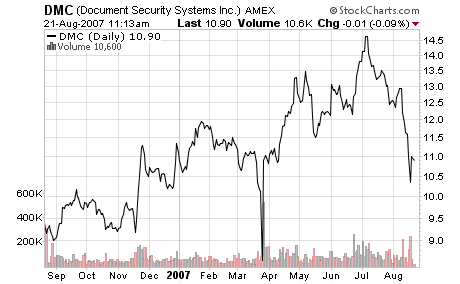

No, I’m not writing about the old school rap group. I’m writing about Document Security Systems, Inc. [[DMC]], which is currently trading at $10.90. Any investor in DMC should do one thing: run!

DMC is a company without a decent product, without any significant assets (tangible or intangible), without any hope of ever making any sales significant enough to justify its current market cap. While the company has doubled its revenues over the last year ($1.75 million in Q1 2007, vs. $0.86 million in Q1 2006), about half of that increase has come from acquisitions ($215k from 2006 acquisition of P3) and from growth in the acquired companies (approximately $200k in sales growth in P3, see p.17 of the 10Q for details). Also, for an intellectual property company, Document Security Systems spends very little on R&D: $109k in the most recent quarter (see the August 9, 2007 press release). Net loss was $2.9 million in the most recent quarter (Q2, ended June 30). As for sales, they were up 10% in Q2 2007 versus Q2 2006. Not bad. But again, the company did make some acquisitions in that time. Oh, and share count was up 6% in the same period of time.

DMC’s one supposed asset is a patent on a document security system that prevents documents from being digitally scanned or copied. The one problem is that the patent was ruled invalid in the United States in 2000 and was ruled invalid in Britain and WIPO just this spring (the company has filed appeals). The company is of course appealing the recent rulings in Europe, but the case against them seems to me to be pretty strong. Also, if the company loses its appeals in Europe, it will not only have its patents invalidated but it will be liable for the court costs of the European Central Bank (which is trying to have the patents ruled invalid). The company did win an identical case in Germany, but it is unclear what would happen if the company won cases in some countries but not others. For a brief synopsis, I suggest reading Asensio.com’s report (Asensio.com is an independent short-selling research outfit). I also suggest reading Asensio’s prior reports on DMC. You can see DMC’s European patent online. I have uploaded a pdf copy of the patent to my website here.

I came across an analyst that upgraded DMC to buy recently (see report). It turns out that the company that hired the analyst is being paid $30,000 per year to ‘to assist with strategies related to the increase of share liquidity and general market presence’. That sounds a lot like ‘pump up the stock’ to me. And while the analyst himself is independent, he would be a fool to bite the hand that feeds him, and he is no fool. CCM Opportunities, the research company that hired the analyst, has only 1 company with a rating of sell or avoid, and of the companies that it rates hold, only one is a microcap (others, like WMT and ADM are megacaps). So in other words, if you pay CCM to get coverage for your microcap company, you can be pretty darn sure that you will get at least a ‘speculative buy’ rating. Not bad for $30k.

DMC has a market cap of $148 million. It has net tangible assets of about $3 million. Because of its huge SG&A costs and resulting losses, the company’s fair value is $0. I suggest avoiding investing in DMC.

I am currently trying to get a copy of the German patent court decision and I am trying to get an opinion from an expert on European patent law. I will post an update when I know more information.

Disclosure: I am short DMC. Short selling is very risky and I do not recommend it. My disclosure policy has patents pending.

1. ARE YOU PRESENTLY SHORT DMC?

2. DO YOU WORK FOR OR HAVE ANY TYPE OF ASSOCIATION WITH ASENSIO?

3. I SAW THE POSTING OF CCM BY DMC, WHERE DID YOU SEE IT?

4. CAN YOU TELL ME ABOUT THE NAKED SHORTS IN DMC (SCARY)?

5. WHAT DO YOU KNOW ABOUT ANY IMPENDING CONTRACTS IF ANY?

6. ANY CURRENT NEWS ON THE DMC / EU SETTLEMENT?

APPRECIATE YOUR INFORMATIVE REPLY

Joe,

1. As always, I disclose when I am short or long a stock about which I write. You can see right above, at the end of my article, I say that I am short.

2. My only association with Asensio is that I read his website Asensio.com (which, by the way, he claims to no longer be involved with).

3. I saw the press release by CCM and the link to the research was in there. I looked at their other research on their website.

4. To do naked shorting, a person has to have the consent/cooperation of their broker or clearing firm. I use Interactive Brokers (and they have their own clearing firm) and they have never been accused of abetting naked shorting. Anyhow, DMC is not on the Reg SHO threshold list, indicating that it has not likely been a target of naked shorting.

5. I have no clue about impending contracts.

6. To my knowledge there is no EU/DMC settlement nor will there be unless the ECB loses in more countries. I am still trying to get details on DMC’s win in Germany.

Chip sent me the following in an email (to which he got my canned response saying that I do not discuss individual stocks in emails):

> In regardes to DMC.

> Your research maybe correct. A couple of questions I have, where have you >seen their product? Do you know the pricipal behind the produt and how it >actually works?

My response is as follows:

Yes, I have seen the ‘product’–at least I have seen hundred dollar bills, which supposedly use the same technology as the product (this is the case that invalidated the company’s patents in the US: http://sec.edgar-online.com/2005/03/31/0001167687-05-000022/Section2.asp

I have read the patents and understand the principles behind the products–simply put, watermarks in the document create moire patterns when it is scanned. As far as the services and products the company actually sells, they are legitimate and probably useful. The only problem is that if the company loses its European patent lawsuits it will have no patent protection whatsoever and anyone will be able to sell identical products and no one will pay licensing fees.

See the relevant patents at the USPO:

http://patft.uspto.gov/netacgi/nph-Parser?Sect1=PTO2&Sect2=HITOFF&u=%2Fnetahtml%2FPTO%2Fsearch-adv.htm&r=69&f=G&l=50&d=PTXT&p=1&p=2&S1=5,018,767&OS=5,018,767&RS=5,018,767

http://patft.uspto.gov/netacgi/nph-Parser?Sect1=PTO2&Sect2=HITOFF&u=%2Fnetahtml%2FPTO%2Fsearch-adv.htm&r=47&f=G&l=50&d=PTXT&p=1&p=1&S1=5,193,853&OS=5,193,853&RS=5,193,853