The SEC and FINRA crackdown on brokers, transfer agents, and other ‘gatekeepers’ in the microcap markets continues with a new SEC lawsuit filed February 21st, 2019 in the US District Court for the Middle District of Florida. The case is US Securities and Exchange Commission v. Spartan Securities Group, Ltd et al (8:19-cv-00448). See the docket. The very detailed complaint (pdf) can be found on CourtListener. See also the SEC litigation release for a good summary.

Spartan Securities Group Ltd is a broker and market maker (OTC market maker ID: MICA). Read their FINRA BrokerCheck report. Spartan’s sole clearing firm according to its BrokerCheck report (PDF copy) is Cor Clearing. Cor was forced to stop accepting penny stocks for deposit and sale as part of its settlement with the SEC in October 2018.

Also included as defendants of this lawsuit are Island Capital Management LLC (dba Island Stock Transfer), which is under common ownership with Spartan Securities; Carl E. Dilley; Micah J. Eldred; and David D. Lopez. Dilley, Eldred, and Lopez “were common owners of the parent of both Spartan Securities and Island Stock Transfer, and principals of both Spartan Securities and Island Stock Transfer,” according to the complaint.

Below are the general allegations:

3. This action involves Defendants’ roles in one or two separate fraudulent schemes from approximately December 2009 through August 2014 to manufacture at least 19 public companies for sale fundamentally premised on a deceptive public float of purportedly “free-trading” securities: 14 by Alvin Mirman and Sheldon Rose (the “Mirman/Rose Companies,” identified in paragraph 30 below) and five by Michael Daniels, Andy Fan, and Diane Harrison (the “Daniels Companies,” identified in paragraph 102 below).

4. The fraudulent schemes depended on misrepresentations and omissions to, among others, the Commission, the Financial Industry Regulatory Authority (“FINRA”), and the Depository Trust Company (“DTC”) that the Mirman/Rose and Daniels Companies were legitimate small businesses with independent management and shareholders. In reality, both the management and shareholders were nothing more than nominees for control persons who always intended merely to sell all the securities of the companies privately in bulk for their own benefit. The essential value of these securities (each bulk sale realized proceeds of hundreds of thousands of dollars) was their false designation as “free-trading” with the ability to be sold immediately on the public market. If the truth had been known to the public, the securities would have been restricted from such sales and would have had little value.

5. Dilley and Eldred knew or were reckless in not knowing from the onset that the Mirman/Rose Companies and Daniels Companies, respectively, were pursuing their stated plans under false pretenses and instead being packaged for sale as public vehicles, and that the shareholders were mere nominees for the control persons. Nonetheless, Defendants took critical steps to advance the frauds.

6. Dilley schemed with Mirman and Rose, and Eldred schemed with Daniels, Fan and Harrison, to defraud the public that the Mirman/Rose Companies and Daniels Companies were operating businesses with independent management and shareholders, rather than undisclosed “blank check” companies (sometimes referred to as “shells” or “vehicles”) for sale. In furtherance of the Mirman/Rose scheme, Dilley signed false Form 211 applications submitted to FINRA, contributed to false DTC applications, found potential shell buyers, signed an escrow agreement and false attestation letters for shell buyers, and effectuated the bulk transfer of the entire deceptive public float of Mirman/Rose Companies to shell buyers. Eldred similarly schemed with Daniels, Fan and Harrison by filing false Forms 211 with FINRA, signing false securities deposit forms and executing trades in Spartan Securities’ proprietary account, all in support of the manufacture of undisclosed public vehicles – one of which Eldred expressly proposed to acquire himself while its Form 211 was pending.

7. A necessary step in both fraudulent schemes was for the issuer’s stock to be eligible for public quotation, which requires a broker-dealer to file a Form 211 application with FINRA to demonstrate compliance with Rule 15c2-11 under the Securities Exchange Act of 1934 (“Exchange Act”). FINRA typically raises specific concerns or seeks further information from the broker-dealer in one or more deficiency letters before clearing the application. Meanwhile, transfer agents perform a number of roles for issuers pertaining to their securities and shareholders, including recording changes of ownership, maintaining the issuer’s security holder records, canceling and issuing certificates, and resolving problems arising from lost, destroyed or stolen certificates.

8. Spartan Securities and Island Stock Transfer acted in tandem to provide these various services which were critical to the Mirman/Rose and Daniels/Fan/Harrison shell factories. For example, Spartan Securities filed the Form 211 application with FINRA in order for the securities of these 19 issuers to be publicly quoted. Spartan Securities, Dilley, and Eldred made materially false statements and omissions to FINRA regarding the purpose, management and shareholders of the Mirman/Rose Companies and Daniels Companies. Spartan Securities and its principals also had information that undermined any reasonable basis that the information required by Rule 15c2-11 was materially accurate and from a reliable source. Spartan Securities then initiated unpriced quotations for all the Mirman/Rose Companies and Daniels Companies (except PurpleReal) upon FINRA’s clearance of the Form 211.

One of the key allegations here is that Spartan “filed the Form 211 application with FINRA in order for the securities of these 19 issuers to be publicly quoted. Spartan Securities, Dilley, and Eldred made materially false statements and omissions to FINRA regarding the purpose, management and shareholders of the Mirman/Rose Companies and Daniels Companies.” For a stock to be quoted over the counter, a market maker has to file a form 211. According to FINRA, “Form 211 is the form which must be completed pursuant to FINRA Rule 6432 and submitted to the FINRA OTC Compliance Unit to initiate or resume quotations in the OTCBB, OTC Markets or any other quotation medium pursuant to SEC Rule 15c2-11.“

I wrote back in April 2018 in my blog post about the criminal charges against another OTC market maker and microcap broker, Delaney Equity Group, “the fact that the forms 211 are mentioned is a big deal for OTC Markets in my opinion– this could scare off market makers from filing these forms for any sketchy company in the future.” That is even more true now and I believe that this lawsuit against Spartan Securities Group will scare all other OTC market makers into doing much more due diligence before filing forms 211. This should result in fewer fraudulent shells being listed to trade.

The SEC complaint (pdf) goes into a lot of detail of how Spartan and its principals allegedly failed to do much due diligence before filing form 211 for different shell companies. There are 14 charges against the companies and individuals that are defendants of this lawsuit, although not every charge is against every defendant. The SEC is seeking a permanent injunction against all defendants from violating securities laws, disgorgement of all alleged “ill-gotten gains”, additional “civil money penalties”, and a penny stock bar against Spartan Securities, Dilley, Eldred, and Lopez (but not Island Stock Transfer).

Surprisingly to me, Spartan Securities put out a press release in response to the lawsuit. The full text of the press release follows:

Spartan Securities Group / Island Stock Transfer Statement Regarding Recent SEC Litigation

Thursday, February 21, 2019 4:15 PM

CLEARWATER, FL / ACCESSWIRE / February 21, 2019 / Spartan Securities Group, Ltd. (”Spartan”) and its affiliated company, Island Capital Management, LLC, doing business as Island Stock Transfer (”Island”), are disappointed in the decision by the U.S. Securities Exchange Commission (”SEC”) to file this Complaint.

Spartan, Island, and their principals vehemently deny any wrongdoing and look forward to taking this case to trial. Contrary to what is alleged and/or insinuated in the Complaint, neither Spartan nor Island (nor any of their employees) were involved in the creation or operation of any of the 19 named companies listed in the Complaint. Those 19 companies – which it is important to note represent a miniscule fraction of the thousands of legitimate issuers that Spartan and Island have worked closely with over the years – were, unbeknownst to Spartan and Island, operated by alleged fraudsters.

According to the SEC, those fraudsters went to great lengths to make everyone – including Spartan and Island, as well as the SEC itself – believe that they were real businesses with actual operations.

In fact, before Spartan or Island provided any services to any of these 19 companies, each company prepared and filed a registration statement with the SEC. In turn, each registration statement was declared effective by the SEC. The representations the companies made to the SEC in support of their respective registration statements – i.e., the representations on which the SEC relied and which it accepted – were the same those companies made to Spartan and Island, and the same ones on which Spartan and Island relied. In short, Spartan and Island – just like the SEC – were victims of the fraud that these individuals behind these 19 companies were committing, and not, as the Complaint alleges, themselves perpetrators of any fraud.

Spartan and Island appreciate all of the expressions and offers of support already provided by a multitude of our friends and colleagues, including law firms, other financial institutions and issuer clients alike. We have always strived to create and maintain a stellar reputation for service in our industry, and will continue to do so.

The micro-cap and small-cap industry has endured an inordinate amount of regulatory assaults over the last ten years. Alan Wolper, partner with Ulmer & Berne LLP in Chicago, longtime outside counsel for Spartan and Island, stated, ”My clients and I look forward to our day in court, as we are confident that any reasonable judge or jury will conclude that the SEC is unable to carry its burden of proof.”

Spartan and Island wish to reassure their clients that this litigation will not affect the services our 500+ issuer clients have come to expect and our services will continue with the same great staff that our clients have come to appreciate.

Media Contact:

Alan M. Wolper / Heidi VonderHeide

Ulmer & Berne LLP

312.658.6564

While I am sure it has happened previously, I cannot remember the last time a defendant in an SEC lawsuit issued a press release to announce that it will fight the charges. Also, the press release does not appear to me to assert that the SEC’s factual allegations are incorrect. The PR states in part, “Contrary to what is alleged and/or insinuated in the Complaint, neither Spartan nor Island (nor any of their employees) were involved in the creation or operation of any of the 19 named companies listed in the Complaint.” Yet after reading the whole complaint I did not get the impression that the SEC was even insinuating that Spartan was involved in the creation or operation of the shell companies. Instead, the SEC alleged the following actions as “Defendants’ roles in one or two separate fraudulent schemes “:

6. Dilley schemed with Mirman and Rose, and Eldred schemed with Daniels, Fan and Harrison, to defraud the public that the Mirman/Rose Companies and Daniels Companies were operating businesses with independent management and shareholders, rather than undisclosed “blank check” companies (sometimes referred to as “shells” or “vehicles”) for sale. In furtherance of the Mirman/Rose scheme, Dilley signed false Form 211 applications submitted to FINRA, contributed to false DTC applications, found potential shell buyers, signed an escrow agreement and false attestation letters for shell buyers, and effectuated the bulk transfer of the entire deceptive public float of Mirman/Rose Companies to shell buyers. Eldred similarly schemed with Daniels, Fan and Harrison by filing false Forms 211 with FINRA, signing false securities deposit forms and executing trades in Spartan Securities’ proprietary account, all in support of the manufacture of undisclosed public vehicles – one of which Eldred expressly proposed to acquire himself while its Form 211 was pending.

The complaint also mentions people who were allegedly involved in the creation and sale of the shell companies that are at issue in this lawsuit. Some of them have previously been sued by the SEC for the actions at the heart of the complaint, as listed in the quote below.

From the complaint:

18. Alvin Mirman, of Sarasota, Florida, was the undisclosed control person of Changing Technologies, Inc. (“Changing Technologies”) and an undisclosed control person, along with Rose, of On the Move Systems Corp. (“On the Move”), Rainbow Coral Corp. (“Rainbow Coral”), First Titan Corp. (“First Titan”), Neutra Corp. (“Neutra”), Aristocrat Group Corp. (“Aristocrat”), First Social Networx Corp. (“First Social”), Global Group Enterprises Corp. (“Global Group”), E-Waste Corp. (“E-Waste”) and First Independence Corp. (“First Independence”). Mirman was a defendant in SEC v. McKelvey et al., Case No. 15-cv80496 (S.D. Fla. 2015), in which the Court entered, by consent, a judgment of permanent injunction, officer and director bar and penny stock bar against Mirman. On August 19, 2016, Mirman pled guilty to a one-count Information charging him with conspiracy to commit securities fraud. U.S. v. Mirman et al., Case No. 16-cr-20572 (S.D. Fla.). Both the Commission and criminal actions included his misconduct in connection with the Mirman/Rose Companies. In 2007, without admitting or denying wrongdoing, Mirman consented to being barred by FINRA from association with any FINRA member.

19. Sheldon Rose, of Sarasota, Florida, was the undisclosed control person of Kids Germ Defense Corp. (“Kids Germ”), Obscene Jeans Corp. (“Obscene Jeans”), Envoy Group Corp. (“Envoy”) and First Xeris Corp. (“First Xeris”) and an undisclosed control person, along with Mirman, of On the Move, Rainbow Coral, First Titan, Neutra, Aristocrat, First Social, Global Group, E-Waste and First Independence. The Commission entered, by consent, a cease-and-desist order, officer and director bar and penny stock bar against Rose. In re Sheldon Rose et al., Exch. Act Rel. No. 78894 (Sept. 21, 2016). The Commission later ordered Rose to pay disgorgement and prejudgment interest in the amount of $2,973,916.18. In re Sheldon Rose, Exch. Act Rel. No. 80301 (Mar. 23, 2017). On November 9, 2016, Rose pled guilty to a one-count Information charging him with conspiracy to commit securities fraud. U.S. v. Kass et al., Case No. 16-cr-20706 (S.D. Fla.). Both the Commission and criminal actions included his misconduct in connection with the Mirman/Rose Companies.

20. Michael Daniels, of Palmetto, Florida, was the undisclosed control person of Dinello Restaurant Ventures, Inc., n/k/a AF Ocean Investment Management Co. (“Dinello/AF Ocean”), President, Chief Executive Officer, Chief Financial Officer, Treasurer and Chairman of the Board of Court Document Services, Inc., n/k/a ChinAmerica Andy Movie Entertainment Media Co. (“Court/ChinAmerica”), Principal Executive Officer, Secretary, Treasurer, Chairman of the Board and Chief Financial Officer of Quality Wallbeds, Inc., n/k/a Sichuan Leaders Petrochemical Co. (“Wallbeds/Sichuan”), Secretary, Chief Financial Officer, Treasurer, Director, and Chairman of the Board of Top to Bottom Pressure Washing, Inc., n/k/a Ibex Advanced Mortgage Technology Co. (“TTB/Ibex”), and undisclosed control person of PurpleReal.com Corp. (“PurpleReal”). On April 25, 2018, the Commission filed a Complaint against Daniels related to his conduct in connection with the Daniels Companies. SEC v. Harrison, et al., No. 8:18-cv-01003 (M.D. Fla.).

21. Diane Harrison, of Palmetto, Florida, was the Chief Financial Officer, Secretary, Treasurer and Director of Dinello/AF Ocean, Treasurer, Principal Accounting Officer and Director of Wallbeds/Sichuan, Director and Secretary of TTB/Ibex, and President, Director, and Chairman of the Board of PurpleReal. Harrison, an attorney, is the owner of the law firm Harrison Law, PA, which is based in Florida. Harrison, who is Daniels’ wife, is a defendant in the SEC v. Harrison case based on her conduct with respect to the Mirman/Rose Companies and the Daniels Companies.

22. Andy Fan, of Las Vegas, Nevada, was the President, Treasurer, Chief Executive Officer, Chief Financial Officer and Director of Dinello/AF Ocean and Court/ChinAmerica, and was the President and Director of Wallbeds/Sichuan and TTB/Ibex. The Commission entered, by consent, a cease-and-desist order, officer and director bar and penny stock bar against Fan, and ordered him to pay a civil money penalty of $140,000. In re Andy Z. Fan, Securities Act Rel. No. 10487 (Apr. 25, 2018). The Commission’s action related to Fan’s conduct with respect to certain of the Daniels Companies.

For a good overview of previous shell factory lawsuits by the SEC and criminal prosecutions of the same actions, see this article by the excellent pseudonymous penny stock researcher nodummy. That article lists all the companies and individuals involved.

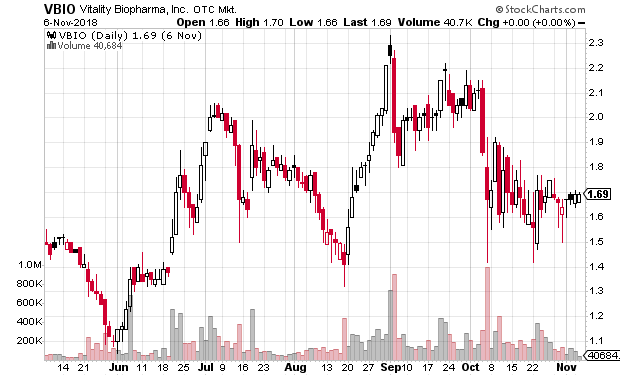

I previously wrote about at least one of the companies involved in this case, Aristocrat Group (ASCC).

Updates and errata:

2019-2-22: Updated to include Spartan Securities Group press release and my opinion thereof.

2019-3-7: Typo corrected (“Thee” changed to “There”).

2019-3-24: Paragraph on my opinion of the strength of the case against Spartan deleted.

Disclaimer: I have no position in any stock mentioned. I am a big user of CourtListener. Otherwise, I have no relationship with any other parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.