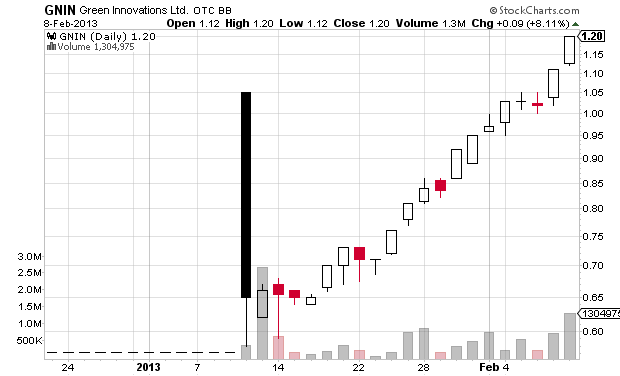

Yesterday was the first day of volume and prior to the open today I received pump emails from several promoters linking to http://srblreport.com/index.html

Disclosed budget: $373,614

Shares outstanding: 88,833,334

Previous closing price: $1.16

“Meson Consulting Ltd. has budgeted $373,614.39 for the dissemination of this info to enhance public awareness for SRBL.”

Full disclaimer:

IMPORTANT NOTICE AND DISCLAIMER: This paid email advertisement by MicroCap MarketPlace (hereafter “MCMP”) does not purport to provide an analysis of any company’s financial position, operations, or prospects and this is not to be construed as a recommendation by MCMP, or an offer to sell or solicitation to buy or sell any security. Great American Energy, Inc. (hereafter “SRBL”), the company featured in this issue, appears as paid advertising. Meson Consulting Ltd. has budgeted $373,614.39 for the dissemination of this info to enhance public awareness for SRBL. Although the information contained in this advertisement is believed to be reliable, MCMP makes no warranties as to the accuracy of any of the content herein and accepts no liability for how readers may choose to utilize it. The information contained herein is based exclusively on information generally available to the public and does not contain any material, non-public information. Readers should perform their own due-diligence before investing in any security including consulting with a qualified investment advisor or analyst. Readers should independently verify all statements made in this advertisement and perform extensive due-diligence on this or any other advertised company. MCMP has received fifteen thousand dollars for this and related marketing materials. MCMP also expects to receive new subscriber revenue, the amount which is unknown at this time, as a result of this advertising effort. MCMP nor any of their principals, officers, directors, partners, agents, or affiliates are not, nor do we represent ourselves to be, registered investment advisors, brokers, or dealers in securities. MCMP is not offering securities for sale. An offer to buy or sell can be made only with accompanying disclosure documents and only in the states and provinces for which they are approved. Research and any due diligence was conducted by an outside researcher for this advertisement. More information can be received from SRBL’s website at www. gamericanenergy.com. Further, specific financial information, filings and disclosures as well as general investor information about publicly listed companies and other investor resources can be found at the Securities and Exchange Commission website at www.sec.gov and www.finra.org. Any investment should be made only after consulting with a qualified investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Many states have established rules requiring the approval of a security by a state security administrator. Check with www.nasaa.org or call your state security administrator to determine whether a particular security is licensed for sale in your state. This advertisement is not intended for readers in any jurisdiction where not permissible under local regulations and investors in those jurisdictions should disregard it. Investing in securities is highly speculative and carries a great deal of risk, which may result in investors losing all of their invested capital. Past performance does not guarantee future results. The information contained herein contains “forward-looking” statements and information within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including statements regarding expected continual growth of the featured company. “Forward-looking” statements are based upon expectations, estimates and projections at the time the statements are made and involve risks and uncertainties that could cause actual events to differ materially from those anticipated. “Forward-looking” statements may be identified through the use of words such as expects, will, anticipates, estimates, believes, or by statements indicating certain actions may, could, should, or might occur. Any statements that express or involve predictions, expectations, beliefs, plans, projections, objectives, goals or future events or performance may be “forward-looking” statements. In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the publisher notes that statements contained herein that look forward in time, which include other than historical information, involve risks and uncertainties that may affect the company’s actual results of operations. Factors that could cause actual results to differ include, but are not limited to, the size and growth of the market for the company’s products and services, regulatory approvals, the company’s ability to fund its capital requirements in the near term and the long term, pricing pressures and other risks detailed in the company’s reports filed with the Securities and Exchange Commission. All other trademarks used in this publication are the property of their respective trademark holders. MCMP is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by MCMP to any rights in any third-party trademarks.

PDF copy of pump website for when the website is taken offline.

Update 3/11/2013: Market Authority has joined the pump on SRBL and posted a PDF of a purported hard mailer. The PDF is at http://srblreport.com/srbl16pg-disclaimer.pdf which makes me believe it more. See a copy of the PDF here. The compensation in the disclaimer in the PDF is over twice the amount on the online landing page.

Meson Consulting Ltd. has budgeted $795,671.81 for the dissemination of this info to enhance public awareness for SRBL.

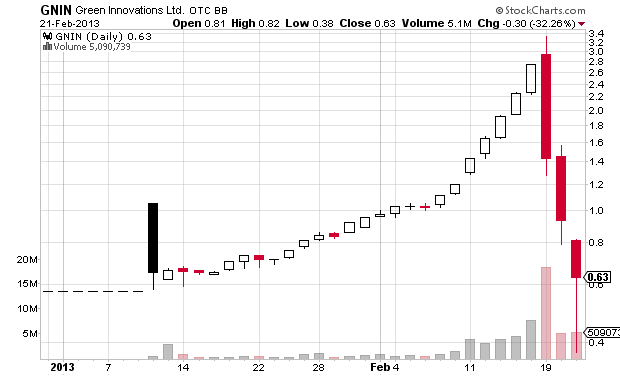

Disclaimer: I have no position in any stock mentioned above. (As of my update on 3/11/2013 I am short SRBL.) This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.