Today the SEC suspended trading in NuTech Energy Resources (NERG):

because of questions that have been raised about the accuracy and adequacy of information in the marketplace about the company’s operations and the company’s recent public announcements concerning an unsolicited tender offer.

SEC trading suspension (PDF)

SEC trading suspension order (PDF)

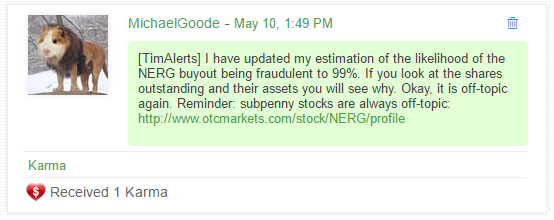

When I first saw the tender offer I immediately concluded that it was almost certainly fraudulent:

Why was this? Well, a quick look at OTCMarkets.com showed that the company had a total of 42,761,863,781 shares outstanding (42.7 billion shares). The buyout offer was for a price of $0.025 per share, which would value NERG at $1.07 billion. That is an absurd price to pay for a company with total assets of $5.7 million.

These kinds of fake buyout offers on sketchy OTC companies seem to happen one or two times per year. I can’t recall the last time I saw a sketchy OTC buyout offer that actually occurred so my default assumption on these is that they are fraudulent. In the world of OTC stocks, that is a very good assumption. There are occasionally real buyouts of OTC companies but those companies are invariably ones with real businesses with assets in proportion to the buyout price.

Disclaimer No position in any stock stock mentioned above. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.