In an administrative proceeding released on April 26, 2017, the SEC issued a cease and desist order (PDF) to brokerage and OTC market maker Wilson Davis (Market maker ID: WDCO) for violations of Regulation SHO and ordered the company to pay $235,714.50 in disgorgement of profits and interest thereon and a $75,000 civil penalty. But the headline of a violation of short selling regulations obscures the fact that the trading in question was related to some of the biggest pump and dumps ever perpetrated, all promoted by AwesomePennyStocks.com or related websites.

There are a few details in the order that are key. First, Wilson-Davis had two separate trading groups. From the SEC’s order linked above:

WDCO was comprised of two trading groups: a retail trading group and a proprietary trading group. The activity that is the subject of this Order pertains to WDCO’s proprietary trading group. Traders in the proprietary trading group had agreements with WDCO under which the traders were allowed to use WDCO funds for proprietary trades of securities and would split their profits with WDCO in accordance with their agreements.

Not mentioned in the order is that one of the traders was Anthony Kerrigone, who has already been sanctioned by the SEC in December 2016 (PDF). From that administrative order:

Kerrigone, a proprietary trader at WDCO, is a WDCO representative who caused WDCO’s Regulation SHO violations by executing certain short sales of securities on behalf of WDCO without WDCO being engaged in bona-fide market making activity and without WDCO obtaining a locate prior to effecting the short sales. Kerrigone improperly relied on the bona-fide market making exception for certain short sale trades without having a reasonably sufficient understanding of the rule, without sufficiently discussing with anyone at WDCO whether such trading qualified WDCO for the bona-fide market making exception, and by conducting such trading in a manner that closely resembled examples explicitly identified by the Commission— years before the conduct at issue—as activity that generally is not bona-fide market making.

Anthony Kerrigone was ordered to pay disgorgement of profits (and interest thereon) of $550,000.50 and a civil penalty of $50,000. Prior to the SEC order, Kerrigone (CRD#: 2612581) was also cited by FINRA back in November 2015. From FINRA BrokerCheck (FINRA does not allow direct linking so you have to search for Kerrigone by his name):

Initiated By FINRAAllegationsWithout admitting or denying the findings, Kerrigone consented to the sanctions and to the entry of findings that he caused his member firm to violate Rule 203(b)(1) of SEC Regulation SHO when on occasions, Kerrigone placed orders to sell short low-priced stocks through the firm’s proprietary trading account and failed to locate the securities, claiming the market marker exemption to the locate requirements. The findings stated that the market maker exemption was not available to the firm because Kerrigone was not engaging in bona-fide market marking activities in these securities. The firm generated over $158,239 in profits from these short transactions.ResolutionAcceptance, Waiver & Consent(AWC)SanctionsCivil and Administrative Penalty(ies)/Fine(s)Amount: $10,000.00SanctionsSuspensionDuration: six monthsStart Date: 12/7/2015End Date: 6/6/2016

Surprisingly, Kerrigone was able to get another job in the industry after that suspension and according to BrokerCheck he still holds it, working for BMA Securities, another OTC market maker (Market maker ID: BMAS).

The Pumps & Dumps

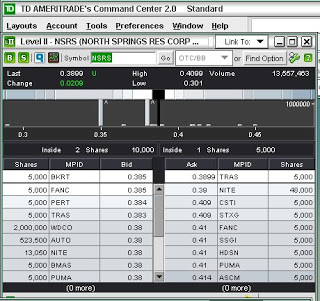

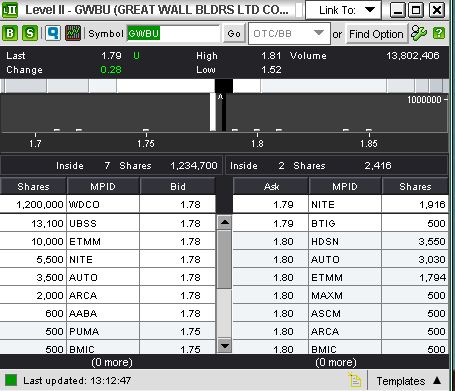

Listed in the SEC order are five examples of stocks where a trader or traders at Wilson Davis improperly sold short stocks using the market maker exemption while not acting as a bona fide market maker: Amwest Imaging (AMWI), North Springs Resources Corp (NSRS), Sunpeaks Ventures (SNPK), Great Wall Builders (GWBU), and Pristine Solutions (PRTN). AMWI was promoted in December 2011 by Crazypennystocks.com and related websites (a predecessor promoter to Awesomepennystocks). NSRS was promoted in January and February of 2012 by Crazypennystocks.com. See synopses of these and other big promotions of 2011/2012. SNPK was promoted in April 2012 by Awesomepennystocks-related websites. GWBU was promoted by Awesomepennystocks in June 2012. See also this article on GWBU manipulation. PRTN was promoted by Awesomepennystocks in September/October 2012. Infitialis wrote an excellent article on SeekingAlpha at the time alleging manipulation of PRTN.

That Infitialis article in particular does a great job of explaining some of how a trader at WDCO allegedly traded Awesomempennystocks pumps while at Wilson-Davis. From that article:

We also know that one specific broker dealer Wilson Davis & Company is continually engaged in showing abnormally large bid sizes on every single APS scam since 2010.

The most obvious question to ask is why? Why would WDCO go out of its way to display such larger orders if their true intention was to buy the shares. The obvious answer is that WDCO is not trying to buy shares they are trying to manipulate the stock while other market makers such as ATDF liquidate shares. These transactions occur simultaneously often serendipitously:

- APS Stock begins to decline

- WDCO shows up with an abnormally sized bid, stock stabilizes

- ATDF shows up on the offer and sells into the buying generated by WDCO.

This behavior is described in the SEC order as WDCO updating its bids for stocks but having a very high offer and then short-selling through other market makers (“While posting an offer quotation that was not at or near the best offer, WDCO executed short sales at prices that were substantially away from its posted quotation.”). Of course, that SEC order makes no mention of big bids, yet that is something that has been documented many times (most traders who traded Awesomepennystocks pumps will recall this and this is documented on numerous blogs and tweets). For example, here is a post about manipulation on GWBU that shows multiple screenshots of Wilson-Davis (WDCO) displaying huge bids. Here are screenshots of big bids by WDCO on NSRS. I have copied just two of those screenshots below in case the original website is taken down.

Note: None of this is to suggest that the firm approved of or ordered any trader to act in an unethical or illegal manner — all I know is that I have seen someone at WDCO posting large bids on many of these stocks.

Just for fun, here is WDCO showing absurdly large offers on a non-Awesomepennystocks pump (I make no commentary during the video so just mute it if you do not want to hear the music I was listening to at the time):

Disclaimer. No position in any stocks mentioned and I have no relationship with anyone mentioned in this post. I traded (both long and short) most if not all of the stocks mentioned in this post at the time they were promoted. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

Is this him? LOL http://kdvr.com/2015/08/18/foo-fighters-dave-grohl-sings-my-hero-to-crying-man-at-fiddlers-green-concert/

Yes.

A couple of the articles linked towards the end of the above article are no longer online. Here are a few related links:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=90168151

http://investorshub.advfn.com/boards/replies.aspx?msg=90168151

Internet archive results for the pages taken down:

https://web.archive.org/web/20150629093046/http://www.theotc.today/2012/06/hour-in-life-of-gwbu-manipulation.html

The above link appears to redirect to a password-protected page. The link below works.

https://web.archive.org/web/20150529060529/http://www.theotc.today/2011/12/north-springs-resources-nsrs-supports.html

The first page linked above was first posted at https://web.archive.org/web/20120830203521/http://www.pumpsanddumps.com/2012/06/hour-in-life-of-gwbu-manipulation.html and the archived version of that page is online.

I saved a PDF copy of the both pages in case they disappear from the Internet Archive.

See also: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=90168151