I haven’t kept up with John Babikian (evidently the man behind Awesomepennystocks.com, perhaps the most successful stock promoter of its time) for the last couple years as not much has happened with him. But I did notice a few things have happened that I had not recorded on this blog, so here they are.

Babikian’s (now ex-) wife dropped her suit against Babikian in LA Superior Court three years ago. I have no clue what happened to the divorce proceedings (those are normally sealed in Quebec).

Request to drop suit (pdf)

Order dropping suit (pdf)

In October 2016 Jean-François Cloutier of Journal de Montreal wrote about Babikian’s former associate Robert Kalfayan and his alleged attempts to remove money from Canada to allegedly escape seizure by the tax authority (article in French). See previous article on Revenue Québec getting a lien on Kalfayan’s home.

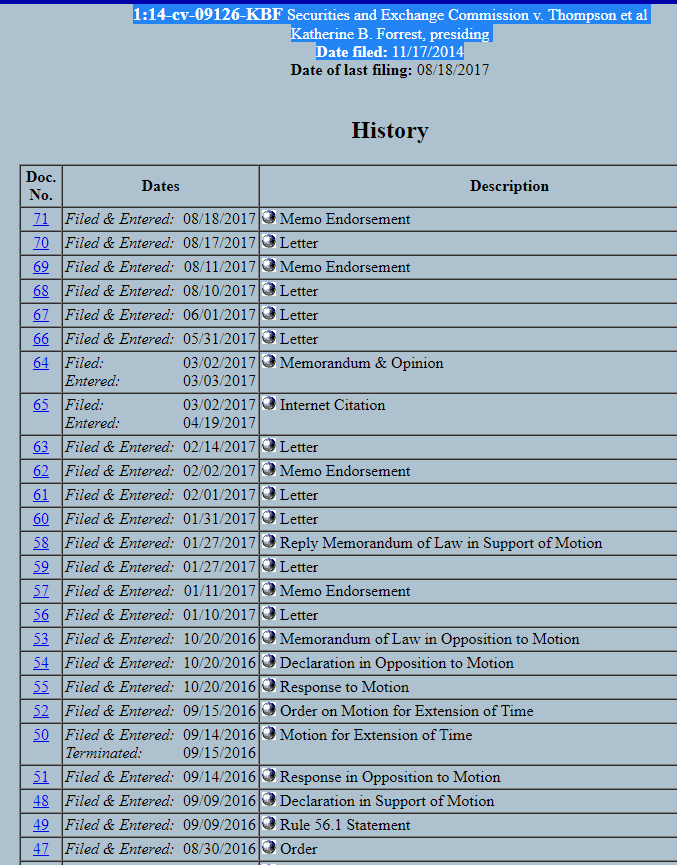

Meanwhile, the SEC’s case against Anthony Thompson, Jay Fung, and Eric Van Nguyen (associated with Awesomepennystocks predecessor websites) continues. That case is:

1:14-cv-09126-KBF Securities and Exchange Commission v. Thompson et al

Katherine B. Forrest, presiding

Date filed: 11/17/2014

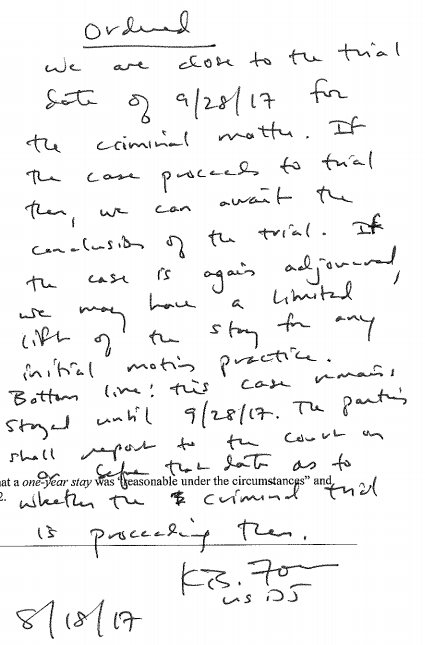

Currently the case is stayed pending the resolution of the parallel criminal case against Thompson, Fung, and Nguyen and the CEOs of five penny stock companies. If the criminal case (supposed to go to trial on September 27, 2017) does not immediately go to trial the civil case may continue per request of Thompson’s attorneys (docket 70; PDF copy). Below is the judge’s decision (hand-written on the last page of docket 70)

The criminal matter is New York State Court (Manhattan Supreme Court) case 3853/14. See the press release about the original indictment.

Back on May 16th, 2016 the judge ordered a bunch of the charges dropped, including larceny charges, because they were deemed not to fit the crime. The order described in that article can be found on Justia.

I should mention that while the promoters were the ones who became infamous, they were not the alleged mastermind(s). Instead, that was allegedly Kevin Sepe (who was not charged in the case). From the statement of facts in the order I linked above:

STATEMENT OF FACTS

The indictment arises from 9 alleged fraudulent “penny stock” “pump and dump” schemes. A penny stock is one which trades for less than $5 per share, is not listed on the NASDAQ and requires limited disclosure, making investments more risky and volatile. The company shares in this case traded for pennies or fractions of pennies but the conduct here also involved millions of shares. Those companies and their ticker symbols (the symbols which designated the companies on the market) were: Blast Applications (BLAP), Blue Gem Enterprises (BGEM), Recyle Tech (RCYT), Hydrogenetics (HGYN), Xynergy Holdings (XYNH), Mass Hysteria Entertainment Company Inc. (MHYS), Lyric Jeans (LYJN), SunPeaks Ventures (SNPK) and Smart Holdings (SMHS) (hereinafter sometimes referred to as the “subject companies”).

The architect and orchestrator of the scheme was Kevin Sepe. The remaining defendants, as described infra, were either affiliates of Kevin Sepe or stock promoters who worked with him to implement the alleged frauds. The Defendants’ work with the companies followed a similar pattern. A publicly traded “shell” company (a company with no substantial business) would be [*3]identified and Mr. Sepe and his affiliates would then act to merge a private company they controlled into the shell company. This allowed the shares of the new company to be freely traded without a waiting period. Money would be loaned to the company and then the loan would be converted into equity through the receipt of shares of the company stock as a substitute for the repayment of the debt. A stock promotion would then take place. Typically, there would have been very little trading in the company’s stock prior to the promotion. Immediately prior to the beginning of the promotion, however, some shares might be leaked into the market so that regulators would not see that a company went immediately from having no shares traded to a large trading volume.

The shares held by Sepe and his affiliates would rise in value following the promotion. Sepe and his affiliates would sell the shares at huge profits. The promotional campaign would then end. The share price would then rapidly decline. Kevin Sepe and his affiliates knew, in advance, that the stocks would follow this pattern pursuant to the beginning and end of internet marketing campaigns and scheduled and coordinated their stock sales accordingly. In each case, the sales and profits followed the pre-arranged pattern.

A key part of the scheme was to conceal the fact that Kevin Sepe controlled a vast portion of the trading shares. To conceal his ownership, his shares were placed in the names of multiple loyal nominees including Defendants Luz Rodriguez and Joseph Dervali who then sold their shares and split the profits with Kevin Sepe. In addition to concealing his ownership and control, having shares held by these nominees allowed Sepe to evade requirements that persons who held more than 5% of the shares of a company be disclosed.

Kevin Sepe was sued by the SEC back in 2012 for his involvement in the pump and dump of Recycle Tech and HydroGenetic and he settled that case. “Sepe agreed to disgorgement of $1,416,466.16, prejudgment interest of $126,761.86, and penalties of $185,000 as well as a permanent bar from participating in an offer or sale of penny stocks.” As with most SEC settlements, Sepe neither admitted nor denied the allegations in the settlment.

Disclaimer. No position in any stocks mentioned and I have no relationship with anyone mentioned in this post. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

Evidently not content to make money running a stock trading newsletter, Ciaran Thornton was paid for positive articles that he wrote about some stocks, without disclosing that compensation. He was

Evidently not content to make money running a stock trading newsletter, Ciaran Thornton was paid for positive articles that he wrote about some stocks, without disclosing that compensation. He was