I usually ignore SEC insider-trading litigation so I managed to miss when Jay Fung was arrested for insider-trading on a takeover (specifically, the Gilead takeover of Pharmasset in 2011). This was a follow-up to SEC v. Kevin L. Dowd (3:13-cv-00494) and USA v. Kevin Dowd (3:13-cr-00636-AET), all in the US District Court for the District of New Jersey (links are to dockets at CourtListener.com). The original civil complaint (pdf) was brought by the SEC on January 25, 2013. The final judgment against Dowd ordered him to pay $33,325 to the SEC. As to the criminal complaint, Dowd plead guilty and was sentenced to 3 years probation and forfeiture of $35,000.

The criminal complaint against Dowd listed his co-conspirators (the ones who actually traded on the information) as follows:

j. Co-conspriator J.F. was defendant DOWD’s childhood friend, and resided in or around Del Ray Beach, Florida. Among other things, J.F. operated “Company A” , which maintained a brokerage account with a brokerage firm headquartered in Shrewsbury, New Jersey (“Brokerage Firm B”). J.F. previously worked at a penny stock promotion company in Boca Raton, Florida (the “Stock Promotion Company”) from approximately in or about 2000 to approximately in or about late 2006, where defendant DOWD also worked between in or about May 2000 through in or about July 2001.

k. Co-conspirator E.B. resided in or around Boca Raton, Florida, and among other things, was the vice president of “Company B” , a business based in Boynton Beach, Florida. E.B. worked at the Stock Promotion Company with co-conspirator J.F. from

approximately in or about 2003 through in or about 2005, and knew defendant Dowd.

“Con-conspirator J.F.” was later revealed to be Jay Fung when he was charged on information on March 9, 2016 and immediately pled guilty. The case was US v. Fung (3:16-cr-00107) in the US District Court, District of New Jersey. On January 17, 2018 he was sentenced to 1 year in prison to be followed by 3 years of supervised release. Jay Fung forfeited $345,245.

Jay Fung is currently imprisoned at CI Taft:

Previously, Jay Fung had been sued by the SEC for his promotion of RecycleTech (RCYT). That case was SEC v. Recycle Tech, Inc (1:12-cv-21656) in the US District Court, Sourthern District of Florida. I blogged about that case when it was first filed in 2012. In that case, the final judgment against Jay Fung was rendered on February 14th, 2014. Fung and his company Pudong LLC were judged to be jointly and severally liable for disgorgement of $456,457 along with interest of $30,998.36. Fung was also ordered to pay a civil penalty of $120,000.

Criminal and Civil cases against Jay Fung, Anthony J. Thompson Jr., and Eric Van Nguyen

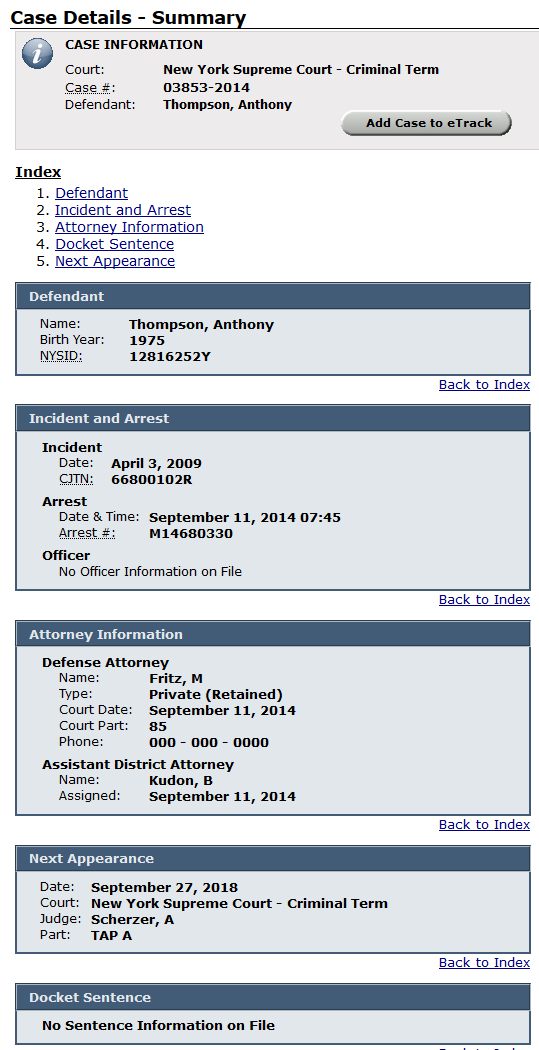

The Manhattan District Attorney charged a number of stock promoters including the three listed above, back in 2014. The case is 03853-2014 in Manhattan Supreme Court. I first reported on that case in September 2014 and then provided an update on September 26th, 2017.

The summary of the criminal case is below:

The charges (at least against Thompson) are shown below:

The appearances in the case are shown below. Unfortunately, details are not given so I cannot be sure if any of the defendants have been dropped from the case. Sentencing is scheduled for September 27th, 2018.

The most recent decision in the case that I can access is from May 16th, 2016. Decisions do not appear to be accessible through the court’s website.

SEC Case against Anthony J. Thompson et al

Notwithstanding my ignorance of the exact outcome of the criminal case, the civil case has resumed (see docket). This week (on July 11th) the SEC alleged the following in a letter (document 99):

We write in advance of the July 10, 2018 prehearing conference in this matter in order to provide the Court with additional background as to the status of this litigation. Unfortunately, it has become apparent that defendant Anthony J. Thompson (“Thompson”) has engaged in a pattern of obfuscation and delay. The SEC has recently obtained documents from other litigation in which Thompson is involved that suggest not only that he has deliberately delayed the discovery process in the SEC action, but that his misconduct might be far broader than originally thought, and that Thompson might have significant assets secreted abroad.

As to defendant Jay Fung, he was agreed to a settlement offer that the staff is prepared to submit senior management and the Commission for review.

The other litigation referred to by the SEC is his divorce, Kendall Thompson v. Anthony J. Thompson, Jr., Case No. 147268-FL, and a trust litigation “in which Kendall [Thompson] alleges that Thompson has fraudulently diverted assets from a trust supposedly set up for the benefit of their children to pay for drugs and prostitutes, among other things.” (The quote is from the first footnote in the above-linked letter.)

This letter highlights how the SEC had agreed to a settlement with Thompson but he never formally agreed and now with the new allegations it is my opinion that the SEC will not settle with Thompson:

After approximately two months of what the SEC believed were good faith settlement discussions, Thompson has failed to formally agree or execute the settlement papers sent to him.

Information Obtained From the Matrimonial Case and the Trust Litigation

The SEC has learned from an initial and by necessity cursory review of some of the materials it has recently received of certain facts that are potentially material to the case at bar. These facts include that Thompson, in addition to the funds received in from the schemes set out in the Complaint, sold off OTC Solutions, Inc. for $6 million. The SEC was also informed that Thompson has been providing “consulting” services to companies located in Belize, might have been paid several million dollars in Belize. The SEC further learned that Thompson might have converted his ill-gotten gains into luxury cars and boats, and jewelry, including expensive watches. Finally, from reviewing the pleadings in those cases the SEC learned that Thompson was accused of similar dilatory and obfuscatory discovery tactics therein, including failing to adequately produce tax returns, banking information, and other financial data.

Disclaimer: I have no position in any stock mentioned above. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.