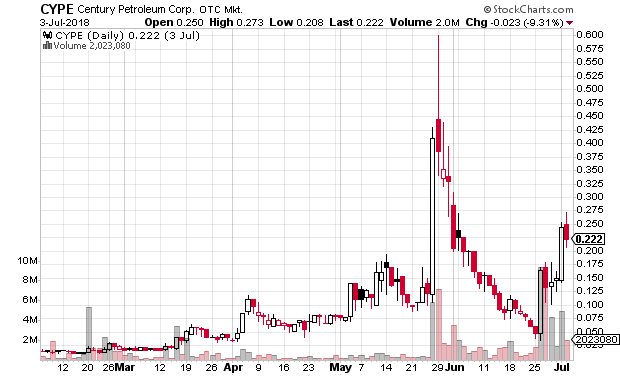

This morning the SEC suspended trading in three stocks that had “unusual and unexplained market activity” (in other words, they looked like pump and dumps) and because of questions about the accuracy of the companies’ press releases and 8-Ks. The date on all the suspensions is July 3rd but the most liquid of the stocks CYPE traded all day July 3rd (a half-day) and the suspensions didn’t show up in the SEC trading suspension RSS feed until this morning after the open.

The three stocks are: Century Petroleum Corp (CYPE), Big Time Holdings, Inc (BTHI), and Williamsville Sears Management (WSML). All three companies show Brian K. Kistler as a consultant or officer. On OTCMarkets.com he is listed as CEO of BTHI and a consultant at WSML and a consultant at CYPE.

LinkedIn lists Mandla J. Gwadiso as founder of BTHI and WSML (pdf copy of his LinkedIn profile). He just tweeted two days ago that he was going to buy CYPE stock:

$CYPE at it, I’m finna buy this stock my self now. https://t.co/87NyRFlGaG

— Mandla J. Gwadiso (@mj_gwadiso) July 3, 2018

See more about these companies here:

$WSML, $CYPE, $BTHI all suspended today – they were all Milost Global Inc/Palewater Advisory Group shells. Their other shell – $AXMP somehow avoided suspension but could be suspended very soon. I posted lots of warning signs about this group https://t.co/3PnmCXOsWH

— Promotion Stocks (@promotionstock) July 5, 2018

Century Petroleum Corp (CYPE)

SEC suspension release (pdf)

SEC suspension order (pdf)

Reason for the suspension (from the release):

The Commission temporarily suspended trading in the securities of CYPE because of questions about the accuracy of information in the company’s press releases since at least May 25, 2018, regarding the company’s business plans and acquisitions, and concerns since at least May 25, 2018, about recent, unusual and unexplained market activity in the company’s common stock.

Big Time Holdings, Inc (BTHI)

SEC suspension release (pdf)

SEC suspension order (pdf)

Reason for the suspension (from the release):

The Commission temporarily suspended trading in the securities of BTHI because of questions about the accuracy of information contained in BTHI’s Form 8-K filed with the Commission on May 24, 2018, and concerns since at least May 24, 2018, about recent, unusual and unexplained market activity in the company’s common stock.

Williamsville Sears Management (WSML)

SEC suspension release (pdf)

SEC suspension order (pdf)

Reason for the suspension (from the release):

The Commission temporarily suspended trading in the securities of WSML because of questions about the accuracy of information in the company’s press releases since at least May 29, 2018, regarding the company’s business plans and acquisitions, and concerns since at least March 9, 2018, about recent, unusual and unexplained market activity in the company’s common stock.

Disclaimer: I have no position in any stock mentioned above. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.