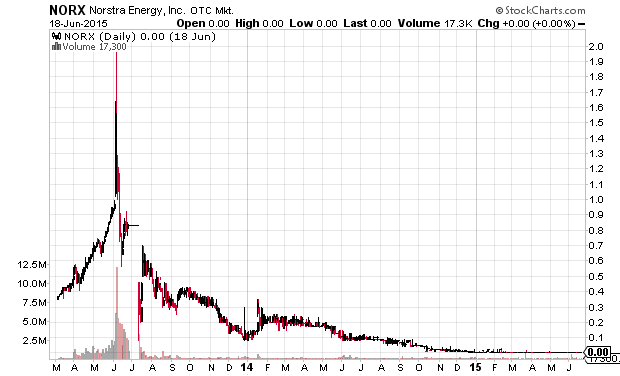

Two years ago, Norstra Energy (NORX) was a postal mailer stock promotion. Approximately three months after the start of the promotion, trading in the stock was suspended by the SEC. Since then the stock has slowly but inexorably declined.

Yesterday the SEC sued Glen Landry, the former CEO of the company, and Eric Dany, the promoter of the stock two years ago.

See the complaint (pdf)

A few choice excerpts from the complaint:

1. From March 2013 to the present, Landry, the President and CEO ofNorstra, has made numerous materially false and misleading statements about Norstra’s oil reserves, drilling plans, and business prospects. These statements, for which Landry was solely responsible, appeared in numerous Norstra press releases and on its website, as well as in Commission filings

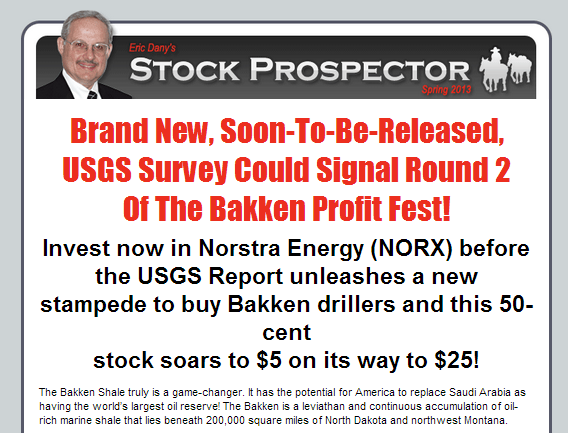

that Landry signed.2. From April through June 2013, Dany, a stock-picking newsletter writer, made

materially false and misleading statements of his own about Norstra’s projected business prospects in spam e-mails and hard-copy mailers he was paid to endorse. Those materials touted Dany’s enthusiastic predictions ofNorstra’s business prospects that were both objectively and subjectively false.

Regarding Landry:

22. The Geologist never intended for his Reserve Report to be publicly disseminated or issued to anyone other than trained geologists; he had accepted Landry’s limited assignment to perform what Landry called “some rough calculations” ofOOIP.

23. Landry knew, or was reckless in not knowing, that the Reserve Report’s estimate of OOIP, as well as the amount of oil actually recoverable, depended on the existence of the favorable geological conditions that were unknowable until Landry and Norstra started to drill, but which the Geologist had assumed would be favorable to Norstra in making his estimates.

24. When the Geologist became aware that Landry and Norstra had disseminated his report to the general public, he revised the report to include disclaimers explaining the variables that had not been factored into his estimates and the difference between OOIP and recoverable reserve estimates. He attached the updated report to an email that he sent Landry on August 9,

2013 and asked that Landry replace the earlier report with this revised one. Landry did not respond to the email, and as of July 2, 2014, the original report was still displayed on Norstra’s website.

Regarding Dany:

46. In the Promotional Materials, Dany made three materially false and misleading claims. First, both theE-Mailer and the Mailer proclaim that “Norstra Energy could be sitting on top of as much as 8.5 billion barrels of oil!” That claim was baseless and was not one that Dany actually believed. In describing how he arrived at the 8.5 billion number, Dany has claimed that he used a complicated mathematical formula that relied on two undisclosed assumptions, neither of which had a basis in fact. First, he assumed that Norstra’s own estimated oil reserves per section should be increased by 300 per cent. And second, he assumed that Norstra’s intentions to acquire 10 times the acreage that it currently held would be realized.

47. In any event, neither undisclosed assumption supported Dany’s claim that

Norstra’s currently-owned “10,097 acres could hold as much a [sic] 8.5 billion barrels of original oil in place.” Because, by his own admission, Dany’s 8.5 billion estimate relied on Norstra’s acquisition of additional acreage it did not yet own, Dany could not have believed that its current acreage held that much.

Disclaimer: I have no position in NORX. I have no relationship with any parties mentioned above. This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.