To sell short, a trader first needs to borrow shares that will be sold short. For the most part, brokers will only lend shares if they have other customers who own the shares. While there is an inter-broker stock loan market, it is not very well developed (LocateStock.com is one company that provides such services to brokers; AQS is another). The method of borrowing shares differs at different brokers. For most normal discount brokers, you need to place a short order and then if no shares are available the broker will reject the order because there are no shares to borrow. Following are instructions for many different brokers on how to borrow shares to short and how to see which stocks are available to short.

Common Brokers

E*Trade – There is no way to determine which stocks are shortable. You must enter a short order and if it is rejected then that stock is not shortable at the present time. Shorting stocks priced below $1 per share is prohibited. Etrade has instituted a hard to borrow program that allows for the possibility of shorting hard to borrow stocks. You can read more and enroll here. If a stock is hard to borrow you will be quoted a borrow fee as an annual interest rate and once you accept that fee the order will be sent to the market.

Lightspeed Trading – Lightspeed generally sets up clients to clear through Penson, although they can clear through Goldman Sachs. They tell me that they also obtain borrows that they get from other sources as well. The Lightspeed trading platform will display a symbol if a stock is not readily available to short. According to Lightspeed, “We have a standing request with our clearing firms to locate or pre-borrow a certain quantity of every hard to borrow stock.” If a hard to borrow stock is in inventory through that standing request, it will be marked as available to short in the Lightspeed platform. If a stock is marked as hard to borrow in the trading platform, the user can send a request for the borrow through email or live chat. Lightspeed will then make an additional attempt to secure the requested shares for that specific user.

Scottrade – There is no way to determine which stocks are shortable. You must enter a short order and if it is rejected then that stock is not shortable at the present time. Scottrade generally has poor short stock availability. Shorting stocks below $5 per share is prohibited.

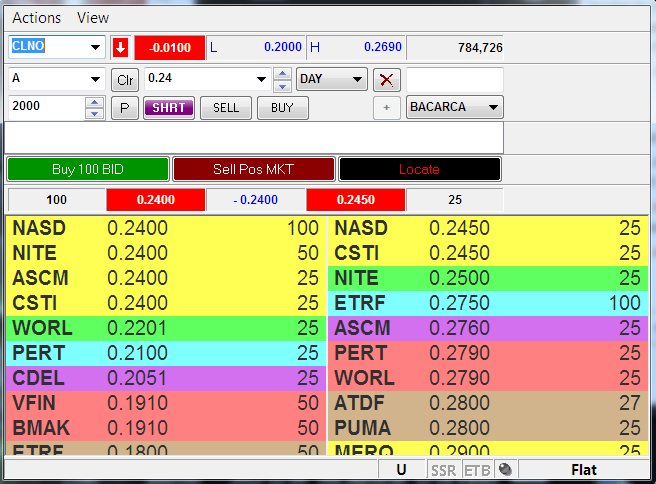

Centerpoint – At the bottom of the level 2 montage there are the letters “ETB”. If the stock is not easy to borrow then those letters are greyed out. In the image below they are in greyed out, meaning that CLNO is not easy to borrow/short. Stocks that are not easy to borrow may be located using the locate monitor in Sterling Trader Pro.

TD Ameritrade – There is no way to determine which stocks are shortable. You must enter a short order and if it is rejected then that stock is not shortable at the present time. TD Ameritrade generally has poor short stock availability (although sometimes they will have shares of hard-to-borrow stocks). Shorting non-marginable stocks (including all OTC stocks) is prohibited.

Tradestation – Tradestation primarily self-clears for stock trades. The Tradestation platform has a “Short Locate” function, which search for hard to borrow securities. About 20-30% of the times when IB does not offer shortable securities they can be found on Tradestation (this is according to a reader)). It takes around 30 seconds up to 15 minutes; usually under 2 minutes) to get the answer from a “locate request” – using their built-in platform locate tool. Tradestation does not allow short selling of OTC stocks or stocks under $2.50 per share.

Other random discount brokers – Most small discount brokers clear through Penson Financial (which has now changed its name to Apex Clearing), so the borrows would be the same, although the method for borrowing shares may be different. Noble Trading, Cobra Trading, and LowTrades.com all clear through Penson.

Recommended Broker

Interactive Brokers – I like to use the FTP text version of IB’s short stock list: Shortable Stocks FTP (when prompted for a password just hit enter or okay). The FTP link will show a large text file; use your browser’s search function to find a stock by name or ticker. An HTML version of the shortable stocks list is also available. Both show how many shares are available to short and what interest rate a trader must pay to borrow said shares. For example, the FTP link shows each stock on a line that looks like this: “AMEL|USD|Amerilithium Corp|73282418|US03077G1067|03077G106|-2.69|NA|NA|20000|”. The first entry is the ticker, the next the base currency, followed by name, two different identification numbers I’m not familiar with, the stock’s CUSIP, and then the indicative annual interest rate (positive numbers indicate a short sale rebate, in other words you get paid to hold the short position). The right-most entry is the number of shares available. The top line of the file indicates when the data were updated (ie, #BOF|2010.06.07|13:30:03) and the second line shows each column’s headers. So the line above indicates that as of 1:30pm EST on June 7, 2010 there were 20,000 AMEL to short at an annualized interest rate of 2.69%. The interest rate can change from day to day as the stock becomes more or less easily available to short.

If you log in to your account and go to “Tools > Short Stock Availability” you can see more detailed data on how many shares of a stock were available at different times. Interactive Brokers has detailed instructions on how to use this tool. I have also configured my Trader’s Workstation software to show the “Shortable” column. Below is a detailed video of how to do that. IB allows short selling stocks of any price (although short selling stocks under $2.50 requires more capital) and allows short selling of OTC BB and Pink Sheets stocks. Interactive Brokers does not allow for reserving shares to short; the first trader to get a short order filled gets the shares. Because Interactive Brokers’ system automatically searches for stock to borrow from various lenders and then displays how many shares are shortable, if it shows that there are no shares to short, placing an order to short is almost futile. You can place an order, which will cause the system to automatically look for more shares, but I have found that to almost never result in the system finding shares. The one benefit of placing an order is that TWS should notify you if you place a short order for which there are no shares and shares do later become available.

[Update 2017-5-3]: Interactive Brokers allows preborrowing shares to short of any stock. To submit a preborrow order you must have a Portfolio Margin account (this requires approval and a minimum $110,000 equity in your account). Preborrow orders are accepted on all US stocks and the minimum size for a preborrow order is $10,000. Preborrowing shares reduces the likelihood of a forced buy-in and will enable a short seller to sell short stocks that are hard to borrow. Preborrowed shares can be held without shorting the stock for up to 3 days (afterwards they will be automatically returned). There is a $20 per ticket charge for each filled preborrow order.

See the first video below for how to use the shortable column. The quick way to add it is to right-click the column header just to the right of where you want the shortable column, then select “Insert column before XXX column” > “Contract Description” > “Shortable”.

Below is a video about how to use Interactive Brokers’ short stock availability tool. (Direct link to video)

Disclosure: Updated 4-12-2018 to add info on Tradestation. No positions. I use Interactive Brokers (which I love) and Centerpoint Securities (clearing through Vision Financial). I have my IRA accounts at TDA (formerly Scottrade). I have an account at Etrade that I rarely use. I have a disclosure policy.

If a stock is marked as hard to borrow in the trading platform, the user can send a request for the borrow through email or live chat. Lightspeed will then make an additional attempt to secure the requested shares for that specific user.

Great great post. I think you’ll make a a lot of your readers very happy with this one.

thanks Reaper. I never knew IB had an FTP list I’ve always used the HTML. Just goes to show you can always learn something.

You ever short at speedtrader? That’s about the only major broker I see you left off that I’ve heard decent things about.

Speedtrader I don’t know. I’m sure someone who uses them will tell me about them and then I’ll add them.

This may be normal but you can not short a non-marginable security there at Ameritrade, I had that problem the other day with a stock.

You can not short OTC stocks either, so I asked them if there was a way that I could narrow my scans to find only those stocks and they said no. I can search just the NASDAQ or AMEX but the only way to find out about non-marginable stocks is to call.

I have a question, when you or anyone else is talking about Think or Swim, is that Ameritrade, or is there another broker that has that platform as well. I have Ameritrade and use the ToS platform but I see other people talking about it and wonder sometimes if it’s the same thing because they are talking about being short OTC stocks and I can’t short them.

Thanks for the blog, really is very good information as usual, I have come to expect nothing less from you and your writing/knowledge.

ThinkorSwim was bought by Ameritrade. Until they were bought by Ameritrade, TOS cleared through Penson and thus had different short stock availability and different rules. I have no clue if their systems have yet been totally merged. If not, using the TOS platform on an Ameritrade account may remain different from using the TOS platform at TOS.

Wow, this post is already #4 on Google for the search “how to borrow shares to short”, right behind a Tim Sykes post.

Wow, this post is already #4 on Google for the search “how to borrow shares to short”, right behind a Tim Sykes post.

Congratulations!

I’m not surprised there’s very places that actually tell you how to do it.

Nice job reaper- great post (I just scheduled a tweet for monday morning with the url). Just saw GBE break 1.00 with Investor’s Live.

Heya reaper, just being a irritating-newbie-prick, but.. would you suggest IB in general, even if you’re starting out? Thanks.

Yes.

Dude you rock thanks for the information!

great information, thanks a lot

I decided to call up speedtrader.com and they said that they allow the short trading of penny stocks. However they said that they are hard to get. But I think pretty much everyone knows that. The great thing about TOS is its reserve feature. I don’t know if speedtrader has it

ok, I found out speedtrader uses pension like TOS and IB does. So they should have the same short lists too

Every small online discount broker of which I am aware (except perhaps Zecco) clears through Penson.

Lightspeed, Sogotrade (Genesis), and Interactive Brokers all self-clear, as do the big brokers (TD-Ameritrade, E*trade).

well today I finally decieded to open an account with TOS. To tell you the truth I don’t really like the platform too much, little overbearing at times. But being able to reserve shares is one big advantage to have over others. I saw GVBP on the SEC few days ago. Wonder if tims under any heat from that one

GVBP is not currently on the Reg Sho threshold list. http://www.nasdaqtrader.com/Trader.aspx?id=RegSHOThreshold

I do not remember ever seeing it there. Anyway, just because a stock is on the list does not mean it cannot be short sold.

It seems on the Interactive Brokers list they always seem to have shares to short. I notice they route through allot of firms. Hopefully I can get my account to 10k so I can try them..

I found this page fascinating and well done. I would like to point out that there are a number of ways to get ‘short’ which includes selling the stock, trading options and selling Single Stock Futures (SSF).

Borrowing shares entails rebates and negative rebates (commisions) that are not transparent and somewhat variable. These rates are in fact priced into SSF contracts. While not all stocks have SSF trading at this time we list over 1400 including many of the Hard to Borrow variety. You can view quotes here:

http://www.onechicago.com/?page_id=1289

In addition we provide a unique comparison calculator allows you to see stock and SSF postions side by side to see which position makes more sense from the perspective of a common component which is the interest rate paid or collected.

Nice job on the video. It is a dark corner of the world that you help to bring some sunshine to.

Yes, I agree David that one does need to be open to other means of obtaining a ‘short’ position. However, I have found for most of the volatile stocks that I like to trade, few have options or SSFs. Those few that do have options of SSFs often have huge spreads on those instruments. So for my day-trading I will stick to just shorting stocks and not doing anything more complicated.

For long-term shorts, there is a lot to be said for SSFs as fixed-term instruments (unlike with a short stock borrow that can be called away any time).

Reaper,

for a small account to test strategy, ZECCO account will be good?

Thanks!

Most people never ask the right questions. Your question is too vague.

Hi,

IB needs 100k to short.

TOS has higher commisions than ZECCO.

For small accounts Zecco should be better to start, but doesn’t have trading platform 🙁

Your opinion?

Thanks.

IB does not require 100k to short, only to use the AQS borrowing platform. Even without that it is still better for shorting than any other broker. If you want to trade like me or Tim Sykes, you need borrows, and IB really is the best. SogoElite has good borrows but I don’t like them. Zecoo, I have heard, has very poor borrows.

Hi REAPER,

so with 10k you can short sell pennystocks by IB ?

Above $1 ?

Commissions are competitive?

Thank you very much!

Yes, and you can short stocks of any price, even $0.01.

Thanks Reaper for the AQS stock loan info.

I wonder, however, how useful is this service for hard-to-borrow stocks, I am not just talking penny stocks.

IB is self-clearing but even their rates are huge, for some stocks with big volatility skews (aka futures discount) the borrow rates are ridiculously high – approx 100% on annual basis. I tried to look at that IB feature (I am also IB user), but they require portfolio margin account, will not even allow that feature in the paper trading account, which is stupid. Anyway, I am really interested whether one can get competetive/superior rates in the AQS auctions compared to the mean indicative rates given in the SLB list.

Thanks,

Lam

I have found in general poor availability of stocks there, but of the stocks I do find, the rates are often superior to IB rates.

Hi Reaper,

Can we try a quick small sample to see how much better is the AQS auction? For example lets look at the following HTB stock – FUQI has a current mean borrow rate of -61%, what rates can you bid on the AQS.

Thanks in advance,

Lam

It is closed for the day, at 3pm EST. Ask me again next Monday morning.

Hi Reaper,

Can we try the comparison study today, whenever you have time?

I researched the HTB stocks and found out the following sample :

APWR : IB current rate -61.50

PARD: IB current rate -81.88

FUQI: IB current rate -50.38

SEED: IB current rate -50.50

Thanks,

Lam

At the moment there are no offers to lend any of those. The last auction (20 min ago) saw 32,400 SEED lent at 38.45%. I will update this comment later if I see other transactions.

Due to low volume, it can take awhile to get filled on a borrow request and what you need to do is just bid and then let it sit out for awhile until lenders see it.

Any info out there regarding availability of borrows with Lightspeed and how it compares to IB or Genesis?

I’ve been looking around and can’t seem to find info.

I’ve updated this with info on Lightspeed.

Hi reaper lately I wasn’t able to short sale stocks like ZANE and IFLG, at IB

so I see that you used sogoelite for these stocks?

are you able/need to reserve shares with sogoelite in order to short sale these stocks like IFLD and ZANE ?

if yes , how do you reserve?

These were all on Sogo’s easy to borrow list.

I am a sales representative with Interactive Brokers and can be a resource for opening an account with Interactive Brokers.

Besides very transparent borrow availability lists, IB offers the lowest margin cost in the industry. Another innovation is the AQS market place where you can borrow and lend shares, check it out, http://institutions.interactivebrokers.com/en/software/pdfhighlights/PDF-StockLoanBorrow.php?ib_entity=inst

John Carroll Seeberg

Institutional Sales

Interactive Brokers Corporation

Greenwich CT 06830

203-618-5991

reaper, thanks for the ftp for IB’s shortable stocks list. Didn’t know that even existed!

I’ve just double-checked the html version of the list – the interest rate for borrowing is not reflected in there. It’s still in the text version obtained via ftp though.

Cheers, useful stuff!

Hey Michael – thanks for the post. Valuable information for a noob .

HI. The short stock availability changed a little bit. do you noe the different between “current rebate rate” and “current fee rate” ? Thank you.

Just ignore rebate rate. You pay the fee rate. https://ibkb.interactivebrokers.com/tag/short-selling

Best brokerage firm for shorting stocks is LIGHTSPEED TRADING. Apex Clearing is their agent, and they are best in the industry.

No. Apex has sucked for years for borrows.

Thanks for this blog post. Here I am reading this almost 5 years later, but looks like the brokerages haven’t changed their methods or platform (except the merging of TDAmeritrade and ToS). Very helpful.

Thanks again.

Great post! Reading this in 2015 after watching one of your presentations. It may be important to note that the AQS marketplace is only available to portfolio margin customers. Users on a Reg T margin account can’t take advantage of preborrowing through AQS.

Great post Michael

You still find IB as the best for short selling stocks in the range (1$ – 30$) ? even with their per share commissions.

Also : how much it cost at the moment for IB scanner / charting / level 2 ?

Thanx

Hi Michael. You won’t remember me but we have spoken on the phone a couple of times regarding being a millionaire challenge student of Tim Sykes. It is something I still want to do when I get the $ together. I was also a silver subscriber of Tim’s last year but could not afford to renew my subscription as yet.

I usually short with Etrade but recently had my account fall below $25k then made the mistake of buying and shorting the same stock on the same day which turned out to violate an SEC rule I had never heard about. Now my Etrade account is restricted for 90 days so I took Tim Gritanni’s advise and opened an account with another broker. I went with TD Ameritrade to short sell, but have not been able to get shares for the last 5 trades I have tried to make. My account is around $20k. Can you recommend a good broker other than IB (which requires you make $40k a year to trade), Speed Trader (they turned me down as I do not make “20-40 trades a day”), or Etrade for short selling Nasdaq stocks under $10.00? Thank you. I look forward to rejoining Tim as soon as I can get my account back up above $25k.

Can you recommend a company to short trade with?

Thank you, Michael. Did you know your “how to short stocks” webpage is dated aci to September.

Check out https://www.venomtrading.com/

I noticed just recently that the link the IB holding cost data no longer works. Is there an alternative, or is there just no way to get that without an account anymore?

Thanks so much,

Ryan

I cannot find a way to access that anymore.

Can you now reserve shares to short at Interactive Brokers? I saw online that it seemed so for an extra charge I believe. Do you recommend doing this? I have not been able to get very good locates recently.

Yes but you need a Portfolio Margin account (which means you need over $110,000 in your account) to submit preborrow requests.

I get a pop-up that says pre-borrow requests are only for market orders only. (I have porfolio margin). Does this make sense?

Yes — PB requests can only be market orders, which means you pay whatever interest rate they say (although it doesn’t differ substantially from the current rate).

DAMN This is an amazing Post Michael. 9 years running. WTF. Impressive. Thank YOU for not filling it with ads.

RU still of the same opinion that IB is the place to be for shorting. I use TOS and got a lowered price. As a noob i Was scared of IB.

I use IB for longer-term shorting and Centerpoint Securities for stuff I can’t short at IB. Etrade is the third-best and TDA is worthless.

What platform are you using with centerpoint securities and why?

DAS Trader Pro just because I’ve used it for years and like it and it is cheap to use with Vision Financial clearing. I hear CP is suggesting new clients go with Hilltop for clearing because it is cheaper to hold shorts there overnight. The one problem with DAS Pro is that CP has so few routes for it for trading OTCs — if you want to trade OTC stocks with them I would recommend Sterling Trader Pro.

Hi Michael, not sure if you’re still responding to this thread but I’ll give it a go.

I’ve been having trouble getting the shorts I want with IB. Pretty much every day I get rejected at least once (and only looking at maybe 5 to 10 trades a day…something like that).

Just wondering, if IB doesn’t have the shorts, where should I go? You mentioned Centerpoint (backup) and Tradestation (20-30% when IB doesn’t have them). Is this who you would recommend as backups? I’m thinking to keep my IB account as my main, but then opening smaller margin accounts with 2 or 3 brokers (I’m fine with only 3 trades each per week) for the time IB doesn’t have shorts.

FYI. My account is less than 110k so I can’t reserve with IB (yet) 😉

I still use and like Centerpoint, but have been hearing good things recently about Cobra Trading. So maybe get an Etrade account (which is my 3rd broker) and a Cobra account.

Thank you!

Hi Michael, this post is so helpful I keep going back to it. Couple more questions:

1. With Centerpoint, do you have an update of what is better, Vision or Hilltop?

2. Is there any practical difference between Centerpoint Trader and Das Pro?

Thanks again.

Hi Reaper do you have any opinion on Velocity clearing… They are providing brokerage services now directly and as far as I am aware they provided stock locates to Centerpoint… The fees are very low and attractive as they are a clearing house and passing on lot of savings to customer…. Don’t know how good is their ETB and HTB list as compared to Centerpoint

I have no opinion on them at the moment and have not looked at them yet.