Yesterday the SEC suspended trading in Force Energy (FNRG), which is the first time I have ever seen a listed stock receive an SEC trading suspension. Listed stocks often get halted, delisted, and then suspended, but I have never seen one get suspended prior to the stock being delisted. The executive chairman of the board of directors, Richard St. Julien, was arrested over the weekend so perhaps that led to the extra quick action. The stock was halted by the Nasdaq on Monday, July 20th at 10:21:37 AM with a T12 halt code (additional information requested by Nasdaq). The SEC suspended trading in premarket the next day.

SEC Suspension notice (PDF)

SEC Suspension order (PDF)

The reason given for the suspension was:

due to concerns about the adequacy and accuracy of information available to investors concerning the funding of recent articles and promotions touting FNRG, including for example in articles published on December 9, 2014 and February 26, 2015. Questions have also arisen concerning potential manipulative activity of FNRG’s stock, including transactions between February 25 and April 2, 2015 and the funding of those transactions.

The press release by the Department of Justice contains more information about why St. Julien was arrested:

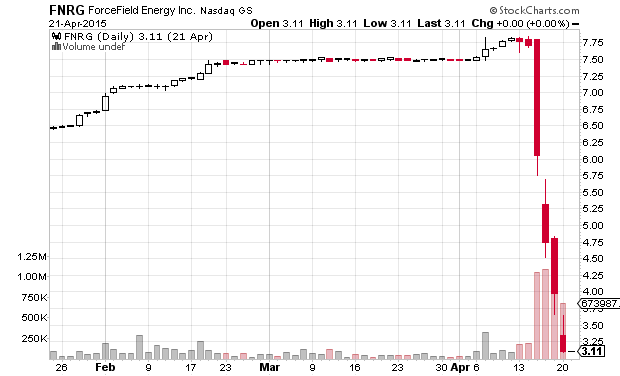

Through his scheme, St. Julien and his co-conspirators deceived the investing public by creating the appearance of genuine trading volume and interest in ForceField’s stock, and as a result, from approximately January 2014 to April 2015, the price of the stock rose from a low of $4.55 per share to a high of $7.82 per share.

FNRG’s stock price had dropped precipitously in the days prior to the halt thanks to a negative report by Mox Reports released on April 15th. That was an excellent (and timely) look at the comopany and it may even have caused the Feds to arrest St. Julien sooner than they had planned.

The promoter that was paid to promote FNRG has been identified as Big Investment Group LLC. See some screenshots of them promoting FNRG.

Disclaimer: I have no position in any stock mentioned. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

not the first. NEWL was suspended too. I believe FU went straight to grey as well

NEWL was delisted to OTCBB during a Nasdaq trading halt and it was never suspended by the SEC. See https://www.sec.gov/Archives/edgar/data/1322587/000114420414044689/v384482_6k.htm

FU was delisted from the NYSE during a halt and was never suspended by the SEC: http://ir.theice.com/press-and-publications/press-releases/nyse-regulation/2014/nyse-mkt-to-suspend-trading-immediately.aspx

Both stocks were dumped to the greys automatically because the length of their halts meant they lost compliance and would have to have a market maker file a form 15c2-11 to get them off the grey market:

“As a result of its recent trading halts, the Company will be required to have a market maker file an application on Form 15c2-11 with FINRA in order to have its common shares trade on an OTC market other than the Grey Market on which it is currently trading”