Motivation is everything. In the penny stock world, most participants’ motivation is plain: greed. The stock manipulators and promoters do what they do so they can get rich quickly. For the most part, their choices are risky and unethical but smart: only some of them pay the ultimate price of going to prison. Many end up paying settlements on only a portion of their fraudulent activity and still end up with a nice profit and a retirement in some sunny locale. On the other hand, the buyers of penny stocks are stupid and greedy: the vast majority will lose most of their money. A few will make nice profits but only those who are cynical, smart, and a little lucky. There are also the regulators: they are motivated by a combination of trying to achieve justice and trying to make themselves look good and advance their careers.

But there is another group involved in penny stocks that many ignore. These are the amateur sleuths, the gadflies, the crusaders against fraud. Some of them are traders, although they are motivated not just by profits — they put effort into research and whistleblower tips to the SEC even when they have no position. But some of the most prolific anti-fraud crusaders don’t even trade penny stocks. There are just a handful of whom I’m aware although I am sure there are others who submit whistleblower complaints to the SEC and never mention things publicly. The most famous is Yolanda Holtzee, who has been doing this for over a decade and seemingly knows every single SEC enforcement agent of note as well as FBI agents and US Attorneys. Janice Shell is also quite well known and she has been posting on investorsHub (primarily on the DD Support Board and Fraud Research Team) for longer than I can remember. The WSJ wrote about her in 2000. Another researcher, known only as ‘nodummy’, has posted on InvestorsHub and then when he saw his research on pump and dumps being used by others to profit from trading those stocks, started a service offering his research (Promotion Stock Secrets, now known as Pennystocks.buzz). I have repeatedly linked to his research, particularly on AwesomePennystocks.

But writing about penny stock frauds and informing regulators about them is one thing. It would be quite another thing to actually do something to directly impede the fraud. That brings me to the most enigmatic penny stock crusader I’ve encountered: George Sharp. The reason to bring him up now is that I just recently came across the news from last June 13th that he had been retained by OTCMarkets.com as a consultant. Before getting into that, I should review what I have previously written about Sharp.

I first became aware of George Sharp (or at least his actions) back in 2011 because of his legal battle with Michael Osborn, a convicted felon at the time who was later convicted of another felony and lost a libel suit brought by Sharp. Also, on May 17th, 2011 George Sharp filed a lawsuit against Writers Film Group (WRIT), an AwesomePennyStocks promotion. This wasn’t even his first lawsuit against a public company. It appears that his first lawsuit was on September 24th, 2010 against Yasheng Eco-Trade Corporation (that suit was filed on 10/19/2009 as 37-2009-00100574-CU-MC-CTL in the Superior Court of California, County of San Diego ). He also acquired some attention by suing Arena Pharmaceuticals (a real biotech; not just a pure pump & dump scam).

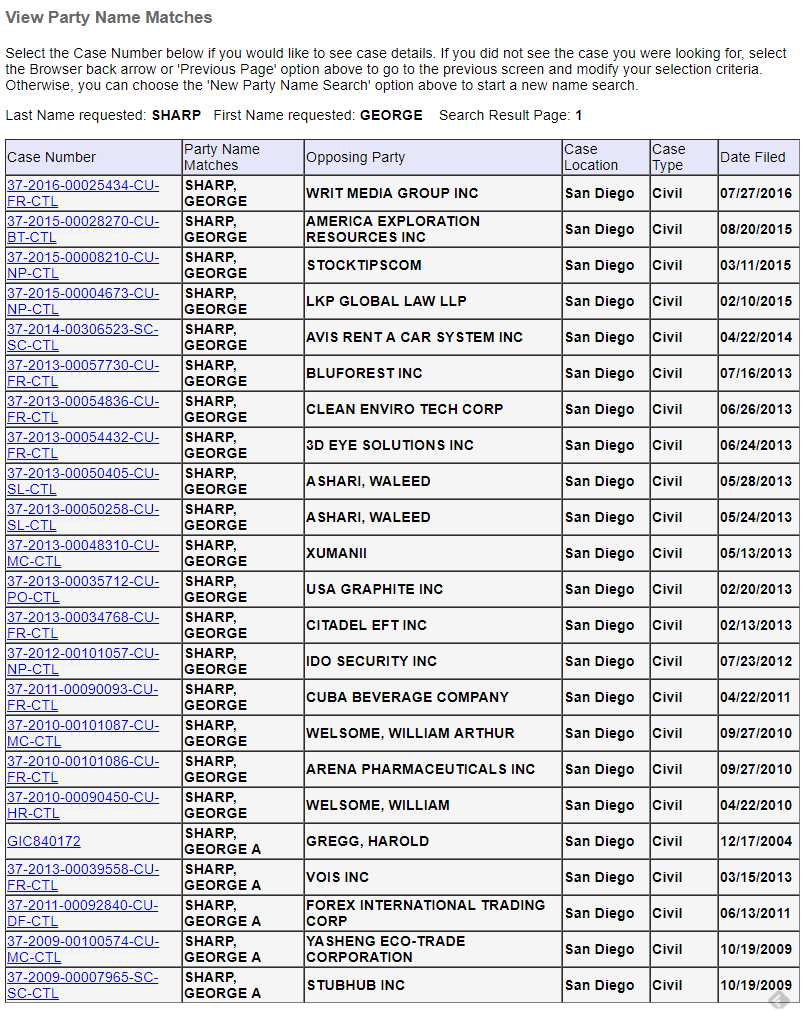

If you search for Sharp, George on the Superior Court of California, County of San Diego case locator (in San Diego city only to exclude a few cases that involve a different George Sharp), you can see just how litigious Sharp has been (while I am sure that most of the suits below were filed by Sharp, I have not examined every one and it is possible that one or two of them were filed by a different George Sharp). In chronological order, the public companies that Sharp sued were Yasheng Eco-Trade Corporation (10/19/2009), Arena Pharmaceuticals (ARNA; 9/27/2010), Cuba Beverage Company (CUBV; 4/22/2011), Forex International Trading Corp (FXIT and FXITE; 6/13/2011), IDO Security Inc (IDOI; 7/23/2012), Citadel EFT Inc (CDFT; 2/13/2013), USA Graphite Inc (USGT; 2/20/2013), Xumanii Inc (XUII; 5/13/2013), 3D Eye Solutions Inc (TDEY; 6/24/2013), Clean Enviro Tech Corp (CETC; 6/26/2013), Avis Rent a Car System Inc (this was just a consumer complaint in small claims court; 4/22/2014), America Exploration Resources Inc (AREN; 8/20/2015), and Writ Media Group Inc (WRIT; 7/27/2016). In addition to these lawsuits against public companies (all but Avis and Arena Pharmaceuticals traded over the counter and were allegedly pump and dump scams), Sharp sued LKP Global Law LLP (2/10/2015), which had represented penny stock companies, and Stocktips.com (3/11/2015), a stock promoter. This list is not even exhaustive because Sharp filed other lawsuits in other jurisdictions, including a lawsuit against Writers’ Film Group (WRIT) filed on 9/4/2011 (Los Angeles County Division of California Superior Court Case No. BC461550).

Details on a few of the lawsuits

Note: Most of all of these suits were filed with numerous John Doe defendants whose names were added to the lawsuit once their names became known to Sharp. Rather than show only the names listed in the original complaint for each of the lawsuits I have shown every name listed as a defendant on the list of parties to the lawsuits. In parentheses after each company that was a public company I have included its ticker at the time of the lawsuit.

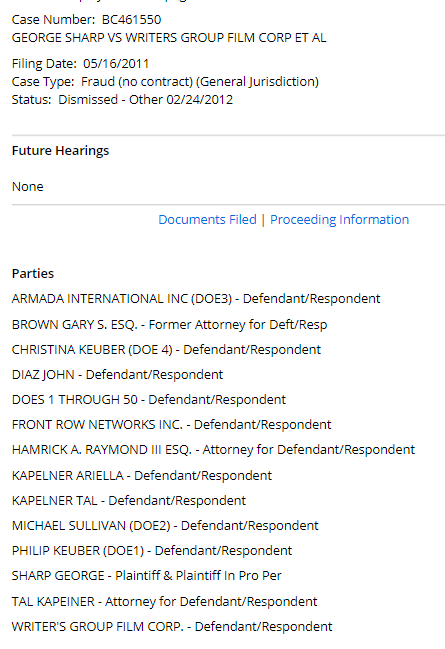

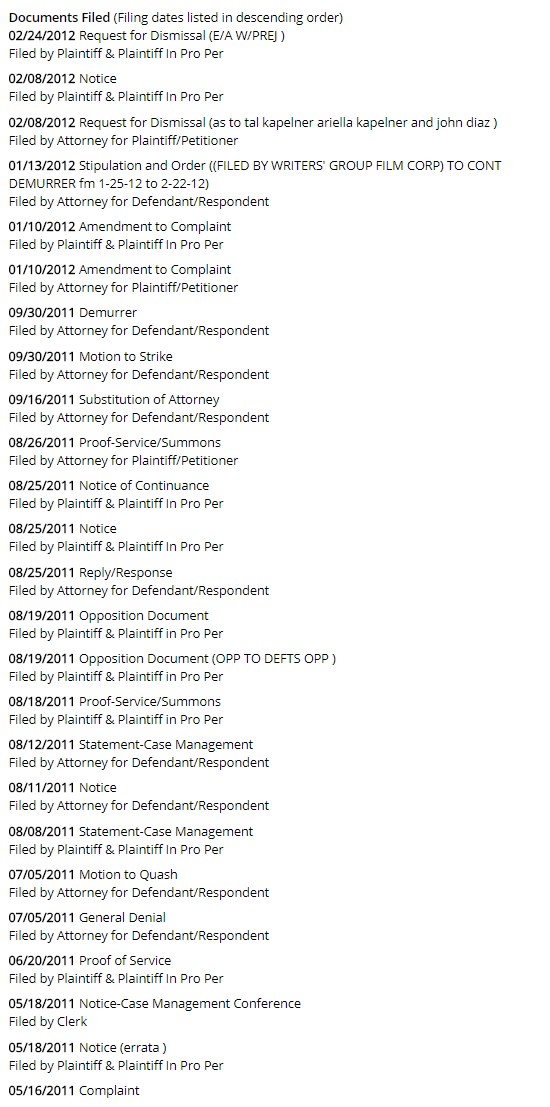

George Sharp v. Writers’ Film Group (WRIT), Armada International Inc, Christina Kueber, John Diaz, Front Row Networks Inc, Ariella Kapelner, Tal Kapelner, Michael Sullivan, Philip Kueber

Writers’ Film Group (WRIT) was promoted by Crazypennystocks.com and related websites (a predecessor to AwesomePennyStocks) back in 2011. This is the first lawsuit of Sharp’s I remember seeing. Sharp filed his lawsuit against the company on 9/4/2011 (Los Angeles County Division of California Superior Court Case No. BC461550) and put out a press release about the lawsuit. Defendants Philip Kueber, Christina Kueber, Michael Sullivan, and Armada International were all added as Doe defendants after the suit was filed. Sharp filed for dismissal against defendants Tal Kapelner, Ariella Kapelner, and John Diaz on 2/8/2012. A press release by Writers’ Film Group in 2013 referring to the Kapelners and Diaz states “the settlement stated that they did not engage in any wrongdoing.” Sharp filed for the case against Writers’ Film Group and the remaining defendants to be dismissed on 2/24/2012. In both cases the dismissals were with prejudice (meaning that Sharp could not re-file the suit later). This is one of the most common endings for civil suits and is usually indicative of a settlement of some kind. Unfortunately for bystanders like us, there is no way to know details of such a settlement most of the time — a settlement could be big or small and could favor either side. Sharp litigated the whole case in propria persona (without an attorney). Among Sharp’s suits, this was one of the shortest (lasting about six months).

(Note: the register of parties incorrectly spells the last names of Christina and Philip Kueber as ‘Keuber’. Philip Kueber is best known for pleading guilty to conspiracy to commit stock fraud in the case of Cynk Technology).

However, the settlement was actually made public in George Sharp’s subsequent lawsuit against WRIT Media Group (slightly different name, same corporate shell, same ticker). From that complaint:

On or about February 16, 2012, the remaining parties in the 2011 case

entered into a Settlement Agreement whereby SHARP was to receive $10,000 in cash and ten million free-trading shares of WRIT stock. SHARP received the settlement payment and stock as agreed, thus making SHARP a shareholder of WRIT and entitling him to all the rights and protections afford any shareholder. SHARP remains a shareholder of WRIT to this day.

Perhaps most notable about that settlement is that Sharp did not ever sell those shares. Obviously Sharp is not an idiot and knows how penny stocks work — if he were only in this for the money then the obvious thing to do would be to sell the shares right away. Even for someone who is not just in it for the money, the smart thing to do is sell. But for some reason Sharp did not sell those shares and he was eventually diluted to almost nothing. That brings me to his follow-up suit against the successor company to Writers’ Film Group.

George Sharp v. Writ Media Group (WRIT), Inc & Eric Mitchell

On 7/27/2016 George Sharp filed suit against Writ Media Group, Inc and Eric Mitchell (President & CEO of the company). The case is 37-2016-00025434-CU-FR-CTL in the Superior Court of California, County of San Diego. See the original complaint. Here are a couple excerpts from the complaint (emphasis added by me):

7. On or about May 16, 2011, the Plaintiff filed litigation (“the 2011

case”) against Defendant WRIT and other defendants for Fraud, Negligent Misrepresentation, Violation of California Corporations Code Section 25400 et seq; Violation of California Unfair Business Practices Act – Business & Professions Code Section 17200; and Violation of California Unfair Business Practices Act – Business & Professions Code Section 17500 (LA Superior Court Case No. BC461550).

8. On or about February 16, 2012, the remaining parties in the 2011 case entered into a Settlement Agreement whereby SHARP was to receive $10,000 in cash and ten million free-trading shares of WRIT stock. SHARP received the settlement payment and stock as agreed, thus making SHARP a shareholder of WRIT and entitling him to all the rights and protections afford any shareholder. SHARP remains a shareholder of WRIT to this day.

…

14. On February 4, 2014 the Defendants executed a one for one thousand reverse split of stock reducing the number of shares outstanding in WRIT from at approximately 5.7 billion shares to approximately 5.7 million shares, effectively wiping out the holdings of small shareholders.

15. From February 4, 2014 to July 24, 2015, the Defendants issued

approximately 455.5 million shares of WRIT.

16. From June 11, 2014 to June 13, 2014 WRIT stock was promoted by various known stock touts who specialize in creating hype for intrinsically worthless penny stocks in order to enable certain insiders to divest themselves of shares. The promotion created an increase in share price and trading volume of WRIT stock. The stock touts usually included a disclaimer within their emails identifying their compensation for services rendered.

17. On July 24, 2015 the Defendants executed a one for five hundred

reverse split of stock reducing the number of shares outstanding in WRIT from at approximately 461.2 million shares to 2,306,061 shares, once again effectively wiping out the holdings of small shareholders

Of the causes of action listed in the complaint, the most interesting to me is the third cause of action, “breach of fiduciary duty”. That cause of action was only asserted because Sharp was a shareholder at the time of the suit. If he had sold his shares after the earlier settlement he would not have been able to assert this cause of action.

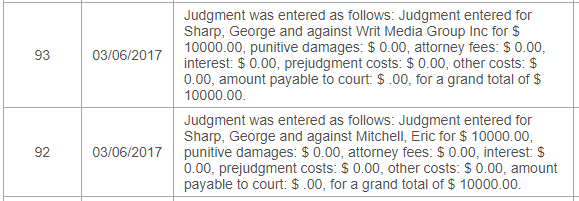

On February 28, 2017, Mitchell and Writ Media Group offered to accept judgments of $10,000 each payable to Sharp, with each party paying their own legal costs. These offers were accepted by George Sharp. Those two judgments were quickly paid.

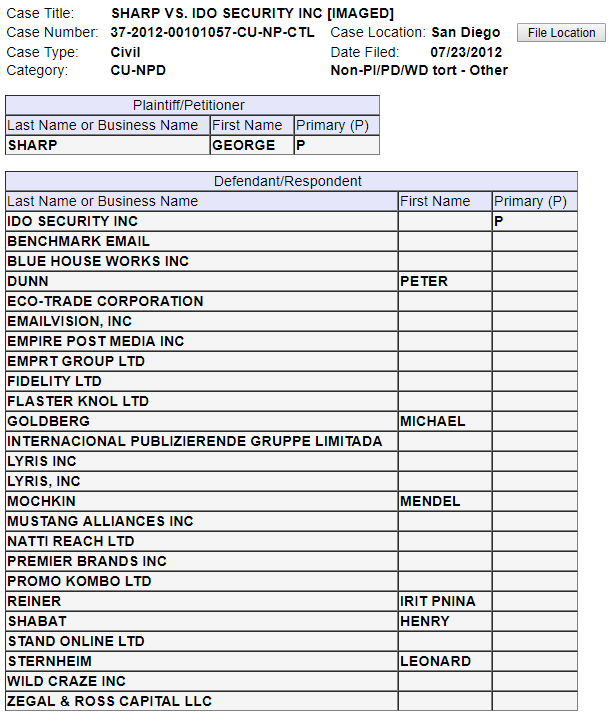

George Sharp v. IDO Security Inc (IDOI), Benchmark Email, Blue House Works Inc, Peter Dunn, Eco-Trade Corporation (BOPT), Emailvision Inc, Empire Post Media Inc (EMPM), EMPRT Group Ltd, Fidelity Ltd, Flaster Knol Ltd, Michael Goldberg, Internacional Publizierende Gruppe Limitada, Lyris Inc, Mendel Mochkin, Mustang Alliances Inc (MSTG), Natti Reach Ltd, Premier Brands Inc (BRND), Promo Kombo Ltd, Irit Pnina Reiner, Henry Shabat, Stand Online Ltd, Leonard Sternheim, Wild Craze Inc (WILD), & Zegal & Ross Capital LLC

This is one of the more interesting and complicated of the suits filed by Sharp. It was also briefly mentioned in a Wall Street Journal article in 2015. This was against a large number of defendants, many of which likely never existed (they were made up companies), promoted by, employed by the promoted companies, or connected to the spam stock promoter that was known most commonly as StockCastle (though they had many names with at least dozens of different websites). See my blog post on some of their pumps. On July 24th, 2012 George Sharp filed a press release about the lawsuit he had just filed. See the complaint. The case lasted for just under two years (until April 8th, 2014 when Sharp requested dismissal). The case was 37-2012-00101057-CU-NP-CTL in the Superior Court of California, County of San Diego. You can find the court documents by searching that case number here. With 377 actions recorded in the case I will not attempt to reproduce the full list here. Below is the list of defendants:

The two causes of action listed in the complaint were “Violations of California Restrictions on Unsolicited Commercial E-mail Advertisers (Cal. Bus. & Prof. Code § 17529.5)”, which is a law prohibiting spam email, and “Violations of Consumers Legal Remedies Act (Cal. Civ. Code§ 1750 et seq.)”. The Consumers Legal Remedies Act (CLRA) “applies to deceptive acts intended to result in the sale or lease of goods or services as well as acts that actually result in the sale or lease of goods or services”.

On January 17th, 2013, Sharp filed a press release announcing that he had subpoenaed Luke Zouvas, an attorney who had “contacted him [Sharp] on behalf of a client, in order to settle in advance any future claims that Mr. Sharp may have against that client.” (Luke Zouvas was sued on April 26, 2016 by the SEC for an unrelated “pump and dump scheme”). Unfortunately, I found no mention of Zouvas in the court documents from around January 17, 2013 or in any of the other court documents I read.

Of all the parties named in the suit, most of the presumed promoters (the various names they used in their spam emails) were dismissed from the case presumably because they did not actually exist. IDO Security and Mustang Alliances Inc litigated the case and Sharp did not win judgments against them (he likely settled with them — he filed to have both dismissed from the case with prejudice and the dismissal minute order states “Attorney David Harter notifies the Court, case has settled except as to defaulted defendants“).

Empire Post Media litigated and lost. Premier Brands Inc and Wild Craze Inc did not litigate and Sharp won default judgements against them. George Sharp apparently reached a settlement with defendant Blue House Works Inc (see Blue House Works’ earlier first amended answer to the complaint). Blue House Works Inc “provided the MyNewsletterBuilder email marketing service platform from which Plaintiff alleges that he received unsolicited emails.”

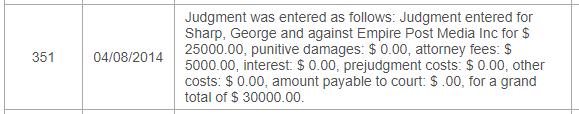

On April 8th, 2014 Sharp was awarded a judgment for $30,000 against Empire Post Media (EMPM, one of the promoted companies).

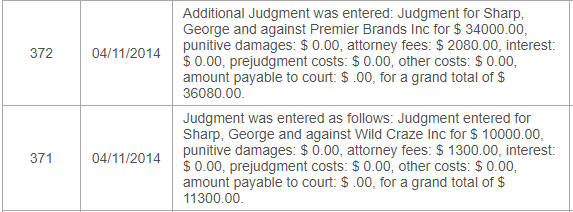

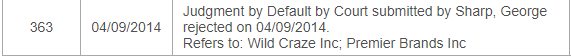

On April 11th, 2014 Sharp was awarded a judgment for $36,080 against Premier Brands Inc (BRND) and $11,300 against Wild Craze Inc (WILD; both companies promoted by the spammers).

Both of these were judgments by default:

Perhaps the most interesting thing I found in all the filings from this case is the following declaration of David J. Harter, George Sharp’s attorney, from a motion to compel IDO Security to produce a PMK (primary most knowledgeable person) to depose. That link also contains the full deposition of Michael Goldberg of IDO Security.

In January 2000, I formed the Law Offices of David J. Harter, APC. My standard hourly rate for litigation cases is between $400.00 and $450.00 per hour depending on the nature of the case. I am billing

Mr. Sharp based on my lowest standard hourly rate for my services in connection with this action.…

Hence, the total legal time expended with respect to this motion to compel the deposition totals 10 hours. Based on my lowest standard

hourly rate the reasonable attorney’s fees incurred total $4,000.00.

That is certainly a reasonable rate for an experienced litigator. The point is, with that kind of work required by his lawyer, a not insignificant portion of the settlements Sharp received and judgments he was awarded and able to collect on must have gone to his lawyer. In this case, while Sharp “filed this action in propria persona, he substituted in counsel [David J. Harter] on December 30, 2013 ” (that is from this minute order).

George Sharp filed on 3/24/2014 for dismissal with prejudice of the lawsuit against IDO Security et al (and his attorney notified the court that the case had settled except for the defendants that defaulted). On 4/3/2104 Sharp was awarded a judgment by stipulation in the amount of $30,000 ($25,000 in damages plus $5,000 in attorney fees) against Empire Post Media, Inc (EMPM). The case was dismissed without prejudice.

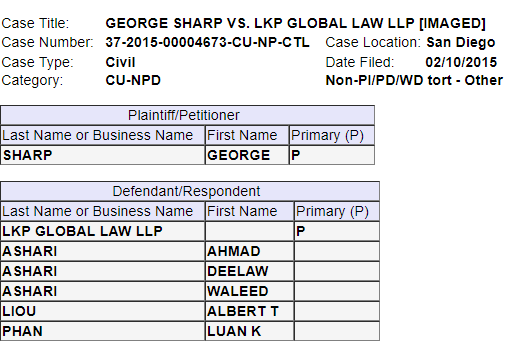

George Sharp v. LKP Global Law LLP, Ahmad Ashari, Deelaw Ashari, Waleed Ashari, Albert T Liou, and Luan K Phan

George Sharp filed a suit against LKP Global Law LLP and some of the lawyers there on 2/10/2015. Below is the list of parties in the suit:

Unlike some of his other suits, Sharp did not file this pro se / in propria persona but was represented by his long-time lawyer David Harter. The case was 37-2015-00004673-CU-NP-CTL in the Superior Court of California, County of San Diego. At the end of 2016 the case was transferred from San Diego to Los Angeles. See the original complaint (pdf). This lawsuit was a complaint for “1) MALICIOUS PROSECUTION 2) ABUSE OF PROCESS” against the law firm representing pump and dump Xumanii (XUII), which had sued Sharp for exposing Xumanii. To quote from Sharp’s complaint:

9. This action arises out of the Ashari Class Action wherein Ashari, LKP, Phan and Liou filed a frivolous class action complaint against Plaintiff alleging that Plaintiff engaged in market manipulation and fraud concerning the stock of Xumanii, Inc. (“XUII”) in violation of

Corporations Code sections 25400(d) and 25500. The class action was filed in retaliation, among other things, for SHARP’s exposure of the XUII stock manipulation and for his own action against XUII alleging violations of California’s anti-SPAM email statute.

10. In response to the Ashari Class Action, Plaintiff filed a motion to strike the complaint pursuant to Code of Civil Procedure section 425.16, known as the Anti-SLAPP Statute. The Court granted the Anti-SLAPP motion and dismissed the Ashari Class Action with prejudice finding, among other things, that Ashari and his attorneys had failed to present evidence to establish any element of Ashari’s one and only cause of action. The Court also awarded Plaintiff his fees and costs in the Ashari Class Action in excess of $33,000. True and correct copies of the Notice of Ruling granting the Anti-SLAPP motion and the Notice of Entry of Judgment are attached hereto respectively as Exhibits A & B. The Ashari Class Action was frivolous and filed without probable cause because Ashari and his attorneys had failed to present evidence to establish any element of Ashari’s one and only cause of action and because LPK, Phan and Liou admitted to the Court that they had no evidence to establish any element of Ashari’s one and only cause of action.

Prior to that lawsuit against Sharp, LKP had litigated another lawsuit by a penny stock company against Sharp. That suit was:

known as Forex International Trading Corp. v. George Sharp, San Diego Superior Court Case No. 37-2011-00092840 (the “Forex Action”). That suit was also dismissed as frivolous pursuant to Plaintiff’s Anti-SLAPP motion. The Court also awarded Plaintiff his fees and costs in the Forex Action in excess of $12,000.

The quote above is again from the complaint against LKP Global Law LLP.

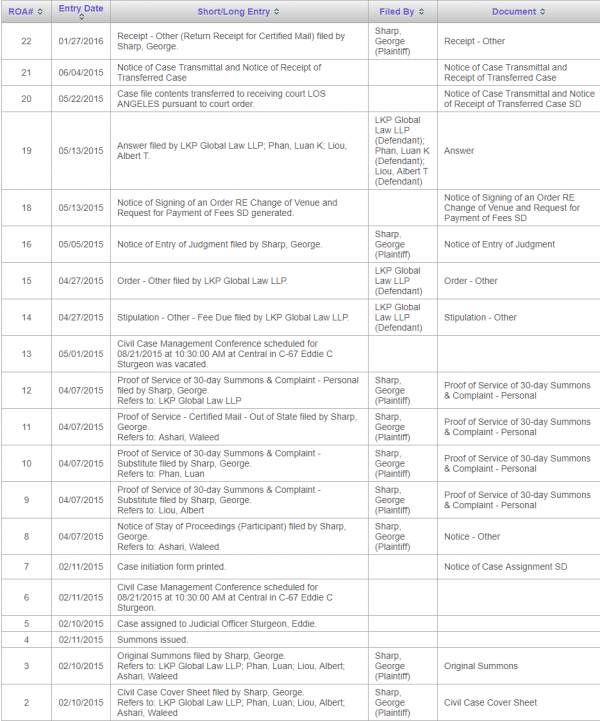

See the San Diego register of actions (click to enlarge):

The case in the Superior Court of California, Los Angeles County, is Case Number: BC583586 GEORGE SHARP VS LKP GLOBAL LAW LLP ET AL. Filing Date: 06/02/2015. See the summary here by searching the case number. The case was dismissed on 6/15/2017. See Sharp’s motions to compel from 4/22/2016, 4/26/2016, and 4/26/2016. There was a settlement conference scheduled for May 10, 2017 and with the case having not gone to trial and being dismissed with prejudice I believe the parties settled (although there is no way for me to know what any settlement entailed).

Below is the register of actions:

06/15/2017 Request and Entry of Dismissal (W/PREJUDICE AND AS TO THE ENTIRE ACTION OF ALL PARTIES AND ALL CAUSES OF ACTION )

Filed by Attorney for Plaintiff/Petitioner05/22/2017 Notice of Change of Address

Filed by Attorney for Plaintiff/Petitioner02/21/2017 Notice-Change of Address

Filed by Attorney for Plaintiff/Petitioner01/19/2017 Stipulation and Order (STIPULATION AND ORDER CONTINUING TRIAL AND RELATED DATES: MSC c.f. 5-10-17 to 9-12-17; FSC c.f. 5-19-17 to 9-21-17; J.T. c.f. 5-30-17 to 10-2-17 )

Filed by Attorney for Deft/Respnt12/19/2016 Notice of Continuance

Filed by Clerk11/23/2016 Notice (OF DISASSOCIATION OF COUNSEL )

Filed by Attorney for Pltf/Petnr10/21/2016 Declaration (SUPPLEMENTAL DECLARATION OF JODY BORRELLI IN SUPPORT OF DEF MOTION TO COMPEL )

Filed by Attorney for Deft/Respnt10/19/2016 Opposition Document (TO MOTION TO COMPEL FURTHER RESPONSES TO FORM INTERR HRG: 11/1/16 )

Filed by Attorney for Deft/Respnt10/19/2016 Statement of Facts (SEPARATE STATEMENT IN SUPPORT OF OPPO TO MTN TO COMPEL FURTHER )

Filed by Attorney for Deft/Respnt10/18/2016 Opposition Document (TO MOTION TO COMPEL FURTHER HRG: 10/31/16 )

Filed by Attorney for Deft/Respnt10/18/2016 Statement of Facts (SEPARATE STATEMENT IN SUPPORT OF OPPOSITION TO MOTION TO COMPEL HRG: 10/31/16 )

Filed by Attorney for Deft/Respnt10/17/2016 Reply/Response

Filed by Attorney for Pltf/Petnr10/13/2016 Opposition Document (CORRECTED OPPOSITION TO PLTF MOTION TO COMPEL FURTHER RESPON TO REQUEST FOR PROD OF DOCU/ DECL OF JODY BRRELLI )

Filed by Attorney for Deft/Respnt10/13/2016 Opposition Document (NOTICE OF ERRATA RE: OPPOSTION TO PLT’S MOTION TO COMPEL FURTHER RESPONSES/SEPARATE STATEMENT )

Filed by Attorney for Deft/Respnt10/13/2016 Statement of Facts (CORRECTED SEPARATE STATEMENT IN SUPPORT OF OPPO TO PLTF MTN TO COMPEL FURTHER HRG: 10/24/16 )

Filed by Attorney for Deft/Respnt10/11/2016 Opposition Document (TO PLAINTIFF MOTION TO COMPEL FURTHER RES TO PROD OF DOC )

Filed by Attorney for Deft/Respnt10/11/2016 Opposition Document (TO MTN TO COMPEL FURTHER RESP TO REQ FOR PRODU DECL OF J. BORRELLI/SEP STATE IN OPPO )

Filed by Attorney for Deft/Respnt09/27/2016 Notice of Association of Attorneys

Filed by Attorney for Pltf/Petnr09/26/2016 Stipulation and Order (STIPULATION AND ORDER CONTINUING MANDATORY SETTLEMENT CONFERENCE FROM 4-13-17 TO 4-20-17; [NOTE: MSC WAS CONTINUED PREVIOUSLY FROM 10-5-16 TO 4-13-17 PER STIP. AND ORDER OF 6-23-16])

Filed by Attorney for Pltf/Petnr06/23/2016 Stipulation and Order (STIPULATION AND ORDER CONTINUING TRIAL AND FINAL STATUS CONFERENCE FROM 11-14-16 AND 11-4-16, RESPEC- TIVELY, TO 5-30-17 AND 5-19-17, RESPECTIVELY; MSC SET FOR 4-13-17; DISCOVERY/MOT. CUT-OFFS EXTENDED)

Filed by Attorney for Pltf/Petnr06/10/2016 Response (TO DEFEF’S NOTICE OF RELATED CASES )

Filed by Attorney for Pltf/Petnr06/03/2016 Notice-Related Cases

Filed by Attorney for Deft/Respnt04/26/2016 Motion to Compel (FURTHER RESPONSES HRG 10/31/16 )

Filed by Attorney for Pltf/Petnr04/26/2016 Statement of Facts (SEPARATE STATEMENT OF ITEMS IN DISPUTE RE: FORM INTERROGATORIES )

Filed by Attorney for Pltf/Petnr04/26/2016 Motion to Compel (FURTHER RESPONSES HRG: 11/1/16 )

Filed by Attorney for Pltf/Petnr04/26/2016 Statement of Facts (SEPARATE STATEMENT OF ITEMS IN DISPUTE RE REQUESTS FRO ADMISIONS, SET ONE, )

Filed by Attorney for Pltf/Petnr04/22/2016 Motion to Compel (FURTHER RESPONSES )

Filed by Attorney for Pltf/Petnr04/22/2016 Statement of Facts (separate statement in dispute )

Filed by Attorney for Pltf/Petnr04/22/2016 Motion to Compel (FURTHER RESPONSES HRG: 10/24/16 )

Filed by Attorney for Pltf/Petnr04/18/2016 Notice (OF WITHDRAWAL OF MOTION TO COMPEL )

Filed by Attorney for Deft/Respnt04/18/2016 Declaration (NOTICE OF TERMNATION OR MODIFICATION OF STAY )

Filed by Attorney for Pltf/Petnr04/18/2016 Request to Enter Default (IS REJECTED AS ASHARI #28. )

Filed by Attorney for Pltf/Petnr04/13/2016 Opposition Document (TO MOTION TO COMPEL RESPONSES )

Filed by Attorney for Pltf/Petnr04/13/2016 Statement of Facts (SEPARATE STATEMENT IN SUPPORT OF OPPOSITION TO MOTION TO COMPEL )

Filed by Attorney for Pltf/Petnr04/04/2016 Statement-Case Management (HRG: 3/29/16 )

Filed by Attorney for Pltf/Petnr03/21/2016 Statement-Case Management

Filed by Attorney for Defendant/Respondent03/15/2016 Statement-Case Management

Filed by Attorney for Deft/Respnt01/26/2016 Statement of Facts (SEPARATE STATEMENT IN SUPPORT OF MOTION TO COMPEL HRG: 4/22/16 )

Filed by Attorney for Deft/Respnt01/26/2016 Motion to Compel (FURTHER RESPONSES TO REQUEST FOR ADMISSIONS )

Filed by Attorney for Deft/Respnt01/12/2016 Statement-Case Management

Filed by Attorney for Pltf/Petnr01/08/2016 Statement-Case Management

Filed by Attorney for Deft/Respnt01/04/2016 Statement-Case Management

Filed by Attorney for Deft/Respnt10/09/2015 Notice (OF ERRATA RE NTC OF CMC )

Filed by Attorney for Pltf/Petnr10/09/2015 Statement-Case Management

Filed by Attorney for Pltf/Petnr10/09/2015 Proof-Service/Summons

Filed by Attorney for Pltf/Petnr09/14/2015 Statement-Case Management

Filed by Attorney for Deft/Respnt09/08/2015 Notice (TAKING MOTION TO QUASH OFF CALENDAR 2/8/16 )

Filed by Attorney for Pltf/Petnr09/08/2015 Notice (OF WITHDRAWAL OF MOTION TO STAY AND QUASH DEPOSTITION SUBPOENA FOR THE PRODUCTION OF BUSINESS RECORDS )

Filed by Attorney for Deft/Respnt09/04/2015 Answer to Complaint

Filed by Attorney for Deft/Respnt09/03/2015 Answer to Complaint

Filed by Attorney for Deft/Respnt07/27/2015 Joinder (TO NONPARY TO MOTION TO STAY )

Filed by Attorney for Pltf/Petnr07/24/2015 Statement of Facts (for pumpsanddumps. com )

Filed by Attorney for Real Pty in Interest07/24/2015 Motion to Quash

Filed by Attorney for Real Pty in Int07/21/2015 Motion to Quash (DEPOSITION )

Filed by Attorney for Pltf/Petnr07/21/2015 Statement of Facts

Filed by Attorney for Pltf/Petnr07/20/2015 Objection Document (TO DEPOSITION SUBPOENA (ISSUED TO SCOTTRADE, INC.) )

Filed by Attorney for Pltf/Petnr07/20/2015 Objection Document (TO DEPOSITION SUBPOENA )

Filed by Attorney for Pltf/Petnr07/20/2015 Objection Document (TO DEPOSITION SUBPOENA/ (ISSUE TO FMR, LLC) )

Filed by Attorney for Pltf/Petnr07/20/2015 Objection Document (TO DEPOSITION/ ISSUED TO TRADEKING GROUP, )

Filed by Attorney for Pltf/Petnr07/20/2015 Objection Document (TO DEPOSITION SUBPOENA (ISSUED TO THE CHARLES SCHWAB CORP.) )

Filed by Attorney for Pltf/Petnr07/20/2015 Objection Document (TO DEPOSITION SUBPOENA (ISSUED TO OMGEO, LLC) )

Filed by Attorney for Pltf/Petnr07/20/2015 Objection Document (TO DEPOSITION SUBPOENA (ISSUED TO THE DEPOSITORY TRUST & CLEARING CORP.) )

Filed by Attorney for Pltf/Petnr07/20/2015 Objection Document (TO DEPOSITION SUBPOENA (ISSUED TO PROFESSIONAL TRADING SOLUTIONS, INC.) )

Filed by Attorney for Pltf/Petnr07/20/2015 Objection Document (TO DEPOSITION SUBPOENA (ISSUED TO SCOTTSDALE CAPITAL ADVISORS CORP) )

Filed by Attorney for Pltf/Petnr07/20/2015 Objection Document (TO DEPOSITION SUBPOENA (ISSUED TO TD AMERITRADE, INC. )

Filed by Attorney for Pltf/Petnr07/20/2015 Objection Document (TO DEPOSITION SUBPOENA (ISSUED TO TRADE STATION GROUP, INC.) )

Filed by Attorney for Pltf/Petnr07/06/2015 Amendment to Complaint (DOE 1, 2,3,4,5,6,7,8,9 )

Filed by Attorney for Pltf/Petnr06/30/2015 Substitution of Attorney

Filed by Attorney for Deft/Respnt06/23/2015 Notice

Filed by Attorney for Pltf/Petnr06/18/2015 Notice (of cmc )

Filed by Attorney for Pltf/Petnr06/12/2015 Notice-Case Management Conference

Filed by Clerk06/09/2015 Notice-Case Management Conference

Filed by Court Attendant06/08/2015 Affidavit of Prejudice–Peremptory (DEFT LUAN K PHAN’S MTN FOR PEREMPTORY CHALLENGE AND DECL OF JANET LY IN SUPP THEREOF )

Filed by Attorney for Defendant/Respondent06/02/2015 Complaint

06/02/2015 Summons Filed

Filed by Attorney for Plaintiff/Petitioner06/02/2015 Notice-Stay (AUTMOATIC STAY CAUSED BY A FILING IN ANOTHER COURT FILED 4/7/15 )

Filed by Attorney for Plaintiff/Petitioner06/02/2015 Proof of Service

Filed by Attorney for Plaintiff/Petitioner06/02/2015 Notice of Incoming Case Transfer

Filed by ClerkProceedings Held (Proceeding dates listed in descending order)

06/15/2017 at 09:45 am in Department 74, Joseph R. Kalin, Presiding

Court Order – Case Dismissed/Disposed05/01/2017 at 08:30 am in Department 74, Teresa Sanchez-Gordon, Presiding

Order Re: Related Cases – Completed10/24/2016 at 09:00 am in Department 74, Kevin C. Brazile, Presiding

Motion to Compel – Motion Denied10/05/2016 at 09:30 am in Department 74, Teresa Sanchez-Gordon, Presiding

Mandatory Settlement Conference ([c.t. 4-13-17 per stip. and orderof 6-23-16]) – Matter continued04/22/2016 at 09:00 am in Department 74, Teresa Sanchez-Gordon, Presiding

Motion to Compel – Off Calendar03/29/2016 at 01:30 pm in Department 74, Teresa Sanchez-Gordon, Presiding

Conference-Case Management ((c.f. 1-14-16)) – Trial Date Set01/14/2016 at 09:00 am in Department 74, Teresa Sanchez-Gordon, Presiding

Conference-Case Management ((c.f. 9-29-15)) – Matter continued09/29/2015 at 01:30 pm in Department 74, Teresa Sanchez-Gordon, Presiding

Conference-Case Management – Matter continued06/11/2015 at 08:30 am in Department 34, Michael P. Linfield, Presiding

Affidavit of Prejudice – Granted

The Other Side: Leslie Howard & First Microcap Report

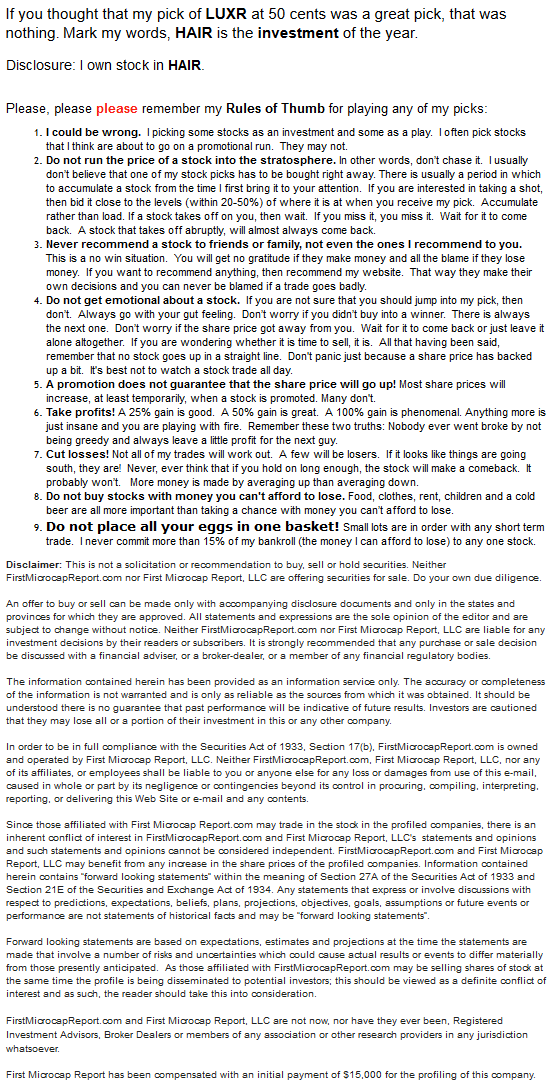

Back in early 2012 I started noticing ads on Pumpsanddumps.com for FirstMicrocapReport.com which was run by Leslie Howard. The service started out free and purported to identify stocks that were likely to undergo promotion. I wasn’t a huge fan of the service because by its very nature trying to identify and buy stocks pre-pump will lead to trading illiquid stocks and if the pump doesn’t happen then the stock can drop big. (That being said, I did trade a number of the picks, buying quickly and selling to slower traders for over $1500 in total profits.) FirstMicrocapReport acquired a bit of a following and then in late May 2012 Leslie Howard released a paid stock promotion of the Biostem US Corporation (ticker:HAIR and unrelated to current ticker HAIR, Restoration Robotics). For this promotion, Leslie disclosed payment of $15,000 and ownership of the stock. After this stock promotion was over, Leslie Howard continued to release uncompensated picks and did not promote any other stocks for money.

Here is the disclaimer from the first email I received (May 24, 2012) promoting Biostem US Corporation (HAIR):

After this I gave little thought to ‘Leslie Howard’. It wasn’t until October 2013 that I came across a lawsuit George Sharp had filed against Biostem US Corporation (HAIR). It became clear reading the lawsuit that Leslie Howard was the alter ego of George Sharp. I was a bit puzzled about the lawsuit and why Sharp had promoted a company like Biostem US Corp but I really didn’t give it any further thought. I finally have reason to revisit this case (as I will get into below) so I looked back into it and it still doesn’t make a lot of sense to me.

See the first complaint by George Sharp (and his company Market Broadcast, LLC) against Biostem et al. Below are a series of allegations from Sharp’s third amended complaint (emphasis added by me):

32. On or about May 9, 2012, Defendants ELCO, LONDON and MAZUR, with the consent and participation of BIOSTEM entered into a contract with the Plaintiff MARKET,

entitled “Engagement Agreement for Marketing Services” (“AGREEMENT”). A true and correct copy of that agreement is attached hereto as Exhibit “A,” and incorporated herein by

reference. The AGREEMENT required the Plaintiff MARKET to be provided 300,000 freetrading shares at the time that the investor awareness program began. The AGREEMENT

further provided that Defendants to disclose all known material facts to the Plaintiff MARKET regarding BIOSTEM. The AGREEMENT required Plaintiff MARKET to be kept informed of key developments regarding BIOSTEM.…

34. On or about May 24, 2012, Defendants breached the AGREEMENT by failing to provide the stock when required under the AGREEMENT.

35. Defendants further breached the AGREEMENT by failing to inform the Plaintiff of all known facts and failing to keep Plaintiff informed of key developments as required under the AGREEMENT, including but not limited to failing to inform Plaintiff that the equity financing agreement between Defendants BIOSTEM and ELCO that was announced on May 24, had not been consummated and would not be consummated…

41. In that April 12, 2012 meeting Defendants MAZUR and Ari Kaplan made the following false statements to Plaintiffs: (1) that BIOSTEM was a reputable and viable business in the hair restoration industry, (2) that BIOSTEM had reached and consummated an equity financing agreement for $5,000,000 with Defendant ELCO, (3) that BIOSTEM had entered into

a medical affiliate agreement with Pizarro Hair Restoration Clinics, and (4) that there was an increasing market demand for BIOSTEM shares.…

45. The facts were that BIOSTEM was a sham business and it had no equity financing agreement for $5,000,000 or any other amount and had no medical affiliate agreement with Pizarro Hair Restoration Clinics which was in fact an actual reputable company in the hair restoration industry.

…

71. As a further result of this fraud, most subscribers to the newsletters retained by MARKET to bring investor awareness to BIOSTEM and who purchased the common stock of

BIOSTEM, lost a significant portion, if not all of their investment, and MARKET has since been unable to retain additional paying clients for investor awareness programs.

72. SHARP was further damaged in reliance on these false statements in that he was induced to purchase additional shares of BIOSTEM stock on the open market. Sharp made 23 separate purchases of BIOSTEM stock during the relevant period all to his damage in an amount to be proven at the time of trial…

73. As a further result of this fraud, the reputation of SHARP as a forthright and credible source of information and as a crusader against stock fraud was compromised, causing damages in an amount to be proven at the time of trial

A few things from the above allegations strike me as odd. First, it seems odd that a stock promoter would specify in his contract that his client “disclose all known material facts” about the company and “be kept informed of key developments.” The typical promoter just parrots whatever the pump and dump mastermind wants him to say or makes up his own puffery. He does his sales job and doesn’t worry about the details of the company. Second, Sharp made 23 open market purchases of Biostem stock — again I have only rarely heard of a stock promoter buying stock in the open market in an ongoing paid pump & dump scheme. Also odd was that Sharp filed the suit seven months after the arrest of most of the participants in the pump and dump scheme — obviously he wouldn’t have a chance of collecting any damages from any of the defendants except maybe Crocs (yes, that Crocs — the executives of Biostem had come from Crocs), and Crocs as a defendant seems to me a very long-shot.

Sharp and his company dropped the suit on October 1st, 2014 after filing a notice on September 22nd, 2014 stating that the case had been settled. Crocs had filed a demurrer that was then sustained by the court on August 7th, 2014 so it was not part of the settlement. The order sustaining the demurrer essentially stated that Sharp had failed to prove that Crocs was sufficiently involved in the alleged conspiracy.

Even among promoted stocks, Biostem US Corp was a total disaster — in early 2013 the FBI arrested fourteen people for market manipulation in Biostem and four other companies. The case was USA v. Sherman Mazur et al and is Case 2:13-cr-00062-SVW in the US District Court, Central District of California, Western Division. Read the indictment. I have not had time to read through everything in the case but it looks like the FBI messed up in a very big way. See the transcript of the proceedings in the application by Sherman Mazur’s lawyer for review/reconsideration of order setting conditions of release/detention (docket 460 from 4/16/2014). The charges against Mazur and the other defendants were dropped in late March, 2014 “because of problems with a wiretap application”.

What does this all mean? Was it just a coincidence that the first (and only) stock George Sharp promoted later resulted in a number of arrests and criminal prosecutions (criminal prosecutions of pump and dump schemes are rare). Did he get involved to try to assist the already ongoing investigation? I really don’t know but that wouldn’t surprise me.

George Sharp, helping to put promoter scum in prison?

Sharp took partial credit for the indictment of Jamie Boye and Eric Cusimano. See update on Cusimano’s guilty plea. Presumably that is because he obtained information relevant to the prosecution and sent it to the authorities, but of course there is no way to confirm or disprove this with access only to public records.

It’s a great day! A year of my work paid off with the pick up of Eric Cusimano in Panama by the FBI on Monday. Brought to Buffalo yesterday.

— George Sharp (@GeorgeASharp) June 11, 2014

I will be front row at Cusimano’s arraignment in Buffalo. He was indicted by grand jury on May 19.

— George Sharp (@GeorgeASharp) June 11, 2014

George Sharp working for OTC Markets

For the following few years George Sharp continued to periodically sue penny stock companies and promoters. Other than that, I paid him little thought. I figured that he had just gotten greedy and that in his lawsuits he was looking for quick settlements. In the case of a promoted stock, many of which have management in on the scam, it is good business to settle quickly to get someone like Sharp to go away rather than risk going to discovery and having the whole scheme revealed. Despite that logic, many of Sharp’s lawsuits were long and drawn-out affairs.

I did not reconsider any of this until I saw the news this summer that Sharp had been hired by OTCMarkets.com as a consultant. Below is the full text of the press release:

OTC Markets Group Inc. (OTCQX: OTCM), operator of financial markets for 10,000 U.S. and global securities, today announced it has retained well known, market analyst George Sharp, as a consultant. Mr. Sharp will assist OTC Markets as we develop compliance processes to bring more timely and actionable data to the OTC market.

“George’s expertise in tracking small and microcap market activity makes him a valuable asset as we improve market transparency.” said Matthew Fuchs, Executive Vice President of Market Data and Strategy at OTC Markets Group. “Our goal is to use data to bring greater transparency to the market, arming investors, issuers and market participants with information they need to make informed decisions and identify unusual activity.”

“I am pleased to work with OTC Markets Group as they take a proactive approach to improve the small and microcap market by providing more information to investors,” stated George Sharp. “Information availability and investor education are key elements of a trusted, efficient markets.”

Obviously I had to reconsider my earlier opinion that Sharp was mostly in it for the money. I can’t imagine that OTC Markets Group pays fabulously well and if Cromwell Coulson considered Sharp to be just a pro-se ambulance chaser and stock promoter then he would not have hired Sharp. I do believe that Coulson is a man of good faith and has worked to reduce the prevalence of scams that trade on OTC Markets (although I don’t think he has done nearly enough). At the end of the day, of course Sharp likes the money he wins in his lawsuits. But he is suing many bad people (although I’m sure at least some of the CEOs of promoted companies in his suits were not involved in any promotion) and I no longer doubt that he does consider himself a crusader against penny stock fraud. Maybe he uses his lawsuits to gather useful information (during discovery) about penny stock companies that he then uses in other ways. I can’t know for sure. Two things are certain: George Sharp will keep suing people and the world is a better place as a result of his lawsuits. I can only hope that his anti-scam fervor spreads throughout the OTC Markets organization and that he really does as much behind the scenes to inform regulators as he has claimed (such as in his tweets about Cusimano).

Appendix: George Sharp’s lawsuits against other penny stock companies

In the near future I aim to add a brief description of all the lawsuits mentioned above including the outcome of each suit. This post is being published before this is complete because frankly this is an exhausting task. I may never get around to posting all the lawsuits.

George Sharp v. Stocktips.com, Alkame Holdings Inc (ALKM), Amerada Corp, Aweber Communications, Aweber Systems Inc, Robert Bandfield, Coastal Integrated Services Inc (COLV), Ecrypt Technologies Inc (ECRY), Empire Stock Transfer Inc, Harold Gewerter, Laluna Services Inc, Quicksilver Stock Transfer LLC, Telupay International Inc, Adrian Herman Thomas, Tiger Oil and Energy Inc (TGRO), & Well Power Inc (WPWR)

George Sharp filed case 37-2015-00008210-CU-NP-CTL in the Superior Court of California, County of San Diego on 3/11/2015 and dismissed on August 15, 2017. (Read the first amended complaint filed May 27, 2016.) I cannot find any evidence of the case being settled and Sharp requested dismissal of the case a few days before a hearing on an order to show cause (OSC).

Following are some of the documents from the case:

37-2015-00008210-CU-NP-CTL_ROA-110_08-05-16_Minute_Order_1509378411802

37-2015-00008210-CU-NP-CTL_ROA-137_10-07-16_Minute_Order_1509378411880

37-2015-00008210-CU-NP-CTL_ROA-142_10-06-16_Request_for_Dismissal_with_Prejudice_Party_1509378411974

37-2015-00008210-CU-NP-CTL_ROA-147_10-27-16_Request_for_Dismissal_with_Prejudice_Party_1509378412083

37-2015-00008210-CU-NP-CTL_ROA-162_11-04-16_Minute_Order_1509378412161

37-2015-00008210-CU-NP-CTL_ROA-169_12-02-16_Minute_Order_1509378412224

37-2015-00008210-CU-NP-CTL_ROA-180_08-04-17_Notice_of_Hearing_SD_1509405496917

37-2015-00008210-CU-NP-CTL_ROA-181_08-15-17_Request_for_Dismissal_with_Prejudice_Entire_Acti_1509378412333

37-2015-00008210-CU-NP-CTL_ROA-179_08-04-17_Minute_Order_1509405496839 37-2015-00008210-CU-NP-CTL_ROA-44_01-08-16_Minute_Order_1509378410708 37-2015-00008210-CU-NP-CTL_ROA-45_01-19-16_Order_to_Show_Cause_Sanctions_SD_1509378410817 37-2015-00008210-CU-NP-CTL_ROA-53_01-29-16_Minute_Order_1509378410911

37-2015-00008210-CU-NP-CTL_ROA-55_01-29-16_Minute_Order_1509378410989

37-2015-00008210-CU-NP-CTL_ROA-65_03-26-16_Order_Other_1509378411098

37-2015-00008210-CU-NP-CTL_ROA-91_05-27-16_Amended_Complaint_1509378411208

37-2015-00008210-CU-NP-CTL_ROA-92_05-20-16_Amendment_to_Complaint_Cross_Complaint_naming_Doe_1509378411333

37-2015-00008210-CU-NP-CTL_ROA-99_06-20-16_General_Denial_1509378411458

37-2015-00008210-CU-NP-CTL_ROA-101_06-20-16_General_Denial_1509378411552

37-2015-00008210-CU-NP-CTL_ROA-106_08-09-16_Demurrer_1509378411630

37-2015-00008210-CU-NP-CTL ROA -89 05-25-16 Motion to Compel Discovery from COLV

37-2015-00008210-CU-NP-CTL — Subpoena to Aweber (dated 8-31-2015)

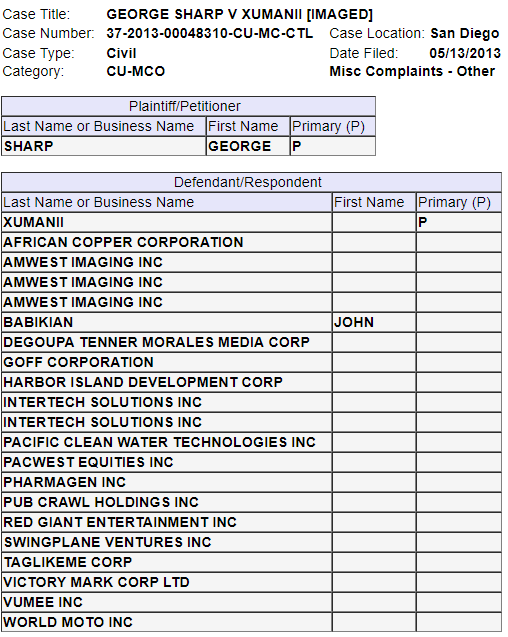

George Sharp v Xumanii (XUII), African Copper Corporation (ACCS), Amwest Imaging Inc (AMWI), John Babikian, De Groupa Tenner Morales Media Corp, Goff Corporation (GOFF), Harbor Island Development Corp (HIDC), Intertech Solutions Inc (ITEC), Pacific Clean Water Technologies Inc (PCWT), Pacwest Equities Inc (PWEI), Pharmagen Inc (PHRX), Pub Crawl Holdings Inc (PBCW), Red Giant Ventures Inc (REDG), Swing Plane Ventures Inc (SWVI), Taglikeme Corp (TAGG), Victory Mark Corp Ltd, Vumee Inc (VUME), & World Moto Inc (FARE)

George Sharp filed suit against Xumanii and other companies promoted by Awesomepennystocks and Victory Mark Corp on 5/13/2013. The case is 37-2013-00048310-CU-MC-CTL, in the Superior Court of California, County of San Diego.

See the judgment won by Sharp. All the judgments in this case were default judgments. I know at least in the case of his judgment against Goff the judgment has not been collected.

Default judgment is entered in favor of Plaintiff George Sharp and against Defendants Vumee, Inc., Intertech Solutions, Inc. fka Amwest Imaging, Inc , Goff Corporation, and Excelsis Investments, Inc..Plaintiff George Sharp to recover from Defendant Vumee, Inc. the total amount of$19,700, consisting of statutory damages in the amount of $18,000 and attorney’s fees in the amount of $1,700.Plaintiff George Sharp to recover from Defendant Intertech Solutions, Inc. fka Amwest Imaging, Inc. the total amount of $43,220, consisting of statutory damages in the amount of$41,000 and attorney’s fees in the amount of $2,220.Plaintiff George Sharp to recover from Goff Corporation the total amount of $57,450, consisting of statutory damages in the amount of $55,000 and attorney’s fees in the amount of $2,450.Plaintiff George Sharp to recover from Defendant Excelsis Investments, Inc. the total amount of $19,700, consisting of statutory damages in the amount of $18,000 and attorney’s fees in the amount of $1,700.

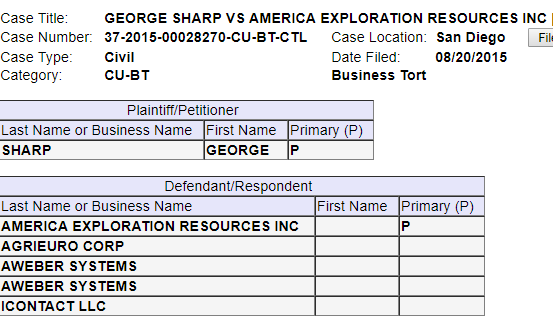

George Sharp v America Exploration Resources Inc (AREN), Agrieuro Corp (EURI), Aweber Systems, & iContact LLC

George Sharp filed suit against America Exploration Resources on 8/20/2015. The case is 37-2015-00028270-CU-BT-CTL in the Superior Court of California, County of San Diego. Sharp posted the original complaint to Scribd. See his subpoena to iContact from 8/31/2015.

George Sharp v. Citadel EFT (CDFT), Buzzbahn LLC, Diane Dalmy, Gary Deroos, & Nancy Figueiredo

See George Sharp’s press release about his lawsuit against Citadel EFT. The case (37-2013-00034768-CU-FR-CTL) was filed on February 13, 2013 in the Superior Court of California, County of San Diego.

Appendix 2: Further Info

George Sharp’s Scribd profile

George Sharp’s blog

Disclaimer: No position in any stocks mentioned and other than being a subscriber to Pennystocks.buzz and having interacted with all of the anti-fraud crusaders mentioned above I have no business or close relationship with anyone mentioned in this post. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

Curious , why do some of the documents refer to the reverse split itself as ‘wiping out small shareholders’ when it’s actually the price depreciation prior and after that event that’s at fault.

One thing I should’ve included in the article — info on the Jim Can aka Cem Can libel lawsuit against George Sharp in Osceola County, Florida. Cem Can was indicted in late 2014: http://www.cbc.ca/news/business/brian-de-wit-cem-can-indicted-by-fbi-in-500m-offshore-tax-fraud-scheme-1.2761811

SUMMARY

Judge:

SCHREIBER, MARGARET H

Case Number:

2013 CA 003136 OC

Clerk File Date:

8/30/2013

Total Fees Due:

0.00

Agency Report Number:

Court Type:

CIRCUIT CIVIL

Uniform Case Number:

492013CA003136OCXXXX

Status Date:

8/30/2013

Booking Number:

Custody Location:

Case Type:

LIBEL/SLANDER-OTHER CIVIL

Status:

OPEN

Waive Speedy Trial:

Agency:

Foreclosure:

PARTIES

TYPE PARTY NAME ATTORNEY

PLAINTIFF CAN, JIM

Active SADAKA, THOMAS A. (Main Attorney)

PLAINTIFF MAINLAND INVESTMENTS INC

Active SADAKA, THOMAS A. (Main Attorney)

DEFENDANT SHARP, GEORGE

Active SAXE, DANIEL (Main Attorney)

DEFENDANT PUMPANDDUMP.COM

DEFENDANT DOE, JOHN

EVENTS

DATE EVENT JUDGE LOCATION RESULT

4/13/2015 11:00 AM MOTION FOR SANCTIONS POLODNA, SCOTT HEARING ROOM 6A HEARING HELD

3/10/2015 2:30 PM MOTION FOR CONTEMPT POLODNA, SCOTT HEARING ROOM 6A HEARING HELD

3/10/2015 1:30 PM MOTION FOR SANCTIONS POLODNA, SCOTT HEARING ROOM 6A CANCELLED

2/3/2015 9:45 AM MOTION TO REQUIRE PAYMENT POLODNA, SCOTT HEARING ROOM 6A HEARING HELD

11/5/2014 1:30 PM MOTION TO DISMISS POLODNA, SCOTT HEARING ROOM 6A HEARING HELD

6/24/2014 10:15 AM MOTION TO VACATE DEFAULT POLODNA, SCOTT HEARING ROOM 6A HEARING HELD

4/15/2014 11:15 AM MOTION FOR DEFAULT POLODNA, SCOTT HEARING ROOM 6A HEARING HELD

2/6/2014 9:45 AM MOTION HEARING POLODNA, SCOTT HEARING ROOM 6A

2/6/2014 8:45 AM MOTION FOR DEFAULT POLODNA, SCOTT HEARING ROOM 6A HEARING HELD

10/29/2013 8:45 AM MOTION HEARING POLODNA, SCOTT HEARING ROOM 6A

9/16/2013 10:00 AM MOTION FOR TEMPORARY INJUNCTION POLODNA, SCOTT COURTROOM 5E

CASE DOCKETS

DATE ENTRY

6/6/2016 MANDATE FILED FROM 5DCA/5D15-1776 (REC)

5/13/2016 MANDATE FILED FROM 5DCA/5D15-1776

10/1/2015 TRANSMITTED APPEAL RECORD TO 5DCA

8/28/2015 PAYMENT $100.00 RECEIPT #2015111292

8/13/2015 PAYMENT $203.50 RECEIPT #2015104480

8/7/2015 LETTER TO JOHN W. ZIELINSKI

8/7/2015 LETTER FROM THOMAS A. SADAKA

8/7/2015 STATEMENT FOR PREPARATION OF APPEAL TO DANIEL L. SAXE

8/7/2015 INDEX TO APPEAL

8/7/2015 LETTER TO DANIEL L. SAXE

6/19/2015 ORDER DECLINING REFERRAL TO MEDIATION-5D15-1776

6/2/2015 NOTICE OF FILING TRANSCRIPT

5/20/2015 E-MAIL CORRESPONDENCE FROM 5DCA/NOTICE OF APPEAL ACCEPTED

5/20/2015 ACKNOWLEDGMENT OF NEW CASE/5D15-1776 (UNDER CONSIDERATION FOR MEDIATION)

5/19/2015 E-FILING CONFIRMATION OF TRANSMITTAL OF NOTICE OF APPEAL

5/19/2015 E-FILING CONFIRMATION OF APPEAL TRANSMITTAL

5/19/2015 NOTICE OF APPEAL TRANSMITTAL FORM

5/19/2015 NOTICE OF APPEAL (REC)

5/15/2015 NOTICE OF APPEAL

5/13/2015 ORDER DENYING DEFENDANTS’ MOTION FOR REHEARING ON THE COURT’S APRIL 28, 2015 ORDERS ON DEFENDANTS’ MOTIONS FOR SANCTIONS AND FOR CONTEMPT AGAINST PLAINTIFF AND THEIR COUNSEL

5/11/2015 MOTION FOR REHEARING ON THE COURT’S APRIL 28, 2015 ORDERS ON DEFENDANTS’ MOTIONS FOR SANCTIONS AND FOR CONTEMPT AGAINST PLAINTIFFS AND THEIR COUNSEL

4/29/2015 ORDER ON DEFENDANTS MOTION FOR SANCTIONS AGAINST PLAINTIFFS AND THEIR COUNSEL PURSUANT TO FL STAT SECTION 57.105

4/29/2015 ORDER ON DEFENDANTS MOTION FOR CONTEMPT OF COURT AND FOR SANCTIONS AGAINST PLAINTIFFS AND THEIR COUNSEL

4/13/2015 DECLARATION OF WILLIAM VOGELER (FILED IN OPEN COURT)

4/7/2015 NOTICE OF FILING TRANSCRIPT

3/18/2015 CHECK REQUEST SENT TO ACCOUNTING

3/17/2015 ORDER ON PLAINTIFFS’ MOTION FOR RECONSIDERATION

3/11/2015 MOTION FOR SANCTIONS SET FOR 04/13/2015 AT 11:00 AM IN 6A BEFORE JUDGE: POLODNA, SCOTT

3/10/2015 AMENDED NOTICE OF HEARING APRIL 13 2015 / 11AM / 6A

3/6/2015 ADOPTION OF PLAINTIFF’S RESPONSE TO DEFENDANT’S MOTION FOR SANCTIONS AGAINST PLAINTIFFS AND THEIR COUNSEL PURSUANT TO FLA. STAT. SECTION 57.105

3/5/2015 CHECK REQUEST OR CHANGE FORM

3/5/2015 PLAINTIFF’S RESPONSE TO DEFENDANT’S MOTION FOR CONTEMPT

3/4/2015 PLAINTIFF’S RESPONSE TO DEFENDANT’S MOTION FOR SANCTIONS AGAINST PLAINTIFFS AND THEIR COUNSEL PURUSANT TO FLA. STAT. SECTION 57.105

3/4/2015 DEFENDANT’S OPPOSITION TO PLAINTIFFS’ MARCH 3, 2015 MOTION TO CONTINUE MARCH 10, 2015 HEARING ON DEFENDANTS’ MOTION FOR SANCTIONS AND CONTEMPT AGAINST PLAINTIFFS AND THEIR COUNSEL

3/3/2015 MOTION TO CONTINUE HEARING

3/3/2015 NOTICE OF APPEARANCE OF COUNSEL

3/2/2015 DEFENDANT’S OPPOSITION TO PLAINTIFFS’ “MOTION FOR RECONSIDERATION”

2/27/2015 DEFENDANTS’ MOTION TO STRIKE FEBRUARY 26, 2015 “NOTICE OF COUNSEL’S CHANGE OF LAW FIRM ADDRESS AND ESERVICE” FILED BY PLAINTIFF

2/27/2015 PAYMENT $7,500.00 RECEIPT #2015027391

2/26/2015 MOTION FOR RECONSIDERATION

2/26/2015 NOTICE OF COUNSEL’S CHANGE OF FIRM NAME, ADDRESS AND ESERVICE

2/18/2015 MOTION FOR CONTEMPT SET FOR 03/10/2015 AT 2:30 PM IN 6A BEFORE JUDGE: POLODNA, SCOTT

2/18/2015 NOTICE OF COMPLIANCE

2/18/2015 NOTICE OF HEARING 3/10/15 2:30PM 6A

2/17/2015 AFFIDAVIT IN SUPPORT OF DEFENDANTS’ MOTION FOR CONTEMPT AND FOR SANCTIONS

2/17/2015 DEFENDANTS’ MOTION FOR CONTEMPT OF COURT AND FOR SANCTIONS AGAINST PLAINTIFFS AND THEIR COUNSEL

2/11/2015 ORDER ON DEF MOTION FOR RECOVERY ON PAYMENT BOND

1/26/2015 NOTICE OF FILING CERTIFICATE OF SERVICE

12/10/2014 MOTION FOR SANCTIONS SET FOR 03/10/2015 AT 1:30 PM IN 6A BEFORE JUDGE: POLODNA, SCOTT

12/9/2014 NOTICE OF COMPLIANCE

12/9/2014 NOTICE OF HEARING 3/10/15 1:30PM 6A

11/20/2014 MOTION TO REQUIRE PAYMENT SET FOR 02/03/2015 AT 9:45 AM IN 6A BEFORE JUDGE: POLODNA, SCOTT

11/19/2014 NOTICE OF COMPLIANCE

11/19/2014 NOTICE OF HEARING FEB 3 2015 / 9:45AM / 6A

11/11/2014 MOTION FOR SANCTIONS AGAINST PLAINTIFF’S AND THEIR COUNSEL PURSUANT TO FLA. STAT. SECTION 57.105

11/11/2014 DEFENDANTS’ MOTION FOR RECOVERY ON PAYMENT BOND

11/10/2014 ORDER GRANTING DEFENDANTS’ GEORGE SHARP AND PUMPSANDDUMPS.COM’S MOTION TO DISMISS

11/4/2014 RESPONSE TO SHARP’S MOTION TO DISMISS

10/8/2014 MOTION TO DISMISS SET FOR 11/05/2014 AT 1:30 PM IN 6A BEFORE JUDGE: POLODNA, SCOTT

10/8/2014 NOTICE OF COMPLIANCE

10/8/2014 NOTICE OF HEARING 11/5/14 1:30PM 6A

9/23/2014 AFFIDAVIT OF GEORGE SHARP

9/23/2014 DEFENDANTS’ GEORGE SHARP MOTION TO DISMISS

9/16/2014 ORDER GRANTING DEFENDATN SHARPS MOTION TO VACATE DEFAULT JUDGMENT

9/10/2014 MOTION TO STRIKE NOTICE OF FILING

9/10/2014 NOTICE OF FILING PRESS RELEASE FROM THE UNITED STATES ATTORNEY’S OFFICE OF THE EASTERN DISTRICT OF NEW YORK

9/10/2014 NOTICE OF FILING PRESS RELEASE FROM THE UNITED STATES ATTORNEY’S OFFICE OF THE EASTERN DISTRICT OF NEW YORK

7/18/2014 NOTICE OF FILING TRANSCRIPT

6/24/2014 NOTICE OF FILING AFFIDAVIT OF WILLIAM VOGELER

6/23/2014 NOTICE OF FILING PROOF OF SERVICE AND AMENDED INJUNCTION

6/20/2014 RESPONSE TO SHARP’S MOTION TO VACATE DEFAULT JUDGMENT

5/16/2014 MOTION TO VACATE DEFAULT SET FOR 06/24/2014 AT 10:15 AM IN 6A BEFORE JUDGE: POLODNA, SCOTT

5/16/2014 NOTICE OF COMPLIANCE

5/16/2014 NOTICE OF HEARING JUNE 24 2014 / 10:15AM / 6A

5/13/2014 AFFIDAVIT OF GEORGE SHARP

5/13/2014 DEFENDANT SHARP’S MOTION TO VACATE DEFAULT JUDGMENT

5/5/2014 NOTICE OF APPEARANCE AND DESIGNATION OF EMAIL ADDRESSES PURSUANT TO RULE 2.516

5/2/2014 FINAL DEFAULT JUDGMENT ORDER (REC)

4/15/2014 FINAL DEFAULT JUDGMENT ORDER

4/9/2014 MOTION FOR DEFAULT SET FOR 04/15/2014 AT 11:15 AM IN 6A BEFORE JUDGE: POLODNA, SCOTT

4/8/2014 NOTICE OF HEARING APRIL 15 2014 / 11:15AM / 6A

4/3/2014 PLAINTIFF’S MOTION TO FOR ENTRY OF FINAL DEFAULT JUDGMENT AND ASSESMENT OF DAMAGES

3/27/2014 ORDER GRANTING PLAINTIFF’S MOTION FOR ENTRY OF JUDICIAL DEFAULT AGAINST DEFENDANTS

3/20/2014 AMENDED MOTION FOR ENTRY OF CLERKS DEFAULT

3/20/2014 ORDER GRANTING PLAINTIFF’S MOTION FOR ENTRY OF JUDICIAL DEFAULT AGAINST DEFENDANTS

3/20/2014 COPY OF MOTION FOR ENTRY OF CLERKS DEFAULT

3/19/2014 MOTION FOR DEFAULT

3/19/2014 AFFIDAVIT OF JIM CAN

2/18/2014 ORDER GRANTING PLAINTIFF’S MOTION TO ALLOW SERVICE OF PROCESS VIA EMAIL

2/6/2014 ORDER GRANTING PLAINTIFF’S MOTION FOR ENTRY OF JUDICAL DEFAULT AGAINST DEFENDANTS

2/6/2014 MOTION HEARING SET FOR 02/06/2014 AT 9:45 AM IN 6A BEFORE JUDGE: POLODNA, SCOTT

2/6/2014 NOTICE OF HEARING 2/6/14 9:45AM 6A

2/6/2014 MOTION TO ALLOW SERVICE OF PROCESS VIA EMAIL

1/23/2014 MOTION FOR DEFAULT SET FOR 02/06/2014 AT 8:45 AM IN 6A BEFORE JUDGE: POLODNA, SCOTT

1/22/2014 NOTICE OF HEARING 2/6/14 9:45AM 6A

1/3/2014 PLAINTIFF’S MOTION FOR ENTRY OF JUDICAL DEFAULT

11/18/2013 AFFIDAVIT FOR SERVICE OF PROCESS, ORDER GRANTING TEMPORARY INJUNCTION TO GEORGE SHARP

11/5/2013 DEFAULT AGAINST GEORGE SHARP

10/29/2013 MOTION HEARING SET FOR 10/29/2013 AT 8:45 AM IN 6A BEFORE JUDGE: POLODNA, SCOTT

10/29/2013 ORDER GRANTING TEMPORARY INJUNCTION

10/28/2013 NOTICE OF HEARING 10/29/13 8:45AM 6A

10/28/2013 .DEFAULT

10/28/2013 MOTION FOR CLERKS DEFAULT

10/28/2013 DECLARATION OF THOMAS SADAKA

10/15/2013 AFFIDAVIT FOR SERVICE OF PROCESS, GEORGE SHARP (DO NOT SAY WHAT TYPE OF SERVICE)

10/15/2013 PLAINTIFF’S MOTION TO MODIFY TEMPORARY INJUNCTION

9/23/2013 MOTION FOR TEMPORARY INJUNCTION SET FOR 09/16/2013 AT 10:00 AM IN 5E BEFORE JUDGE: POLODNA, SCOTT

9/16/2013 FILED IN OPEN COURT: ORDER GRANTING TEMPORARY INJUNCTION

9/11/2013 DECLARATION OF THOMAS A. SADAKA

9/11/2013 NOTICE OF HEARING 9/16/13 AT 10AM 5E

9/4/2013 AFFIDAVIT OF JIM CAN

9/4/2013 NOTICE OF FILING AFFIDAVIT OF JIM CAN

9/4/2013 SUMMONS ISSUED (EMAILED TO ATTY)

9/3/2013 PLAINTIFF’S MOTION FOR TEMPORARY INJUNCTION

9/3/2013 PAYMENT $410.00 RECEIPT #201326242

8/30/2013 SUMMONS ASSESSED $10.00

8/30/2013 CIRCUIT CIVIL FILING ASSESSED $400.00

8/30/2013 JUDGE POLODNA, SCOTT: ASSIGNED

8/30/2013 CASE FILED 08/30/2013 CASE NUMBER 2013 CA 003136 OC

8/27/2013 SUMMONS

8/27/2013 VERIFED COMPLAINT (INJUNCTIVE RELIEF)

8/27/2013 CIVIL COVER SHEET

Thanks, Mark for the research! no doubt this has taken a lot of work. I recently gained interest in George Sharp after watching him on twitter talking about $RDGL (vivos inc). I guess he was hired as an advisor for them (he also says he owns shares). Still trying to figure him out so I am watching from a distance.

Also, It was great to meet you at the 2018 summit in Orlando. I met you at the cocktail party. My name is Guy and you said I was your 2nd favorite Guy after Gentile (LOL). Once again thanks for your research. I am still going through your spreadsheet from the lesson you gave on the new strategy you have been testing. Keep up the “Goode” work!

Thanks for the kind words. I respect a lot of what George has done but not enough to be interested in buying a penny stock just because they hired him as a consultant.

What about the people who lost money to the companies that he won his case against? Are they eligible for lost recovery?

If you mean the investors in those companies than no you are probably not eligible for anything. Of course that depends on the company and exact details, but it is very rare in penny stocks to be able to recover lost investments.

You lost me when you claimed Janish shell an sharp etc are good people if you really followed they they are just pretending to be Holy OTCM saviors but they are the biggest fraud and market manipulators in the world and should be thrown in a jail cell and they key thrown away the Damage I’ve seen Sharp and Janis shell do has cost me and others so much money with their bs

as for me I like G, no man is always correct in statements or positions they take they just do what they think is best/right. he was clear he didn’t want HMBL to R/S & began his separation’s soon after its implement, but it was clearly needed I now believe! (not 10,000 to 1) wish I sold too cause was life changing money I desperately needed! I cant work! (stroke) Brian is/was well intended but ahead of times that ppl aren’t placing in day to day lives AS OF YET! G has stated many times we owe credit to Brian’s path & he makes lots of honorable choices that costs occur. HMBL back down to where it began in OTC .000’s but I think best days still remain for G&B still both are good ppl @ heart continue to walk w heads held high & I admire them much!! it isn’t easy being cheesy. I bet they regroup together like the dynamic duo they should be!( Calvin & others too!) hope HMBLE holds up we don’t get R/S or BK or any other negative thing to the dedicated share holders whom remain. we are always heading toward unknown future & digital wallets/money will probably play major roles in this future! I look forward to regrouping in Nashville one day & truly having a victory celebration & shaking Brian’s hand once more meet G for 1st time & more shareholders… & all these litigation’s above appear G more right than wrong but I had no dog in those hunts…. I wish all ppl best that life has to offer! beginning in your own driveways those roads lead all around the country & back with so many choices we all make wrong turns…G/L