Norstra Energy (OTCBB: NORX) was first promoted that I saw on April 1st, 2013 right at the market open, by TheStockFreak.com / StockPublisher.com / PennyStockCrew.com, PennyStocksProfile.com, and BreakoutStocks.com. After the market close that day NORX was promoted by Global Marketing Media LLC websites.

The Stock Freak has been compensated $100,000.00 in cash compensation from Service Media LLC for the 3 day profile of Nostra Energy (OTCBB:NORX) which services include the issuance of this release and the other opinions that we release concerning Nostra Energy (NORX).

…

Stock Publisher has been compensated $100,000.00 in cash compensation from Service Media LLC for the one day profile of Nostra Energy (OTCBB:NORX) which services include the issuance of this release and the other opinions that we release concerning Nostra Energy (NORX).

…

Penny Stock Crew has been compensated $100,000.00 in cash compensation from Service Media LLC for the 3 day profile of Nostra Energy (OTCBB:NORX) which services include the issuance of this release and the other opinions that we release concerning Nostra Energy (NORX).

PennyStocksprofile.com is owned and operated by PLVP LLC. The company Has [sic] been compensated fifteen thousand dollars for the publication of this information by a non affiliated third party Odd Marketing LLC.

Breakoutstocks.com has been compensated by a third party ODD Marketing LLC fifteen thousand dollars for a one day company advertisement on NORX.

PennyStockPlayers is owned and operated by Global Marketing Media LLC. Global Marketing Media LLC has been compensated fifty thousand dollars for a two day marketing and promotional effort on NORX by Full Service Media, LLC.

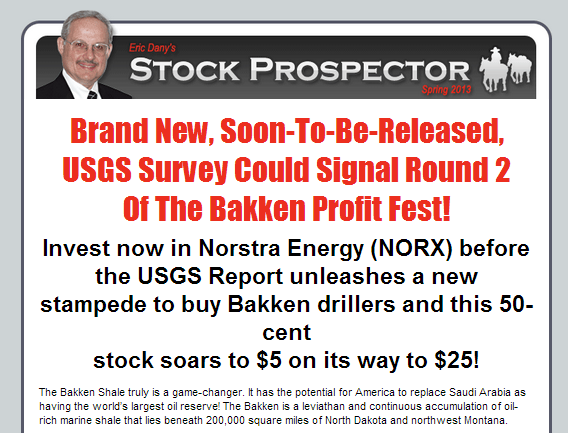

This morning at 8:10am Eastern. I received an email from alerts@StreetAuthorityFinancial.com linking to http://norxreport.com/

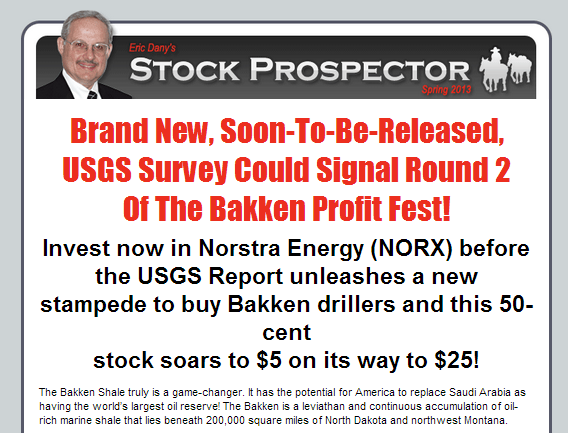

Disclosed budget: $426,035

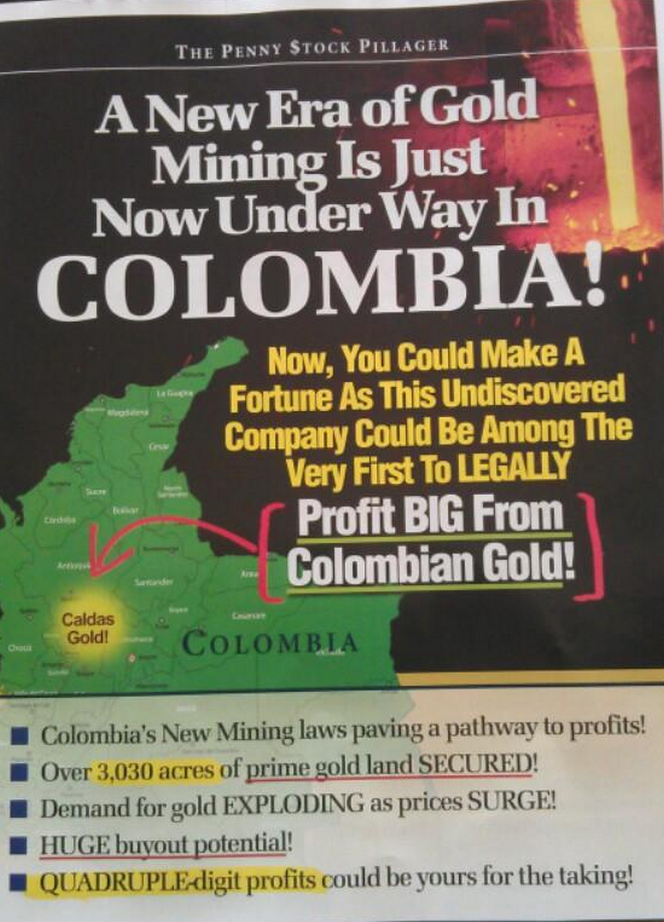

Promoter: Full Service Media and Eric Dany / Eric Dany’s Stock Prospector

Paying party: Arista Theme Ltd.

Shares outstanding: 38,250,000

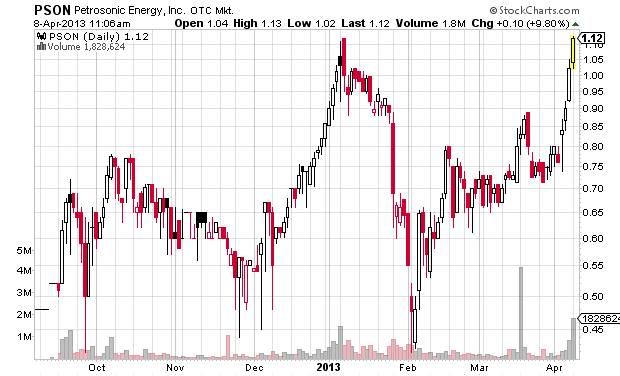

Previous closing price: $0.56

Market capitalization: $21 million

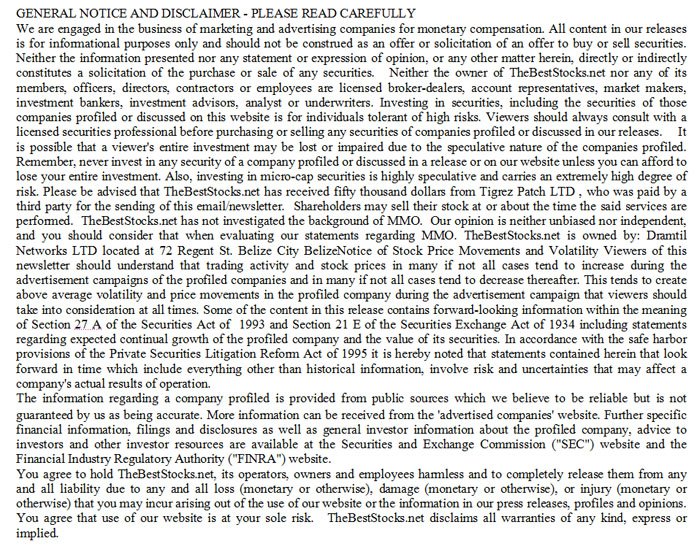

Excerpt from disclaimers:

This is a paid advertisement by Eric Dany and/or Eric Dany’s Stock Prospector (collectively, “EDSP”). EDSP has received $10,000 from Full Service Media, LLC in compensation for this advertisement to enhance public awareness of Norstra Energy, Inc. (hereafter “NORX”).

…

Third Party Advertiser/Advertising Agency IMPORTANT NOTICE AND DISCLAIMER: Arista Theme Ltd., the third party advertiser, has paid $426,035 USD to Full Service Media, LLC (FSM) as of April 2, 2013 for this advertising effort in an effort to build investor awareness. FSM shall retain any amounts over and above the cost of creating and distributing this email advertisement which advertises Eric Dany’s Stock Prospector Newsletter coverage of Norstra Energy, Inc., Advertising services include; production, outsourced advertising copywriting services, mailing and other related distribution services and advertising media placement costs. Arista Theme Ltd., the third party advertiser, is a company based in Tortula, BVI. Arista Theme Ltd., the third party advertiser, has represented to FSM in writing that it is not a current shareholder of Norstra Energy, Inc. and that neither it nor its affiliates will buy or sell any shares of Norstra Energy, Inc. during the period that this advertisement is being disseminated by FSM third party media vendors.

One interesting thing is the disclosure that the party that paid for the advertising, Arista Theme Ltd., has no shares of NORX. My hunch is that Arista Theme Ltd. is just a shell company created for the sole purpose of funneling money to the stock promoters from the person or entity that holds the shares so that they can hide their identity. People don’t pay for large stock promotions out of the goodness of their hearts. I have no evidence to support this belief.

PDF copy of NORX pump page.

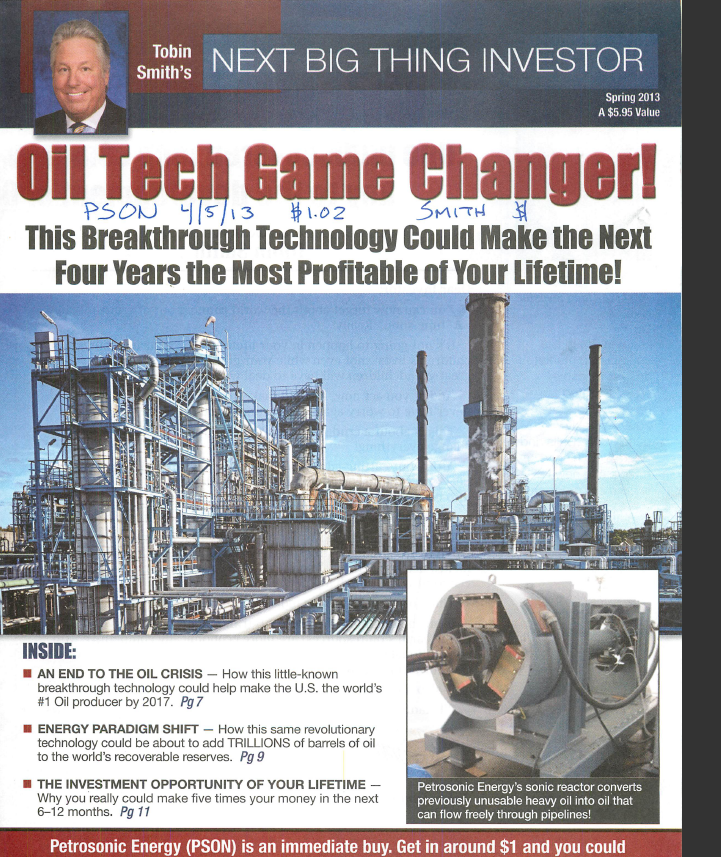

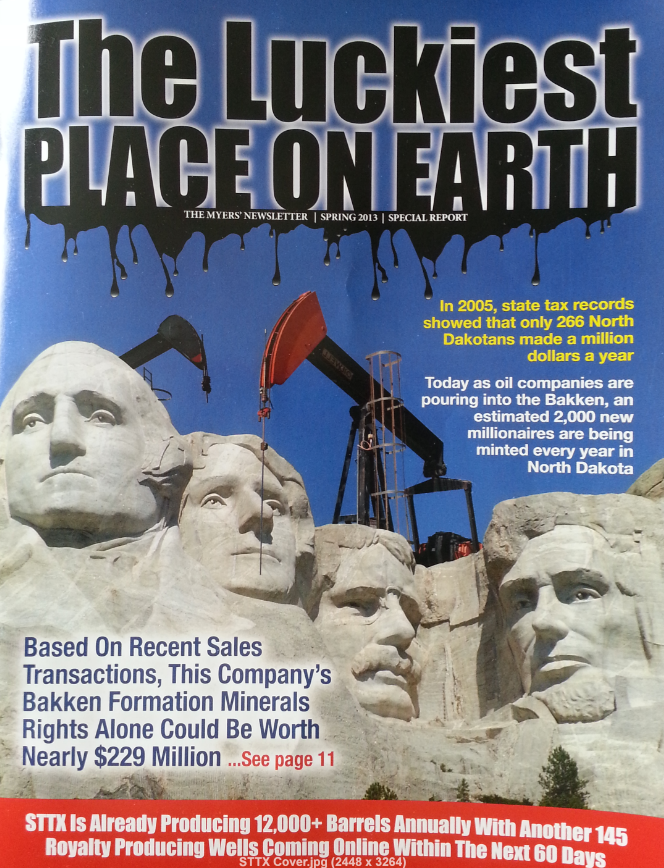

[Edit 2013-6-21]: The budget has been increased to $3.64 million and Tim Lento has posted a scan of the hard mailer he received promoting the stock.

Disclaimer: I have no position in any stock mentioned above and no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

(click to enlarge)

(click to enlarge) (click to enlarge)

(click to enlarge)