On March 28, 2018 the SEC announced in a press release that Aegis Capital Corporation (a broker and investment bank) had settled with the SEC following accusations of failing to file suspicious activity reports (SARs) that brokers are required to file.

From the press release:

Broker-dealers are required to file SARs for certain transactions suspected to involve fraudulent activity or have no business or apparent lawful purpose. The SEC’s order found that Aegis failed to file SARs on suspicious transactions that raised red flags indicating the transactions were potentially related to the market manipulation of low-priced securities.

“Aegis failed to meet its AML obligations to report suspicious activity, including when it was faced with specific information alerting the firm to suspicious transactions,” said Antonia Chion, Associate Director and head of the Broker-Dealer Task Force of the SEC’s Enforcement Division. “Given the critical importance of SARs to the regulatory and law enforcement community, brokerage firms must comply with their SAR reporting obligations.”

The SEC’s order found that Aegis willfully violated an SEC financial recordkeeping and reporting rule. Aegis agreed to pay a $750,000 penalty and retain a compliance expert. FINRA also announced a settlement with Aegis today that includes an additional $550,000 penalty.

In addition to the fines against the company, two Aegis employees settled with the SEC and agreed to fines and a third is defending himself against the SEC’s charges:

In a separate settled order, Aegis’ former anti-money laundering (AML) compliance officer Kevin McKenna was found to have aided and abetted the firm’s violations. Aegis CEO Robert Eide was found to have caused them. Without admitting or denying the SEC’s findings, Eide and McKenna agreed to pay penalties of $40,000 and $20,000, respectively. McKenna also agreed to a prohibition from serving in a compliance or AML capacity in the securities industry with a right to reapply.

In a litigated order, the Enforcement Division alleges that another former Aegis AML compliance officer, Eugene Terracciano, failed to file SARs on behalf of Aegis. Terracciano is alleged to have aided and abetted and caused Aegis’ violations. The matter pertaining to Terracciano will be scheduled for a public hearing before an administrative law judge, who will prepare an initial decision stating whether the Enforcement Division has proven the allegations in the order and what, if any, remedial actions are appropriate.

SEC Press Release

FINRA Press Release

SEC Order on Aegis Capital (PDF)

SEC Order on Kevin McKenna and Robert Eide (PDF)

SEC Order on Eugene Terracciano (PDF)

The SEC orders have lots of great details, some of which I have excerpted below. While firms and clients and stocks are not named, I was able to determine two of the stocks given as examples in the orders (Issuers A and F).

First, some details about Aegis’ business from the SEC order on Aegis (emphasis mine):

RESPONDENT

Aegis is a dually-registered investment adviser and broker-dealer with multiple branches and is headquartered in New York, NY. For its fiscal year 2014, Aegis had revenues of approximately $123 million and, for its fiscal year 2015, revenues of approximately $98 million. During those fiscal years, Aegis had revenues of approximately $250,000 and $270,000 from its low-priced securities business. Aegis’ business consists of investment banking, venture capital,

and debt market services as well as full-service retail and institutional advisory and brokerage services. Aegis’ CEO is also the firm’s founder and 100% owner.FACTS

A. Aegis’ Low Priced Securities Business

1. During the relevant period, Aegis had various brokerage customers who transacted in low-priced securities. Several of these customers did so through DVP/RVP accounts. In

DVP/RVP accounts held at Aegis, the customer deposited their shares at another firm in a custodial account, and the sale transactions were effected through Aegis. During the

relevant period, Aegis had relationships with various clearing firms that assisted in effecting low-priced securities transactions.2. Aegis had customers at their branch offices who transacted in low-priced securities.

Several of these customers were foreign financial institutions that effected transactions on

behalf of their underlying customers, all of whom were unknown to Aegis.

So Aegis penny stock business was very small relative to the size of its business overall and it appears that much of the low-priced securities (penny stock) business was with foreign financial firms. One such client (“customer A”) is described as well as its trading in “Issuer A” (quote from the Order on Aegis; emphasis mine):

Illustrative Examples of Transactions in which Aegis Failed to File SARs

i. Customer A

23. Between October 17 and December 27, 2012, an Aegis customer – Customer A – sold approximately 2.1 million shares of Issuer A, which traded on OTC Link (previously

“Pink Sheets”) operated by OTC Markets Group Inc. (“OTC Link”). Customer A held a DVP/RVP account at Aegis and is a private Swiss bank that traded significant volumes of low-priced securities through an omnibus arrangement with Aegis on behalf of the Swiss bank’s underlying clients who were unknown to Aegis.24. At the same time Customer A was selling shares of Issuer A, a stock promotion touting the company’s prospects was underway. Coinciding with the promotional campaign,

Issuer A’s share price fluctuated from a low of $0.51 to a high of $0.93 on average daily volume of 558,792 shares. In the two months prior to October 17, 2012, no shares of

Issuer A traded at all. Thus, Customer A’s trading in Issuer A occurred during a period of a sudden spike in price and volume – which were specific AML red flags identified in

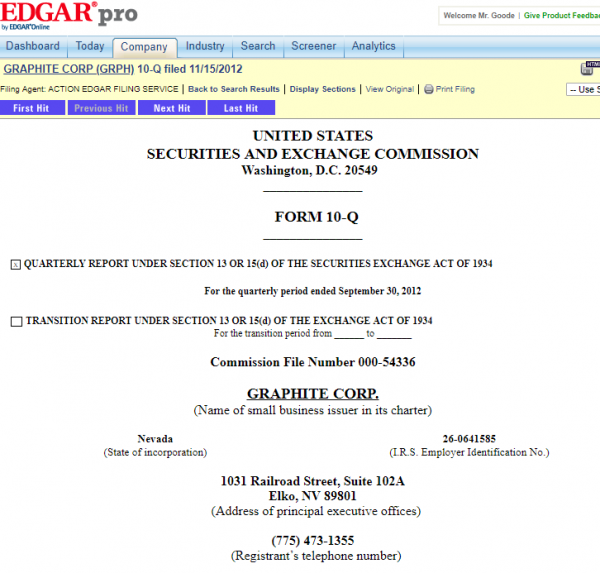

Aegis’ written supervisory procedures.25. Prior to Customer A’s trading in Issuer A, Issuer A had undergone several name changes – again a specific AML red flag identified in Aegis’ written supervisory procedures. Moreover, contrary to the rosy picture of Issuer A painted by the above described promotional campaign, Issuer A’s Form 10-Q for the period ending September 30, 2012 reported that Issuer A had no revenues, a net loss of $143,345, and a “going concern” statement from its management.

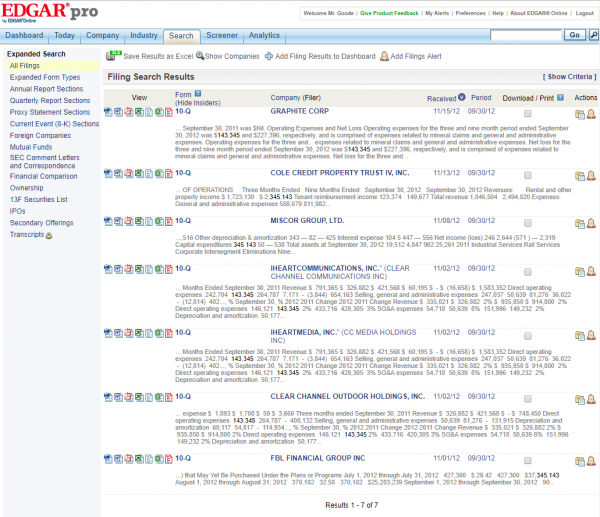

After doing a search on Edgar Pro I discovered that the only company with a net loss of $143,345 in that quarter was Graphite Corp (GRPH at the time) that was a pump and dump at the time (and multiple times since). Therefore Graphite Corp is Issuer A. Here is a screenshot of the results of my search:

And a screenshot of the 10-Q in question:

Another stock traded by Customer A was also a purported graphite company undergoing a pump and dump campaign (Issuer B). From the order on Aegis:

In addition to the suspicious trading noted above, there were other indicia that Issuer B likely was the subject of market manipulation. For example, Issuer B reported in 2013 that it was a world-class graphite company, yet two years earlier it had been a Malaysian publishing company that operated under a different name. Recent changes in an issuer’s name and business was one of the specific AML red flags identified in Aegis’ written supervisory procedures.

“Customer B” is also interesting:

37. Customer B is a British Virgin Islands company based in China that offers consulting and advisory services.

38. In an approximately one month period beginning in April 2013, Customer B sold approximately 200,000 shares of Issuer C through Aegis for proceeds of $2.3 million, or

over $10 per share. Issuer C was listed on NASDAQ.

“Customer D” was yet another foreign company:

55. Another Aegis customer – Customer D – engaged in suspicious low-priced securities transactions for which Aegis did not file a SAR. Customer D was a foreign financial

institution with a DVP/RVP account at the firm and traded on behalf of underlying customers who were unknown to Aegis.

56. Over an approximately six-month period beginning in late May 2013, Customer D sold approximately 457,000 shares of Issuer F for proceeds of approximately $2.8 million. Issuer F traded on OTC Link. Just prior to the trading – and coinciding with a promotional campaign – Issuer F’s share price climbed from $3.90 to $9.39 on

substantially increased volume.

57. Customer D was not the only Aegis customer who traded suspiciously in Issuer F. Starting approximately two months before Customer D’s trading, Customers A and E sold a substantial amount of Issuer F shares for substantial proceeds. Customer E was yet another foreign financial institution with a DVP/RVP account at the firm and traded on behalf of underlying customers who were unknown to Aegis; it was incorporated in New Zealand and operated from Switzerland

Based solely on the description of the stock price and volume, I believe that “Issuer F” is Octagon Resources (OCTX), about which I wrote a blog post. In addition to “Customer D” selling shares of “Issuer F”, “Customer A” and “Customer E” also sold many shares:

Starting approximately two months before Customer D’s trading, Customers A and E sold a substantial amount of Issuer F shares for substantial proceeds. Customer E was yet another foreign financial institution with a DVP/RVP account at the firm and traded on behalf of underlying customers who were unknown to Aegis; it was incorporated in New Zealand and operated from Switzerland.

58. In particular, Customer A sold approximately 638,000 shares of Issuer F for proceeds of approximately $3.7 million while Customer E sold approximately 494,000 shares of Issuer F for proceeds of approximately $3.3 million. Thus, together Customers A and E sold over one million shares of Issuer F for proceeds of approximately $7 million.

I am late to reporting this and I apologize for that (I did previously tweet about it on the day it was announced).

Disclaimer. I have no position in any stock mentioned above. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

One thought on “SEC fines Aegis Capital Corporation after it admits to failing to file SARs”