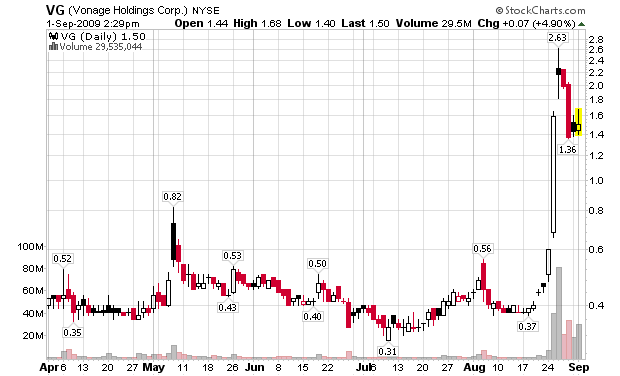

I covered way too early on Vonage Holdings Corp. (Public, NYSE:VG) but still made $1645.36. I predicted that there would be a significant morning panic on Vonage today and I was right. I have to give props to Tim Sykes who made about the same amount of money on a much smaller position, riding VG down from $2.27 to $1.82. (Want to learn how Tim Sykes and I correctly predicted what would happen to Vonage and profited from it? Check out his Pennystocking Part Deux DVD. I have now made over $80,000 since June of 2008 trading Timothy Sykes’ system!) My total profit on VG this week, long and short, was almost $3000. Far from ideal considering my position sizes, but I’ll take it.

Vonage dropped from about $2.00 to $1.40, an easy 30% drop for those who waited just a few more minutes than did I.

Today’s Profit: $1645.36

Weekly Profit: $3506.69

Disclosure: No positions. I have a disclosure policy.

nice reaper, better than me, i made nothing on this one. for some reason I just couldn’t get the feel of it.

Great work, and great call as well.

Stock promoter scum; A friend of my wifes was signing a loan today borrowing money to invest in the latest thing, $CMBI, the latest in cancer treatment. I looked up the company and of course it;s crap. I talked to her husband this morning and it hurt his feelings, thought he was fixing to get rich.

Michael would you pass your eye over this to make sure I’m right, if you don’t mind please.

Preston, I cannot find that ticker anywhere.

Ah, I see it now. Yeah, it looks like crap. I’m always amazed by random people who are not biologists / medical researchers and they still think they can identify the next big drug company. Here are a couple factors against Mabcure (MBCI):

1. Going public through a reverse merger with an OTC BB shell company is not correlated with success. The only successful company of which I am aware that did this was True Religion (TRLG).

2. The company has little money. Even with a successful drug candidate it takes hundreds of millions of dollars to develop it.

3. For comparison, successful biotech GILD had no revenues for something like 14 years as a public company and its main drug candidate was a failure, before it finally developed something and sent it to market. And that is one of the few success stories.

4. Borrowing money to invest in the best company is stupid. Doing it to invest in this dross is idiotic.

10Q: http://pinksheets.com/edgar/GetFilingHtml?FilingID=6754801

Oh wow VG at $1.59 … oyvey.

Preston–I’m busy all weekend. Remind me if I don’t reply by next Tuesday or so.

lol, yeah I thought about you and VG.

Ok I will, if you dont get time it’s no problem. He really don’t need to buy that anyway, and to borrow money to do it is really a poor decision.

covered way too early….!!! VG 1.49

Oh my.. what a beautiful daily chart on VG. Congrats on the profit taking Reaper, even if it was an early out you still made a killing on the week.

As aforementioned, your going to be busy all weekend, so I’ll post this stock for a later reply and for others that check out reapertrades to judge;

I’m looking at PFAP.OTC (otc.. bleh!) with a strong upward momentum in the last 6 months and a nice consolidation over the last 4 weeks. From a Technical standpoint if this holds its 2.35 and breaks 2.40 on Monday, anyone else see this as a potential breakout? On a more speculative longer-term standpoint, the CEO stated in July they applied for NYSE listing and met the 3 week-over $2 requirement last week and “supposedly” will be listed on NYSE “soon”. That information makes me interested in going longer term for the leap onto NYSE but.. yeah.. anyone else have an opinion on this? Am I mistaken or on the 6 month chart from early June-Present that would be considered a cup and handle breakout pattern, no?

Cheers,

-bta

If you had to compare Trading to something else in life…. what would that be?

@john C

For me it’s like catching fish with your hands

One must concentrate, be patient and be calm. It generally pays to have scouted the area ahead of time to better your chances and now the habits of the fish.

The fish may be still or moving but once it notices you it moves extremely quickly. When you decide to act it must be decisively, hesitation will cost you your fish. You often have a very narrow window of opportunity.

Should you miss the fish it is gone and you must move onto another fish.

Should you catch the fish and lose your focus (or grow overconfident) the fish shall slip out of your grasp.

Should you do all that I mentioned above you can have a wonderful catch and feel absolutely tremendous when you do.

But of course you must banish such feelings should you wish to catch another fish.

I like the fish analogy. I also compare trading (as I or Tim Sykes do it) to being a sniper … everything is practice for the few moments when a perfect trade is possible; for the sniper everything is practice until the few times his skill is actually needed.

Very nice Tasty Philosopher

Hey, what is your take on vonage right now for short-term at 1.35? Can you respond to my email? thanks a lot on your insight!