, stock promotion flag) and restricting stocks with multiple risks. CRSM and TOGL are two other such stocks restricted from trading by Interactive Brokers. OTCMarkets just recently introduced a tool for brokers and others to quantify risks of different stocks using numerous risk factors, called Canari. I think it likely that Interactive Brokers is now using that tool and restricting trading in stocks that score too high on a composite risk score.

FRLI landing page pump details:

Disclosed budget: $2,183,616

Promoter: World Opportunity Investor / James DiGeorgia

Paying party: TGB Media Limited

Shares outstanding: 38,974,107

Free float: 9,538,629

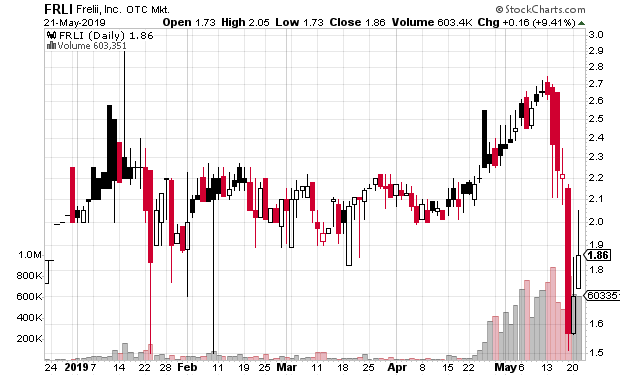

Previous closing price: $1.86

Market capitalization: $72 million

In addition to the landing page promotion, FRLI was promoted via email starting on May 20th by the stock promoter group that I and others believe to be associated with AwesomePennyStocks / John Babikian and that I previously referred to as FinestPennyStocks. That group has stayed relatively under the radar until recently by constantly shifting websites. However, OTCMarkets.com appears to have targeted them, marking their last three large promotions, OOIL, BIIO, and KLMN, as Caveat Emptor and helping to end those promotions. The SEC even joined the act and suspended trading in OOIL (long after the pump was over). The disclaimer from the emails promoting FRLI is shown below:

Besides the stock promotion, Frelii also made news in Canada when its CEO (an American) attended a fundraising dinner for Prime Minister Justin Trudeau. The company then put out a misleading press release about that, which its outside PR person later walked back, saying in part “That was very probably inappropriate language at this point.”

Full disclaimer from online landing page:

All investments are subject to risk, which must be considered on an individual basis before making any investment decision. World Opportunity Investor is an investment newsletter being advertised herein. This paid advertisement includes a stock profile of Frélii Inc. (OTC: FRLI). This paid advertisement is intended solely for information and educational purposes and is not to be construed under any circumstances as an offer to buy or sell, or as a solicitation to buy or sell, any securities. In an effort to enhance public awareness of FRLI and its securities, TGB MEDIA LIMITED (Payor) provided advertising agencies with a total budget of approximately two million, one hundred eighty-three thousand, six hundred sixteen dollars to date to cover the costs associated with creating, printing and distribution of this advertisement for World Opportunity Investor. FRLI was chosen to be profiled in this advertisement after World Opportunity Investor conducted an investigation of the company. World Opportunity Investor was paid thirty thousand dollars as a research fee. In addition, World Opportunity Investor may receive subscription revenue in the future from new subscribers as a result of this advertisement. The advertising agencies will retain any excess sums after all expenses are paid. As of the date these materials are disseminated, neither the advertising agencies nor World Opportunity Investor nor any of their respective officers, principals or affiliates (as defined in the Securities Act of 1933, as amended, and Rule 501(b) promulgated thereunder) own or beneficially own any securities of FRLI. Neither the advertising agencies nor World Opportunity Investor or any of their respective officers, principals or affiliates will purchase or receive any securities of FRLI for a period of ninety (90) days following the date this advertising campaign is concluded. The Payor has represented in writing to World Opportunity Investor and the advertising agencies that neither the Payor nor any of its officers, directors, principals or affiliates (as defined in the Securities Act of 1933, as amended, and Rule 501(b) promulgated thereunder) owns or beneficially owns any securities of FRLI or will purchase or receive any securities of FRLI for a period of ninety (90) days following the conclusion of this advertising campaign. If successful, this advertisement will increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of FRLI, increased trading volume, and possibly an increased share price of FRLI’s securities, which may be temporary. This advertisement, the advertising agencies and World Opportunity Investor do not purport to provide a complete analysis of this company’s financial position. They are not, and do not purport to be, broker-dealers or registered investment advisors. This advertisement is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent publicly-available information about the company and its industry. Further, readers are specifically urged to read and carefully consider the Risk Factors identified and discussed in FRLI’s SEC filings. Investing in micro cap securities such as FRLI is speculative and carries a high degree of risk. Past performance does not guarantee future results. This advertisement is based exclusively on information generally available to the public and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the advertising agencies and World Opportunity Investor cannot guarantee the accuracy or completeness of the information and are not responsible for any errors or omissions. This advertisement contains forward-looking statements, including statements regarding expected continual growth of FRLI. The advertising agencies and World Opportunity Investor note that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the company’s actual results of operations. Factors that could cause actual results to differ include the size and growth of the market for the company’s products and/or services, the company’s ability to fund its capital requirements in the near term and long term, pricing pressures, etc. World Opportunity Investor is the publisher’s trademark. All trademarks used in this advertisement other than World Opportunity Investor are the property of their respective trademark holders and no endorsement by such owners of the contents of this advertisement is made or implied. The advertising agencies and World Opportunity Investor are not affiliated, connected, or associated with, and are not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made to any rights in any third-party trademarks.

Disclaimer: I am short FRLI and may cover my position at any time. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.